Get the free Pre-authorized Debit (pad) Agreement

Get, Create, Make and Sign pre-authorized debit pad agreement

Editing pre-authorized debit pad agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pre-authorized debit pad agreement

How to fill out pre-authorized debit pad agreement

Who needs pre-authorized debit pad agreement?

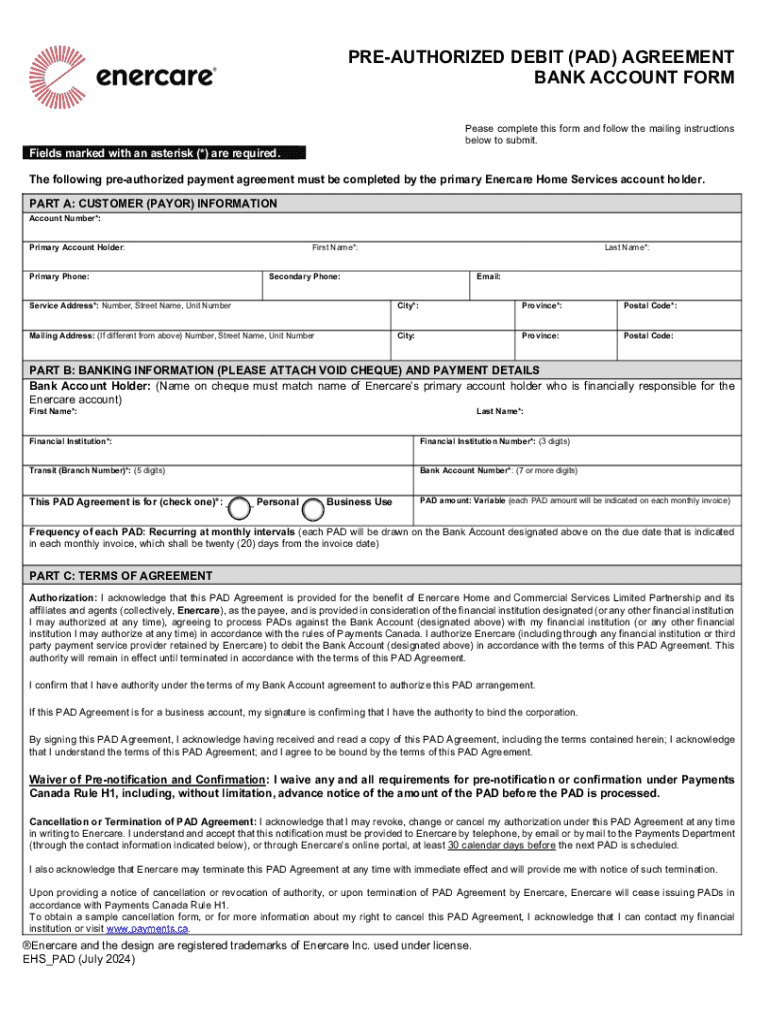

A comprehensive guide to the pre-authorized debit pad agreement form

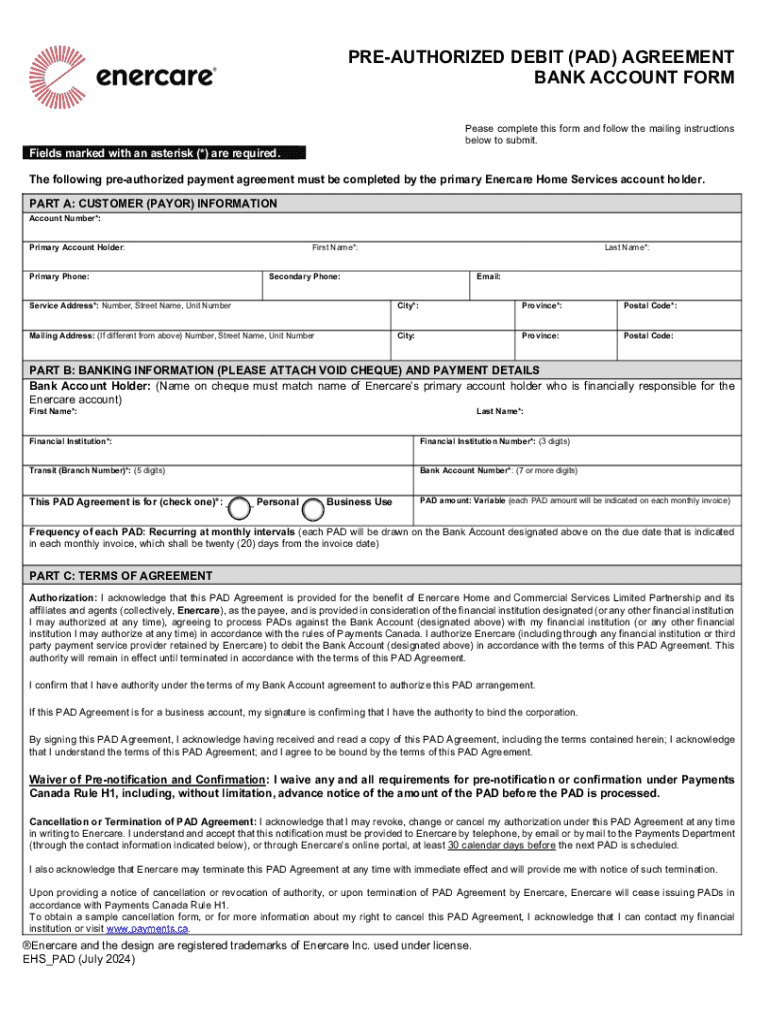

Understanding pre-authorized debit (PAD)

Pre-Authorized Debit (PAD) is a payment method that allows businesses to automatically withdraw funds from a customer's bank account on a scheduled basis. This system streamlines the payment process, ensuring that payments are made on time without the need for manual intervention. For customers, PAD arrangements eliminate the hassle of forgetting due dates or dealing with late fees.

The key benefits of using PAD agreements are numerous. First and foremost, they facilitate automatic payments. This means customers can authorize bill payments, subscriptions, or memberships to be deducted directly from their bank accounts. Such a system not only enhances convenience for both individuals and teams but also helps in effective budget management, as regular, predictable expenses can be accounted for in financial planning.

Importance of the pre-authorized debit pad agreement form

The pre-authorized debit pad agreement form lays the groundwork for establishing a legal framework for transactions via PAD. This form is essential as it outlines the terms of the agreement and defines the rights and responsibilities of both parties involved. In doing so, it provides clarity and accountability to the payment process, benefiting both the service provider and the customer.

Submitting an incomplete or incorrect form can lead to serious consequences. For example, transactions may be rejected, leading to missed payments and potentially straining the customer-provider relationship. Not having a clearly defined agreement increases the risk of misunderstandings or disputes regarding payment schedules and amounts.

Overview of the pdfFiller pre-authorized debit pad agreement form

