Get the free Duplicate 1099 Request

Get, Create, Make and Sign duplicate 1099 request

Editing duplicate 1099 request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out duplicate 1099 request

How to fill out duplicate 1099 request

Who needs duplicate 1099 request?

Navigating the Duplicate 1099 Request Form: A Comprehensive Guide

Understanding the 1099 form

The 1099 form serves as a critical document for reporting various types of income, ensuring that all parties maintain compliance with tax regulations. Its primary purpose is to report income that is not classified as wages, salaries, or tips, typically paid to non-employees or freelancers. Understanding the specific nuances of this form is essential for both issuers and recipients.

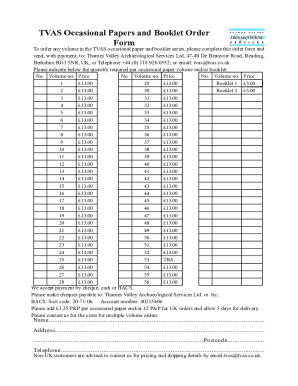

There are several types of 1099 forms tailored for different reporting needs. The two most common versions are the 1099-MISC, which was used for various income types, and the 1099-NEC, specifically designed to report nonemployee compensation. Other variants include the 1099-DIV for dividends and distributions, the 1099-INT for interest income, and the 1099-B for proceeds from broker and barter exchange transactions. Knowing which form applies to your situation can help streamline the payment process.

Accuracy in 1099 reporting is paramount. Incorrect entries can lead to significant tax implications for both the payer and payee, including potential audits by the government. Therefore, understanding how to manage duplicate 1099 requests appropriately is critical for both individuals and businesses.

When to request a duplicate 1099 form

Duplication requests typically arise under specific scenarios. One common reason for needing a duplicate 1099 form is the unfortunate misplacement or loss of the original. Many individuals and businesses accidentally misplace these documents, leaving them seeking a replacement with potentially looming tax deadlines.

Additionally, if the original form contains incorrect information—like an incorrect social security number or payment amount—it becomes essential to request a duplicate that accurately reflects the necessary details. Legal obligations mandate that both issuers and recipients maintain accurate tax records, making timely duplicate requests crucial.

Usually, it is advisable to request duplicates as soon as the error is identified or the original is misplaced, as waiting until the tax filing deadline may complicate your reporting. This proactive approach can prevent disputes and ensure compliance with tax regulations.

