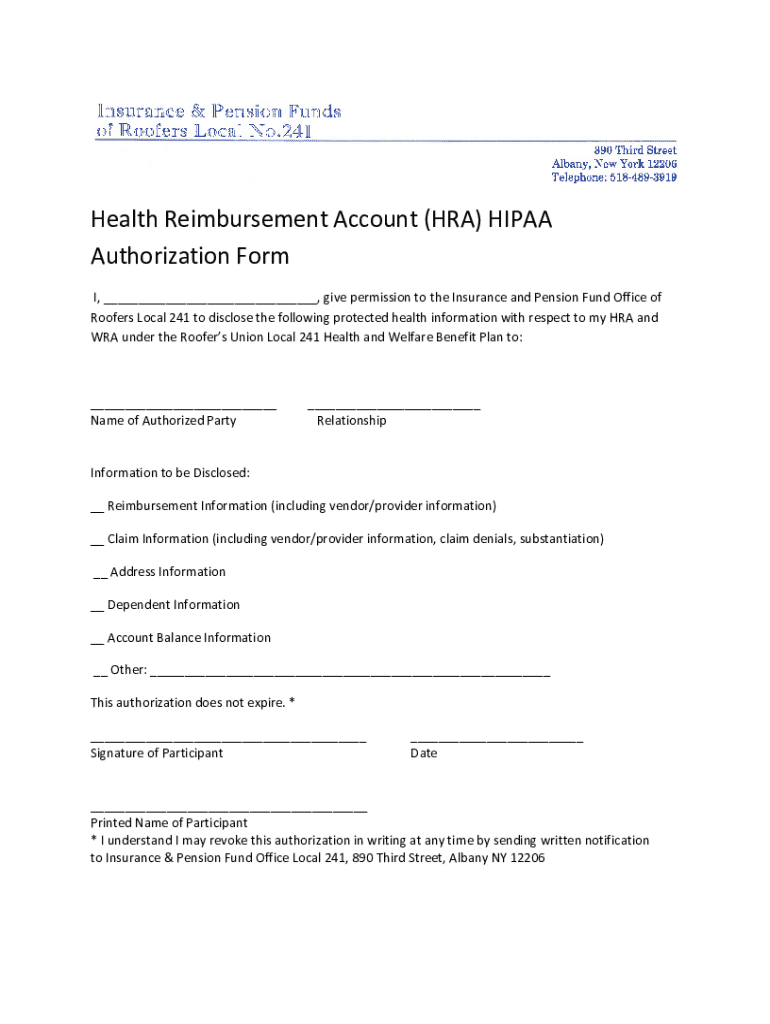

Get the free Health Reimbursement Account (hra) Hipaa Authorization Form

Get, Create, Make and Sign health reimbursement account hra

Editing health reimbursement account hra online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health reimbursement account hra

How to fill out health reimbursement account hra

Who needs health reimbursement account hra?

