Get the free Form 10-k

Get, Create, Make and Sign form 10-k

Editing form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Understanding and Managing Form 10-K: A Comprehensive Guide

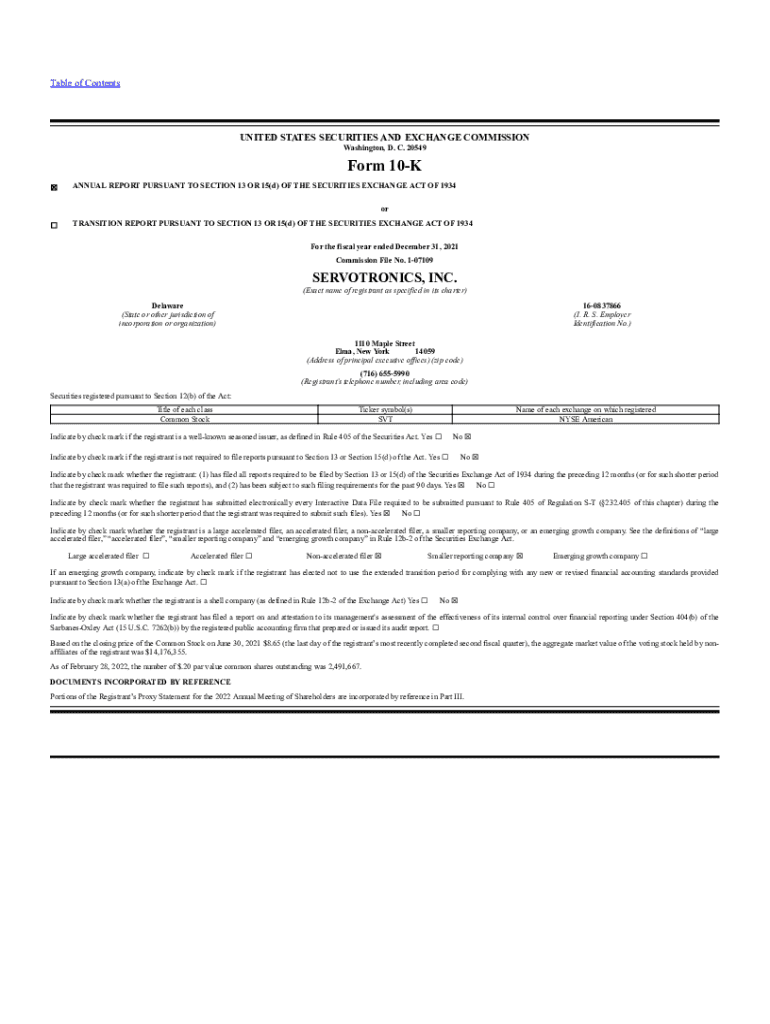

Understanding the 10-K form

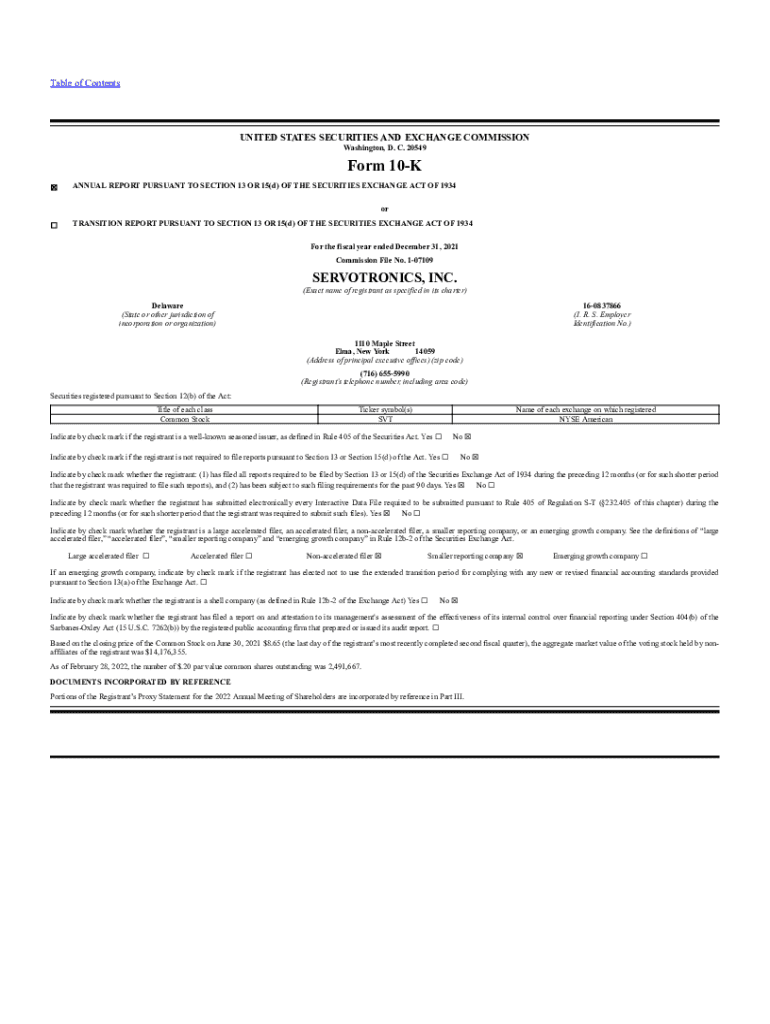

The Form 10-K is a detailed annual report mandated by the U.S. Securities and Exchange Commission (SEC). This filing provides a comprehensive overview of a publicly traded company’s financial performance and business activities over the past fiscal year. Unlike the more frequently filed Form 10-Q, which covers quarterly performance, the 10-K offers a deeper dive into the business, allowing investors and stakeholders to gauge the company’s health and future prospects.

For investors, understanding the 10-K is crucial. It permits them to make informed decisions based on financial health, risk factors, and operational strategies. Moreover, the detailed nature of the report builds a layer of transparency, essential for maintaining investor trust and regulatory compliance.

What information is included in a 10-K report?

A Form 10-K comprises several key components, including business overview, risk factors, financial data, management's discussion, and much more. Specifically, it generally includes:

When compared to other disclosures, such as the proxy statements or Form 10-Q, the 10-K is far more comprehensive and serves different purposes. While a 10-Q focuses on the financial state for a specific quarter, the 10-K provides a complete annual picture, crucial for long-term investors.

Filing requirements

