Get the free Certificate of Authority or Registration

Get, Create, Make and Sign certificate of authority or

How to edit certificate of authority or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of authority or

How to fill out certificate of authority or

Who needs certificate of authority or?

Understanding the Certificate of Authority or Form

Understanding the certificate of authority

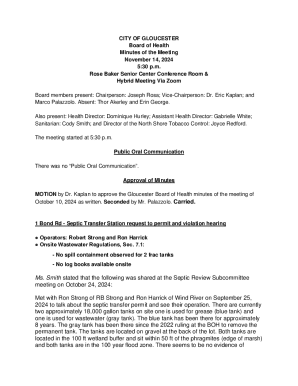

A Certificate of Authority is a legal document that grants permission for a business entity to operate in a state or jurisdiction outside of its original formation state. Essentially, this certificate ensures that a business complies with local laws and regulations, enabling it to conduct its operations legally. For many businesses, obtaining this certificate is a pivotal step in their expansion efforts, especially when they venture into new territories.

The importance of a Certificate of Authority can't be overstated. Without it, businesses may face legal repercussions, including fines or restrictions on their operations. In many states, the ability to legally collect taxes from customers hinges on possessing this authorization. Thus, acquiring a Certificate of Authority is not merely a bureaucratic exercise but a critical aspect of operational legitimacy for any serious business enterprise.

Certificate of authority vs. tax : Understanding the difference

While both the Certificate of Authority and a Tax ID number are crucial for business operations, they serve different purposes. A Certificate of Authority allows a business to operate in a specific jurisdiction, while a Tax ID number, also known as an Employer Identification Number (EIN), is issued by the IRS for tax-related purposes. Essentially, while the former is about local permission, the latter concerns federal taxation.

It's not uncommon for businesses to require both documents. For example, if a company based in California sets up operations in Texas, it will need a Certificate of Authority to operate there legally and a Tax ID number to handle tax obligations federally. This duality highlights the multi-faceted nature of compliance that businesses must navigate.

When do you need a certificate of authority?

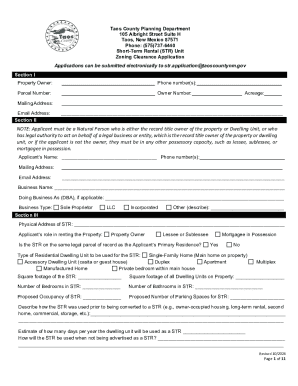

Several common scenarios necessitate obtaining a Certificate of Authority. One prominent case arises when a business operates in multiple states. For instance, an online retailer that ships to customers across the U.S. would need this certification to legally collect sales tax in every state it serves. Therefore, mapping out operational footprints is vital for ensuring compliance.

Another scenario is when selling goods and services that require the collection of state taxes. For businesses that fall within specific industries—such as retail, construction, or professional services—the need for a Certificate of Authority is often mandated. In each case, obtaining this certification ensures that a business can lawfully conduct its transactions and maintain a good standing within regulatory frameworks.

Types of businesses needing a certificate of authority

Different types of business entities, such as sole proprietorships, partnerships, and corporations, all have unique requirements regarding the Certificate of Authority. Sole proprietorships may find it easier to register, often needing less documentation, but they must still ensure they comply with local regulations when expanding. Corporations and partnerships typically face more rigorous criteria, necessitating a thorough understanding of both state-specific laws and their business structure.

The requirements can vary considerably by state jurisdiction. For example, New York may have different regulations compared to Florida concerning foreign qualifications. Therefore, understanding your business entity’s classification and the specific state laws that apply is crucial for compliance and successful operation.

Consequences of failing to obtain a certificate of authority

Neglecting to obtain a Certificate of Authority can lead to various legal and financial penalties. A business may face hefty fines which accumulate over time. Additionally, not having this certificate can severely impact a company’s legality, jeopardizing its operations and reputation. Operating without the necessary certifications can also lead to lost customers—many consumers prefer businesses that manifest compliance with local laws.

Furthermore, the implications extend beyond just financial penalties. A business found to be operating illegally may provoke lawsuits or increased scrutiny from regulatory bodies, hindering its ability to secure permits and licenses in the future, potentially stunting growth and innovation.

