Get the free Form 8-k

Get, Create, Make and Sign form 8-k

How to edit form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

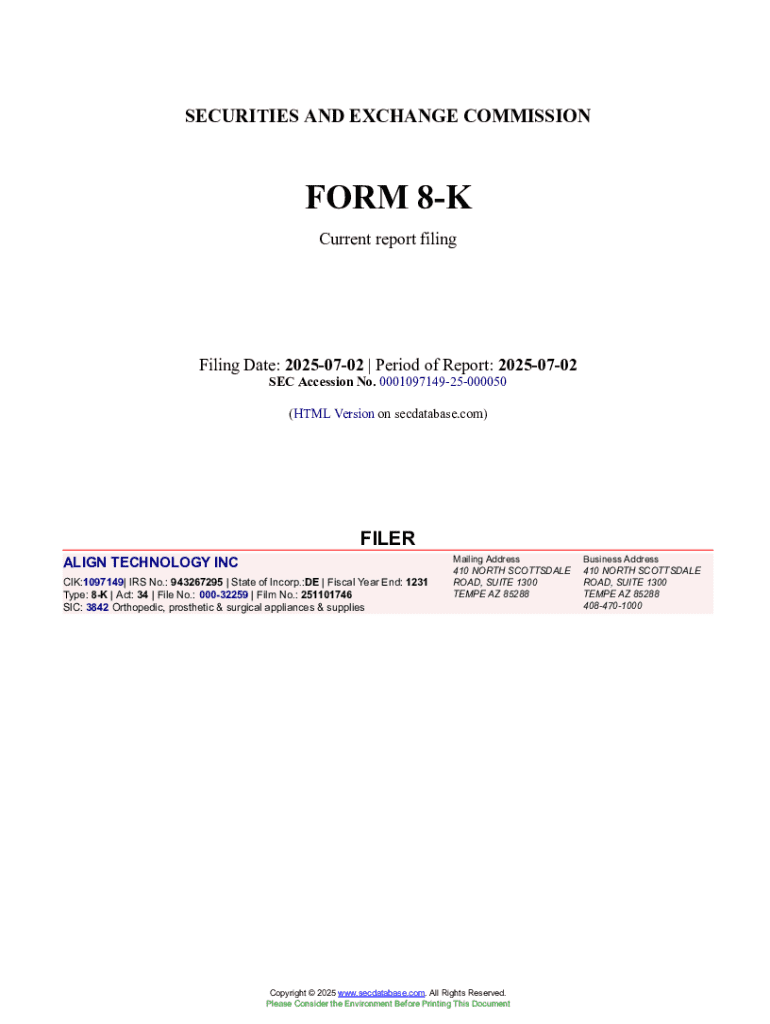

Understanding Form 8-K: The Essential Disclosure Document

What is Form 8-K?

Form 8-K serves as a crucial disclosure document required by the U.S. Securities and Exchange Commission (SEC). It allows public companies to report significant events that might impact investors' decisions. Unlike other SEC filings such as Form 10-K and Form 10-Q, which provide annual and quarterly financial results, Form 8-K is intended for reporting specific events on a more ad-hoc basis.

This form includes a variety of important disclosures, from mergers and acquisitions to changes in executive leadership and financial health. By failing to disclose material events, companies risk legal penalties, market distrust, and reputational damage. Understanding the importance and implications of Form 8-K is essential for both companies and investors.

Importance of Form 8-K in corporate transparency

For public companies, filing a Form 8-K is not just a regulatory requirement; it’s a commitment to transparency. The SEC mandates that companies disclose material events promptly to ensure that investors have timely access to crucial information. Late or inadequate disclosures can lead to significant legal repercussions and eroded investor trust.

Investors rely heavily on these disclosures to make informed decisions. Therefore, timely and accurate disclosure through Form 8-K contributes to a healthier marketplace, ensuring that all investors are on an even playing field. The financial markets thrive on transparency, and maintaining trust through proper disclosures can significantly influence both short-term stock pricing and long-term investor relationships.

Key components of Form 8-K

Understanding the structure of Form 8-K can help both companies and investors. A typical Form 8-K is divided into items, each corresponding to different types of disclosures. Common disclosures include the announcement of major acquisitions, changes in management, bankruptcy filings, or disruptions affecting a company’s operations.

Notably, not all items on the form are mandatory. According to Regulation S-K, certain items must be disclosed, while others are optional. However, providing additional information can enhance investor comprehension and goodwill towards the company.

When is Form 8-K required?

Form 8-K must be filed within four business days of specific triggering events. These events can vary widely, but typical circumstances that necessitate a filing include mergers, acquisitions, a change in control, bankruptcy, or termination of a director. Understanding when to file is crucial for compliance and to avoid penalties.

Late filings can lead to scrutiny from the SEC and potential penalties. Companies must have robust internal processes to ensure timely compliance with filing obligations, enabling them to avoid unnecessary legal complications.

