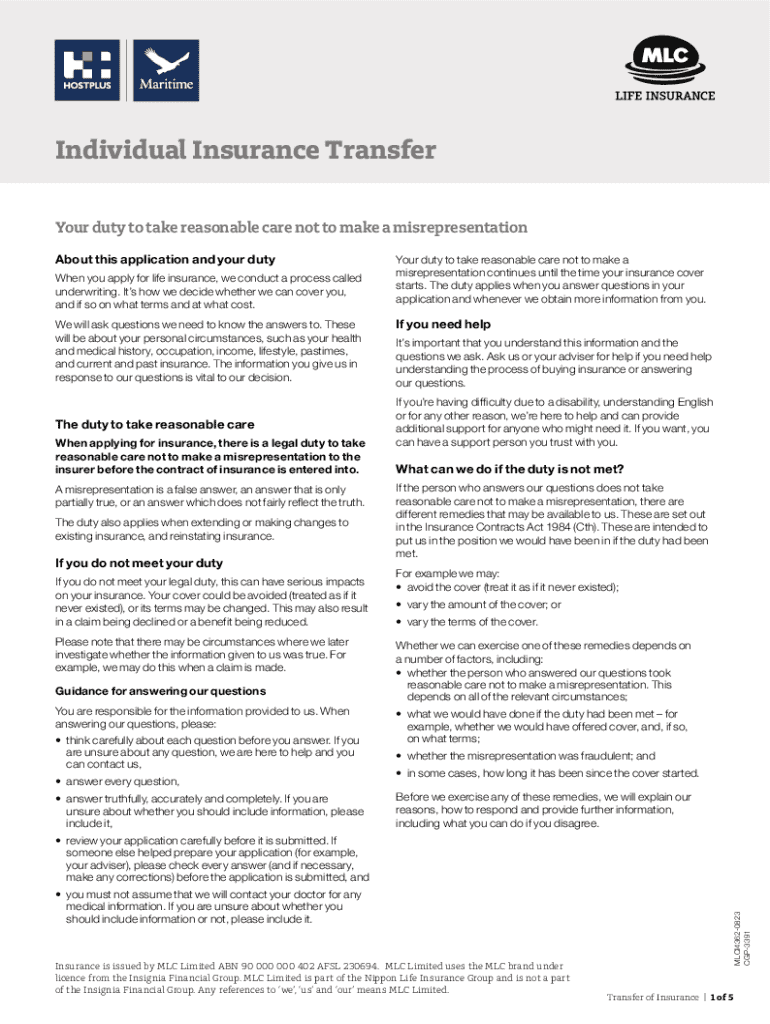

Get the free Individual Insurance Transfer

Get, Create, Make and Sign individual insurance transfer

Editing individual insurance transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out individual insurance transfer

How to fill out individual insurance transfer

Who needs individual insurance transfer?

