Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

Understanding Form 990

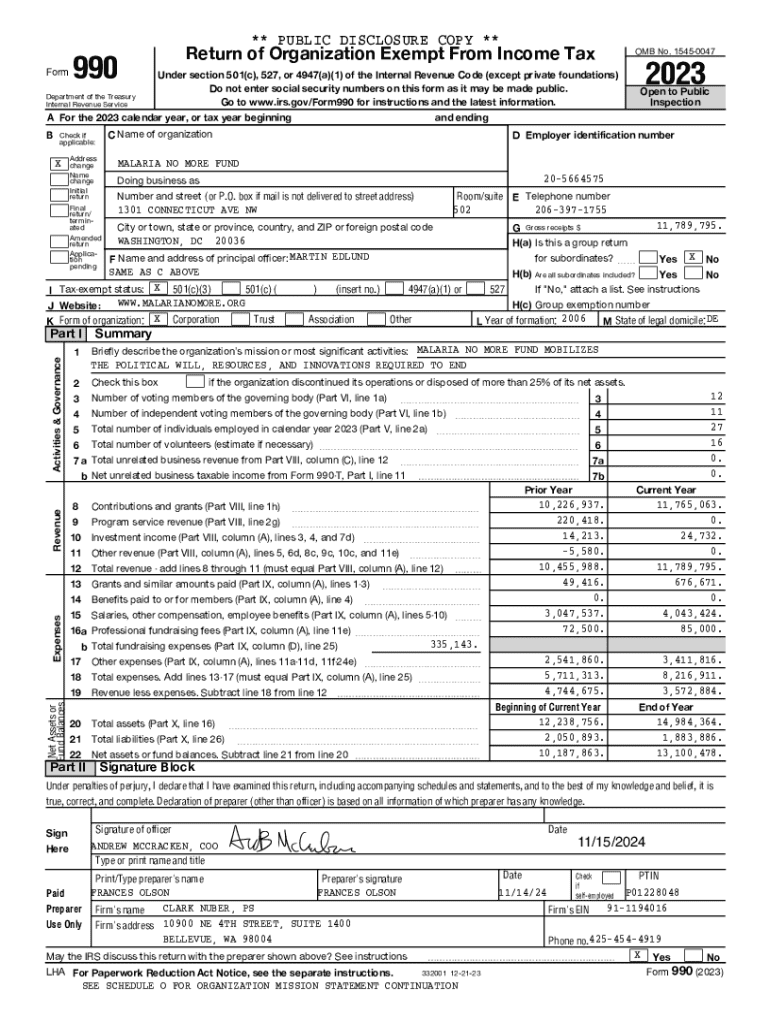

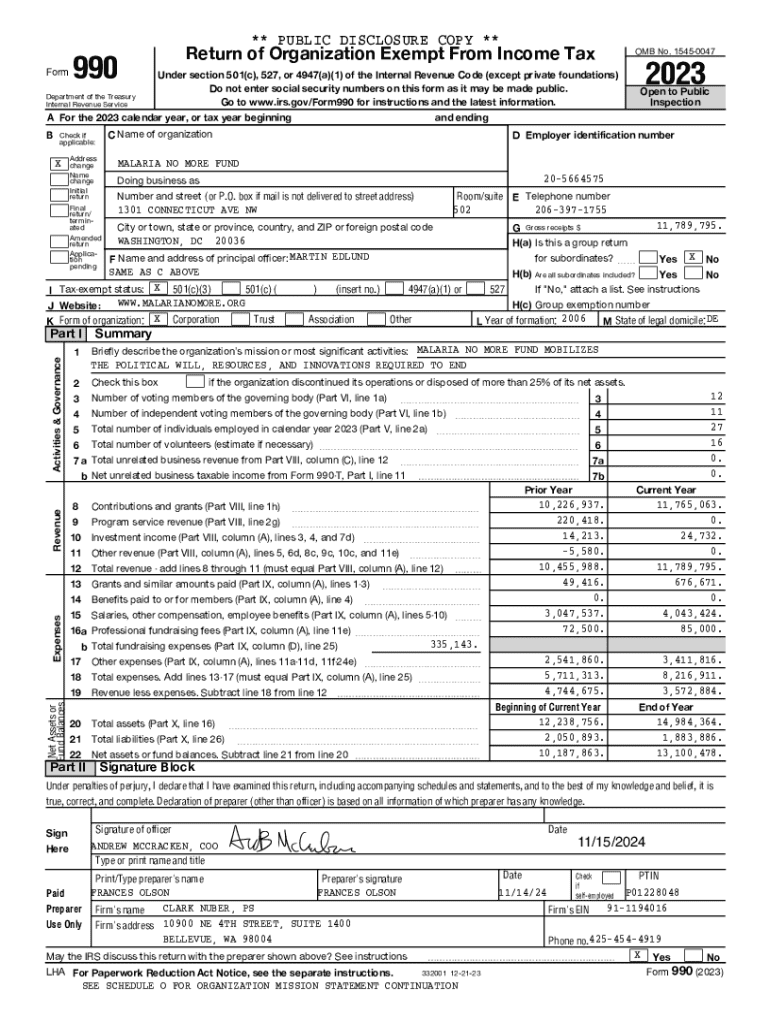

Form 990 is a vital document required by the Internal Revenue Service (IRS) for tax-exempt organizations, including nonprofits and charitable institutions. This form serves multiple purposes, primarily documenting an organization’s financial health and operational activities. Its significance extends beyond regulatory compliance; it acts as a transparent record that stakeholders can review to assess the nonprofit’s accountability and effectiveness.

The importance of Form 990 cannot be overstated, as it provides valuable insights into an organization’s operations. It can reflect the financial landscape, indicating how funds are utilized, which programs are operational, and future developmental goals. For stakeholders, it acts as a source of information that fosters trust and investment in an organization's mission.

Key components of Form 990

Form 990 includes several key components that collectively give a complete picture of an organization's health. The financial summary section outlines income, expenses, and net assets, indicating the organization's financial viability. Governance details highlight the structure and leadership of the nonprofit, illustrating how the organization is run and who makes decisions. Finally, the program accomplishments part showcases the organization’s outputs and impact, showing how resources have been allocated effectively towards their mission.

Importance of filing Form 990

Filing Form 990 is not just a regulatory checkbox; it is a legal requirement for many nonprofits. The IRS mandates organizations that earn over a specified threshold in gross receipts—or have a certain level of total assets—submit this form annually. Noncompliance can lead to severe consequences, including the loss of tax-exempt status, financial penalties, and diminished trust from donors and potential investors.

