Get the free tin application form for new member

Get, Create, Make and Sign tin application form for

How to edit tin application form for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tin application form for

How to fill out tin number registration form

Who needs tin number registration form?

Comprehensive Guide to Completing Your Tin Number Registration Form

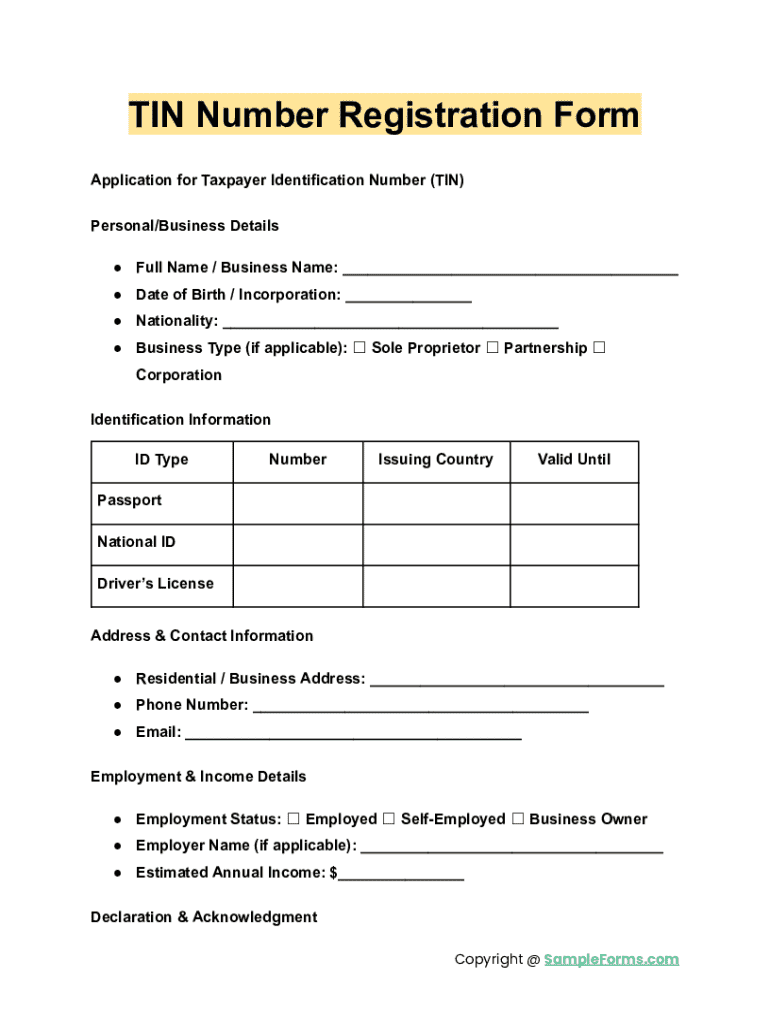

Understanding the tin number registration form

A Tax Identification Number (TIN) is an essential identifier for taxpayers within the United States, used across various tax systems to improve the efficiency of tax collection. Obtaining a TIN is crucial for both individuals and businesses, as it impacts tax obligations and eligibility for regulatory benefits. Without a TIN, filing taxes becomes almost impossible, leading to potential penalties or complications.

Different types of TINs serve varied purposes. For instance, the Individual Taxpayer Identification Number (ITIN) is designated for individuals who need a TIN but are not eligible for a Social Security Number (SSN). The Employer Identification Number (EIN) serves businesses and organizations, acting as their unique identifier in tax matters. Understanding which TIN applies to you or your organization is critical for effective compliance.

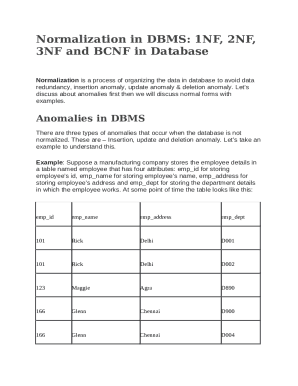

Who needs to complete the tin number registration form?

Identification of who requires a TIN is the first step toward proper registration. Individuals, freelancers, and independent contractors require a TIN for tax reporting purposes, while small business owners need one to file taxes and manage payroll. Non-profit organizations must also secure a TIN to apply for tax-exempt status and comply with tax laws.