Individual Insurance Transfer Form - How-to Guide

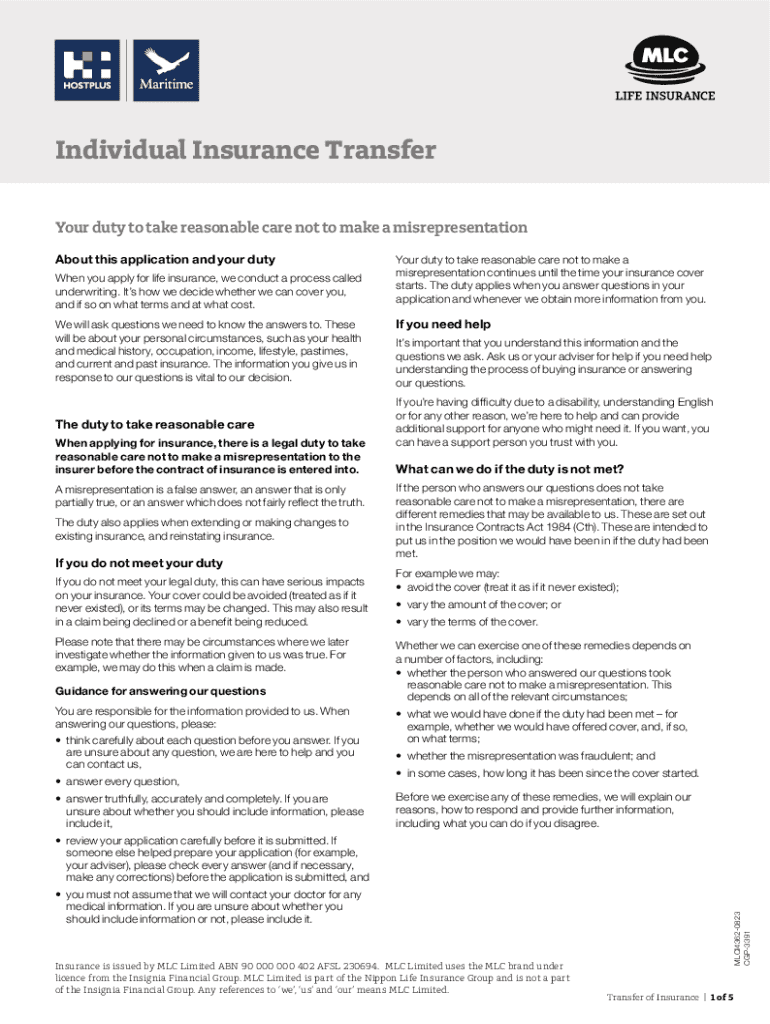

Understanding individual insurance transfer forms

An individual insurance transfer form is an essential document utilized when policyholders wish to change their insurance providers. This form formalizes the request to transfer coverage from one insurer to another, ensuring that the policyholder maintains uninterrupted insurance coverage. The importance of this transfer process lies in its role of safeguarding individuals against lapses in coverage, thereby protecting their financial interests.

The transfer process is pivotal because it allows a seamless transition to a new policy, which may offer better rates, coverage options, or services. Understanding the nuances of this transfer and using the individual insurance transfer form correctly can prevent costly mistakes and help maintain the integrity of one's insurance portfolio.

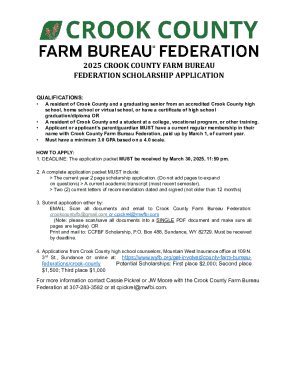

When is the individual insurance transfer form required?

The individual insurance transfer form becomes necessary in various scenarios. Common situations include when a policyholder finds a new insurance provider offering more competitive prices or improved services. Other situations may involve changes in life circumstances, such as marriage, moving, or the sale of a vehicle, leading to a need for different coverage.

Failing to submit the form when needed can have serious implications, such as policy lapses, inability to claim for damages, or even legal issues. Without the proper documentation provided to both the current and new insurer, individuals may find themselves uninsured unexpectedly. Therefore, understanding when this form is required is crucial for maintaining proper coverage.

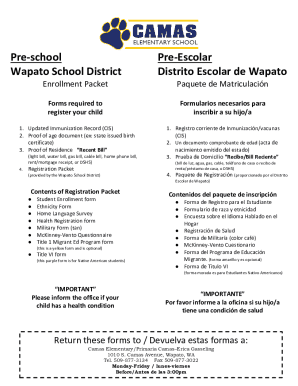

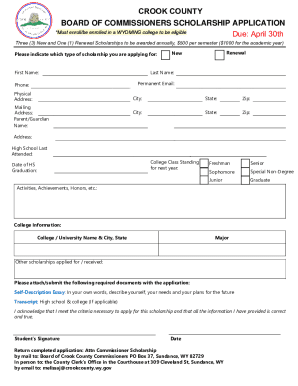

Preparing to complete the individual insurance transfer form

Before starting to fill out the individual insurance transfer form, it's important to prepare by gathering all necessary documents. Individuals should have their personal identification handy, such as a driver’s license or Social Security number, alongside details of their current insurance policy and information about the new insurer, if applicable. This preparation ensures the process is smooth and efficient.

Organizing these documents in advance can streamline the completion of the form. Creating a checklist or a dedicated folder can make the process easier, reducing the chances of missing any critical information.

