Get the free Directive No. 22R4, Proofs of Claim, Proxies, Quorums and ...

Get, Create, Make and Sign directive no 22r4 proofs

Editing directive no 22r4 proofs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out directive no 22r4 proofs

How to fill out directive no 22r4 proofs

Who needs directive no 22r4 proofs?

Understanding Directive No. 22R4 Proofs Form

Understanding Directive No. 22R4

Directive No. 22R4 is a crucial guideline in the realm of bankruptcy and insolvency that outlines the necessary steps and requirements for submitting proofs of claim. This directive plays a vital role in ensuring that creditors can effectively validate their claims during bankruptcy proceedings, thus protecting their financial interests.

The importance of Directive No. 22R4 cannot be overstated, especially in the context of claims and creditor meetings. It sets the groundwork for transparent communication between debtors and creditors, ensuring that all parties have a structured approach to address claims. This lays a foundation for trust and integrity in the often complex and challenging world of insolvency.

Key objectives of Directive No. 22R4

The proofs form: An essential document

A proof of claim is a legal document that a creditor submits to a bankruptcy court to establish the validity of their claim against a debtor. This document is pivotal during insolvency proceedings, as it prompts the creditor’s right to participate in the distribution of any available assets. Knowing the different types of claims—secured, unsecured, and priority—allows creditors to accurately categorize their claims and understand their standing in the bankruptcy process.

The proofs form consists of various components that collectively provide the necessary information for a claim to be accepted. Key elements include the claimant's details, the claim amount, and supporting documentation that backs up the claim. Understanding each component facilitates a smoother submission process and increases the chances of acceptance.

Components of the proofs form

Step-by-step guide to filling out the Directive No. 22R4 proofs form

Before starting, ensure you gather all necessary documentation, including invoices, contracts, and correspondence relevant to your claim. Understanding your rights and being aware of how the process works is critically important for a successful submission.

Preparation before you begin

Filling out the form

Common mistakes to avoid

Interactive tools available on pdfFiller

pdfFiller provides users with powerful document management capabilities, allowing for the effective editing and signing of PDF forms. This platform is invaluable for managing claims and other essential documents seamlessly from any location.

Using pdfFiller for document management

Fillable templates for the proofs form

To further simplify the process, pdfFiller offers fillable templates specifically designed for the Directive No. 22R4 proofs form. These pre-made templates save time while ensuring correctness and compliance with regulatory requirements.

Submission process and important deadlines

Once the proofs form is complete, you need to understand the submission process thoroughly. This involves knowing where and how to submit your claim, while ensuring it meets all required standards. Compliance with local regulations cannot be neglected and is key to having your claim accepted.

Where and how to submit your proof of claim

Key deadlines to remember

Understanding the timelines for filing proofs of claim is crucial for creditors. Missing a deadline can lead to a loss of rights to claim against the debtor's estate, so be diligent in adhering to all necessary timelines.

After submission: What to expect

Once your proof of claim has been submitted, it undergoes a review process conducted by Licensed Insolvency Trustees. They evaluate the legitimacy of claims before confirming acceptance or rejection. Understanding this process demystifies what may happen post-submission.

Review process by trustees

The role of Trustees is critical, as they verify the claims made against the debtor's assets. Their thoroughness ensures fairness in the proceedings, benefiting all parties involved.

Potential outcomes

Appeals process for rejected claims

If your claim is rejected, you still have options available. Knowing the correct steps to take can pave the way for reconsideration or appeal, providing a second chance to validate your financial claims.

FAQs on Directive No. 22R4 proofs form

Navigating the submissions and requirements related to Directive No. 22R4 can raise numerous questions among creditors. Clarifying these common queries enhances the understanding of the entire claims process and empowers creditors.

Common queries addressed

Understanding your rights

Maintaining transparency with creditors is essential in any insolvency proceedings. Ensuring your rights are respected encourages fair treatment and the potential for collaboration on resolving issues.

Appendix

Glossary of terms

The following terms are critical for understanding Directive No. 22R4: proofs of claim, bankruptcy, secured claims, unsecured claims, and priority claims.

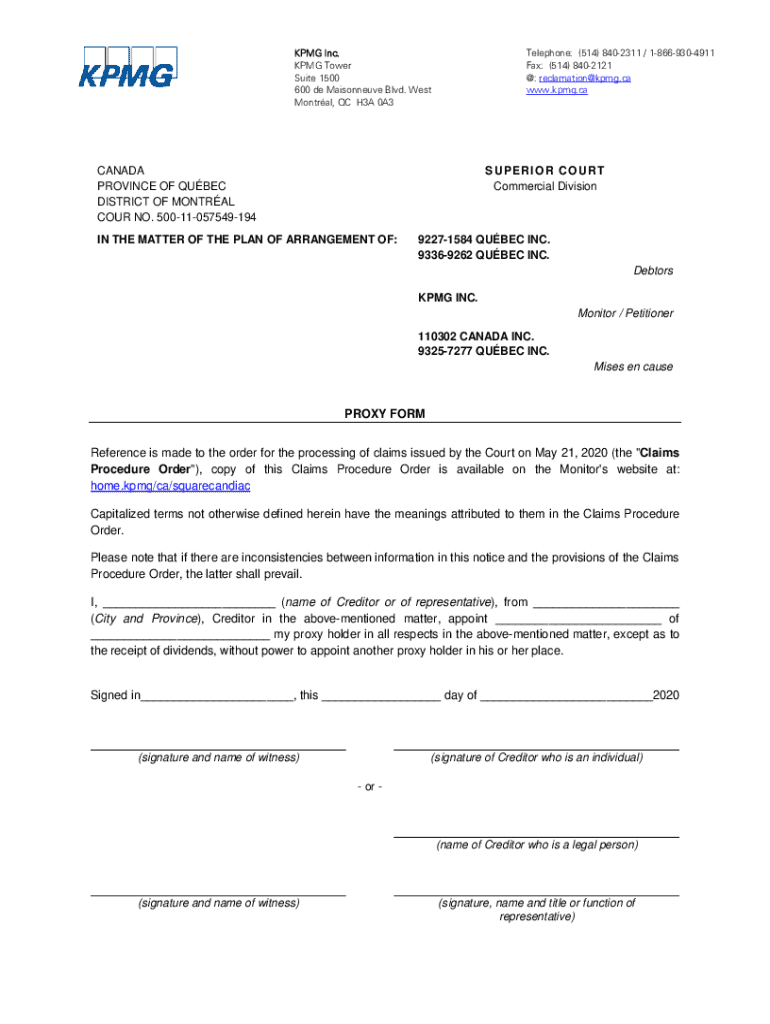

Sample completed proofs form

Providing an example of a completed proofs form can offer a clearer guide for individuals looking to submit their own. Highlighting essential elements along the way ensures a strong grasp of what is required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in directive no 22r4 proofs without leaving Chrome?

How do I edit directive no 22r4 proofs on an iOS device?

Can I edit directive no 22r4 proofs on an Android device?

What is directive no 22r4 proofs?

Who is required to file directive no 22r4 proofs?

How to fill out directive no 22r4 proofs?

What is the purpose of directive no 22r4 proofs?

What information must be reported on directive no 22r4 proofs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.