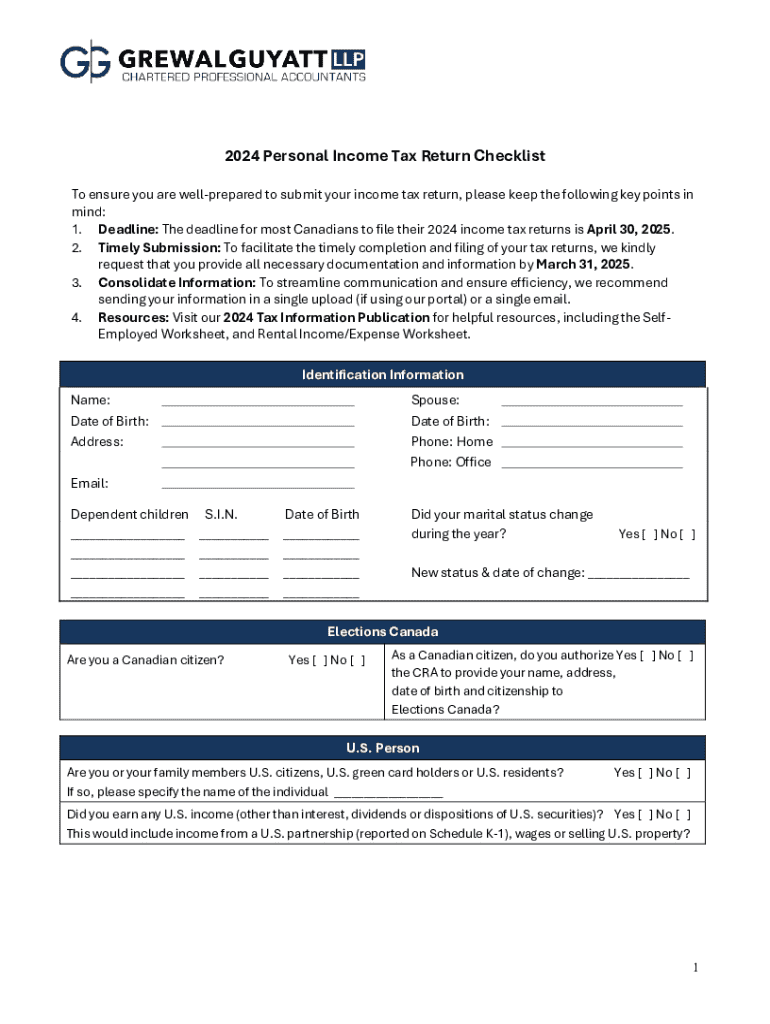

Get the free 2024 Personal Income Tax Return Checklist

Get, Create, Make and Sign 2024 personal income tax

Editing 2024 personal income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 personal income tax

How to fill out 2024 personal income tax

Who needs 2024 personal income tax?

2024 Personal Income Tax Form - How-to Guide

Understanding the 2024 personal income tax form

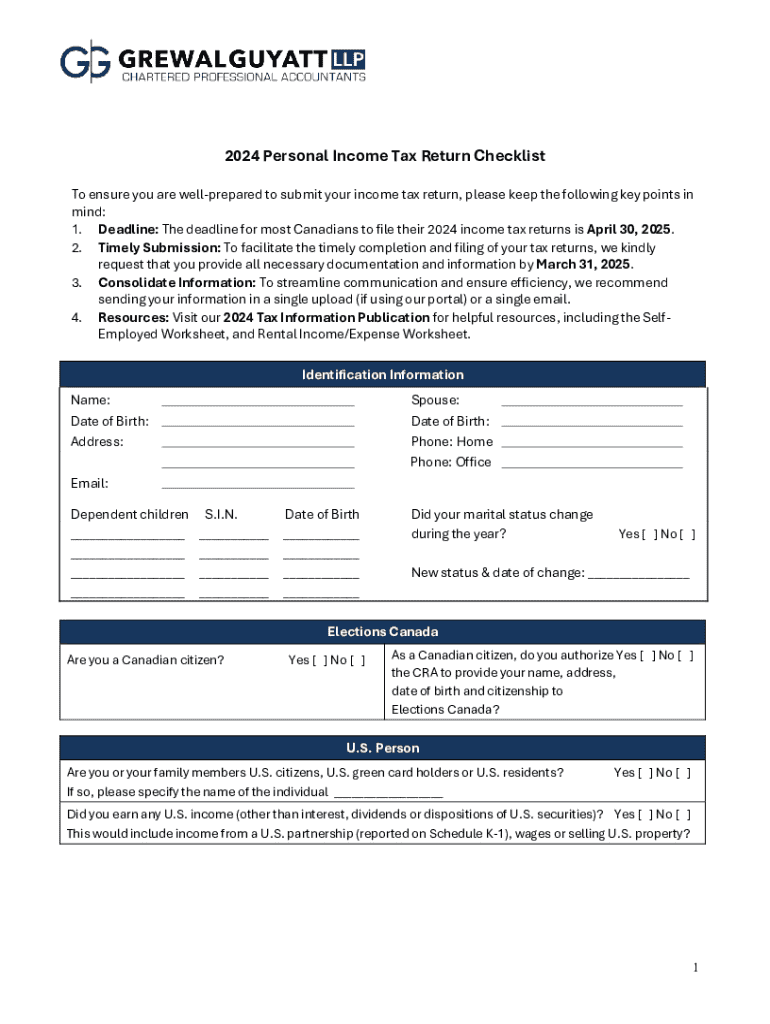

The 2024 personal income tax form is a crucial document that individuals use to report their annual income to the Internal Revenue Service (IRS). The primary form for individual taxpayers is the 1040, which comes in various versions like the 1040-SR for seniors. Understanding the specific form is essential, as each version caters to different taxpayer demographics and needs.

