Get the free Personal Pre-authorized Debit Agreement

Get, Create, Make and Sign personal pre-authorized debit agreement

Editing personal pre-authorized debit agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal pre-authorized debit agreement

How to fill out personal pre-authorized debit agreement

Who needs personal pre-authorized debit agreement?

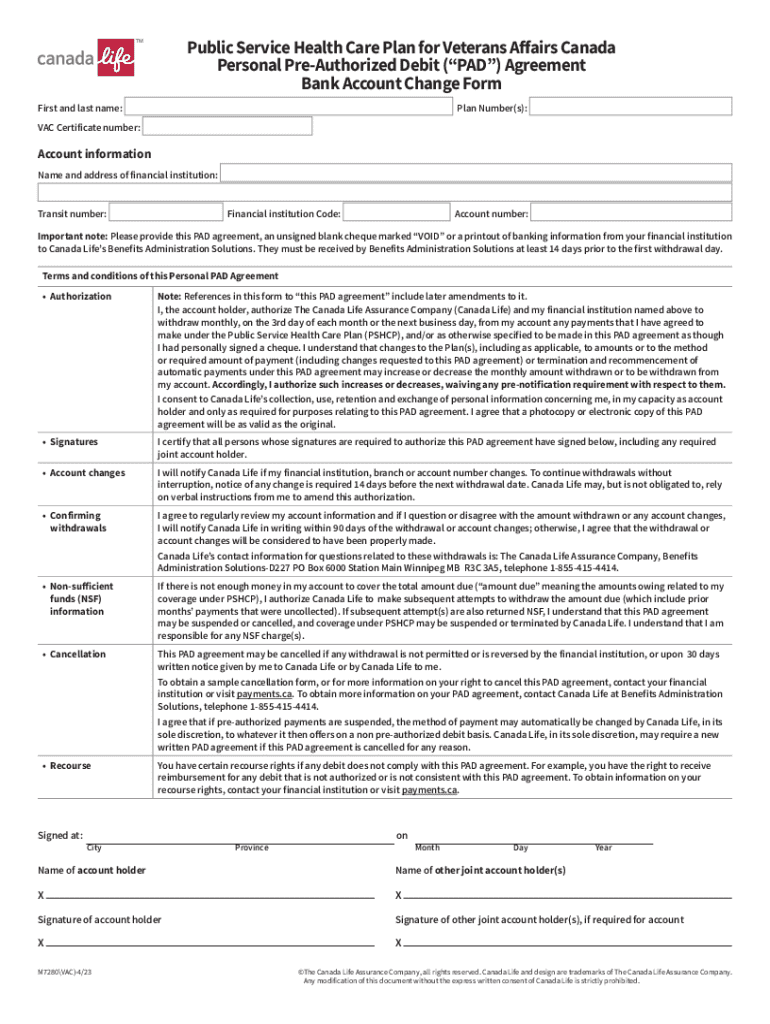

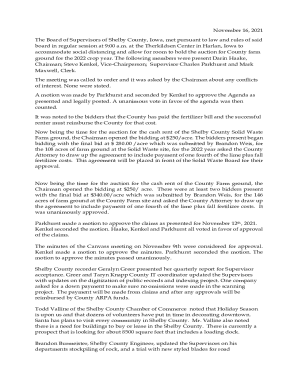

Personal Pre-Authorized Debit Agreement Form: Everything You Need to Know

Understanding personal pre-authorized debit agreements

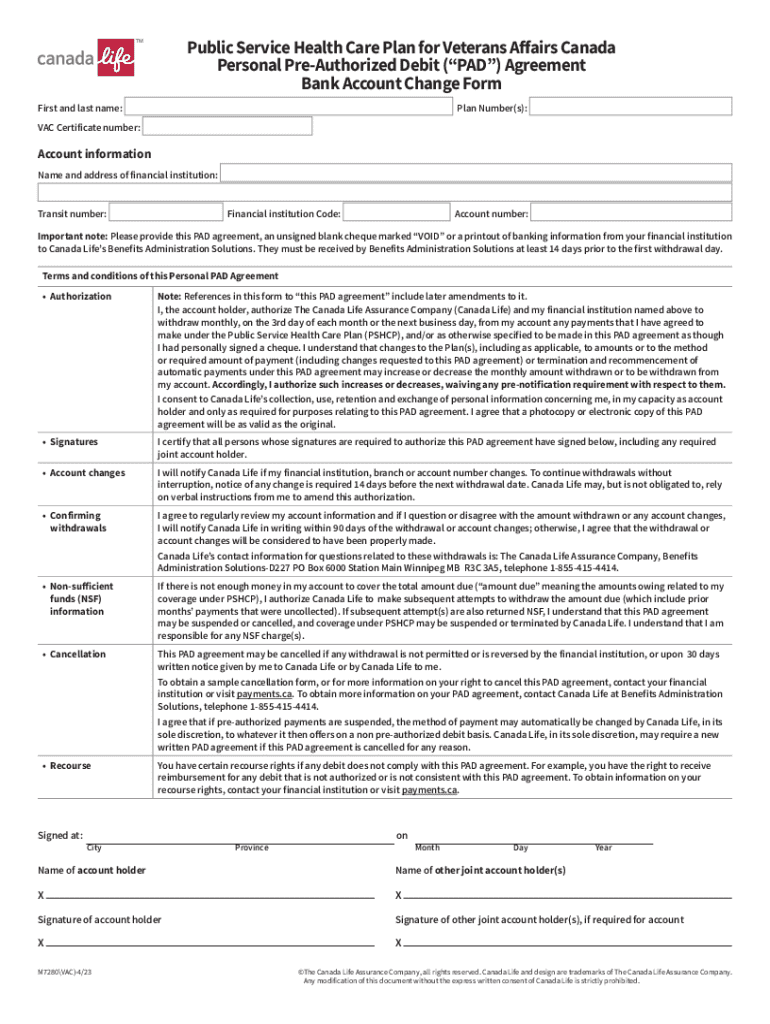

A personal pre-authorized debit (PAD) agreement is a legal document that allows an individual or organization to withdraw funds directly from a bank account on a predetermined schedule. This agreement is crucial for ensuring consistent and timely payments, reducing the risk of late fees and missed deadlines. By setting up a PAD agreement, payors can enjoy the convenience of automated payments, whether for recurring bills, subscriptions, or loan repayments.

The primary participants involved in these transactions are the payor—the individual whose funds will be debited—and the payee—the entity receiving the funds. This structured approach enables both parties to have a clear understanding of the payment process, building trust and transparency in financial dealings.

Key elements of a personal pre-authorized debit agreement form

A well-structured personal pre-authorized debit agreement form includes essential components that provide clarity to both parties. Core fields typically encompass personal information such as the name, address, and contact details of the payor. Additionally, clear instructions regarding bank account details are necessary to facilitate seamless transactions.

Specific terms and conditions should be detailed, particularly payment frequency (weekly, monthly, biannually), amount, and the duration of the agreement. This information ensures both the payor and payee understand their commitments. Importantly, the signatures of the payor and any witnesses required substantiate the validity of the authorization, making it possible to initiate and manage the payments.

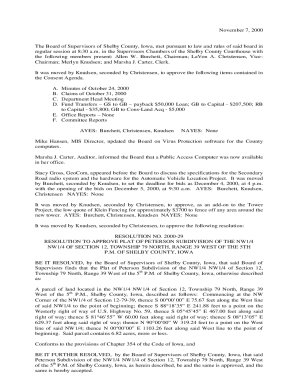

Step-by-step guide to completing your personal pre-authorized debit agreement form

Before filling out the personal pre-authorized debit agreement form, gather necessary information to ensure accuracy. Key documents include your bank statements, identification information, and any prior agreements related to the payments. This preparation enables you to fill out the form without delays or mistakes.