Form 10-K must be filed by all publicly traded companies as per SEC regulations. The eligibility criteria primarily focus on companies that are listed on U.S. exchanges, regardless of their size. This requirement is crucial to maintaining transparency and accountability within the financial markets.

The importance of filing isn’t just a matter of compliance; it’s also about creating trust. Investors rely on these disclosures to understand the performance and risks involved in their investments. Any inaccuracies or late filings can lead to loss of investor confidence, regulatory penalties, and potential legal issues.

Financial reporting requirements associated with 10-K

The SEC sets forth stringent reporting requirements for the Form 10-K to ensure consistency and transparency. The primary financial reporting requirements involve a complete set of audited financial statements, including the necessary disclosures. Generally, companies have 60 to 90 days after the end of their fiscal year to file their 10-K, depending on their size.

Non-compliance with these filing deadlines can have serious consequences, such as reduced investor trust, fines from regulatory agencies, and even trading suspensions. Therefore, it is crucial for reporting and regulatory compliance within the corporate governance landscape.

Preparing to file your 10-K

Preparing a 10-K filing requires meticulous organization. Companies must gather various financial statements, disclosures, and corporate governance documents. The required financial statements generally include the income statement, balance sheet, cash flow statement, and supporting notes. Moreover, it is advisable to also have board meeting minutes, auditor reports, and other pertinent documentation that enhances credibility.