In 2024, there are several key changes to note compared to previous years. For instance, updated income thresholds for tax brackets could significantly impact what individuals owe. Tax forms must be filled out accurately to avoid penalties, ensure timely refunds, and prepare for audits.

Key changes in 2024 tax filing

This year, the government has introduced new tax brackets and adjusted rates impacting individual taxpayers. Understanding these changes is vital as they dictate how much tax you owe. The IRS has updated tax brackets, so it’s imperative to refer to the official IRS guidance to see how these may affect you.

Additionally, adjustments have been made to various deductions and credits. The standard deduction has increased, making this option more beneficial for many taxpayers. Changes to child tax credits and earned income tax credits further shape how much tax your family may be liable for this year.

Preparing to fill out the 2024 personal income tax form

Before diving into the form, gathering all necessary documentation is crucial. Key documents include W-2s that report your wages, 1099s for self-employed income, and receipts for deductible expenses, including charitable donations and medical costs. Having these documents organized will streamline the filing process and reduce potential errors.

Understanding your tax situation is equally important. For example, significant life changes like marriage, divorce, or purchasing a home might qualify you for different deductions or credits. Self-assessment quizzes can help clarify your filing status, whether single, married, or head of household. Be proactive in comprehending your unique tax situation.

Step-by-step guide to filling out the 2024 personal income tax form

Accessing the 2024 personal income tax form has never been easier. Users can download the form directly from the IRS website or through platforms like pdfFiller, which provides integrated tools for filling out the forms. These platforms also offer e-filing options and allow for electronic submissions, making the process smoother.

When filling out the form, be meticulous about each section. You'll begin with personal information that includes your name and Social Security number. Next, report all income sources accurately, followed by deductions and credits you are entitled to. Finally, signatures and any additional forms required must be included to validate your submission.

Common mistakes to avoid

Filing your 2024 personal income tax form correctly is vital to avoid costly errors. Common pitfalls include miscalculating your income, overlooking eligible deductions, and failing to sign the form. Another frequent mistake is neglecting to review your details, which can result in processing delays or even audits.

To ensure the accuracy of your submission, adopt best practices such as double-checking your entries and utilizing available tools within platforms like pdfFiller that offer error-checking functionalities. Maintaining careful attention during the filing process can save you from penalties and necessary follow-up.

Editing and reviewing your tax form with pdfFiller

pdfFiller empowers users by providing interactive tools that effectively assist with editing and reviewing your tax form. Highlighting features allow you to spot errors easily, while built-in error-checking functionalities can catch discrepancies before submission. This proactive approach seeks to reduce the stress of tax filing.

For those seeking collaborative feedback, pdfFiller offers a seamless mechanism to share your form with tax professionals or advisors. Utilizing comment tools fosters effective communication, ensuring you receive valuable insights relevant to your tax situation before submitting your form.

Signing and submitting your 2024 personal income tax form

Once your form is complete, you’re required to sign it. pdfFiller's e-signature solutions streamline this process, enabling quick and secure submission. The e-signature process reinforces the legality of your document, making it a reliable option for online filers.

You have several options for submitting your completed tax form. E-filing remains the most popular choice due to its convenience, allowing for faster refunds and electronic confirmation of submission. If you prefer traditional methods, mailing a paper form is also viable, but be mindful of deadlines to avoid penalties.

Post-filing management

After you've filed your 2024 personal income tax form, tracking your tax return is essential. pdfFiller provides tools to check the status of your filed form easily. Keeping tabs on your return minimizes the surprise of potential issues, ensuring you address them promptly.

Should you receive any correspondence from the IRS, such as notices or requests for additional information, it's imperative to respond promptly. pdfFiller makes document management seamless, allowing you to access necessary records quickly. Being organized will ease your mind and help you address any inquiries efficiently.

Frequently asked questions about the 2024 personal income tax form

One of the most common inquiries surrounding the 2024 personal income tax form involves filing extensions. Taxpayers can request an extension of time to file; however, this does not extend the time to pay taxes owed. Understanding the correct steps for requesting an extension will prevent unnecessary late fees.

Certain situations, like international tax issues or student income, can also complicate filing. Taxpayers facing such unique scenarios should seek targeted guidance to ensure compliance. Proactive research and planning can save considerable time and headaches during the tax season, offering peace of mind.

Community forum and support access

Engaging with peers through community forums can provide invaluable insights and sharing experiences related to the 2024 personal income tax form. Users can access discussions that offer tips and advice, creating a collaborative space to learn from others' experiences.

If you require tailored assistance, contacting the support team from pdfFiller is straightforward. Users can utilize chat or email support to seek guidance on filing, ensuring they leverage the platform to its fullest potential for their needs. Having a support system can help mitigate issues before they escalate.

Next steps after filing

Once the tax form is submitted, safeguarding your personal data is paramount. Consider adopting measures to protect sensitive information. Keep copies of your filed forms, as these documents are essential for future reference and potential audits. Understanding how to manage these records effectively is crucial for long-term financial health.

The filing period can feel daunting, but with organized preparation and the use of platforms like pdfFiller, taxpayers can navigate this process smoothly. By staying informed of changes and ensuring compliance with new regulations, individuals can approach tax season with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2024 personal income tax in Gmail?

How do I edit 2024 personal income tax online?

How do I edit 2024 personal income tax on an iOS device?

What is personal income tax?

Who is required to file personal income tax?

How to fill out personal income tax?

What is the purpose of personal income tax?

What information must be reported on personal income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.