Get the free California Resident Income Tax Return 2012

Get, Create, Make and Sign california resident income tax

Editing california resident income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california resident income tax

How to fill out california resident income tax

Who needs california resident income tax?

A Comprehensive Guide to California Resident Income Tax Forms

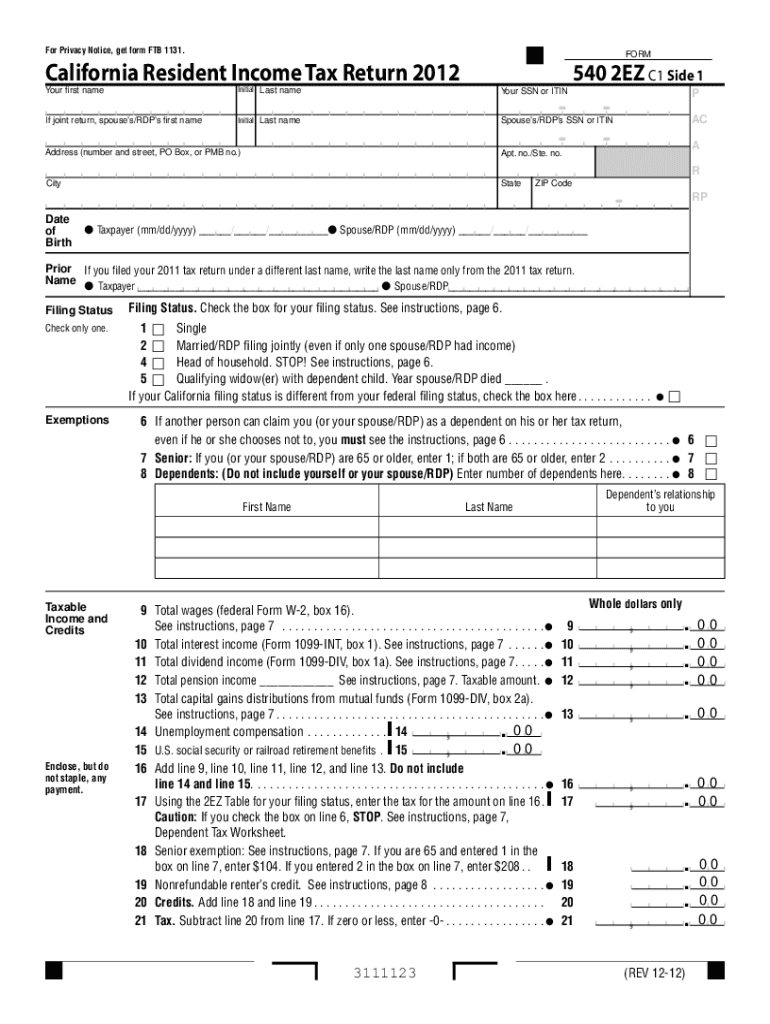

Overview of California resident income tax forms

California resident income tax forms are essential documents that individuals must complete and file to report their earnings to the state. Understanding these forms is crucial for maintaining compliance with state tax regulations, ensuring no penalties arise from incorrect or incomplete submissions.

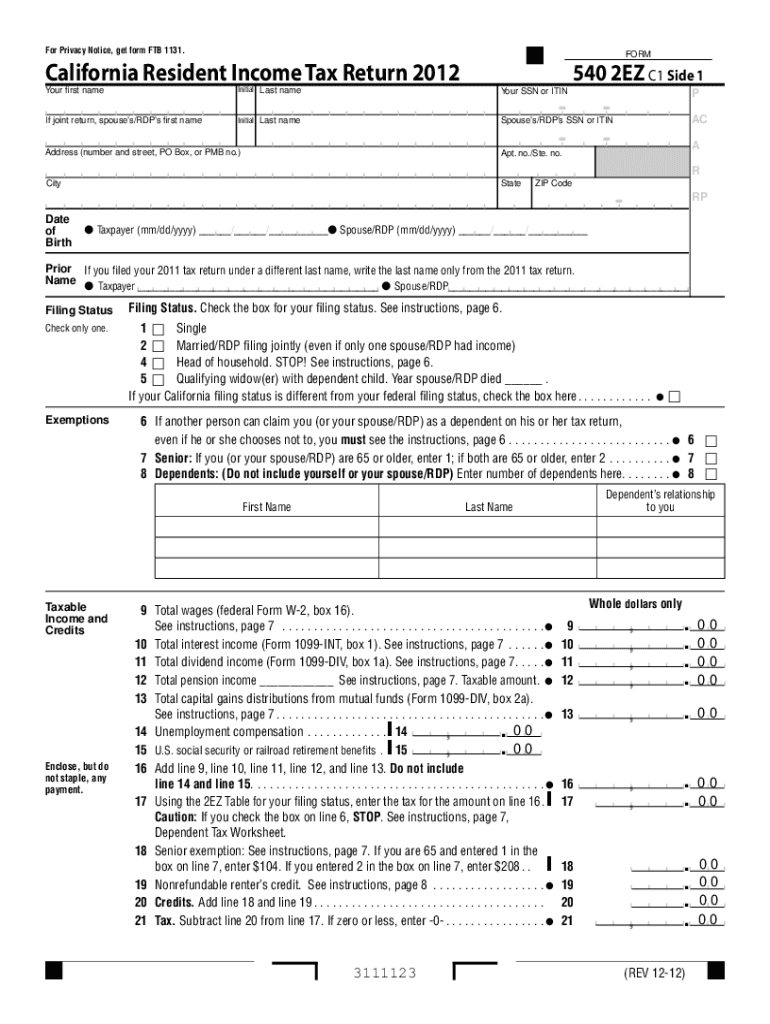

The primary form for California residents is Form 540, with its variants available for specific tax situations. Each of these tax forms is designed to capture the taxable income and applicable deductions or credits, enabling the state to assess how much tax is owed or if a refund is due.

