Get the free New Jersey New Hire Forms Description and Instructions

Get, Create, Make and Sign new jersey new hire

How to edit new jersey new hire online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new jersey new hire

How to fill out new jersey new hire

Who needs new jersey new hire?

Comprehensive Guide to the New Jersey New Hire Form

Understanding the New Jersey New Hire Form

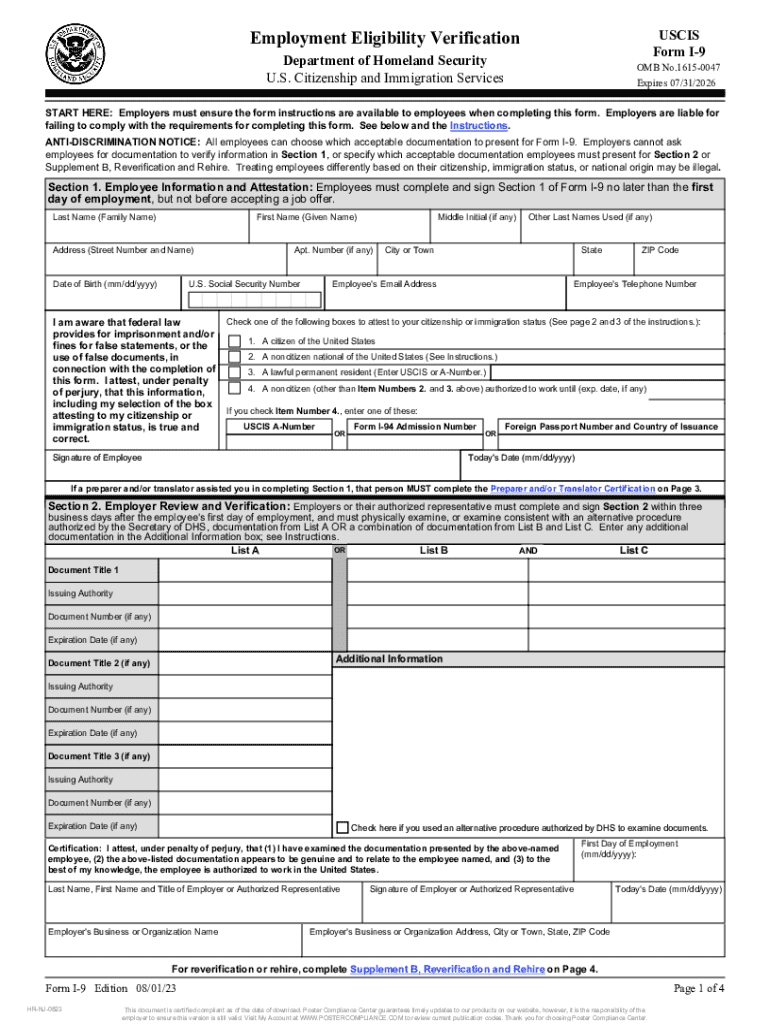

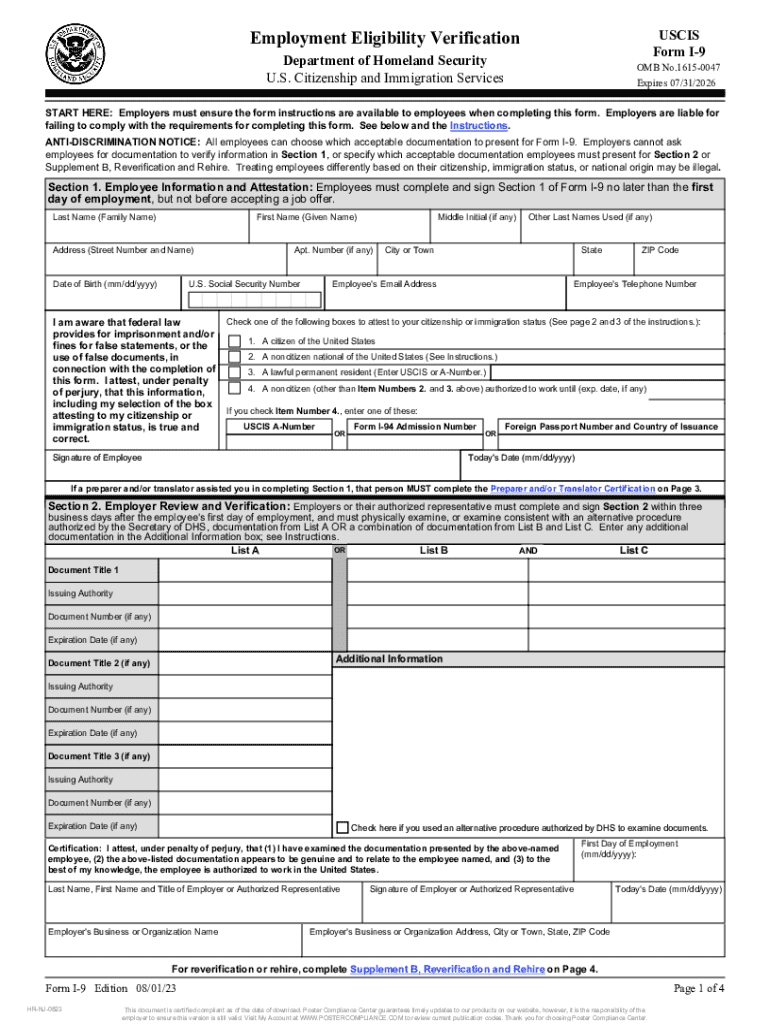

The New Jersey New Hire Form serves a crucial role in the employment process in the state. Designed to collect essential information about new employees, it helps employers comply with state laws and manage their workforce effectively. This form is mandated by New Jersey law to ensure that the state's eligibility for assistance programs is met and to facilitate tax collection.

