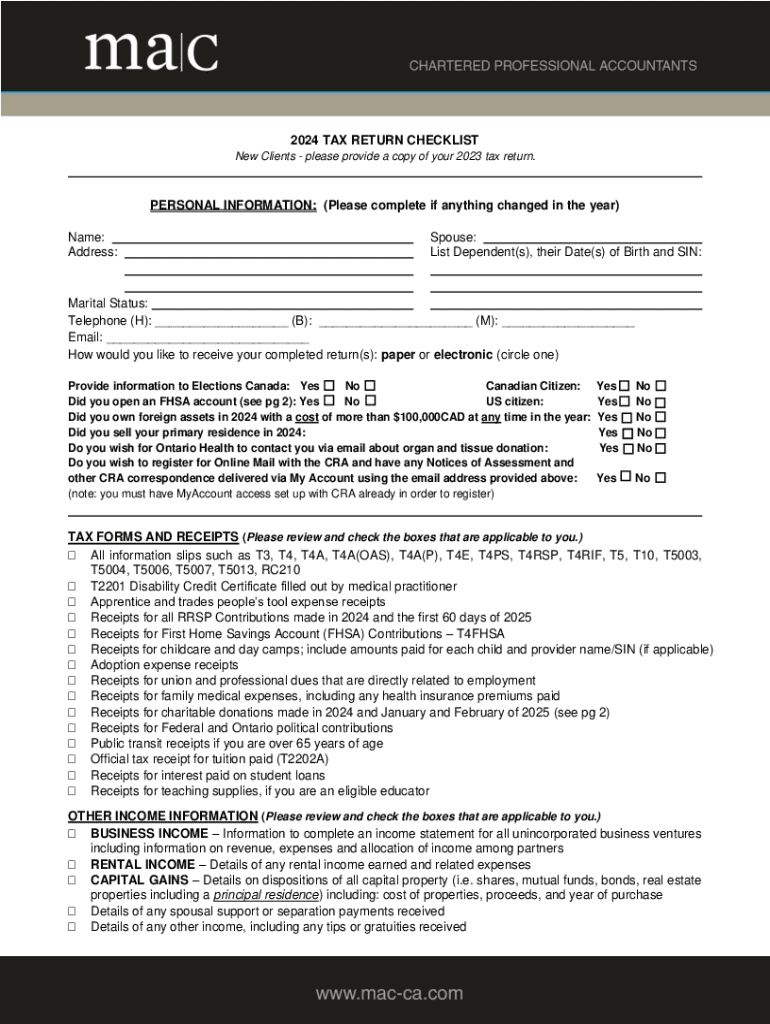

Get the free 2024 Tax Return Checklist

Get, Create, Make and Sign 2024 tax return checklist

How to edit 2024 tax return checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 tax return checklist

How to fill out 2024 tax return checklist

Who needs 2024 tax return checklist?