Eligibility and requirements

Not everyone has to file a California resident income tax return. Individuals are typically required to submit Form 540 if their income exceeds certain thresholds, which vary depending on filing status (single, married, head of household). Additionally, residency status plays a significant role in determining who is required to file; full-time residents and part-time residents may have different reporting requirements under state law.

To file accurately, you'll need to gather various documents. W-2 forms from your employer indicate your wages and withheld taxes, while 1099 forms are essential for reporting alternative sources of income, such as freelance work or interest income. Furthermore, documentation proving eligible deductions and credits plays a crucial role in determining the overall tax liability.

Step-by-step guide to completing the California resident income tax form

When preparing to fill out your California resident income tax form, the first step is gathering all necessary information. This includes your personal identification details, income sources from various forms, as well as records of any deductions or credits you intend to claim.

Filling out Form 540 involves several sections that require careful attention. Start with personal information such as your name and address, then proceed to report various income types and any adjustments. Be sure to dedicate time to deductions as they can significantly affect your tax obligation. As you complete each section, maintain accuracy to avoid common pitfalls that may delay processing or result in audits.

Interactive tools for form preparation

Utilizing tools like pdfFiller can make the creation and management of your California resident income tax form more efficient. This platform offers features for easy editing and filling of the document, ensuring a streamlined process that saves time and reduces errors.

In addition to editing tools, pdfFiller also provides eSignature options, allowing you to sign your forms electronically. Collaborators can engage in real-time editing and feedback, enhancing teamwork and accuracy in document creation, ensuring that everyone involved has seamless access to necessary files.

Filing options for California resident income tax

When it comes to filing your California resident income tax return, you have two main options: electronic filing and paper filing. eFiling is increasingly popular due to its speed and ease of use. Most find it more convenient to file their taxes online, particularly with dedicated platforms like pdfFiller, which simplify the process further.

Be aware of key deadlines for filing and payment of taxes, as missing these dates can incur penalties. It's important to set reminders ahead of the tax season to ensure you don't overlook submission dates. Understanding both deadlines and penalties helps you plan effectively.

Common FAQs about California resident income tax forms

When preparing your California resident income tax form, you may have several questions about the process. For instance, many individuals seek to understand how to amend their tax returns if mistakes are discovered after filing. The state offers procedures to rectify errors by submitting a specific amendment form.

Another frequent query pertains to understanding tax liability. Residents often wish to know the factors influencing the tax amount they owe or might anticipate as a refund. There are numerous elements in play, including income level, deductions, credits, and any applicable state tax laws.

Help and support resources

If you encounter challenges while completing your California resident income tax form, various support resources are available. The California Franchise Tax Board (FTB) is the primary contact for tax-related inquiries, offering guidance and assistance through their website and customer service lines.

Additionally, pdfFiller provides exceptional support resources, including live chat features, comprehensive tutorials, and guides tailored to assist users in efficiently completing their tax documents. Utilizing these resources can enhance your filing experience significantly.

Recent updates and changes to California tax laws

California tax laws are subject to frequent updates, which can directly impact filing requirements and tax liability calculations. It's vital to stay informed about the most recent changes, as they might affect deductions, credits, or overall tax calculations. For the current tax year, new adjustments to thresholds and credit limits may be introduced, offering residents potential new benefits.

Understanding these changes not only aids in accurate tax preparation but also ensures that taxpayers can take full advantage of available credits and deductions. Staying updated can ultimately result in considerable savings or avoid possible penalties due to outdated information.

Related content and documents

In addition to the California resident income tax form, numerous related documents and forms can aid residents filing their taxes. Business tax forms are necessary for those running enterprises, while specialty forms cater to specific situations, ensuring that unique financial circumstances are addressed correctly.

Moreover, publications and tax guides provide further clarity on state tax laws, ensuring taxpayers are well-equipped with the knowledge and resources they need. Familiarizing yourself with these related materials can supplement your understanding of the tax process.

User rights and responsibilities

As a taxpayer, it's essential to understand your rights and responsibilities when filing your California resident income tax form. You have the right to fair treatment by the Franchise Tax Board and to be informed about any decisions impacting your tax situation. Further, taxpayers possess the right to appeal decisions regarding tax assessments or refunds.

Conversely, responsibilities include accurately reporting all income and eligible deductions, maintaining proper documentation, and filing within designated deadlines. It’s crucial to approach tax season with diligence, as fully understanding these rights and responsibilities can help relieve potential stress during the filing process.

Explore additional services through pdfFiller

pdfFiller offers a suite of document management solutions that extend beyond tax forms, including features for tracking, organizing, and securely managing sensitive personal data. Leveraging these tools not only simplifies tax preparation but also enhances overall document workflow efficiency.

Users can enjoy enhanced privacy and security options, providing peace of mind while managing their important documents online. This holistic approach ensures that individuals engage with their tax forms and other documents confidently and efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit california resident income tax from Google Drive?

How do I edit california resident income tax in Chrome?

How do I edit california resident income tax straight from my smartphone?

What is california resident income tax?

Who is required to file california resident income tax?

How to fill out california resident income tax?

What is the purpose of california resident income tax?

What information must be reported on california resident income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.