Get the free Employer's Withholding Tax Guide

Get, Create, Make and Sign employers withholding tax guide

Editing employers withholding tax guide online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employers withholding tax guide

How to fill out employers withholding tax guide

Who needs employers withholding tax guide?

Employers Withholding Tax Guide Form: Your Comprehensive Resource

Overview of employers withholding tax

Employers withholding tax refers to the amount of an employee's earnings that an employer is required to withhold for federal, state, and local taxes. This system is crucial as it ensures that taxes are collected efficiently and distributed to the government throughout the year. For employers, understanding their responsibilities is fundamental not only for compliance but also for maintaining employee trust and financial health. Failure to adhere to withholding rules can result in significant penalties and back taxes.

The importance of withholding tax extends beyond legal compliance. It plays a vital role in managing employee finances, as timely withholding helps workers avoid large tax bills during tax season. Moreover, employers are legally obliged to report and remit these withheld amounts accurately, ensuring the integrity of tax collections in the country.

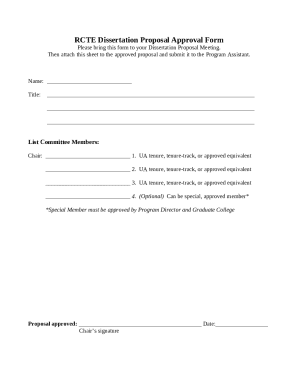

Understanding the employers withholding tax guide form

The employers withholding tax guide form is an essential document in the withholding tax process. It primarily serves as a tool for employers to determine how much tax should be withheld from their employees' paychecks based on provided information. Understanding this form is critical for ensuring compliance and accurate payroll processing.

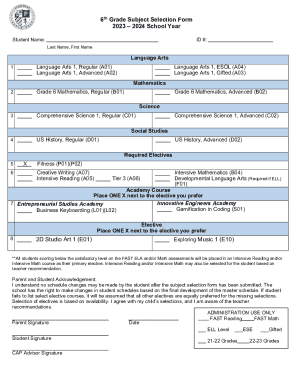

Key components of the form include the employee information section, where personal details are captured; the tax withholding calculation section, where the exact amount to withhold is determined; and the signature and submission section, which validates the information provided. Each segment serves a distinct purpose and must be completed carefully to avoid any discrepancies.

Step-by-step instructions for filling out the employers withholding tax guide form

Filling out the employers withholding tax guide form can be simplified by following a few organized steps. Each step ensures that you gather necessary information and complete the form accurately.

Step 1: Gather required information

Before you start, gather all necessary documents such as the employee's Social Security number, W-4 form, and previous tax documents. Ensuring you have this information at hand can significantly reduce mistakes and save time during the filling process.

Step 2: Complete the employee information section

In this section, input the employee's name, address, Social Security number, and filing status. It is crucial to double-check the accuracy of this information, as any errors can lead to compliance issues.

Step 3: Calculate withholding amount

Utilize the appropriate tax tables to find the correct withholding based on the employee's pay frequency and filing status. Tax tables are updated annually, so ensure you are using the most current version for accurate calculations.

Step 4: Review and confirm entries

Once you've filled out the form, take the time to review each entry for accuracy. A few minutes spent double-checking can save you from costly mistakes down the line. Consider consulting with a tax professional if you're unsure about any entries.

Step 5: Submit the form

Finally, submit the completed form via the preferred method. Options typically include online submissions, mailing hard copies, or delivering them in person. Be mindful of deadlines to avoid penalties or issues with the IRS.

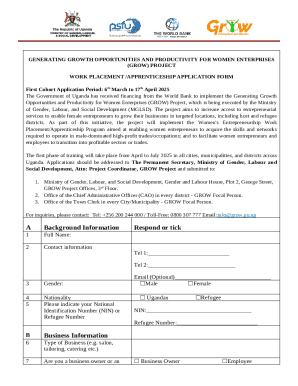

Common scenarios and considerations

Employers often encounter various scenarios that necessitate adjustments to the withholding tax guide form. For instance, if a new employee is onboarded or an employee terminates, the form must be updated to reflect these changes in stature.

Additional considerations also come into play when dealing with part-time versus full-time employees, as their tax obligations can differ. Moreover, if an employee has additional income from side jobs, adjustments to their withholding may be necessary to avoid underpayment of taxes.

Interactive tools and resources

Employers can greatly benefit from interactive tools available through various platforms. These resources help simplify the process of calculating withholdings and completing tax forms accurately.

You can access several online tax calculation tools to assist with withholding amounts, which can be invaluable for accurate payroll. Additionally, downloadable versions of the employers withholding tax guide form are available, ensuring that you have easy access to the latest version required by the IRS. State-specific resources further aid in understanding local regulations that may affect withholding.

FAQs about the employers withholding tax guide form

Navigating the employers withholding tax guide form can raise various questions. It's important to clarify common queries to ensure adherence to tax regulations.

Benefits of using pdfFiller for employers withholding tax

Employers can simplify their tax documentation processes significantly by utilizing pdfFiller. This platform empowers users with seamless PDF editing capabilities, ensuring that forms like the employers withholding tax guide form can be easily modified without hassle.

The eSigning feature allows for quick approvals, reducing the time spent on paperwork and improving workflows. Additionally, pdfFiller offers a cloud-based environment for managing all documents, ensuring that everything is securely stored and easily accessible.

User testimonials and success stories

Users have had varied experiences with the employers withholding tax guide form and pdfFiller. Case studies reveal how small businesses have streamlined their payroll processes significantly through effective document management.

Feedback from HR professionals often highlights the ease of use and convenience provided by pdfFiller. Users consistently express satisfaction with how the platform aids in meeting compliance standards while maintaining efficient workflows.

Quick tips for employers

Maintaining compliance with withholding tax regulations can be complex, but implementing best practices makes it more manageable. Regular training for employees involved in payroll processes can ensure everyone is updated on the latest tax laws.

Additionally, leveraging technology like pdfFiller to automate documentation can alleviate much of the burden that comes with managing forms. Staying informed about tax law changes through reliable sources ensures that your business remains compliant and up-to-date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete employers withholding tax guide online?

Can I create an eSignature for the employers withholding tax guide in Gmail?

Can I edit employers withholding tax guide on an iOS device?

What is employers withholding tax guide?

Who is required to file employers withholding tax guide?

How to fill out employers withholding tax guide?

What is the purpose of employers withholding tax guide?

What information must be reported on employers withholding tax guide?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.