2024 Tax Return Checklist Form - Your Definitive Guide

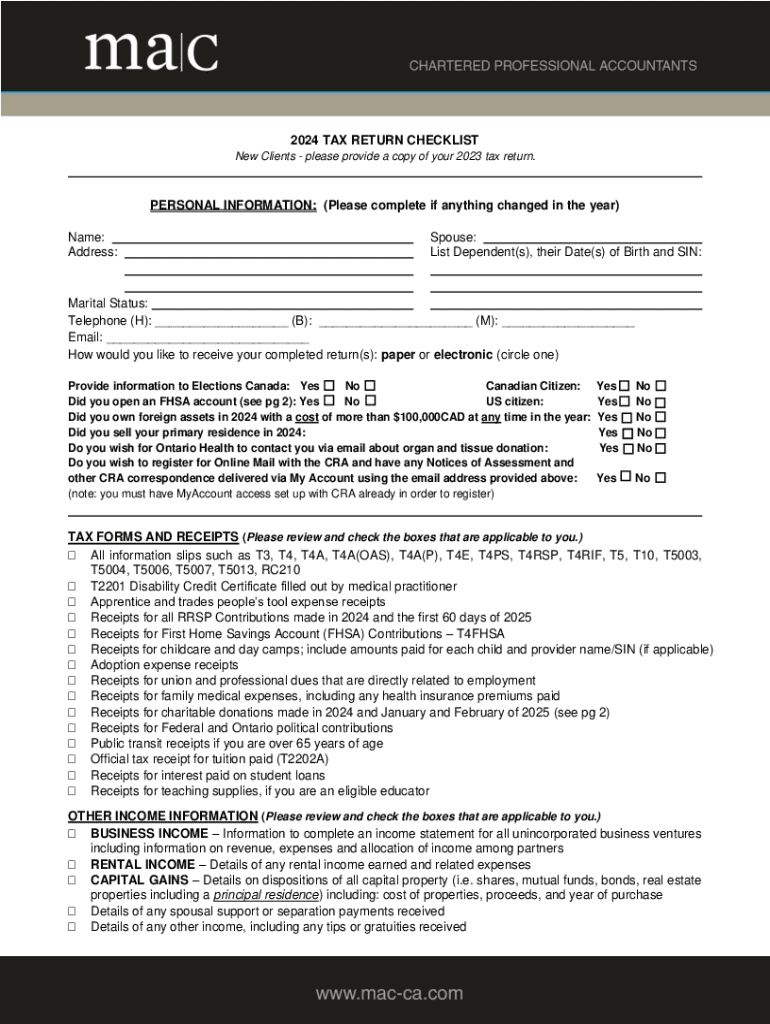

Overview of the 2024 tax return checklist

Tax season can be a source of anxiety and confusion. The 2024 tax return checklist form acts as a systematic approach to organizing your financial documents, streamlining the filing process, and ensuring compliance with all tax regulations.

By having a clear understanding of what is required, taxpayers can avoid common pitfalls and simplify their preparation. The importance of staying organized cannot be overstated, as it saves time and helps minimize errors that can lead to issues with the IRS.

Essential documents and information for your tax return

To effectively utilize the 2024 tax return checklist form, it’s crucial to gather the right documents and information. This includes personal identification information, income verification documents, and supporting documents for deductions and credits.

Personal identification information encompasses Social Security numbers and tax ID numbers, which are essential for accurately processing your return. Income verification involves collecting W-2 forms from employers, 1099 forms for freelancers, and any interest or dividend statements received throughout the year.

Step-by-step instructions on completing the tax return checklist

Getting organized for tax season requires a systematic approach. First, create a dedicated folder—either physical or digital—to store all your tax documents. This prevents any critical information from being misplaced. Next, list out each document needed for various income sources, which can help clarify what you already have and what may still be outstanding.

Utilizing the tax return checklist form effectively involves highlighting critical deadlines. Knowing the filing dates can prevent unnecessary late fees or penalties. Additionally, this checklist serves as a way to identify any potential missing documents, allowing for timely requests or replacements.

Real-time collaboration and document management

Collaboration is essential, especially for families or small businesses. Using tools like pdfFiller can aid in efficiently filling out your tax return checklist form. With interactive features, it allows users to complete forms, share them with others, and ensure that everyone involved has access to the most recent documents.

Digital signing capabilities make it easy to finalize documents securely. eSigning through pdfFiller not only enhances the security of your documents but also preserves a thorough digital trail that can be invaluable if questions arise during tax filing or in the future.

Common mistakes to avoid during the tax filing process

Tax filing can be prone to errors, primarily due to oversight. Missing essential documentation such as W-2s or 1099s can lead to inaccuracies in your return and potential audits. Misreporting income sources or neglecting to report additional earnings from side jobs is another common mistake that can raise red flags with the IRS.

Taxpayers often overlook various tax credits and deductions they may qualify for, impacting their overall tax burden. Always cross-reference your deductions with the tax return checklist form to ensure maximization of your tax benefits.

Frequently asked questions about the 2024 tax return checklist form

As tax season approaches, many individuals have lingering questions about documentation and filing processes. One common concern is what to do if a necessary document cannot be found. In such cases, contact the issuer for replacements or consider alternative documentation, while ensuring compliance with IRS guidelines.

Another frequent inquiry involves the security of online filing versus traditional paper filing. While both options have benefits, online filing can offer enhanced security features, particularly when using trusted platforms like pdfFiller, which employs advanced encryption for document safety.

Special considerations for different tax situations

Not all taxpayers fit the same mold, which is why special situations require tailored checklists. Freelancers and self-employed individuals often have additional considerations, such as tracking business expenses, that necessitate precise documentation throughout the year.

Individuals with dependents should also pay close attention to potential deductions and credits available to them. Unique circumstances, such as those involving moving abroad or handling rental properties, can complicate tax returns, thus requiring additional documentation and specific knowledge of international tax laws.

Resources for further assistance

As you prepare your tax return, don't hesitate to seek guidance from authoritative resources. The IRS provides comprehensive guidelines for tax filing in 2024, which can be invaluable when understanding your obligations and rights as a taxpayer.

Local tax resources and professionals can offer individualized support based on your specific circumstances. For enhanced document management, consider accessing additional features on pdfFiller that cater to your unique tax preparation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 2024 tax return checklist without leaving Chrome?

Can I create an electronic signature for the 2024 tax return checklist in Chrome?

Can I create an eSignature for the 2024 tax return checklist in Gmail?

What is tax return checklist?

Who is required to file tax return checklist?

How to fill out tax return checklist?

What is the purpose of tax return checklist?

What information must be reported on tax return checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.