Legal requirements stipulate that all employers in New Jersey must report new hires to the state within 20 days of their start date. This requirement applies to full-time, part-time, permanent, and temporary employees, ensuring a comprehensive employment database for services like child support enforcement. Failure to complete and submit this form can lead to financial penalties for employers.

The key benefits of the New Jersey New Hire Form extend to both employers and employees. Employers gain a streamlined process for reporting and managing new workforce members, while employees can ensure accurate tax reporting and access to appropriate benefits. Engaging in this process fosters transparency between both parties.

Components of the New Jersey New Hire Form

The New Jersey New Hire Form is designed to gather critical information relevant to the employment relationship. The required details can be categorized into essential and optional information.

Essential information that employees must provide includes:

While optional, additional information like emergency contacts and details on benefits like health insurance can enhance employee safety and welfare.

Step-by-step guide to filling out the New Jersey New Hire Form

Completing the New Jersey New Hire Form doesn’t have to be daunting. To make the process smoother, here are the necessary steps for preparing and filling out the form.

Before you begin, collect the following information:

The form is typically divided into three main sections:

Common mistakes to avoid when filling out the form

While completing the New Jersey New Hire Form is straightforward, several common pitfalls could result in delays or legal issues. Recognizing these can save valuable time and prevent complications.

One of the most common mistakes is providing incomplete information. Fields left blank can lead to processing delays and may even subject employers to fines. It is essential that all required sections are filled out correctly and thoroughly.

Another frequent error relates to misunderstanding tax withholding options. Many employees do not fully understand how to complete the tax portion accurately, which may lead to incorrect tax deductions and future complications.

Additionally, failing to maintain accurate records post-submission can cause problems in verifying employment information in the future or during audits. Employers should keep copies of submitted forms for their records.

Interactive tools for managing the new hire process

As organizations increasingly rely on digital solutions, tools like pdfFiller can enhance the efficiency of managing the new hire process significantly. pdfFiller provides a user-friendly cloud platform that simplifies the New Jersey New Hire Form completion and submission.

With pdfFiller, users can easily edit the form in real-time, making instant changes and corrections as necessary. The platform's editing features allow for adjustments to be made quickly, supporting a more dynamic work environment.

Moreover, pdfFiller offers eSignature capabilities, enabling employees to sign forms electronically without the hassle of physical paperwork. This not only accelerates the process but also enhances record-keeping and tracking.

Collaboration among HR teams is made seamless through its collaborative features, allowing multiple team members to work together on filling out documents, ensuring accuracy and compliance.

How to submit the New Jersey New Hire Form

Once you have completed the New Jersey New Hire Form, it’s essential to know how to submit it correctly. There are two primary submission methods: electronically or via paper.

For electronic submission, utilize pdfFiller's platform to send the completed form directly to the required state department. This method is frequently the fastest and most efficient, ensuring timely reporting.

If you prefer paper submission, be prepared to send the completed form to the New Jersey Department of Labor and Workforce Development. Make sure to follow the prescribed guidelines for paper submissions and keep a copy of the form for your records.

Be mindful of deadlines as well, as the form must be submitted within 20 days of the employee's start date to avoid any penalties or complications.

Frequently asked questions (FAQs) about the New Jersey New Hire Form

Understanding what follows after submission of the New Jersey New Hire Form is crucial for both employers and employees. Many have questions regarding the next steps.

After submission, the state processes the form and updates the new employee's information in their system. Employers typically receive confirmation of submission, which should be filed for reference.

If you need to amend any part of the form later, you can contact the state department or, where appropriate, submit a new form with the correct details indicated.

Another important aspect is data privacy. The information collected on the New Jersey New Hire Form is handled in compliance with state and federal data privacy laws, meaning confidentiality is maintained. Employers should reassure employees that their personal information is safe and securely stored.

Additional forms and resources for new employees in New Jersey

In addition to the New Jersey New Hire Form, several other documents are often required for new employees. Awareness of these forms ensures a smooth onboarding process and compliance with legal obligations.

Important forms include:

For further guidance, links to state resources and HR guidelines are available online. Engaging in workshops or webcasts about new hire best practices can also prove beneficial for both employers and employees, enhancing the overall onboarding experience.

Why choose pdfFiller for your document management needs?

When it comes to managing essential documents like the New Jersey New Hire Form, pdfFiller stands out by offering comprehensive, cloud-based solutions accessible from anywhere. Its user-friendly interface aids users in creating, editing, and sharing forms quickly and effectively.

The platform features enhanced capabilities for PDF editing and signing, which simplifies the document management process. With a focus on efficiency and ease of use, pdfFiller empowers users to engage in effective and organized documentation practices.

Additionally, dedicated customer support ensures that users receive assistance as needed, making document management a smooth endeavor. By choosing pdfFiller, businesses gain access to a powerful tool that bolsters their operational capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get new jersey new hire?

How do I edit new jersey new hire on an iOS device?

How do I complete new jersey new hire on an Android device?

What is new jersey new hire?

Who is required to file new jersey new hire?

How to fill out new jersey new hire?

What is the purpose of new jersey new hire?

What information must be reported on new jersey new hire?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.