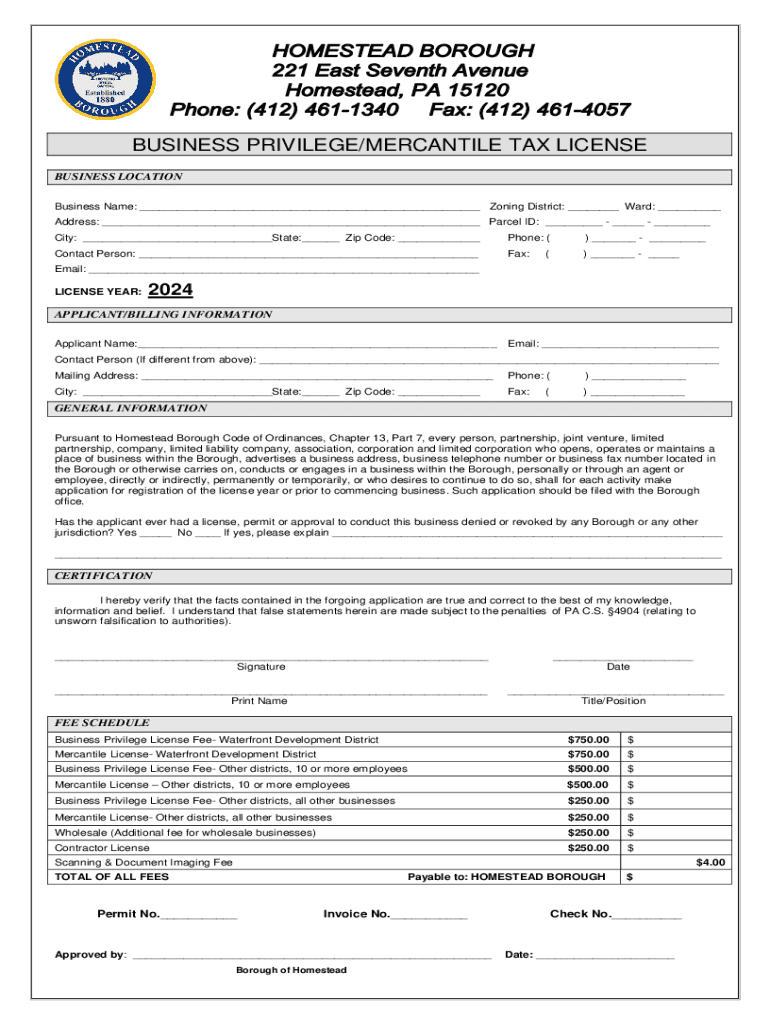

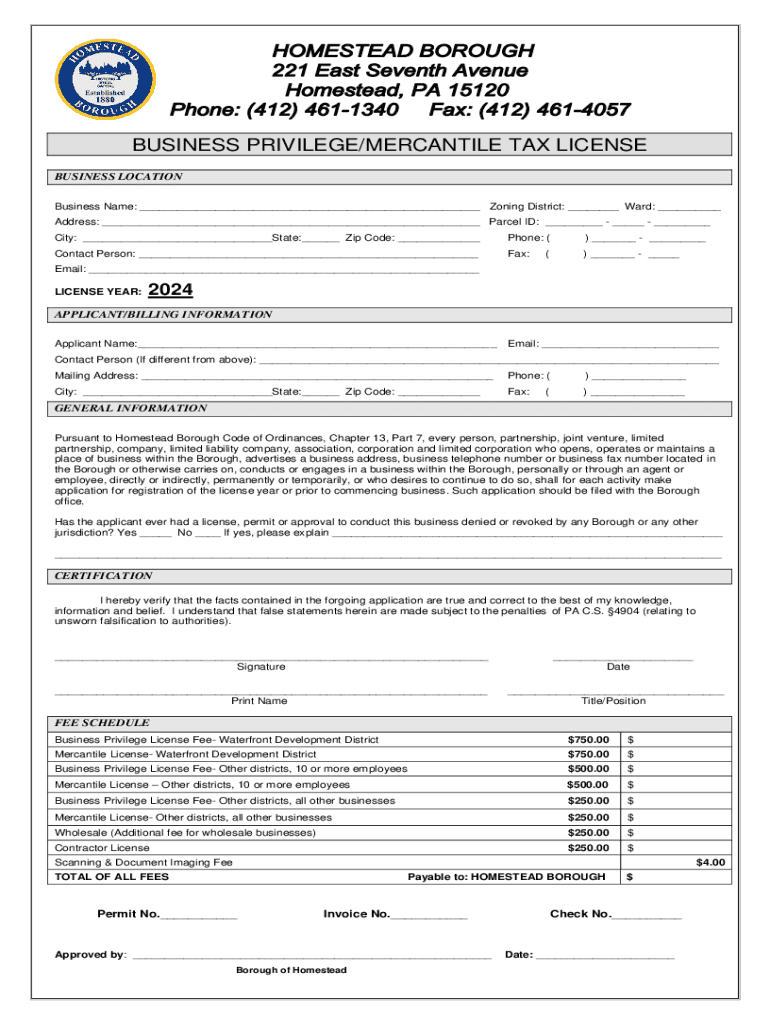

Get the free Business Privilege/mercantile Tax License

Get, Create, Make and Sign business privilegemercantile tax license

How to edit business privilegemercantile tax license online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business privilegemercantile tax license

How to fill out business privilegemercantile tax license

Who needs business privilegemercantile tax license?

Business Privilege Mercantile Tax License Form: A Comprehensive How-to Guide

Understanding business privilege mercantile tax

The business privilege mercantile tax is a tax levied on businesses operating within certain jurisdictions, particularly municipalities. It generally applies to businesses that engage in commercial activities such as selling goods, providing services, or transacting engage in eCommerce. This tax is crucial for local governments to fund various services like infrastructure, schools, and public safety.

Obtaining a business privilege mercantile tax license is more than just a formality; it is a legal requirement for many businesses. If you operate a business subject to this tax, failing to secure a license can lead to penalties. Compliance not only avoids legal repercussions but also enhances your business's credibility with customers and regulators alike.

Overview of the mercantile tax license form

The mercantile tax license form serves as the official document that a business must complete to register with the local government for tax purposes. It typically captures essential information about the business and its financial operations, which assists local authorities in determining tax liabilities.

Businesses required to file the mercantile tax form typically include retailers, wholesalers, and service providers. Certain types of businesses may be exempt, such as non-profits or small enterprises under revenue thresholds, depending on local regulations.

Step-by-step guide to completing the business privilege mercantile tax license form

Completing the business privilege mercantile tax license form requires organized preparation and careful attention to detail. First, gather all necessary information about your business, including identification details and financial data.

Detailed breakdown of form sections

The form typically consists of several key sections:

Tools and resources for managing your application

Utilizing resources like pdfFiller can streamline the management of your application process. With pdfFiller, you can access your PDFs from anywhere, whether you’re in the office or on the go. The platform allows you to edit and eSign documents seamlessly, providing a comprehensive environment for handling tax-related forms.

