Get the free Evaluation of Assets Section C

Get, Create, Make and Sign evaluation of assets section

Editing evaluation of assets section online

Uncompromising security for your PDF editing and eSignature needs

How to fill out evaluation of assets section

How to fill out evaluation of assets section

Who needs evaluation of assets section?

Evaluation of Assets Section Form: A Comprehensive Guide

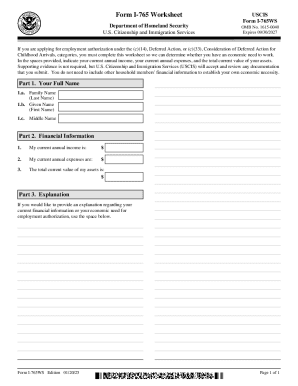

Understanding the evaluation of assets section form

The evaluation of assets section form is a crucial document used to assess and record the value of an individual's or business's assets. The primary purpose of this form is to create a comprehensive inventory of assets for financial analysis, tax preparation, or legal evaluations. By accurately documenting asset values, clients can better understand their financial standing and make informed decisions.

Asset evaluation is paramount in personal and business finance due to its impact on financial health assessments and tax liabilities. It allows individuals and agents to grasp the worth of their holdings, which is essential during tax filings, potential loans, or selling properties. Understanding the intricacies of the evaluation process ensures that no asset is overlooked, providing clients with a complete picture of their financial situation.

Preparing to fill out the evaluation of assets section form

Before filling out the evaluation of assets section form, it's essential to gather pertinent documentation. This means collecting personal identification documents such as government-issued IDs, bank statements, investment account statements, and records of any tangible assets. Having these documents organized will ensure a smoother process when detailing asset information.

Next, identify the types of assets that need evaluation. Common categories include liquid assets like cash, savings, and investments, real estate assets comprising properties and land, and personal property such as vehicles, jewelry, and collectibles. Understanding whether an asset qualifies as liquid or otherwise is vital in assessing total worth accurately.

Step-by-step instructions for completing the evaluation of assets section form

Completing the evaluation of assets section form involves a methodical approach. Step 1 focuses on accurately documenting liquid assets. Clients must calculate the cash and investment value by aggregating all available accounts. This includes checking current balances and valuing investments based on recent market prices, ensuring accuracy.

Step 2 entails evaluating real estate assets. Utilize effective methods such as comparative market analysis (CMA) and appraisal reports to estimate property value. Always consider market fluctuations and overall market health when determining the worth of real estate holdings.

In Step 3, the evaluation of personal property is crucial. Clients should research the value of their vehicles and collectibles using online valuation tools and resources. This includes assessing the depreciation of items and the current market demand, which can significantly affect their value.

Detailed breakdown of each asset category

Liquid assets are the backbone of immediate financial liquidity. Common types include cash in checking accounts, savings accounts, and investment portfolios. Clients need to keep an updated tally of these assets, ensuring that even minor changes are reflected in the assessment. For instance, evaluating cash flow from savings or investment accounts can illustrate not just current worth but also future potential.

Valuing real assets, such as properties, can be complex due to market variability. Different assessment methods like comparative sales analysis allow clients to position their property values accurately. Additionally, staying current on property taxes can assist in determining actual worth and financial obligations related to real estate holdings.

Personal property valuation often requires tools and resources to assist in understanding market trends. Factors influencing personal asset values include condition, rarity, and demand for certain collectibles. Having a good grasp of these components allows clients to provide more realistic numbers on their evaluation form.

Best practices for documenting asset evaluation

Accurate record-keeping is integral to effective asset evaluation. Clients should maintain clear and organized records, including receipts and documentation for each asset. The utilization of technology, particularly platforms like pdfFiller, can streamline this process. Document management features allow users to store information securely and access it from anywhere, making updates easy.

Interactive tools available on pdfFiller enhance asset evaluation processes. These features promote collaboration among teams, allowing multiple users to access and edit documents simultaneously. This step can significantly reduce errors, as team members can provide feedback and ensure more accurate asset valuations.

Common mistakes to avoid in asset evaluation

Clients often underestimate the value of specific assets during the evaluation process. This could lead to significant discrepancies in understood financial worth. It's crucial to conduct thorough market research and consult professionals when necessary to avoid undervaluing important assets.

Another common mistake is failing to regularly update asset valuations. As markets change, the values attached to assets can fluctuate, which means that regular reassessments are essential for accurate financial planning. Moreover, neglecting to document supporting evidence for asset values can cause issues during tax assessments or potential legal proceedings.

Tips for navigating the evaluation process with pdfFiller

Using pdfFiller simplifies the completion of the evaluation of assets section form. The platform allows users to edit PDFs, sign documents, and manage asset evaluations effectively from a single cloud-based solution. Its cloud-based access offers flexibility, enabling clients to manage forms from anywhere, which is invaluable in today's mobile world.

eSignature integration further enhances the efficiency of the evaluation process. Clients can quickly obtain necessary approvals without any physical paperwork delays. Furthermore, pdfFiller allows for effective collaboration with team members during the evaluation process. Shared access and permission settings enable cohesive group work, promoting accuracy and thoroughness.

Frequently asked questions (FAQs) about the evaluation of assets section form

Clients may wonder about the use of the evaluation of assets section form for non-standard assets, such as collectibles or intellectual property. It is recommended to include unique items and seek professional appraisals for accuracy in valuation. These valuations might require different handling than traditional assets.

Another common question relates to how often asset evaluations should be conducted. Regular evaluations are encouraged at least once a year or after significant financial events, such as purchasing a new property or selling significant investments. Finally, yes, this evaluation form can indeed be used for business purposes, allowing businesses to assess their asset value accurately for financial reporting and tax compilations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my evaluation of assets section in Gmail?

How do I execute evaluation of assets section online?

Can I sign the evaluation of assets section electronically in Chrome?

What is evaluation of assets section?

Who is required to file evaluation of assets section?

How to fill out evaluation of assets section?

What is the purpose of evaluation of assets section?

What information must be reported on evaluation of assets section?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.