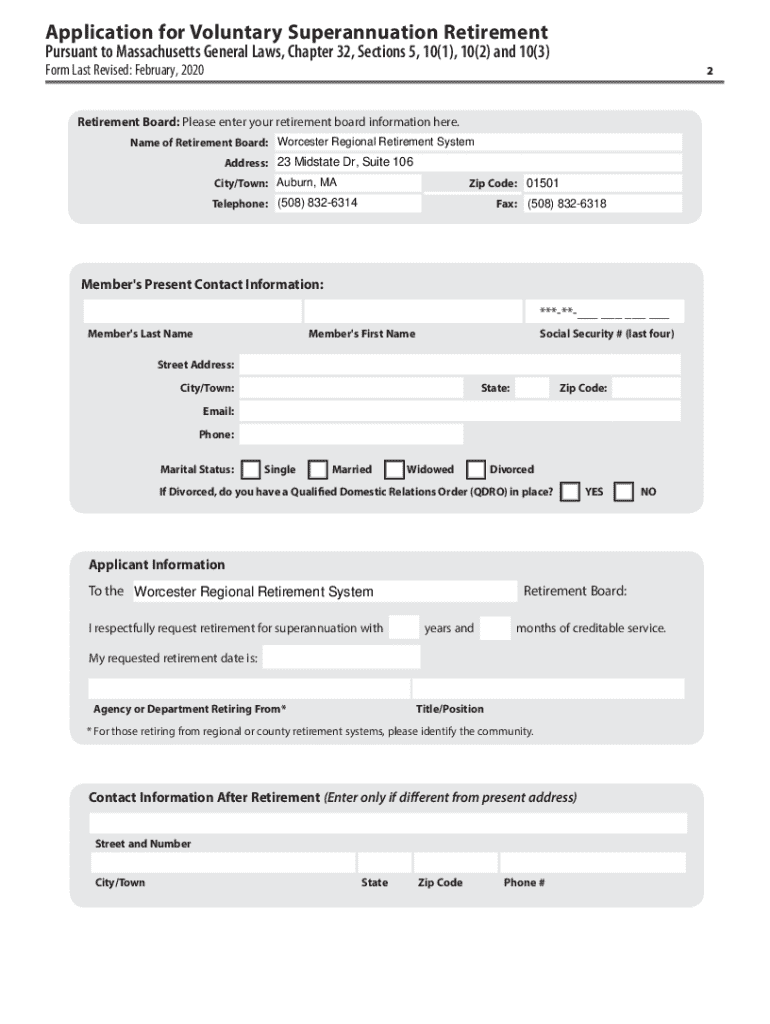

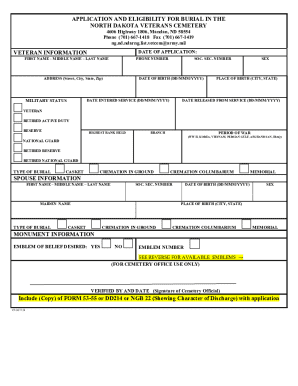

Get the free Application for Voluntary Superannuation Retirement

Get, Create, Make and Sign application for voluntary superannuation

How to edit application for voluntary superannuation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for voluntary superannuation

How to fill out application for voluntary superannuation

Who needs application for voluntary superannuation?

