Get the free Mn Statute 270c.72 Tax Identification Form

Get, Create, Make and Sign mn statute 270c72 tax

How to edit mn statute 270c72 tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mn statute 270c72 tax

How to fill out mn statute 270c72 tax

Who needs mn statute 270c72 tax?

A comprehensive guide to the MN statute 270C72 tax form

Understanding MN statute 270C72: A comprehensive overview

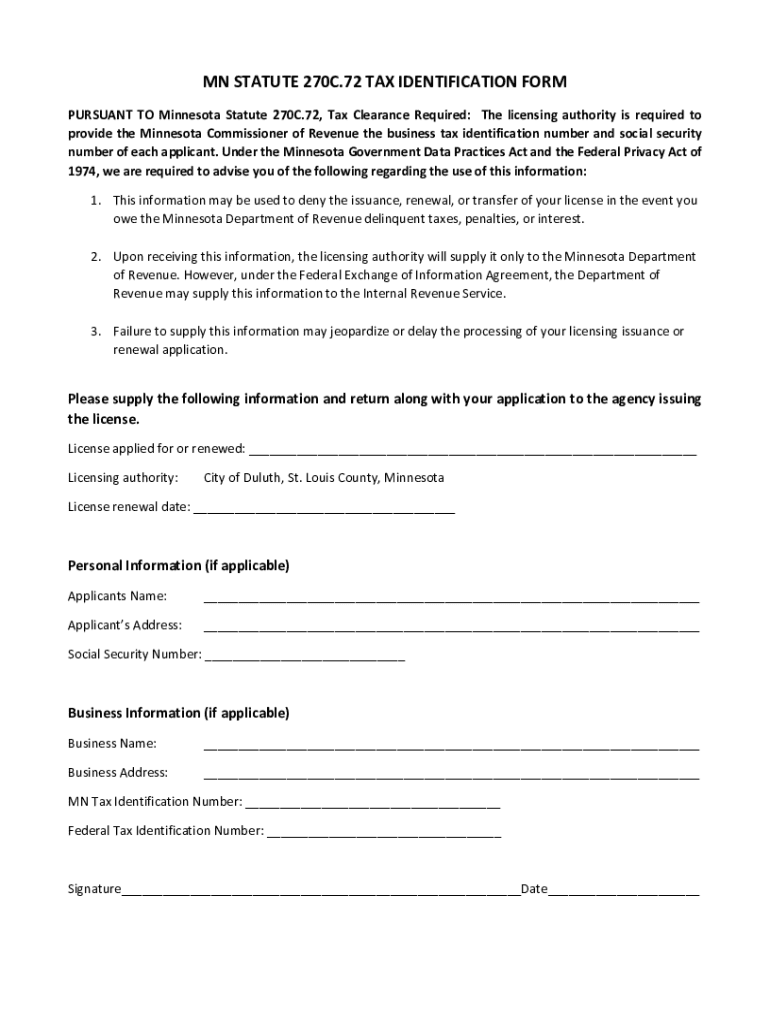

MN Statute 270C72 pertains to the Minnesota tax system, primarily addressing issues related to tax forms and submissions for individual taxpayers. This statute delineates the framework for the Department of Revenue regarding how taxes are reported and ensures compliance with Minnesota's tax laws. Taxpayers must adhere to this statute to avoid discrepancies in their tax submissions and to ensure that they meet their legal obligations.

The implications of MN Statute 270C72 are significant for Minnesota residents. It informs taxpayers about their rights, responsibilities, and the procedures required for accurate tax filing. Understanding this statute not only aids in accurate reporting but also empowers taxpayers by giving them insights into how their tax burdens are calculated, helping them to make informed decisions regarding deductions and credits.

Key features of the MN statute 270C72 tax form

The MN statute 270C72 tax form includes critical elements pertinent to tax reporting. At its core, this form is structured to capture essential taxpayer information, income details, applicable deductions, and credits. Detailed sections are integrated to facilitate clear and straightforward reporting for taxpayers adhering to Minnesota tax laws.

Key sections of the tax form include things like personal identification, a summary of income sources (employment, investments), and itemized deductions. Each section adheres to transparency requirements set forth in the statute, and taxpayers must also prepare supporting documents such as W-2 forms, 1099s, and others to ensure their submissions are complete and in compliance with Minnesota’s tax regulations.

Step-by-step guide to accessing the MN statute 270C72 tax form

Accessing the MN statute 270C72 tax form can be done easily online. The Minnesota Department of Revenue’s website is the primary repository for tax documents and information. Taxpayers can navigate through their official website by selecting relevant sections pertaining to individual taxes and searching for the 270C72 form.

Once on the tax forms page, locating the specific tax form can be expedited by filtering for year-specific documents. After finding the MN statute 270C72 tax form, users can easily download and print it to begin their filing process.