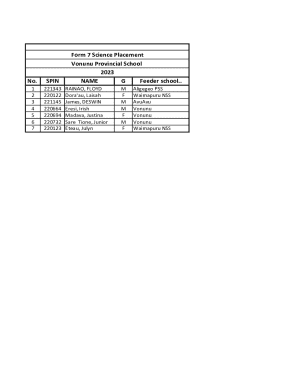

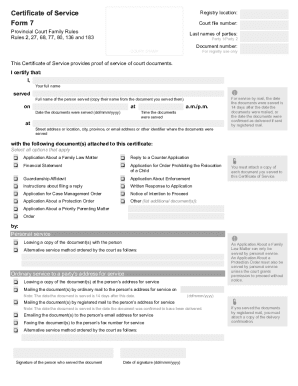

Key information found on a certificate of authority

A Certificate of Authority typically includes a variety of important details about the business. This generally encompasses the business name and address, crucial for identifying the entity in question. Additionally, it will outline the owner(s) or responsible party’s information, effectively linking the individual(s) managing the business with its operations.

Furthermore, the certificate provides registration details and its validity period, ensuring that all stakeholders are aware of the operational timeframe of the business's legitimacy. This key information forms a framework that not only facilitates compliance but also strengthens customer trust in the business.

Costs associated with obtaining a certificate of authority

The costs associated with obtaining a Certificate of Authority can vary widely based on location and business structure. Generally, state filing fees are the primary expense, ranging from a few hundred to several thousand dollars. In addition to these state fees, businesses may encounter further expenses related to document preparation or legal advice, especially if the application process is more complex or if they lack prior experience.

It's essential for businesses to prepare for these costs upfront to avoid unexpected delays during the process. Many states offer online tools for calculating fees, and some legal services provide estimations of total costs when applying for the Certificate of Authority.

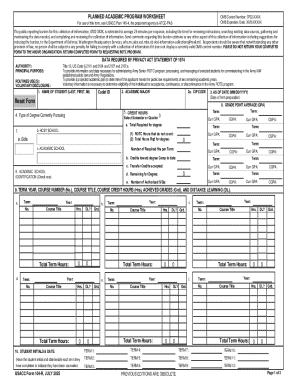

Step-by-step guide to obtaining your certificate of authority

Achieving your Certificate of Authority involves a few critical steps, starting with preparation. Step one is gathering all necessary documents, which may include your business registration documents, identification numbers, and any existing licenses or permits. Each state will have specific requirements, so it’s crucial to research your state’s needs comprehensively before proceeding.

Next, you'll need to file your application. This can often be done online through the state’s business registration website, though some states may also allow applications to be submitted by mail or in person. Pay careful attention to details when submitting the application, as errors can lead to unnecessary delays.

After submitting your application, it’s important to maintain awareness of approval timeframes, which can range widely by state. Some states provide instant electronic confirmations, while others may take weeks to process. Keeping track of this process is essential to ensure compliance once you receive your Certificate of Authority.

Tips for managing your certificate of authority

Managing your Certificate of Authority is just as important as obtaining it. Keeping your document updated is crucial, especially when there is a change in your business structure or ownership. Most states require that any changes be reported within a specific time frame, so it is prudent to stay on top of these requirements to avoid penalties.

Utilizing document management platforms, such as pdfFiller, can streamline this process. Businesses can easily edit, update, and store relevant documents in a secure environment, ensuring they have access to essential forms anytime and anywhere. Collaborating with team members through these platforms facilitates smoother operations while enhancing compliance.

Exploring related documentation and forms

In addition to a Certificate of Authority, there are several related business forms and documents that you may need. Business licenses, permits, and registrations all play a vital role in establishing a legal business operation. Understanding the nuances of these documents is essential for ensuring you have a comprehensive approach to compliance.

Using pdfFiller's platform can ease the burden that comes with managing these forms. By offering features that enhance document creation, editing, and collaboration, businesses can efficiently handle their administrative needs. This cloud-based solution allows users to access required documents from anywhere, tailoring their processes efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send certificate of authority or for eSignature?

Can I edit certificate of authority or on an iOS device?

How do I fill out certificate of authority or on an Android device?

What is certificate of authority or?

Who is required to file certificate of authority or?

How to fill out certificate of authority or?

What is the purpose of certificate of authority or?

What information must be reported on certificate of authority or?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.