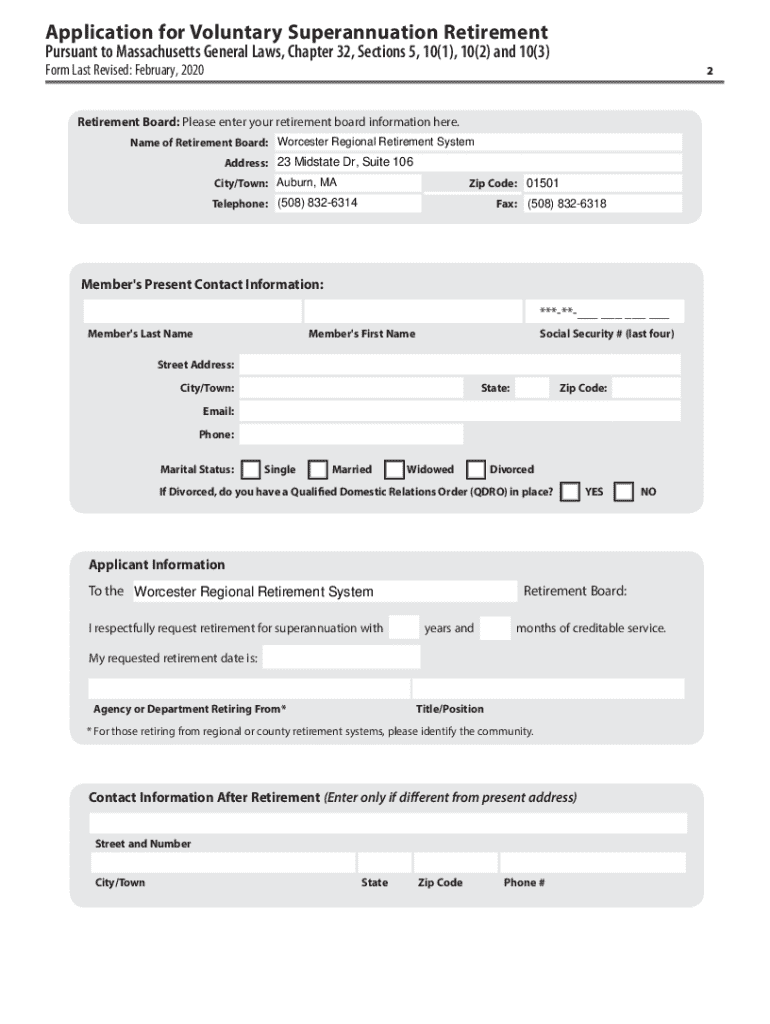

Your Comprehensive Guide to the Application for Voluntary Superannuation Form

Understanding voluntary superannuation

Voluntary superannuation contributes significantly to one's nest egg at retirement, allowing individuals to boost their savings beyond mandatory contributions. This form of superannuation provides an avenue for workers to take charge of their financial destiny by investing more in their future.

Making voluntary contributions not only enhances your retirement savings but can also provide potential tax benefits. This is particularly critical considering how current and future economic conditions may impact regular retirement funds. Understanding the full scope of voluntary contributions is essential for maximizing retirement security.

Eligibility criteria for voluntary superannuation

Anyone who earns an income and is eligible to contribute to a superannuation fund can apply for the voluntary superannuation form. This includes self-employed individuals, employees, and even those who are on paid parental leave, making it a flexible option for many.

Age can also play a role in eligibility; younger workers may benefit more from long-term contributions, while older individuals nearing retirement may want to prioritize bolstering their savings in the short term. However, it’s important to adhere to the contribution limits set by the Australian Taxation Office (ATO) to avoid unnecessary penalties.

Overview of the voluntary superannuation form

The voluntary superannuation form serves as the primary mechanism for individuals looking to submit additional contributions to their super fund. It allows for customization of contribution amounts and fund selections, ensuring that individuals have a direct hand in shaping their retirement savings.

This form is not just a mere document but a powerful tool that can unlock enhanced benefits and features of superannuation funds, including tax rebates and potentially higher interest rates on contributions. Understanding its components is crucial for successful submission.

Step-by-step instructions for completing the application

Completing the application for voluntary superannuation form requires careful attention to detail. First, gather all necessary information, including personal identification and superannuation details. Be prepared with documents such as your tax file number and your current super fund information.

When filling out the form, precision is critical. Start with your personal information, ensuring names and dates are accurate. The contribution amount section dictates how much you will invest; consider your financial capabilities while remaining compliant with ATO contribution limits.

Common mistakes often stem from omitted information or inaccuracies. Double-check your entries to ensure the validity of your submission.

