Get the free Wisconsin Non-combined Corporation Franchise or Income Tax Return

Get, Create, Make and Sign wisconsin non-combined corporation franchise

How to edit wisconsin non-combined corporation franchise online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wisconsin non-combined corporation franchise

How to fill out wisconsin non-combined corporation franchise

Who needs wisconsin non-combined corporation franchise?

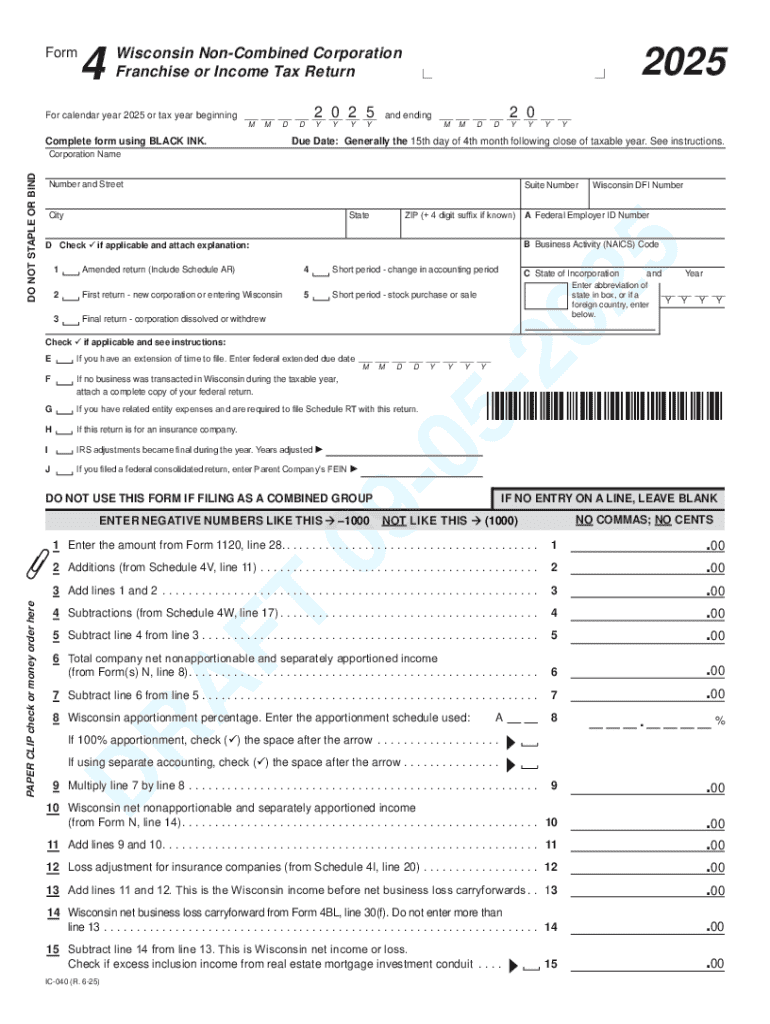

Understanding the Wisconsin Non-Combined Corporation Franchise Form

Understanding the Wisconsin Non-Combined Corporation Franchise Form

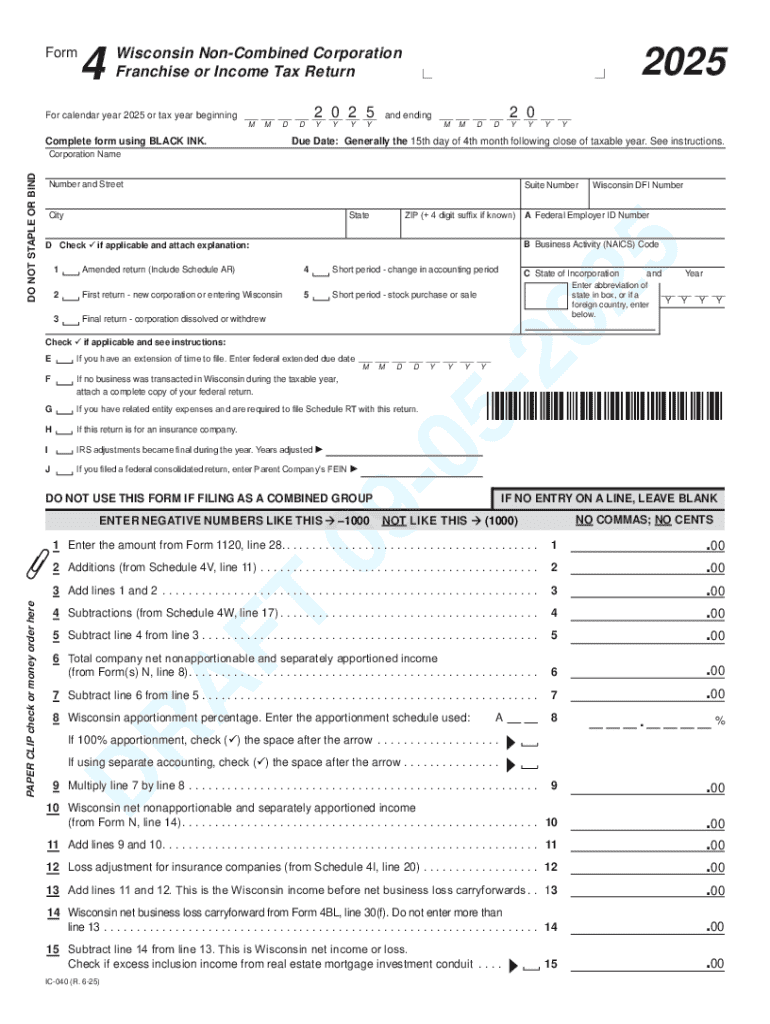

The Wisconsin non-combined corporation franchise form is a critical document for businesses operating in the state of Wisconsin. This form determines the franchise tax owed by non-combined corporations, which are defined as those not requiring the income of affiliated entities to be included in their tax base. Understanding this form is essential for compliance with state taxation laws and ensuring that corporations fulfill their financial obligations.

The importance of the non-combined corporation franchise form extends beyond mere compliance; it reflects the financial health of a business. Accurate filing can lead to favorable tax rates and exemptions, while errors can incur penalties. Therefore, grasping the nuances of this form can significantly affect a corporation's fiscal responsibilities.

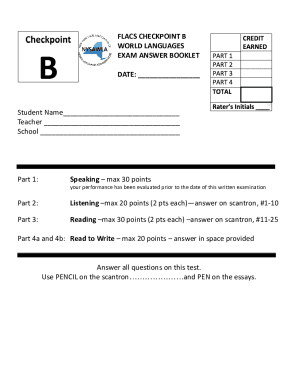

Prerequisites for filing the non-combined corporation franchise form

Before filing the Wisconsin non-combined corporation franchise form, it’s crucial to establish that your corporation meets the eligibility criteria. Generally, corporations that are not classified as combined for tax purposes will need to file this form. Additionally, having the correct definitions and understanding key terms is fundamental to this process.

Key terms associated with the non-combined corporation franchise form include: - **Franchise Tax**: This is a tax levied on corporations for the privilege of doing business in Wisconsin. - **Non-Combined Corporation**: A type of corporation that files separately from its affiliated entities. - **Estimated Tax Payments**: Payments made on anticipated tax liability for the year, often required by state tax officials.