Understanding the structure of the 10-K is also essential. The form is divided into several sections, each addressing a specific aspect of the company’s operations and financial health. Familiarize yourself with specific terms and phrases commonly used within the document to aid in comprehension and ensure accuracy during the preparation phase.

Step-by-step instructions for filling out the 10-K

Filling out the 10-K involves several key steps to ensure accuracy and compliance. First, review your company’s financial performance metrics from the past year. Key indicators to analyze include revenue growth, profit margins, and cash flow. Utilize financial analysis tools or consult with financial experts to deepen your understanding.

Next, complete each section accurately. Focus on key items such as:

Lastly, perform a compliance check based on SEC requirements, ensuring that all necessary information is accurately disclosed. Utilize available tools to cross-reference your completed filing with the SEC guidelines before submission.

Editing and finalizing the 10-K

After completing the initial draft of your 10-K, it’s essential to utilize interactive tools for document management, such as those provided by pdfFiller. These features enhance the editing process, allowing for collaborative input from team members and financial advisors. Cloud-based tools prove beneficial, especially when revising multiple drafts or coordinating feedback from different stakeholders.

Ensuring accuracy and clarity is crucial. Develop a strategy for proofreading and editing to present the document in a professional manner. Gather feedback from key stakeholders within the organization who can provide insights into the content’s accuracy and relevance to the business. Implementing this step ensures a polished final document.

Electronic submission of the 10-K

Submitting the completed Form 10-K via the SEC’s Electronic Data Gathering, Analysis, and Retrieval system (EDGAR) involves a few distinct steps. Start by creating an account if you don’t already have one. Once you’re logged in, follow the prompts to upload your completed document. Be mindful of common mistakes, such as incorrect formatting or failure to include required sections, which can delay the submission process.

Post-submission, it is vital to retain copies and receipts of the submission confirmation. Proper organization of these files is essential for future reference, and keeping accurate records ensures compliance with SEC regulations while aiding in future reporting requirements.

FAQs about 10-K filings

If a company misses the filing deadline for its 10-K, repercussions can include fines from the SEC and potential decline in stock price as investor confidence wanes. It’s crucial to implement a schedule that allows for timely preparation and submission.

Small reporting companies may have certain advantages, such as being able to file a shorter Form 10-K, which simplifies the process, making compliance more manageable. This option provides small companies with some regulatory relief while still maintaining transparency.

The 10-K significantly impacts company valuation since it includes essential financial data and risk factors that investors use to gauge performance and future potential. Accurate and honest reporting helps build a company’s reputation, which can further influence its valuation in the marketplace.

Comparative insight

Understanding the differences between the Form 10-K and an annual report to shareholders is crucial for both consumers and companies. While both documents share some common elements, the 10-K is filed with the SEC and includes more extensive and detailed information that is necessary for regulatory compliance.

In contrast, the annual report is typically designed for a broader audience. It often highlights a company's successes and is more of a marketing tool. Each document is utilized in specific contexts, with the 10-K focusing on regulatory requirements, and the annual report stressing storytelling around company success and strategy to appeal to shareholders.

Utilizing pdfFiller for your document needs

pdfFiller offers extensive functionalities that streamline the Form 10-K preparation process. The platform's comprehensive editing features enable users to tailor documents precisely and with ease, while maintaining a user-friendly interface that simplifies collaboration. Team members can work together, providing feedback and input in real-time, significantly enhancing the overall quality and accuracy of the final submission.

With the added benefit of cloud storage and access-from-anywhere capabilities, companies can manage their documentation on the go. This empowerment allows teams to efficiently handle sensitive reports such as the Form 10-K, ensuring consistency and reliability in communication, especially in geographically diverse settings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form 10-k in Gmail?

How do I edit form 10-k straight from my smartphone?

How do I complete form 10-k on an iOS device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.