Benefits of filing Form 8-K

The advantages of timely Form 8-K filings are multifold. For companies, regular, transparent updates enhance investor confidence. Stakeholders appreciate when companies proactively disclose critical information, building trust and loyalty over time.

Legal compliance is another significant benefit. Companies that accurately file Form 8-K mitigate the risk of penalties for inadequate disclosures. Additionally, a strong reputation for transparency can attract more investors and possibly lead to better stock performance. In an era where information drives market sentiment, managing disclosures effectively is essential for sustaining a positive market image.

How to read and interpret a Form 8-K

Investors and analysts must know how to read and interpret Form 8-K filings effectively. These forms contain complex legal and financial jargon that can be daunting for non-professionals. Key terms to familiarize oneself with include 'material event,' 'disclosure item,' and 'forms of agreement.' Understanding these will promote a better grasp of the critical information being communicated.

To simplify analysis, consider utilizing charts or summaries of the data presented in Form 8-K. Highlighting key updates can facilitate quick assessments, allowing investors to stay informed without wading through dense text.

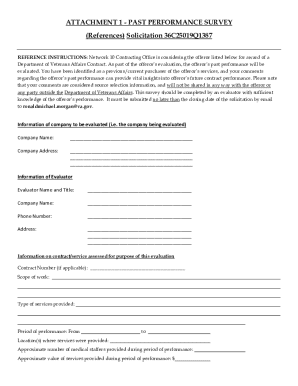

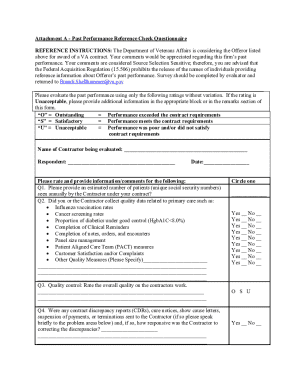

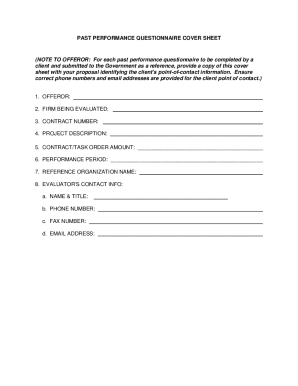

Filling out Form 8-K: Step-by-step instructions

Completing Form 8-K requires careful planning and consideration. Prior to filing, it’s crucial to gather all necessary information and documentation related to the material event. Consulting with legal and compliance teams can ensure that the form is filled out correctly and in adherence to SEC requirements.

When filling out the form, begin by entering basic company information, including the name and contact details. Each section should then be completed according to the relevant events being disclosed. Take caution to avoid common pitfalls, such as incomplete or inaccurate entries, as these can lead to additional scrutiny from the SEC.

Submitting the form

Once the Form 8-K is properly filled out, it needs to be submitted electronically through the SEC’s EDGAR system. This process involves uploading the document and ensuring all relevant fields are completed correctly. It’s advisable to maintain a checklist of requirements to prevent any last-minute oversights.

After submission, it's important to monitor the status of the filing and ensure that it is publicly accessible. This not only fulfills regulatory obligations but also promotes transparency with stakeholders who may wish to review the document.

Interactive tools for Form 8-K management

Using modern tools like pdfFiller can significantly streamline the management of Form 8-K filings. The platform offers customizable templates, making it easier for companies to draft disclosures quickly and accurately. With interactive features, teams can collaborate in real-time, ensuring that all necessary input is captured before submission.

Additionally, pdfFiller's cloud-based platform allows users to access their documents from anywhere, simplifying the editing and signing process. By employing these advanced tools, businesses can focus more on content and compliance, minimizing administrative burdens.

Real-life applications and case studies

Exploring industry insights can provide a better understanding of the implications of Form 8-K filings. For instance, examining high-profile disclosures, such as those involving tech giants during acquisition events or changes in executive leadership, reveals effective communication strategies that build trust with investors.

Additionally, practices can vary widely across sectors. It is vital to learn about compliance benchmarks within specific industries to adopt best practices suitable for various contexts. By studying these real-life applications and case studies, companies can enhance their filing strategies and improve overall transparency.

Frequently asked questions about Form 8-K

Addressing common queries surrounding Form 8-K can clarify its use and requirements. A frequently asked question is how often companies need to file this form. Generally, it depends on the occurrence of material events, meaning it can vary significantly from month to month.

Another common query is whether Form 8-K can be amended after filing. The SEC allows companies to submit amendments to correct any errors or omissions, thus providing an additional layer of protection for companies striving to maintain accurate disclosures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 8-k in Chrome?

Can I create an electronic signature for signing my form 8-k in Gmail?

How do I fill out form 8-k using my mobile device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.