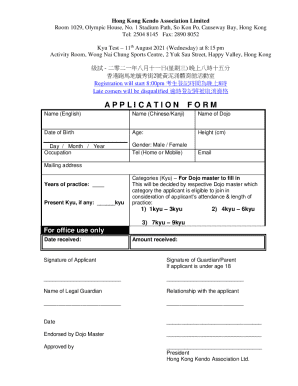

Understanding key terms and sections

Filling out the individual insurance transfer form also requires familiarity with key terms and the structure of the document itself. Key sections typically include policyholder details, information about the previous insurer, and details regarding the new insurer. Understanding what each section requires is crucial for accuracy.

For instance, the policyholder details section usually asks for the full name, address, and contact information of the individual initiating the transfer. The previous insurer information might require the name of the insurance company, policy number, and coverage dates. Engaging with these terms early on can help avoid confusion during completion.

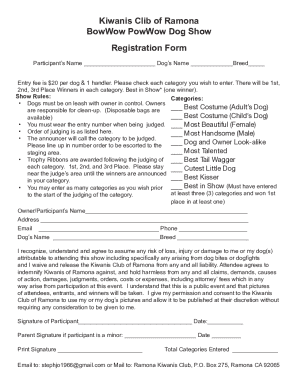

Step-by-step guide to filling out the individual insurance transfer form

Completing the individual insurance transfer form involves several steps, each critical for ensuring proper processing. Start with filling your personal information correctly. This typically includes your complete name, address, and any identifying numbers requested. Accurate data here ensures the transfer aligns with your identity.

After ensuring every field is filled out correctly and that you meet the requirements for a transfer, the final step is to sign and date your form. It's important to note that when completing documents digitally, electronic signatures can often be as legally binding as physical ones, depending on jurisdiction.

Submitting the individual insurance transfer form

Once the form is completed, attention turns to submission. You need to submit the form to both your current and new insurance companies. This can often be done via various methods: email, postal mail, or fax. Each method may have different processing times, so understanding which is fastest can be beneficial.

After submission, confirming the status of your transfer request is crucial. Each insurer should send a confirmation acknowledging receipt and processing of the form. Knowing the expected timelines for processing can help set your expectations and reduce worries during the transition.

Managing the transfer process

As your individual insurance transfer request is processed, it's important to track its status proactively. Most insurers have specific customer service lines or online portals where you can check on the progress. Understanding your rights and what to expect during this process will help you stay informed and engaged.

If you encounter delays or your transfer request is denied, it's crucial to identify the causes. Common reasons include missing information or not meeting eligibility criteria. Taking immediate steps such as following up with your insurers can help rectify these issues. Post-transfer, remembering to update all your records with your new insurance details is equally important as it keeps your information current across various platforms.

Benefits of using pdfFiller for your individual insurance transfer form

Utilizing pdfFiller for your individual insurance transfer form brings additional benefits that streamline the overall process. One of the most significant advantages is the ease of editing and signing PDFs. The platform allows users to fill out forms digitally, making it quicker and more efficient.

These features not only enhance the user experience but also significantly reduce the chances of errors, ensuring that your individual insurance transfer form is completed accurately and submitted promptly.

Frequently asked questions about individual insurance transfers

Common questions regarding the individual insurance transfer process often center around the expectations for filling out the form, the duration of the transfer process, and troubleshooting known issues. One of the most frequent concerns is how long it takes for the transfer to be processed, which typically varies by insurer but can range from a few days to several weeks.

Additional queries may involve what to do if specific information is missing from the form or further documentation is required. Familiarizing yourself with these questions beforehand can help streamline the transfer process. Utilizing resources like pdfFiller can also assist in addressing common problems users face while filling out these forms.

Additional considerations

It’s vital to remain compliant with insurance regulations throughout the transfer process. Different states may have unique requirements influencing how your individual insurance transfer form should be filled out and submitted. Consulting with your new insurer about regional regulations ensures no compliance issues arise.

Furthermore, after completing the transfer, it's prudent to reassess future insurance needs. Changes in coverage may prompt a review of your insurance situation, which could lead to identifying additional opportunities for savings or enhanced coverage options in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my individual insurance transfer in Gmail?

How do I fill out the individual insurance transfer form on my smartphone?

How do I complete individual insurance transfer on an Android device?

What is individual insurance transfer?

Who is required to file individual insurance transfer?

How to fill out individual insurance transfer?

What is the purpose of individual insurance transfer?

What information must be reported on individual insurance transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.