Step-by-step guide to completing the non-combined corporation franchise form

Completing the Wisconsin non-combined corporation franchise form requires attention to detail and a systematic approach. Below is a breakdown of the different sections you will encounter: **Section 1: Basic Company Information** This section will ask for essential details about your business, including your legal business name, tax identification number (TIN), and the principal place of business. Be meticulous in providing this information to ensure there are no discrepancies.

**Section 2: Income Reporting** Here, you will calculate your corporation's revenue. Be sure to account for all sources of income and apply any deductions or exemptions that the state allows. Accurate income reporting is fundamental to determining your tax liability.

**Section 3: Tax Rate Application** Understanding the tax rates applicable to non-combined corporations is crucial. Tax rates may vary based on income levels, so being aware of any updates or changes in rates is essential for correct tax calculations.

**Section 4: Payment Instructions** Finally, you will need to estimate your tax liability based on the calculations in previous sections. Various payment options are available—either through electronic payment or by mail. Ensure you review these options carefully to select the most suitable method for your business.

Tips for accurate completion of the form

Filing the Wisconsin non-combined corporation franchise form can be complex, but avoiding common pitfalls can simplify the process. Here are some tips for ensuring accurate completion: - **Common Mistakes to Avoid**: One frequent mistake is incorrectly calculating revenue or neglecting to include certain income sources. Be vigilant in reviewing all income streams.

- **Double-Checking Essential Information**: Always cross-verify your entries. Minor typos in TIN or business name can lead to significant issues with your filing.