Instructions for filling out the MN statute 270C72 tax form

Filling out the MN statute 270C72 tax form requires careful attention to detail. The foremost section captures personal information, which should be filled in clearly to avoid any possible discrepancies later. Following this, taxpayers are required to provide detailed income information from all relevant sources, such as wages or dividends.

The deductions and credits section is equally critical, as it determines potential tax savings. Not all deductions are straightforward, so taxpayers must ensure they understand which deductions apply in their circumstances. Examples may include student loan interest or mortgage interest deductions. A thorough review of each section is necessary to avoid common errors, such as misreporting income amounts or forgetting to provide all required documents.

Editing and customizing your MN statute 270C72 tax form with pdfFiller

pdfFiller simplifies the process of editing the MN statute 270C72 tax form. Users can access robust editing tools that allow for the addition of text, images, and annotations directly onto the PDF form. This is particularly beneficial for those who need to make adjustments or provide additional context to their tax data.

In addition to editing, pdfFiller enables users to rearrange pages according to their needs, making it an ideal choice for users who may need to compile multiple forms or documents. Once customized, users can save their forms for future use, ensuring a streamlined experience in subsequent tax years.

eSigning and collaborating on your MN statute 270C72 tax form

With pdfFiller, the eSigning process for the MN statute 270C72 tax form is seamless. Users can easily add their eSignatures to the document, ensuring compliance with electronic filing requirements. This offers a streamlined process since taxpayers can provide their signatures from anywhere without needing to print, sign, and scan a physical document.

Additionally, pdfFiller allows users to share the completed form for collaboration, which is particularly beneficial for teams or couples filing jointly. By inviting collaborators, users can ensure that all necessary information is accurate and complete before submission. Best practices include providing clear instructions and tracking changes to avoid confusion.

Filing your MN statute 270C72 tax form

Taxpayers in Minnesota have different filing options available for submitting their MN statute 270C72 tax form. The two primary options are online filing and mail-in filing. Online filing is increasingly preferred for its convenience, allowing for instant submissions and automatic acknowledgment from the Department of Revenue.

For those opting for mail-in filing, it's crucial to pay attention to key deadlines. The filing cut-off generally aligns with the federal tax deadlines. Filing late can result in penalties, so it’s advisable to mark these key dates on your calendar in advance to ensure timely submission.

Frequently asked questions about the MN statute 270C72 tax form

Taxpayers often have a variety of questions concerning the MN statute 270C72 tax form. Common inquiries relate to specific deductions, eligibility requirements, and potential discrepancies in submitted information that may arise during processing. Many taxpayers are concerned about how to amend their tax forms and what steps to take if an issue is identified post-submission.

For any specific queries or clarifications on tax regulations related to MN Statute 270C72, the Minnesota Department of Revenue provides comprehensive resources. Additionally, taxpayers can reach out to their offices directly, as support staff are usually equipped to answer intricate questions.

Keeping track of your MN statute 270C72 tax form submission

After submitting the MN statute 270C72 tax form, it's essential for taxpayers to keep track of their submissions. Confirming the status of your submission can usually be done via the Minnesota Department of Revenue website, where there are services available to verify whether your form has been processed and if any further actions are required.

Document management is also crucial for tax records, as maintaining copies of past submissions and supporting documents can aid in resolving future disputes or discrepancies. Opting for digital storage solutions further ensures accessibility and security for your tax records.

Tips for maximizing your experience with pdfFiller

To fully leverage pdfFiller’s capabilities, users can create templates for future tax years based on their MN statute 270C72 tax form submissions. This preemptive step can save time during the next tax cycle, allowing for rapid filling and personalization without starting from scratch.

Furthermore, pdfFiller offers a mobile app allowing users to manage their tax documents on-the-go. This ensures that whether you’re at home or away, you can always make necessary edits and access crucial files. Should questions or issues arise, pdfFiller also provides robust customer support options.

Additional resources for Minnesota taxpayers

For Minnesota taxpayers seeking further assistance, the Minnesota Department of Revenue serves as the main resource hub, offering valuable insights through their website. They provide clear guidelines on tax regulations, local tax forms, and deadlines, making it easier for taxpayers to navigate their obligations.

In addition, there are local tax assistance services available to help taxpayers with complex issues. Connecting with these services can ensure that you receive tailored support that is crucial in understanding the nuances of Minnesota tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mn statute 270c72 tax?

How do I make edits in mn statute 270c72 tax without leaving Chrome?

How do I edit mn statute 270c72 tax straight from my smartphone?

What is mn statute 270c72 tax?

Who is required to file mn statute 270c72 tax?

How to fill out mn statute 270c72 tax?

What is the purpose of mn statute 270c72 tax?

What information must be reported on mn statute 270c72 tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.