Editing and customizing your application

With pdfFiller, users can easily manage their documents, including the application for voluntary superannuation form. The platform allows for editing, ensuring that users maintain control over their forms. Adjustments can be made seamlessly online.

The ability to add notes and comments can also be beneficial for personal tracking and understanding specific choices made during the application process. This feature is crucial when considering future adjustments to your voluntary contributions.

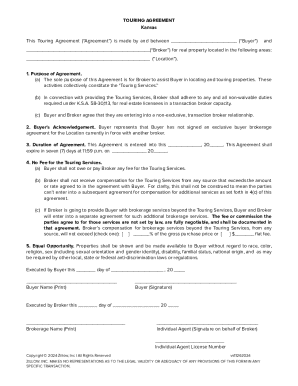

Signing and submitting your form

pdfFiller offers options for electronic signatures, simplifying the signing process. Ensure that your form is signed digitally, which is recognized as legally binding in most circumstances. The convenience of electronic submission can save both time and effort compared to traditional methods.

Once your application is complete and signed, you can submit it through various channels. Whether online or in person, tracking your application status is essential to ensure its progress and catch any potential issues quickly.

Post-submission: what to expect

After submitting your application, you can expect a processing time, typically ranging from a few days to a couple of weeks. The speed may depend on the super fund’s internal protocols and workload.

Following the submission, you should receive confirmation and communication regarding the status of your contributions from your super fund. This is essential for keeping your records updated and monitoring the impact of your voluntary contributions.

Managing your voluntary contributions

Post-application, effectively managing your voluntary contributions is vital. Utilize your super fund’s online portal to regularly check your balance and ensure your contributions are noted and credited appropriately.

If financial situations change, you have the capability to modify future contributions. Understanding the tax implications of these voluntary contributions is also crucial. For instance, if you exceed the cap limits, excess contributions may incur additional taxes that can impact your overall savings.

Resources and tools available at pdfFiller

pdfFiller provides numerous interactive tools that can enhance your experience with the application for voluntary superannuation form. Tools for calculating your contribution amounts can offer clarity on what is feasible based on your current income.

Additionally, accessing templates and other relevant forms related to superannuation can streamline your planning process. Utilizing eSigning tools ensures that all aspects of your documentation are covered on a single, cloud-based platform.

Frequently asked questions (FAQs)

As with any financial procedure, many individuals have questions related to the application process of voluntary superannuation forms. Common queries may include eligibility, deadlines for submission, and modification processes.

In case of difficulties or issues in your application, there are numerous resources available for troubleshooting and support. Awareness of these resources can ease the process and mitigate apprehensions regarding paperwork.

Interactive checklist for application preparation

To ensure that you have completed all necessary steps before starting your application for the voluntary superannuation form, consider utilizing an interactive checklist. This tool can guide you through necessary documentation and details to prevent omissions, making the process smoother.

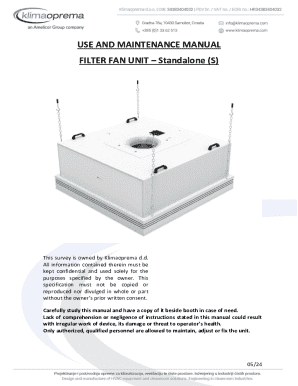

Visual aids and infographics

Visual aids such as graphs illustrating the impact of voluntary super contributions over time can help you make an informed decision about your savings strategy. Understanding how small contributions can significantly affect your retirement portfolio is often motivating.

User testimonials and case studies

Real-life experiences shed light on the benefits of making voluntary super contributions. Testimonials and case studies provide context around various strategies employed by individuals across different income brackets, highlighting the positive outcomes achieved through thoughtful planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send application for voluntary superannuation for eSignature?

Where do I find application for voluntary superannuation?

How do I edit application for voluntary superannuation straight from my smartphone?

What is application for voluntary superannuation?

Who is required to file application for voluntary superannuation?

How to fill out application for voluntary superannuation?

What is the purpose of application for voluntary superannuation?

What information must be reported on application for voluntary superannuation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.