Tracking your application status is also crucial. Maintaining open lines of communication with tax authorities ensures you are updated on the progress of your submission. Keeping a record of your applications will provide reference points for future discussions.

Common challenges and solutions

Navigating the application process may involve several challenges. Mistakes in your application can delay processing or lead to denials. Common mistakes include incorrect financial reporting and failing to provide necessary documentation.

If your application is denied, the first step is to identify the reason for the denial. Common reasons might be incomplete information or failure to meet local requirements. Many municipalities offer an appeal process, which allows you to rectify any issues identified by the authorities.

Staying informed about tax updates and regulations

Keeping up with changes in tax laws and regulations is vital for all business owners. Tax rules can frequently change, and staying informed allows businesses to remain compliant. Regularly checking local and state tax authority websites is one of the best ways to receive updates.

Leveraging technology for tax management

In today's business environment, embracing technology significantly enhances tax management processes. A cloud-based document solution like pdfFiller not only streamlines the paperwork associated with tax filings but also facilitates collaboration among team members. This can be especially beneficial for teams managing multiple tax documents.

Conclusion

Navigating the complexities surrounding the business privilege mercantile tax license form may seem daunting. However, with thorough preparation and the right tools, compliance can be achieved smoothly. Utilizing resources like pdfFiller empowers you to remain organized and efficient while managing these critical documents.

Prioritizing the importance of obtaining the mercantile tax license will ensure your business operates within legal boundaries, ultimately contributing to your long-term success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business privilegemercantile tax license without leaving Google Drive?

How do I fill out the business privilegemercantile tax license form on my smartphone?

How can I fill out business privilegemercantile tax license on an iOS device?

What is business privilege mercantile tax license?

Who is required to file business privilege mercantile tax license?

How to fill out business privilege mercantile tax license?

What is the purpose of business privilege mercantile tax license?

What information must be reported on business privilege mercantile tax license?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.