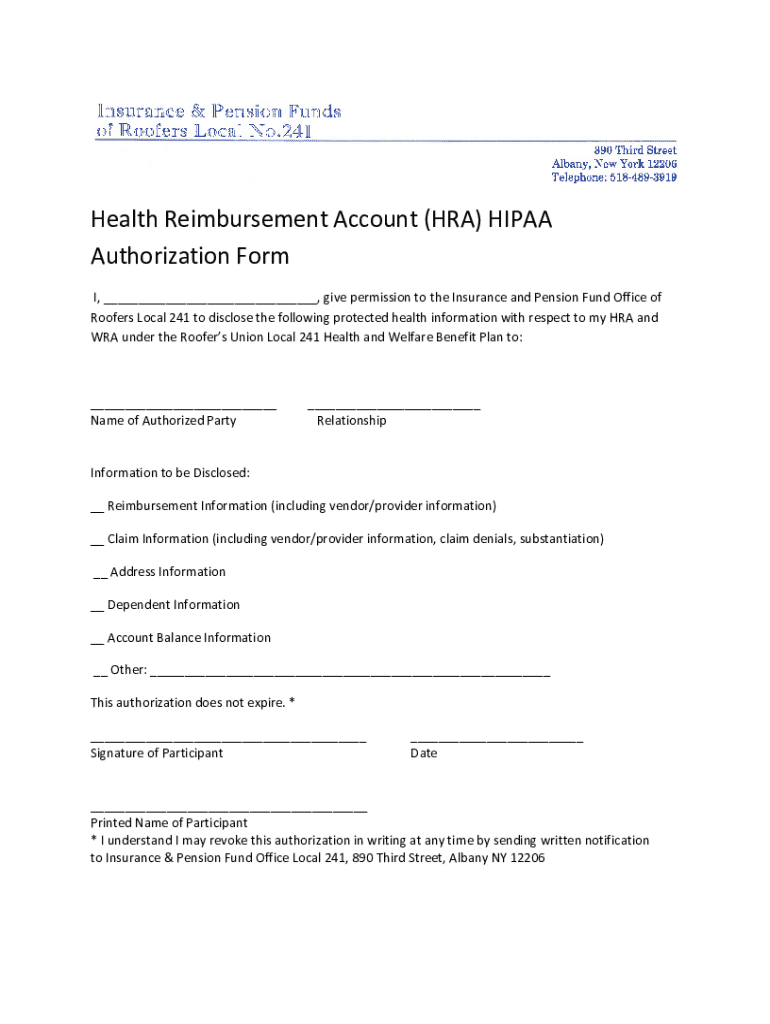

Health Reimbursement Account (HRA) Form: A Comprehensive Guide

Understanding Health Reimbursement Accounts (HRA)

Health Reimbursement Accounts (HRAs) are employer-sponsored benefit plans that reimburse employees for qualified medical expenses. They serve as a powerful tool for both employees seeking assistance with healthcare costs and employers wishing to support their workforce effectively. These accounts allow employees to receive reimbursements for medical expenses tax-free, promoting a healthier, more financially secure workforce.

The primary benefit of HRAs lies in their tax advantages. Employers can deduct contributions made to these accounts when filing their taxes, while employees receive reimbursements without the deduction of income or payroll taxes. This arrangement not only enhances employee satisfaction but can also bolster overall retention rates.

Types of HRAs

Different types of HRAs serve various needs, allowing employers to tailor solutions that align with their workforce’s demographics and healthcare needs. Here’s a breakdown of the common types of HRAs available.

Getting Started with Your HRA Form

The HRA form is crucial for employees who wish to access the benefits of their health reimbursement account. By filling out this form, you initiate the process of receiving funds for qualified medical expenses. It’s essential to ensure that the form is completed accurately and with the necessary documentation to avoid processing delays.

When starting with your HRA form, you'll need to be aware of eligibility requirements. In general, employees must be part of an employer’s health plan to qualify, but specific conditions may vary based on the HRA type provided by the employer.

Step-by-step instructions for filling out the HRA form

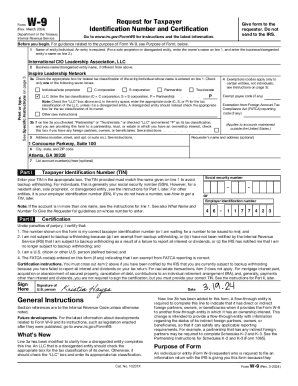

Filling out the HRA form is a systematic process that involves gathering and detailing essential information. Start by obtaining the necessary personal information and documentation related to your medical expenses. Details such as your name, Social Security Number (SSN), and any relevant health reimbursement documentation should be organized before filling out the form.

The various sections of the HRA form include specific areas requiring distinct information. Understanding these sections is vital to ensuring accurate submission.

Common mistakes to avoid include submitting incomplete information, which can lead to delays, as well as misclassifying medical expenses. Ensuring that all entries are accurate and complete is crucial for successful reimbursement.