Beyond legal compliance, Form 990 plays a crucial role in fostering transparency and accountability. Public access to this form allows donors, stakeholders, and the general public to glean insights into an organization’s financial practices. The credibility gained through a well-prepared Form 990 can not only enhance trust among existing supporters but also attract new funding opportunities, as investors often look for organizations with transparent operations.

Step-by-step guide to completing Form 990

Completing Form 990 can seem daunting, but breaking it down into manageable steps makes the process streamlined and efficient. Start by gathering essential information, including financial records such as balance sheets and income statements, details of board members, and summaries of program activities. Having this information readily available will simplify the process considerably.

Each section of Form 990 has specific requirements. Part I provides a summary of the organization, offering insight into its major functions, financial data, and the organizational mission. The signature block in Part II is crucial, as it requires the sign-off of an authorized individual within the organization, ensuring accountability. Part III allows organizations to effectively report on their program activities and how they align with their mission, promoting a narrative of their impact. Finally, Part IV includes a checklist of required schedules; organizations must assess which schedules apply to them based on their activities.

Tips for accurate reporting

Accurate reporting is key when completing Form 990. Common pitfalls often include miscalculating financial figures, neglecting to update board member information, and overlooking necessary attachments. To avoid these mistakes, utilize established best practices. For instance, ensure each financial statement is reconciled with bank statements and that all forms are filed on time. Collaborative review within the team can also catch errors before submission.