- **Utilizing PDF Editing Tools for Clarity**: Using tools like pdfFiller can aid in editing and managing your documents seamlessly, ensuring clarity in disseminating necessary information.

- **Collaboration Options for Teams**: If your corporation has multiple contributors, utilizing collaboration tools can enhance accuracy and ensure that everyone is in the loop about changes.

Interactive tool: Calculate your franchise tax

To make tax calculations more manageable, utilizing an interactive tax estimation tool can be invaluable. These tools allow you to input your data and automatically calculate your projected franchise tax liability based on current tax regulations.

Features of the tool offer various functionalities, such as: - **Input Fields for Income Data**: Specify your revenue, deductions, and exemptions. - **Dynamic Calculation**: Instant calculations based on input changes, providing real-time feedback on potential tax liabilities.

The benefits of using interactive tools extend beyond just quick calculations; they also help you avoid common calculation errors and facilitate better document management.

How to submit the non-combined corporation franchise form

Once the form is completed, following the correct submission process is key to ensuring your filing is acknowledged. There are a couple of methods available for submitting the Wisconsin non-combined corporation franchise form: - **Online Submission**: This method allows for faster processing times and is often preferred by many businesses. Ensure you have all related documentation available for upload.

- **Mail Options**: For those who prefer traditional methods, mailing the completed form is still a valid option. Make sure it is sent to the correct address and that you use certified mail to track delivery.

It's also vital to remember submission deadlines. Missing these deadlines can have significant financial consequences. Ensure that you keep an eye on important dates in Wisconsin’s tax calendar.

After submission, securing a confirmation receipt is crucial. This acts as proof of filing and can be vital in case of any discrepancies later on.

Managing your franchise tax documents

Post-filing, managing your franchise tax documents becomes a priority. Maintaining accurate records is essential for both compliance and future reference. Consider these best practices for document organization:

- **Best Practices for Document Organization**: Create a dedicated folder for all tax-related documents and ensure that it includes copies of all filings, receipts, and correspondence with the Wisconsin Department of Revenue.

- **Using Cloud-Based Solutions for Easy Access**: Services such as pdfFiller can help store these documents securely while enabling access from anywhere, making it easier to manage and share information with your team.

- **Sharing and collaborating on tax documents with your team**: Utilize features within your document management tool that allow for secure sharing and real-time collaboration on tax documents, improving accuracy and communication.

Frequently asked questions about the Wisconsin non-combined corporation franchise form

Navigating the complexities surrounding the Wisconsin non-combined corporation franchise form often leads to common questions. Here are a few frequently asked questions that can provide further clarity: - **What happens if I miss the deadline?** Missed deadlines can result in penalties, interest, and additional fees, so it's crucial to submit on time or request an extension if necessary.

- **How can I amend my franchise form?** You can amend your franchise form by filing an amended return with the Wisconsin Department of Revenue, ensuring to highlight the changes made.

- **Are there penalties for errors?** Yes, errors in the filing can lead to penalties, including interest on unpaid taxes and additional fines, emphasizing the need for accuracy.

Additional guidance and support

For more personalized assistance, reaching out to the Wisconsin Department of Revenue is advisable. They provide resources and support specifically catered to small business owners navigating the non-combined corporation franchise form.

Contact information for inquiries can typically be found on their official website. Utilizing available resources can provide insights on filing accurately and understanding changes in tax law.

Additionally, integrating a comprehensive document management solution like pdfFiller can streamline your document processes, allowing for easy edits, eSign capabilities, and team collaboration, thus enhancing the overall tax management experience.

Ongoing updates and revisions to the franchise tax process

Staying informed on tax law changes is vital for non-combined corporations in Wisconsin. Changes can arise due to legislative updates or shifts in state revenue needs. Regularly reviewing official resources and announcements from the Wisconsin Department of Revenue can keep you informed.

Additionally, it’s beneficial to establish a routine for reviewing your tax obligations and documentation processes annually. This proactive approach enables smoother filing processes and ensures compliance with evolving tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find wisconsin non-combined corporation franchise?

How do I execute wisconsin non-combined corporation franchise online?

Can I sign the wisconsin non-combined corporation franchise electronically in Chrome?

What is Wisconsin non-combined corporation franchise?

Who is required to file Wisconsin non-combined corporation franchise?

How to fill out Wisconsin non-combined corporation franchise?

What is the purpose of Wisconsin non-combined corporation franchise?

What information must be reported on Wisconsin non-combined corporation franchise?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.