Get the free Anti-money Laundering Information Collection & Certification Form - Sellers

Get, Create, Make and Sign anti-money laundering information collection

Editing anti-money laundering information collection online

Uncompromising security for your PDF editing and eSignature needs

How to fill out anti-money laundering information collection

How to fill out anti-money laundering information collection

Who needs anti-money laundering information collection?

Anti-Money Laundering Information Collection Form: A Complete Guide

Understanding Anti-Money Laundering (AML) Compliance

Anti-money laundering (AML) represents a set of regulations, laws, and procedures designed to prevent the generation of income through illegal actions. As financial transactions become increasingly complex in a globalized economy, grasping the essence of AML and its significance is more critical than ever for businesses.

AML regulations are primarily established by government bodies to combat money laundering, terrorism financing, and other illicit activities. These laws require financial institutions and other regulated businesses to monitor customer transactions diligently and report any suspicious activity. For businesses, understanding and implementing effective AML compliance is not just a regulatory requirement but a critical aspect of risk management.

The role of the information collection form

The AML information collection form serves as a crucial tool in the fight against financial crime. Its primary purpose is to gather vital information necessary for assessing customer risk and ensuring compliance with AML regulations. By accurately completing this form, businesses can promote transparency and accountability in their operations.

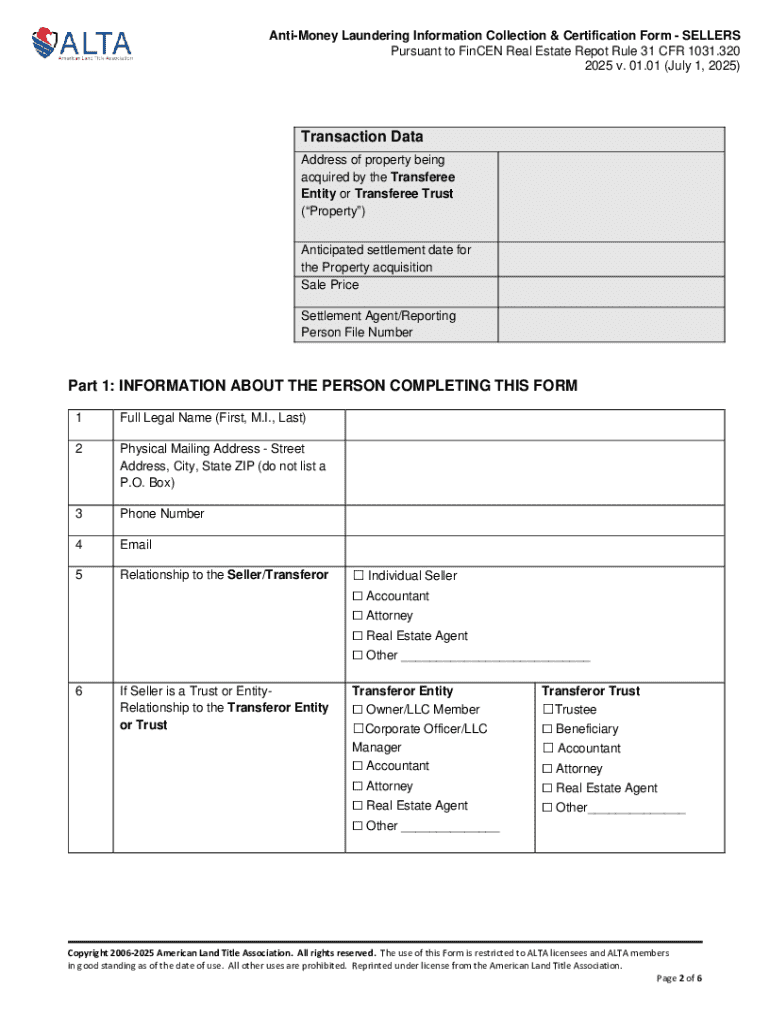

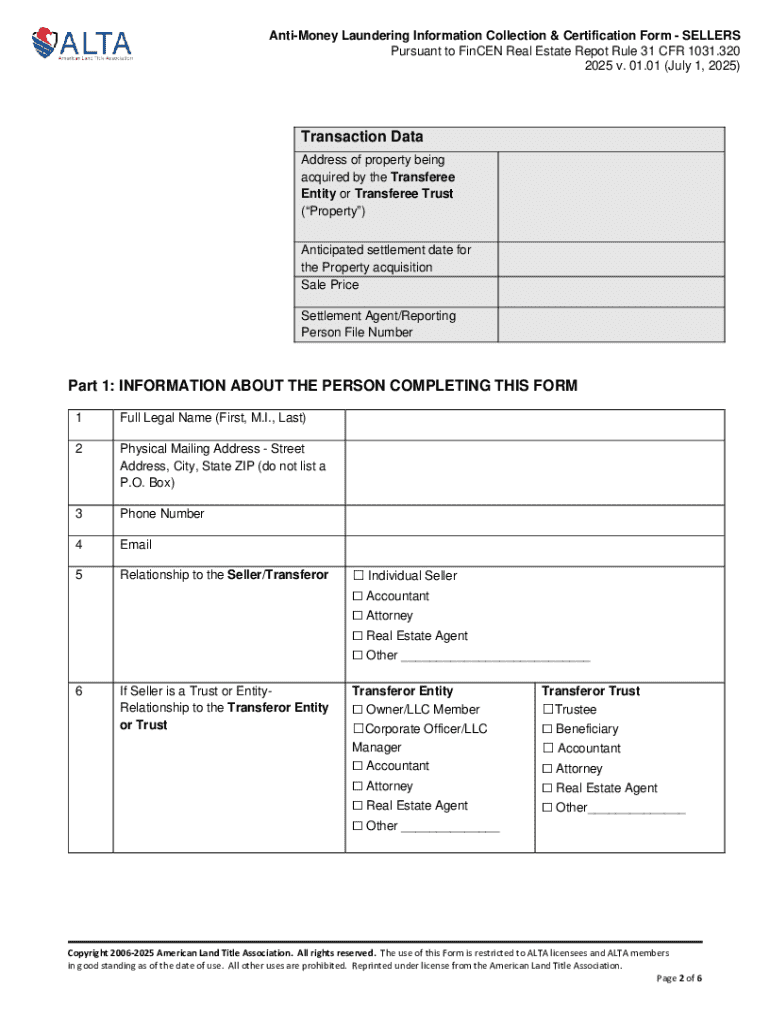

The form typically includes several key elements that businesses must complete to facilitate effective compliance. These components often consist of personal identification of the customer, detailed business information, and a history of financial transactions. Collecting this information helps organizations monitor compliance and mitigate the risk of becoming unwitting accomplices in money laundering activities.

Step-by-step guide to filling out the AML information collection form

Successfully completing the AML information collection form requires thorough preparation and attention to detail. Preparing necessary documentation and understanding the information requested is essential before you begin filling out the form.

Preparation before filling out the form

Start by gathering all relevant documentation to ensure accurate data entry. Common documents include government-issued identification for individuals and business registration documents for companies. Additionally, familiarize yourself with the form to understand which information is required in each section. Being well-prepared reduces the chances of mistakes and omissions.

Detailed instructions for each section of the form

When filling out the form, begin with the personal information section. This typically includes entering the customer's full name, residential address, and contact details. Following that, provide business information, such as legal business name, registration details, and the nature of your business activities.

Next, include any financial transaction disclosures relevant to the customer, such as sources of income and expected transaction volumes. Lastly, a risk assessment section may require you to identify potential risks based on the customer's profile. Be diligent in assessing risk; businesses associated with higher risks may face more stringent scrutiny.