Begin filling out the form by carefully entering personal information. This includes your name, address, and phone number. Subsequently, accurately input bank details to prevent any hindrance to the payment process. Lastly, provide payment details such as the amount and frequency, ensuring you double-check for common mistakes like wrong figures or dates. Errors in these sections could lead to payment issues.

Once the form is filled, reviewing the agreement is critical. You should verify every detail meticulously to ensure legality and compliance with any relevant regulations. A finalized agreement, with its specifics correctly stated, sets a solid foundation for a secure payment process.

Editing and managing your PAD agreement using pdfFiller

pdfFiller provides a robust platform for managing your personal pre-authorized debit agreement forms efficiently. To start, simply upload your completed PDF agreement to the platform. The user-friendly tools available allow for easy editing, enabling you to make any necessary adjustments directly in the document.

Collaboration features enhance the management of your PAD agreement. You can share documents with relevant stakeholders for approvals and signed requests, ensuring everyone is in agreement with the terms. Interactive comments facilitate real-time adjustments, making the revision process collaborative and hassle-free. With pdfFiller, staying organized with your documents is straightforward, promoting effective document management practices that keep your agreements readily accessible and up-to-date.

Frequently asked questions about personal pre-authorized debit agreements

Many users have questions regarding the use of personal pre-authorized debit agreements, especially concerning modifications. It’s common to wonder what to do if you need to change the payment amount or frequency. The process usually involves revising the original agreement and obtaining a new signature, as any changes must be formally approved. It’s important to communicate any changes to the payee promptly to avoid discrepancies in payments.

Another common concern pertains to revoking a pre-authorized debit agreement. This typically involves notifying the payee in writing about the desire to cancel the agreement and obtaining confirmation of the cancellation. Users should keep a copy of this correspondence for their records and monitor their accounts to ensure that no further payments are deducted post-revocation.

Legal considerations for personal pre-authorized debit agreements

Understanding the legal context surrounding personal pre-authorized debit agreements is vital for both payors and payees. These agreements are governed by a framework of regulations designed to protect consumers. In many jurisdictions, financial institutions are required to provide clear disclosures about the terms and conditions of PADs, ensuring that users understand their rights and obligations.

Consumer protection laws exist to safeguard individuals from unauthorized debits or breaches of agreement terms. If disputes arise, customers have recourse through their banks and regulatory agencies. Therefore, being aware of these rights can be beneficial, allowing users to navigate any issues that may arise during the payment process effectively.

Additional tips for using personal pre-authorized debit agreements effectively

Setting up a personal pre-authorized debit agreement effectively requires strategic planning. One recommendation is to clearly communicate with your payee regarding expectations for payments. This dialogue can preempt potential misunderstandings related to timing or amounts, fostering a stable ongoing relationship.

Moreover, ensuring the security of your banking information is imperative. Use secure channels for sharing sensitive information, and utilize the robust security features offered by platforms like pdfFiller. Regularly updating passwords associated with your banking and financial platforms can further protect your accounts from unauthorized access.

Conclusion

Utilizing a personal pre-authorized debit agreement form streamlines the payment process, offering a level of convenience and security for both payors and payees. By leveraging pdfFiller, users can simplify the creation, management, and editing of these agreements. The platform's capabilities empower individuals and teams to navigate their financial commitments efficiently, showcasing the value of effective document management in today's fast-paced environment. We encourage users to take advantage of pdfFiller's interactive tools to enhance their document management experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete personal pre-authorized debit agreement online?

Can I create an electronic signature for the personal pre-authorized debit agreement in Chrome?

How can I fill out personal pre-authorized debit agreement on an iOS device?

What is personal pre-authorized debit agreement?

Who is required to file personal pre-authorized debit agreement?

How to fill out personal pre-authorized debit agreement?

What is the purpose of personal pre-authorized debit agreement?

What information must be reported on personal pre-authorized debit agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.