pdfFiller offers a highly user-friendly pre-authorized debit pad agreement form that enhances the document completion experience. One of its standout features is the editable fields and templates, allowing users to modify information based on their specific requirements. This flexibility ensures that both individuals and teams can tailor the form to their unique circumstances.

In addition, pdfFiller's cloud-based access makes it easy for users to access their forms from anywhere, promoting collaboration and efficiency. With collaborative tools, teams can work on the same document simultaneously, giving them the power to provide feedback in real time, ensuring everyone is aligned and the agreement is up to date.

Step-by-step guide to completing the pre-authorized debit pad agreement form

Completing the pre-authorized debit pad agreement form on pdfFiller is an intuitive process. Start by accessing the form — you can find it through a simple search on the pdfFiller interface or by navigating directly to their PAD template section. Users have the option to begin with a blank form or choose from existing templates, providing flexibility based on personal preference.

Filling out the necessary fields is the next step. Begin by entering customer information, including full name, address, and contact details. This is crucial for identification purposes. Afterwards, you'll need to input banking information, which includes account numbers and bank details. Specify the payment amount and payment frequency next. Clarity in these sections helps prevent errors that could lead to payment mishaps.

After entering all necessary information, reviewing the terms and conditions is essential. This overview provides a clear understanding of the rights and responsibilities of both parties under the PAD agreement. Users should take the time to understand these elements thoroughly to avoid potential misunderstandings.

The authorization section requires users to provide their signature, which is the formal approval to the terms outlined in the agreement. In the digital landscape, pdfFiller allows for alternatives such as electronic signatures, making the process more efficient.

Lastly, finalize your document by conducting a thorough review. Check for accuracy in all entries and ensure compliance with the agreement. Typical pitfalls to avoid include omitting information or misunderstanding terms.