Steps to request a duplicate 1099 form

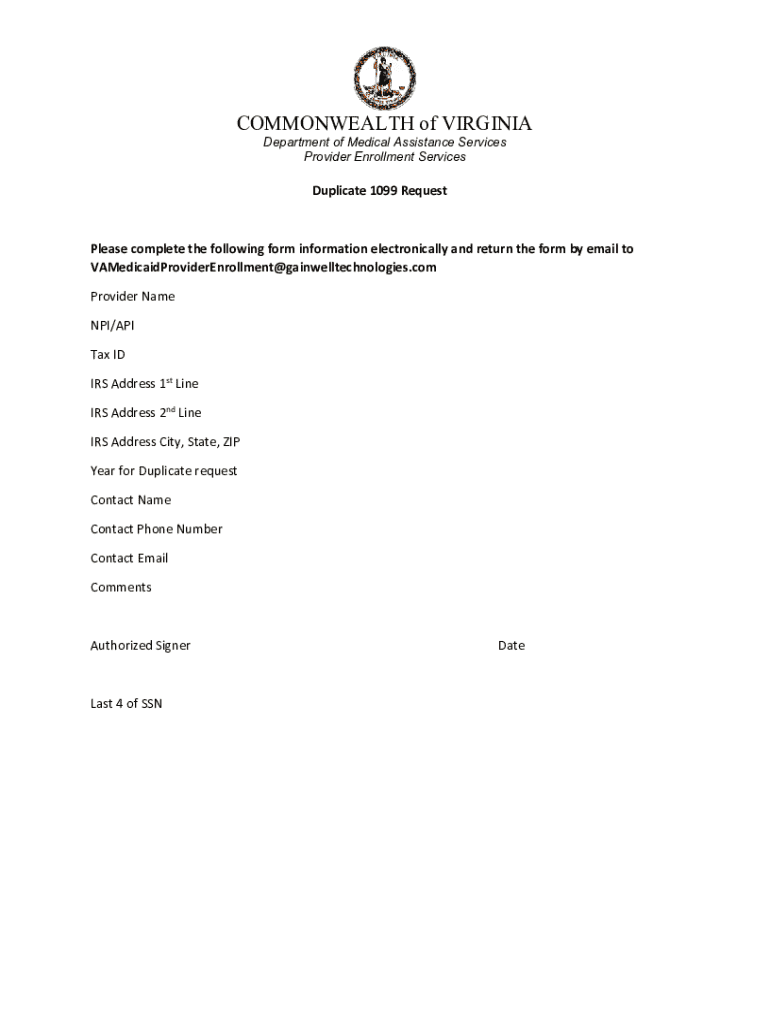

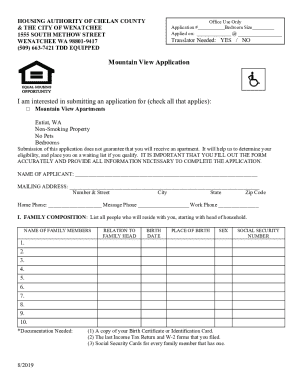

Once you've determined that you need a duplicate 1099 form, preparing the necessary information is crucial to successfully executing a request. To begin, gather personal and business identification details, including your tax identification number (TIN) and any unique identifiers associated with your original form.

After preparing your information, reach out to the issuer of the original 1099 form. Depending on the organization, you may contact them via phone, email, or through their online portals. When making contact, be sure to provide essential details, such as your name, TIN, the year for which you are requesting the duplicate, and specifics of why the duplicate is needed.

After submitting your request, expect a confirmation response from the issuer that will guide you on the next steps or timelines for receiving your duplicate. This helps ensure that your follow-up is effective and organized.

