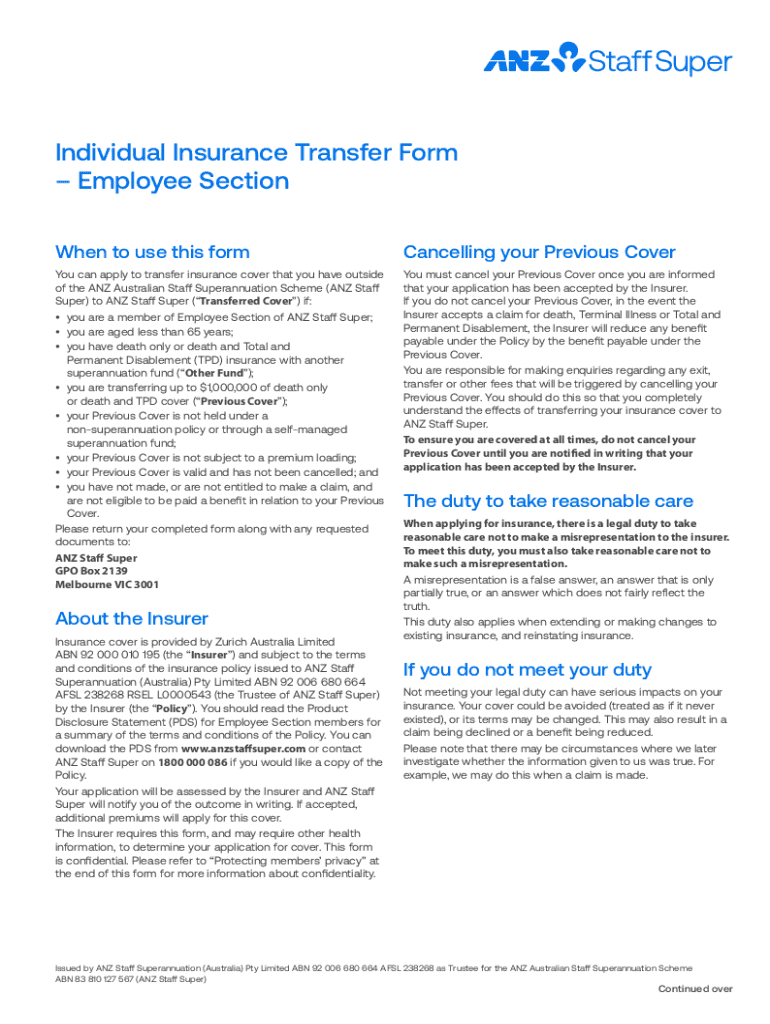

Get the free Individual Insurance Transfer Form

Get, Create, Make and Sign individual insurance transfer form

Editing individual insurance transfer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out individual insurance transfer form

How to fill out individual insurance transfer form

Who needs individual insurance transfer form?