Using your HRA funds effectively

Once your HRA form is processed, knowing how to use your funds effectively is vital. Claiming reimbursements can be done through various methods, either online or via paper submissions, depending on the employer's offering. Each method has its processing times, so ensure you choose the one that best suits your needs.

Understanding which expenses are covered is equally important. Qualified medical expenses can range from doctor's visits, surgeries, to medication costs. However, certain items such as elective procedures may not qualify for reimbursement under standard HRA guidelines.

Managing your HRA account

Management of your HRA account is crucial for ensuring you maximize your benefits. Many employers offer online platforms for employees to access their HRA information conveniently. Services like pdfFiller provide a comprehensive dashboard for managing documents, making it easier to view account balances, check claims status, and submit new reimbursement requests.

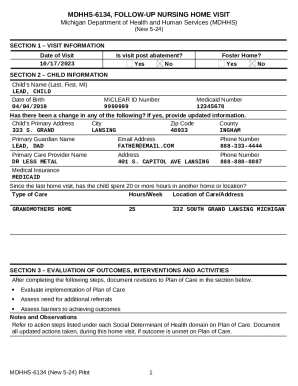

Keeping your personal information updated is essential, as changes may affect your eligibility for reimbursements. Always report modifications, such as changes in address or marital status, to your employer promptly to avoid any disruption in service.

Interactive tools and resources

Utilizing interactive tools can enhance understanding and maximize benefits from your HRA. For instance, online HRA calculators can help you estimate potential tax savings based on your expenses and contributions. These tools guide budgeting for future medical costs, making financial planning more precise.

In addition, pdfFiller provides various HRA templates, allowing users to customize forms for different circumstances. Having access to versatile templates ensures you can adapt your documentation needs to your situation effortlessly.

Navigating the complexities of HRAs

HRAs, alongside FSAs and HSAs, can be complex to navigate due to their distinct attributes and tax implications. Understanding the differences between these accounts is essential when deciding which option may best suit individual needs. HRAs are employer-funded, whereas FSAs are employee-funded and HSAs require high-deductible health plans.

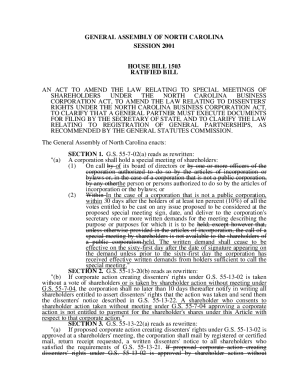

Recent changes in HRA regulations have emerged, influenced largely by the Affordable Care Act (ACA) and IRS guidelines. Staying informed on these regulations is crucial, as changes can affect your eligibility, contribution limits, and available reimbursements.

Frequently asked questions about HRA forms

As you navigate your HRA, questions may arise regarding submissions and fund usage. For instance, if you submit an incorrect form, it may lead to delays or rejected claims. Always double-check your entries before submitting to ensure compliance with your employer's guidelines.

Another common query pertains to using HRA funds for non-medical expenses. Generally, HRA funds should strictly be used for qualified medical expenses; using them otherwise may result in tax penalties. Additionally, understanding how your employer decides on contributions can provide valuable insight into the sustainability of your HRA.

Conclusion of HRA guide

Understanding the intricacies of your health reimbursement account (HRA) and the associated form is vital to maximizing healthcare benefits. Properly navigating your HRA allows you to make the most of employer contributions for medical expenses while ensuring compliance with submitted claims.

Utilizing tools provided by platforms like pdfFiller aids in efficiently managing your HRA forms and ensuring you maintain organized records. With the right knowledge and resources at hand, you can effectively leverage your HRA for better health and financial outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my health reimbursement account hra in Gmail?

How do I edit health reimbursement account hra on an Android device?

How do I complete health reimbursement account hra on an Android device?

What is health reimbursement account hra?

Who is required to file health reimbursement account hra?

How to fill out health reimbursement account hra?

What is the purpose of health reimbursement account hra?

What information must be reported on health reimbursement account hra?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.