Get the free Bankruptcy Notice and Claim Forms

Get, Create, Make and Sign bankruptcy notice and claim

Editing bankruptcy notice and claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bankruptcy notice and claim

How to fill out bankruptcy notice and claim

Who needs bankruptcy notice and claim?

Bankruptcy Notice and Claim Form - How-to Guide Long-Read

Understanding bankruptcy notices and claim forms

Bankruptcy proceedings involve a legal process through which individuals or businesses cannot repay their outstanding debts. When a debtor files for bankruptcy, a court evaluates their financial situation to determine how creditors will be compensated. A crucial component of this process is the bankruptcy notice and claim form, which serves as an official document notifying creditors about the bankruptcy filing and outlining how they can assert their rights.

The importance of the bankruptcy notice and claim form cannot be overstated. It provides essential information on the debtor's case, allowing creditors to understand the implications of the bankruptcy filing on their financial interests. Different types of bankruptcy, such as Chapter 7, Chapter 11, and Chapter 13, each have specific procedures and claims processes, making it vital for creditors to familiarize themselves with these distinctions.

Identifying the key components of the bankruptcy notice

A bankruptcy notice contains several key elements essential for understanding the case's context. It typically includes the debtor's information, case details such as the case number, and the names of recipients who must be notified regarding the bankruptcy. Understanding legal terminology in this context is crucial as it can impact the creditor's response and potential recovery.

There are different types of notices involved in bankruptcy proceedings, which serve varied purposes such as providing updates on case progress or informing about court hearings. Creditors need to be aware of these notices and keep track of communications to ensure they respond appropriately and file claims within set deadlines.

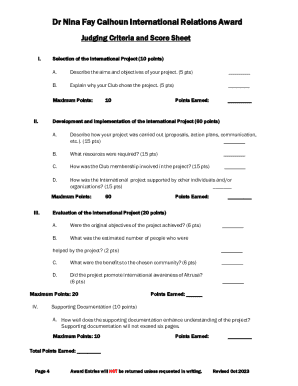

Detailed breakdown of the claim form

The Proof of Claim form is a critical document that creditors file to assert their right to receive a distribution from the bankruptcy estate. This form is the formal mechanism for creditors to make claims against the debtor's estate and is an essential part of the bankruptcy process.

Any creditor whose claim arose before the bankruptcy filing date can file a claim. This includes individuals, businesses, and entities that provided goods or services or loaned money to the debtor. The importance of filing a claim accurately cannot be overlooked, as failure to do so might result in losing the opportunity to collect the debt.

Key components of the proof of claim form typically include:

Step-by-step guide to completing the bankruptcy claim form

Completing the bankruptcy claim form can seem overwhelming, but breaking it down into manageable steps makes the process easier. The following guide will help you navigate through filling out the form with clarity.

Step 1: Gathering necessary information

Start by collecting all relevant documents such as invoices, contracts, or loan documents associated with the debt. Familiarize yourself with your rights as a creditor and the types of claims you can make, which is crucial for completing the form accurately.

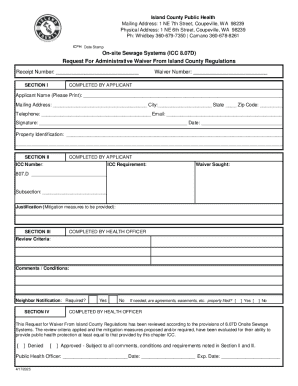

Step 2: Completing the top portion of the form

In the top section of the form, fill out debtor and creditor information precisely. Ensure that the names are spelled correctly, and case numbers match the bankruptcy notice to avoid confusion. Common pitfalls include typos or providing outdated contact information, which can lead to missed notifications.

Step 3: Filling in the numbered sections of the form

As you progress to the numbered sections, carefully detail your claim. When specifying secured vs. unsecured claims, remember that secured claims are backed by collateral, while unsecured claims are not. For accurate reporting of amounts owed, review all documentation to ensure the amounts align with your records.

Step 4: Review and verification

Once the form is complete, utilize a checklist to ensure all sections have been filled accurately. The importance of accuracy and full disclosure cannot be underestimated, as errors may result in delays or potential denial of your claim.

Step 5: Signing and dating the form

Finally, sign and date the form, acknowledging the truth of the information provided. Understand the legal implications of your signature, as it signifies your commitment to your claims' legitimacy. For modern conveniences, leverage tools like pdfFiller for electronic signatures, making the process smoother and more streamlined.

Filing your claim: submission guidelines

Submitting the completed claim form is a crucial step in asserting your right to payments as a creditor. Claims can typically be submitted by mail or through the court’s electronic filing system, depending on the specific court requirements. It's essential to review the local rules as they can vary significantly between jurisdictions.

Be mindful of filing deadlines, which can dictate whether your claim is accepted or denied. While deadlines may vary, submitting your claim promptly increases your odds of being compensated. After submission, you can often track the status of your claim through the court’s online portal or by contacting the clerk's office for updates.

What happens after you file your claim?

After filing your claim, the bankruptcy court will review the details to determine validity and priority. Understanding the claims review process is critical, as the court evaluates claims based on the evidence provided, the applicable bankruptcy laws, and the overall financial situation of the debtor.

Potential outcomes can include approval of your claim, partial allowance based on the debtor’s available assets, or outright denial. If denied, you have the right to appeal, and knowing how to navigate this process can impact the recovery of your owed amounts significantly.

Utilizing pdfFiller for your bankruptcy forms

pdfFiller streamlines the drafting and management of bankruptcy forms, providing a seamless experience for users. You'll find a myriad of features designed specifically for editing, signing, and managing PDFs effectively from a single, cloud-based platform.

To make the most of pdfFiller, follow these steps:

Common frequently asked questions

Navigating the bankruptcy process raises numerous questions. Below are some common inquiries that creditors may have regarding the bankruptcy claim process.

Best practices for managing bankruptcy documentation

Keeping records organized throughout the bankruptcy process is critical. Effective record management ensures that all documentation related to your claims, correspondences, and filed forms are readily accessible.

Consider implementing the following strategies to manage your bankruptcy-related documents efficiently:

Understanding your rights as a creditor in bankruptcy

As a creditor, it's essential to understand your rights in the bankruptcy process. Federal and state laws provide protections for creditors, but navigating these regulations can be complex.

Common challenges faced by creditors include securing payments in a timely manner and understanding your claim's priority. Familiarize yourself with the resources available, including local bankruptcy courts, legal aid organizations, and online forums dedicated to creditors navigating bankruptcy claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in bankruptcy notice and claim?

Can I create an electronic signature for the bankruptcy notice and claim in Chrome?

How do I complete bankruptcy notice and claim on an iOS device?

What is bankruptcy notice and claim?

Who is required to file bankruptcy notice and claim?

How to fill out bankruptcy notice and claim?

What is the purpose of bankruptcy notice and claim?

What information must be reported on bankruptcy notice and claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.