Individual insurance transfer form - How-to Guide

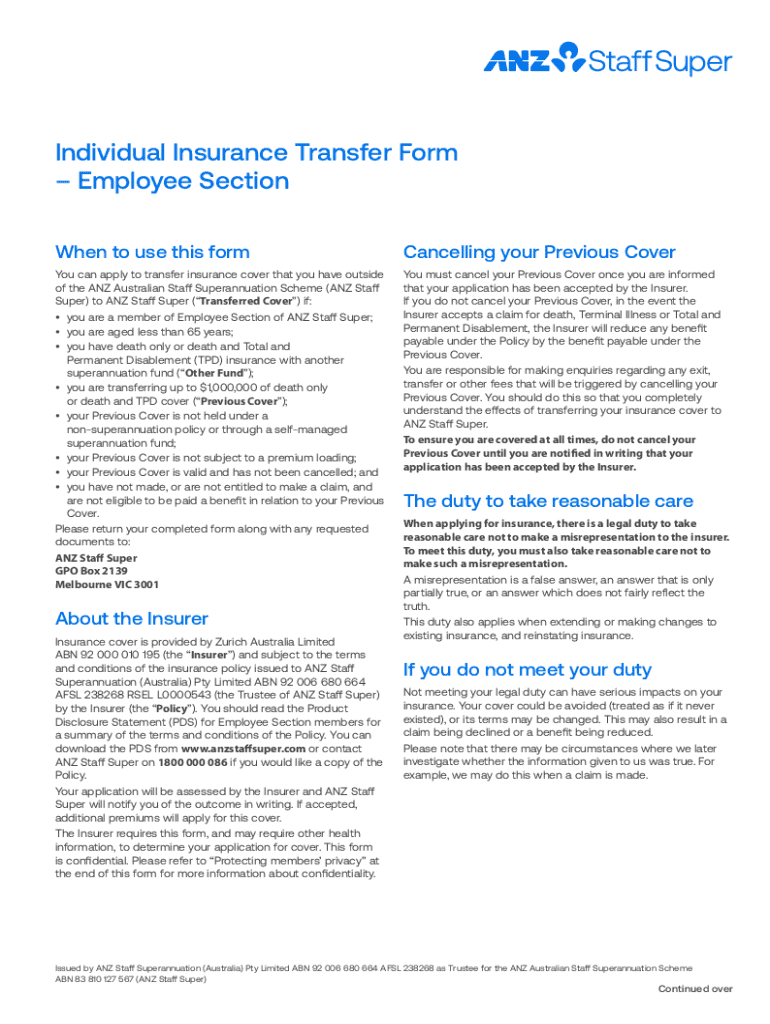

Understanding the individual insurance transfer form

An individual insurance transfer form is a legal document used to change the ownership of an insurance policy from one individual to another. This is crucial in scenarios such as changing insurance providers, updating beneficiary details, or merging policies within teams. Understanding this form is essential for anyone looking to streamline their insurance management.

The importance of the individual insurance transfer form cannot be overstated. It serves as a safeguard against disputes, ensuring that the new policyholder has clear legal rights to the benefits outlined in the insurance policy. This form also maintains transparency in policy ownership, making it a critical tool in personal finance and insurance management.

When to use the individual insurance transfer form

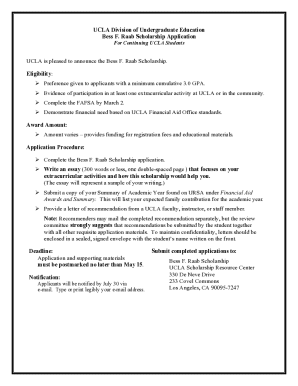

There are specific circumstances under which an individual insurance transfer form should be used. For instance, if you are switching insurance providers for better rates or services, this form allows you to transfer existing policies effectively. Additionally, if you need to update beneficiary information due to life changes such as marriage or divorce, this form facilitates that transition smoothly.

In team settings, merging policies can also be a common reason to employ this form. For example, a small business may choose to consolidate team insurance plans to streamline costs and coverage. Being aware of when to utilize this form can lead to significant benefits in terms of financial management and clarity.

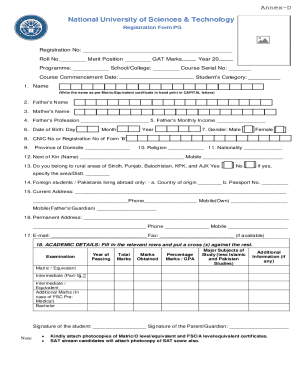

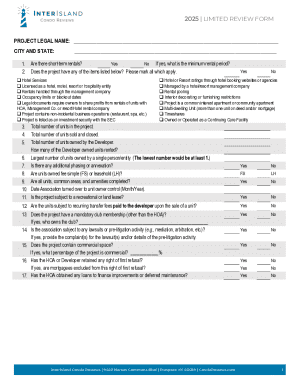

Gathering required information

To complete the individual insurance transfer form accurately, you need to gather essential personal information. This includes your full name, contact details, and the policy number associated with your current insurance provider. Ensuring this information is accurate will help in seamless processing of your transfer.

In addition to personal details, it's crucial to have additional documentation ready. This may include previous insurance documents that specify the terms and conditions of your current policies, as well as identification for verification purposes. Having all necessary documents at hand can significantly reduce processing time.

Step-by-step guide to completing the individual insurance transfer form

Filling out the individual insurance transfer form is straightforward when you know the process. The form consists of several sections that need to be completed clearly and accurately. Start with the section that asks for personal information, then move on to the current policy information.