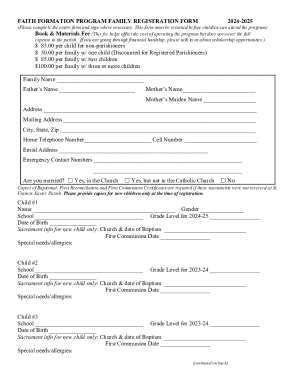

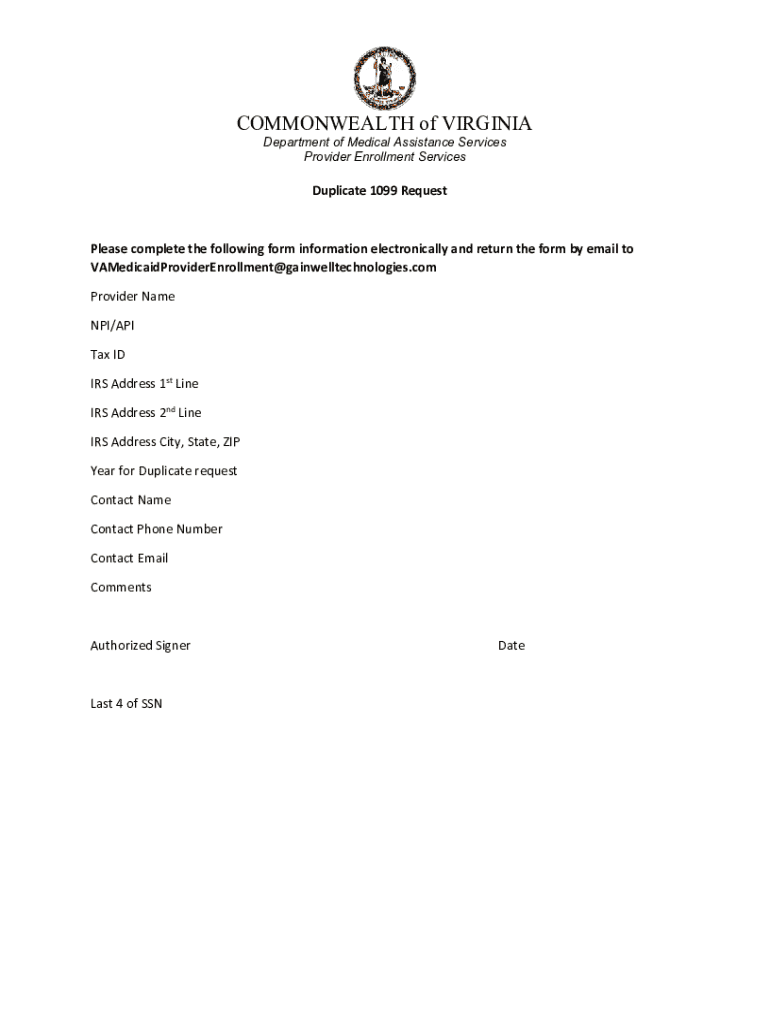

Filling out the duplicate 1099 request form

When you have the duplicate 1099 request form available, understanding its structure is key to ensuring a successful submission. The request form typically requires you to fill out your identifying information, the details of the original document, and, if applicable, corrections that need to be made from the original.

Common pitfalls include failing to provide adequate correction details or omitting necessary documentation to back your claims. In particular, when correcting errors on previous forms, be explicit about the changes, and if you have documentation that supports your request, attach these documents to the application.

To prevent delays in processing, double-check your entries against the original form's information. Accuracy here will lead to smoother handling of your request.

Managing your duplicate 1099 form

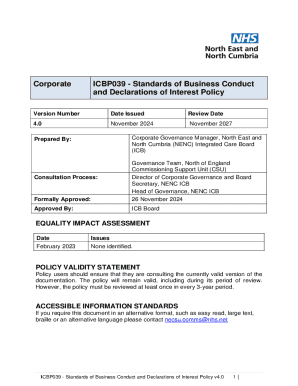

Once you receive your duplicate 1099 form, having a strategy for access and storage is essential. Utilizing cloud-based document solutions can significantly simplify the management of these types of forms. Such platforms allow easy downloading and access from any device, ensuring you can maintain digital copies without the risk of physical loss.

When it comes to editing or electronically signing your duplicate 1099, platforms like pdfFiller can enhance your efficiency. These tools are designed for users to easily collaborate on documents, ensuring that any necessary changes can be made swiftly and shared with necessary team members or household members.

Implementing these practices will ensure your document remains organized and easily retrievable when you need it most.

Frequently asked questions (FAQs)

Many questions arise surrounding the duplicate 1099 request form process. A frequent concern is how long it will take to receive the duplicate after making the request. Processing times may vary between issuers, but generally, it should be completed within a few weeks depending on the issuer's workload and methods. Keeping in contact with them may help maintain clarity on timeline expectations.

Another common query involves handling instances where an issuer refuses to provide a duplicate. In these cases, documenting all communication attempts is vital as it might be necessary to escalate the matter to a regulatory body such as the IRS. Additionally, individuals often ask if the duplicate form needs to be filed along with their tax return. The answer is yes, it should be attached to your tax filings to ensure all claims are accurately substantiated. Lastly, if you discover mistakes after submitting the duplicate, it’s best to contact the issuer immediately for guidance.

Navigating issues related to duplicate 1099 forms

Encountering issues with duplicate 1099 forms can be daunting, particularly when disputes arise with issuers. If discrepancies occur, it is crucial to maintain communication with the issuer to clarify misunderstandings. Formal records of all correspondence can serve as evidence should the matter escalate.

Moreover, any reporting errors can carry tax implications, potentially leading to penalties if not rectified promptly. Therefore, seeking guidance from tax professionals or legal services can provide the necessary support for complicated issues. Additionally, the IRS offers resources and self-service systems to assist taxpayers faced with these concerns.

Finalizing your 1099 submission

Once you acquire your duplicate 1099 form, it's imperative to ensure that all relevant forms are submitted timely to the IRS or other government organizations. Confirming that the duplicate is filed appropriately can impact your tax standing, and being organized can streamline this process.

In addition, employing best practices for record-keeping diminishes future headaches. Regularly updating digital storage solutions will ensure that all documents remain secure and retrievable. Utilizing tools from pdfFiller offers an accessible means to manage and prepare documents needed for future tax seasons.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the duplicate 1099 request in Gmail?

How do I edit duplicate 1099 request straight from my smartphone?

How do I edit duplicate 1099 request on an iOS device?

What is duplicate 1099 request?

Who is required to file duplicate 1099 request?

How to fill out duplicate 1099 request?

What is the purpose of duplicate 1099 request?

What information must be reported on duplicate 1099 request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.