Utilizing interactive tools for Form 990

pdfFiller offers powerful document management solutions that streamline the filling and editing of Form 990. Its features allow users to digitally manage their forms, enabling easy access from anywhere, which is particularly beneficial for organizations with remote teams. By utilizing these tools, nonprofits can enhance collaboration and ensure that their Form 990 is both accurate and compliant.

Users can create custom Form 990 templates that align with their specific needs and workflows. Additionally, pdfFiller's electronic signing capabilities simplify the approval process, ensuring that all necessary signatures are obtained efficiently. This removes the delays associated with traditional signing methods and keeps the filing process on track.

Step-by-step use of pdfFiller

To get started with pdfFiller for Form 990, first design a custom template that can be used year after year, saving time during filing seasons. The platform allows users to add necessary fields, ensuring that all program achievements and financial data can be accurately populated. Once the form is ready, team members can access it from any location, making collaboration seamless.

Collaborating effectively with teams

Collaboration among team members is essential for the successful completion of Form 990. Leveraging document management tools like pdfFiller can facilitate shared access and real-time editing. With users able to track changes and maintain version control, organizations can ensure that everyone is on the same page, which is particularly helpful when multiple individuals contribute to different sections of the form.

Moreover, managing comments and feedback through pdfFiller's built-in commenting features strengthens communication within teams. Team members can leave notes and suggestions directly on the form, which can then be addressed; this collaborative approach reduces mistakes and improves overall accuracy.

Filing and submission process

Filing Form 990 can be executed online through the IRS portal, ensuring immediate submission and faster processing. Organizations should check that the form is complete, accurate, and all required schedules are attached prior to submission. For those opting to mail physical copies of Form 990, it is crucial to follow best practices. This includes confirming the correct mailing address and allowing sufficient time for postal delivery to meet submission deadlines.

Timeliness is essential, as late submissions can lead to penalties and the potential loss of tax-exempt status. Mapping out a filing calendar can aid in staying on track with due dates, allowing organizations to plan and prepare well in advance. Being proactive about filing deadlines can save considerable stress and ensure compliance.

Monitoring and maintaining compliance

Compliance with Form 990 requirements goes beyond annual filings; ongoing review is essential. Organizations should implement annual review guidelines to assess adherence to regulations. This includes tracking changes in tax laws that could affect how Form 990 is filed, ensuring that nuances do not go unnoticed. Staying informed can prevent negative repercussions related to filing deficiencies.

Utilizing tools like pdfFiller can aid in ongoing compliance efforts, as organizations can store and manage Form 990 files in one secure location. Setting reminders for future filings ensures that no deadlines are missed, encouraging an efficient workflow that keeps the focus on mission delivery rather than paperwork concerns.

Leveraging Form 990 insights for organizational growth

Form 990 is not just a regulatory requirement; it serves as a strategic tool for organizational growth. Analyzing performance metrics recorded in the form can provide critical insights to identify strengths and weaknesses in programming. By evaluating this data, organizations can refine their goals, improve operational efficiency, and enhance program delivery to meet the evolving needs of their community.

Additionally, leveraging Form 990 information in fundraising activities can set organizations apart. Grant proposals supported by data from Form 990 emphasize the organization’s track record, making a compelling case to funders. Enhancing donor communications with insights extracted from Form 990 not only strengthens relationships with current supporters but can also cultivate new engagement opportunities.

Frequently asked questions about Form 990

Common concerns about Form 990 often arise during the filing process. Many organizations are uncertain about filing thresholds, such as what constitutes gross receipts that require filing. It's important to note that all organizations with gross receipts of $200,000 or more must file, as well as those with total assets exceeding $500,000. Misinformation about the public accessibility of Form 990 can also create hesitance among nonprofits; however, it is a public record available for review, ensuring transparency in the nonprofit sector.

For those seeking to deepen their understanding of Form 990 and nonprofit compliance, numerous resources are available. Many organizations offer courses, webinars, and extensive literature on best practices for managing nonprofit responsibilities, especially around filing requirements and operational transparency. Engaging with these resources can enhance an organization’s approach to compliance, ensuring they stay informed and well-equipped.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 990 in Gmail?

How can I modify form 990 without leaving Google Drive?

How do I complete form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.