Get the free Pre-authorized Debit (pad) Agreement

Get, Create, Make and Sign pre-authorized debit pad agreement

How to edit pre-authorized debit pad agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pre-authorized debit pad agreement

How to fill out pre-authorized debit pad agreement

Who needs pre-authorized debit pad agreement?

Comprehensive Guide to the Pre-Authorized Debit Pad Agreement Form

Understanding pre-authorized debit (PAD)

Pre-Authorized Debit (PAD) allows individuals and businesses to automate their payment processes by authorizing a third party to withdraw funds directly from their bank accounts. This mechanism simplifies the payment landscape, offering a secure and efficient means to handle regular transactions such as bill payments, mortgage submissions, and subscription fees. With PADs, consumers can avoid late fees and ensure their accounts remain in good standing.

The importance of PADs lies in their ability to streamline financial transactions and foster better cash flow management. By setting up recurring payments, account holders are freed from the hassle of remembering payment deadlines, which ultimately enhances personal and business financial stability.

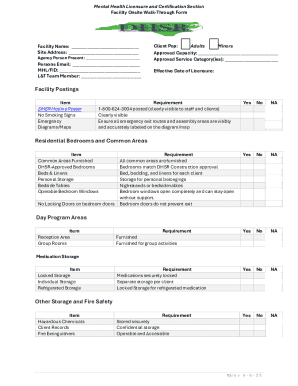

Overview of the pre-authorized debit pad agreement form

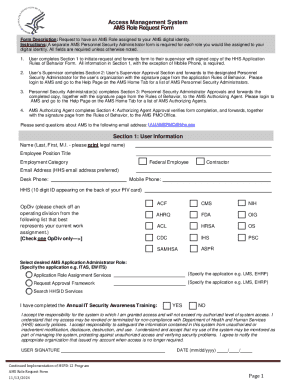

A Pre-Authorized Debit Pad Agreement Form is a legal document that outlines the explicit consent of an account holder to allow a debtor to withdraw funds from their bank account. This document serves as a crucial tool for both the payee and payer, providing important details about the arrangement and establishing clear expectations regarding future transactions.

Key components of this form typically include: - Account holder information, including name, address, and contact details to identify the payer. - Authorization details, which specify the party authorized to initiate withdrawals and the amount to be withdrawn. - Payment frequency and terms, which clarify how often the withdrawals will occur, along with any other conditions pertinent to the agreement.

Benefits of using the pre-authorized debit pad agreement form

Using a Pre-Authorized Debit Pad Agreement Form offers several advantages that enhance both the payer's and payee's experience. By automating the payment process, users can significantly reduce the administration overhead typically associated with regular transactions. This leads to a more efficient payment solution that ultimately saves time for all parties involved.

The reduction of missed payments is another notable benefit. By establishing a reliable pattern of debits, account holders can avoid expensive late fees and damage to their credit scores. Furthermore, enhanced cash flow management becomes possible, allowing individuals and businesses to forecast their financial obligations with a higher degree of accuracy.

How to fill out a pre-authorized debit pad agreement form

Filling out a Pre-Authorized Debit Pad Agreement Form requires careful attention to detail to ensure accuracy. Here’s a step-by-step guide to completing the form efficiently.

Editing and modifying your pre-authorized debit agreement

Life is unpredictable, and situations may arise where you need to edit your Pre-Authorized Debit PAD Agreement. Using tools like pdfFiller makes the process straightforward. With pdfFiller, editing your document is just a few clicks away, allowing you to maintain updated agreements easily.

When using pdfFiller, users can save changes while maintaining version control. This ensures that you have access to previous agreement iterations and can track modifications over time. Having the ability to revert back to prior agreements can be invaluable in case of disputes or when reviewing past terms.

Signing the pre-authorized debit pad agreement

Signing your Pre-Authorized Debit Pad Agreement can be done in various ways, particularly with the advancements in technology. Digital signatures are contemporary alternatives that facilitate remote agreements without requiring physical paperwork.

Steps for using pdfFiller’s eSignature tools include: 1. Upload your PAD Agreement form to the platform. 2. Select the eSignature option and follow prompts to add your signature electronically. 3. Save the final agreement to ensure all parties have access to a signed copy.

As for legal validity, electronic signatures are binding in many jurisdictions, making them a secure method for completing agreements.

Managing your pre-authorized debit transactions

Once your Pre-Authorized Debit transactions are established, managing them becomes essential. Setting up recurring payments involves defining transaction amounts and the intervals at which funds will be withdrawn, directly through your financial institution or via a payment processing platform like pdfFiller’s offerings.

Monitoring these payments regularly ensures that you are aware of your account status and can detect any irregularities. Adjusting your payments or reconfiguring your agreements may be necessary should your financial situation shift. Additionally, it's crucial to familiarize yourself with the process for cancellations and modifications to your PAD to avoid unwanted deductions or disrupted services.

Sample pre-authorized debit authorization forms

Studying sample Pre-Authorized Debit Authorization Forms can provide clarity on how to effectively fill out your own. Analyzing filled and blank forms helps identify common mistakes and reinforces the importance of careful data entry.

Frequently asked questions (FAQs) about pre-authorized debit pad agreement forms

Users frequently have questions about their Pre-Authorized Debit Agreements, stemming from concerns about managing their bank information and understanding cancellation policies.

Conclusion: Mastering your pre-authorized debit arrangements

Embracing the use of a Pre-Authorized Debit Pad Agreement Form can significantly improve your payment management experience. Utilizing pdfFiller not only simplifies the document creation process but also provides a robust platform for editing, signing, and managing your financial agreements efficiently.

With pdfFiller’s capabilities, you can take charge of your financial landscape, ensuring timely payments and enhanced organization. The ease of access and user-friendly interface serves all individuals and teams seeking efficiency in document management. Make your financial transactions smoother today with pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete pre-authorized debit pad agreement online?

Can I create an electronic signature for the pre-authorized debit pad agreement in Chrome?

How can I edit pre-authorized debit pad agreement on a smartphone?

What is pre-authorized debit pad agreement?

Who is required to file pre-authorized debit pad agreement?

How to fill out pre-authorized debit pad agreement?

What is the purpose of pre-authorized debit pad agreement?

What information must be reported on pre-authorized debit pad agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.