Common mistakes to avoid

Many errors arise from incomplete submissions or providing incorrect information on the AML information collection form. Double-checking all entries and ensuring that every required field is filled out completely can prevent significant setbacks. Inaccuracies, whether intentional or accidental, can lead to regulatory penalties and hinder compliance efforts.

Tips for editing and reviewing the AML information collection form

Editing and reviewing the AML information collection form is crucial for successful compliance. Utilizing pdfFiller’s editing tools empowers you to make changes seamlessly, ensuring the form is accurate before submission. Here's how to effectively make edits.

Utilizing pdfFiller’s editing tools

pdfFiller provides an intuitive platform for editing documents online. After filling out the AML information collection form, navigate to the edit section where you can make adjustments. Use the highlight and comment features to mark areas needing attention. Consider comparing your completed form against the requirements specified by AML regulations to confirm compliance.

Checklist for reviewing your submission

Before sending your AML information collection form, ensure that you verify the following essential points:

Electronic signatures: the future of document management

Incorporating electronic signatures into the submission process enhances efficiency and legality. The adoption of electronic signatures is increasingly favored as businesses seek to streamline their document management processes. eSigning the AML form not only saves time but also provides a level of security for all parties involved.

Advantages of using electronic signatures

The advantages of electronic signatures include legal validity, requiring compliance with laws like UETA and ESIGN, enhanced security protocols, and significant time savings. Electronic signatures eliminate the need for physical documentation and allow for quick verification.

How to use pdfFiller for eSigning the AML form

Using pdfFiller for electronically signing the AML information collection form is straightforward. After completing the form, navigate to the eSigning options. Follow the prompts to create your electronic signature. Once your signature is affixed, you can send the signed document securely via email or download it for record-keeping.

Managing your AML documentation

Effective management of AML documentation is paramount for ongoing compliance. Organizing your AML forms and records not only facilitates easier access during audits but also enhances operational efficiency. Employing a systematic approach to document management can prevent errors and streamline operations.

Best practices for document management

Best practices include labeling and categorizing documents based on type and date, ensuring that all documents meet compliance standards, and implementing access controls to protect sensitive information. Moreover, regularly updating your records and conducting periodic reviews will help maintain accuracy in your AML documentation.

Creating a secure archive of your AML compliance documents

Data security remains a critical concern for organizations managing AML documentation. Consider utilizing secure cloud solutions like pdfFiller for archiving compliance documents. By ensuring documents are encrypted and backed up, businesses can protect sensitive information from unauthorized access and potential data breaches.

FAQs on AML information collection forms

What should do if make a mistake in my submission?

If you discover a mistake after submitting your AML form, promptly contact the entity that received your submission. They will provide guidance on how to correct the error or if a new submission is necessary.

How long does it take for my submission to be processed?

Processing times can vary depending on the organization and the complexity of your submission. Generally, you can expect a response within a few business days, but it’s essential to confirm specific timelines directly with the receiving organization.

What happens if my business is flagged for potential money laundering?

If your business is flagged for potential money laundering, regulatory authorities may initiate an investigation. It's crucial to cooperate fully with any inquiries and provide requested documentation to demonstrate compliance and protect your business's interests.

Additional support and resources

Accessing further information on AML regulations is crucial for businesses striving for compliance. Many regulatory bodies, such as the Financial Crimes Enforcement Network (FinCEN) or local equivalents in your region, offer resources and guidance on AML practices.

Connecting with AML experts and consultants can also provide invaluable insights into best practices and compliance strategies tailored to your business's specific needs. Reputable consultants bring expertise and resources to help navigate the complexities of AML regulations, enhancing your compliance efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get anti-money laundering information collection?

How do I edit anti-money laundering information collection in Chrome?

How do I fill out the anti-money laundering information collection form on my smartphone?

What is anti-money laundering information collection?

Who is required to file anti-money laundering information collection?

How to fill out anti-money laundering information collection?

What is the purpose of anti-money laundering information collection?

What information must be reported on anti-money laundering information collection?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.