Additional features and tools in pdfFiller

pdfFiller not only streamlines the completion of the pre-authorized debit pad agreement form but also enhances users' experiences through its comprehensive toolkit. One significant feature is the ability to edit and customize your form. Users can add notes or comments directly onto the document and alter fonts and layouts to improve readability or fit specific branding requirements.

Collaboration options are another highlight of pdfFiller. The platform enables users to share documents with team members or clients, facilitating coordination and communication throughout the document management process. Moreover, real-time editing and feedback capabilities mean changes can be made instantly, promoting an agile workflow.

Management after completion is equally important. pdfFiller allows users to save their documents in various downloadable formats and offers cloud storage solutions, ensuring users can access their documents whenever needed.

Frequently asked questions (FAQs) about the pre-authorized debit pad agreement form

Navigating the process of creating a pre-authorized debit pad agreement form can sometimes lead to questions. If issues arise while filling out the form, pdfFiller's support channels can provide assistance, ensuring users can complete their documents smoothly. Additionally, understanding whether PAD agreements can be revoked is crucial. Typically, both parties must agree to any changes or cancellations to enforce disestablishment.

Tracking scheduled payments is essential for effective budget management. Users should consider setting reminders or utilizing financial apps that integrate with their bank accounts to keep their PAD transactions in check. Moreover, security measures are in place on pdfFiller to ensure online signing and submission are safe. Users can rest assured that their information is protected through encryption and secure servers.

Case studies: Successful use of the pre-authorized debit agreement

Several businesses have successfully leveraged pre-authorized debit agreements to streamline their payment processes. For instance, a subscription-based service noted a significant reduction in late payments after implementing PAD agreements. This implementation not only improved cash flow but also enhanced customer satisfaction as users appreciated the ease of automatic deductions.

Testimonials from satisfied users of pdfFiller reinforce these benefits. Many have highlighted the time saved in document management and the improved accuracy following the use of digital systems. These real-life examples serve to illustrate the impact of effective payment solutions like PAD agreements on both service providers and customers.

Legal compliance and best practices for PAD agreements

Understanding the regulations surrounding pre-authorized debit agreements is crucial for entities establishing them. Compliance with legal standards is necessary to ensure the protection of both parties and to uphold the integrity of the payment process. Familiarizing yourself with the regulatory requirements specific to your industry can prevent complications in your payment systems.

Best practices involve not only adhering to legal guidelines but also ensuring clear communication between customers and service providers. Maintaining proper documentation regarding all agreements, alongside effective record-keeping practices, instills confidence among customers. Clear, concise contracts and periodic reviews of PAD agreements further contribute to successful implementations.

Troubleshooting common issues with PAD agreements

Even with the best systems in place, issues can arise during the payment process. For instance, payment errors may occur due to incorrect information entered on the PAD form. In such instances, swift action is required to investigate the discrepancy and adjust the account as necessary. Users should engage with their financial institutions promptly to rectify any such errors.

Additionally, correcting mistakes on submitted forms can often be accomplished through pdfFiller's editing capabilities. Users must act quickly, as certain corrections may need to be made before a payment is processed. Addressing unauthorized transactions requires immediate communication with the service provider and the bank to halt further withdrawals and investigate any potential fraud.

Engaging with the pdfFiller community

Engaging with the pdfFiller community allows users to gain insights and share experiences. User forums and groups dedicated to document management solutions provide an excellent platform for exchanging information. This collaborative space nurtures an environment where professionals can learn from one another, enhancing their understanding of processes like filling out pre-authorized debit agreement forms.

Additionally, pdfFiller offers a variety of learning resources and webinars aimed at helping users take full advantage of their platform. These resources not only focus on document management best practices but also address common concerns, enabling users to maximize their capabilities and remain up to date on relevant regulatory frameworks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pre-authorized debit pad agreement without leaving Google Drive?

How can I send pre-authorized debit pad agreement for eSignature?

How do I fill out pre-authorized debit pad agreement using my mobile device?

What is pre-authorized debit pad agreement?

Who is required to file pre-authorized debit pad agreement?

How to fill out pre-authorized debit pad agreement?

What is the purpose of pre-authorized debit pad agreement?

What information must be reported on pre-authorized debit pad agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.