1. Personal Information: Include your name, address, and contact info. It's vital to ensure this is correct to prevent future issues. 2. Current Policy Information: Specify the insurance policy number and the provider's name. 3. New Policy Information: Detail the new provider’s name, policy type, and other relevant details. 4. Signature and Date: Finally, sign and date the form to validate your intention to transfer ownership.

Common mistakes to avoid while filling out the form include missing signatures, incorrect policy numbers, and failure to include necessary documentation. Double-checking each section will help ensure a smoother transfer process.

Tips for editing and reviewing your individual insurance transfer form

Once you've filled out the individual insurance transfer form, take the time to edit and review it for errors. Utilizing tools like pdfFiller allows seamless modifications as needed. With its user-friendly interface, you can easily edit any portion of the form directly, making it a valuable asset for ensuring your details are correct.

Verifying the accuracy and completeness of your form before submission is critical. Look for commonly overlooked details such as misspellings or missing signatures. pdfFiller also offers options to save and share your completed form digitally for your records and further processing.

Submitting the individual insurance transfer form

The submission process for the individual insurance transfer form can vary based on your insurance provider. Options typically include online submissions through the provider’s platform or mailing the physical form. Each method has its own set of requirements, so it’s essential to follow the instructions provided by your insurer carefully.

After submitting the form, you should expect a confirmation process from the insurance provider. This may include an email acknowledgment or a physical letter confirming the received request. Additionally, processing timelines can vary; you may experience completion within a few days to several weeks, depending on the provider's internal workflow.

Frequently asked questions about the individual insurance transfer form

Individuals often have various inquiries regarding the individual insurance transfer form, particularly about ensuring their rights and understanding the implications of their actions. Common questions involve what happens if the form is rejected or how quickly one can expect to see changes reflected in their policy.

Troubleshooting tips can be beneficial, such as keeping copies of submitted forms for your records and verifying with your insurance provider about specific policies regarding transfers. Understanding the legal implications of transferring insurance is also crucial; be aware of any potential voiding of previous agreements or coverage after the transfer.

Enhancing your document management with pdfFiller

pdfFiller not only simplifies the filling out of the individual insurance transfer form but also enhances overall document management. Its features are designed to support users in managing their insurance documents efficiently. You can create, edit, and eSign documents all in one secure location, which makes it particularly beneficial for individuals and teams working remotely or spread across different locations.

Collaboration is made easy with pdfFiller, allowing multiple users to access and modify documents as needed. This centralized management also ensures that all team members have the latest version of documents, reducing the potential for confusion. Moreover, secure document management features help protect sensitive insurance data, offering peace of mind in today’s digital landscape.

Real-life examples of successful insurance transfers

Understanding real-life applications of the individual insurance transfer form can provide valuable insights. For instance, a local small business owner in California had to transfer their insurance policy after merging with another company. Using the transfer form streamlined the process, allowing them to save time and hassle, ultimately securing better coverage for their employees.

Another example comes from an individual who experienced a significant life change. After getting married, they needed to update their beneficiary information. By successfully filling out the individual insurance transfer form, they ensured that their partner was listed accurately, illustrating how these processes impact personal financial planning.

Best practices for future insurance transfers

Maintaining organized records is key for smoother transitions in future insurance transfers. Regularly updating your insurance documentation not only keeps you prepared for any changes but also ensures that all relevant information is at your fingertips when needed. It's also important to stay informed about policy regulations and requirements, which can vary significantly between providers.

Leveraging pdfFiller for ongoing document needs can greatly enhance your experience. By using this platform continuously, you can manage all forms related to your insurance efficiently, ensuring that your documentation remains organized and easily accessible. This proactive approach ultimately supports better financial planning and risk management in the long run.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify individual insurance transfer form without leaving Google Drive?

How can I send individual insurance transfer form to be eSigned by others?

Can I edit individual insurance transfer form on an Android device?

What is individual insurance transfer form?

Who is required to file individual insurance transfer form?

How to fill out individual insurance transfer form?

What is the purpose of individual insurance transfer form?

What information must be reported on individual insurance transfer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.