Moreover, foreign nationals operating in the U.S. are required to obtain a TIN to meet tax obligations. Each of these groups must understand the necessity of the tin number registration form to prevent legal complications, ensuring their compliance with local and federal tax requirements.

Preparing to fill out the tin number registration form

Preparation is key before filling out the tin number registration form. Gather all necessary documentation to ensure a smooth registration process. Common requirements include proof of identity, such as a passport or driver's license, along with any business documentation if you’re registering for an EIN.

Avoid common mistakes such as incomplete forms or using outdated versions. Verify that your information is current and accurately reflects your identity or business profile before submission.

Step-by-step guide to completing the tin number registration form

Accessing the tin number registration form can be done easily through the pdfFiller website, available in an editable PDF format. This platform provides a user-friendly interface for filling out the form, allowing you to complete it at your convenience.

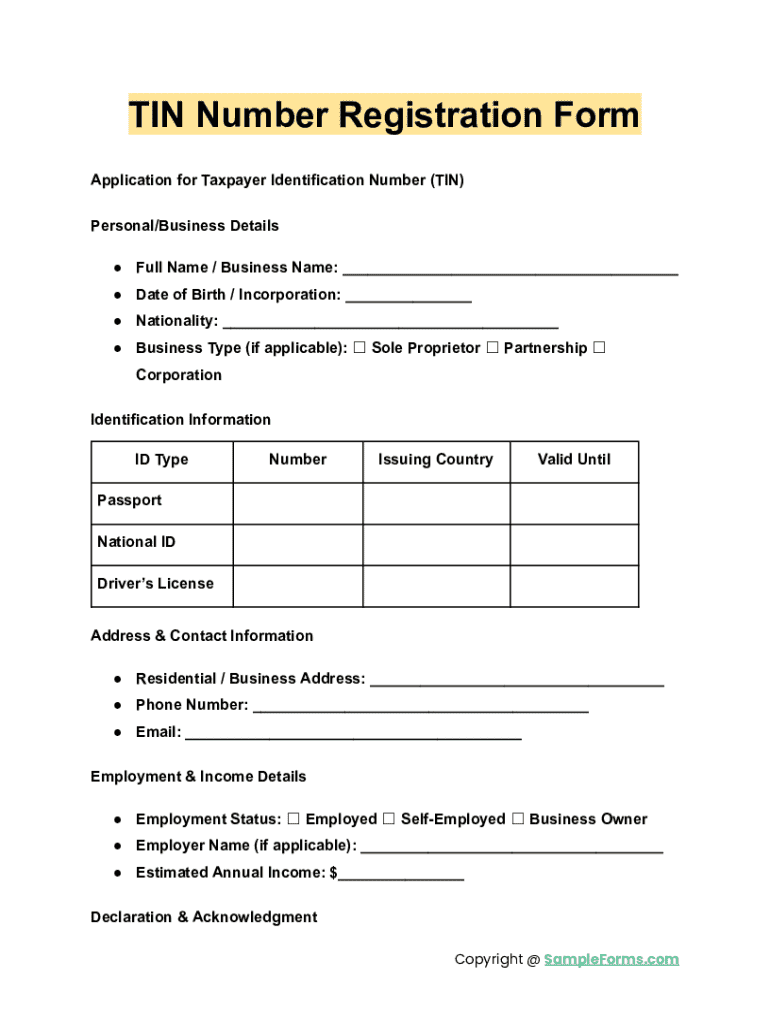

Each section of the form is crucial. Begin with your personal information fields, which require your full name, address, and date of birth. For businesses, the business information fields need details such as the legal name and business structure—Sole Proprietor, Corporation, LLC, etc.

Another essential aspect is the supporting documentation upload, where you must attach any necessary files such as proof of business registration. Tips for accurately completing each section include double-checking your personal data for typos and ensuring you select the correct business type, as this can impact tax filings significantly.

Editing and customizing your tin number registration form

Thanks to pdfFiller's robust editing tools, making adjustments to your tin number registration form has never been easier. Users can add or remove information with just a click, allowing for a streamlined experience as they prepare the necessary documents.

Furthermore, pdfFiller offers various templates tailored to specific needs, saving time for those who may need to use the same or similar forms repeatedly. Utilizing these templates can enhance efficiency and ensure you don't overlook important details when completing the form.

Signing the tin number registration form

Once you’ve filled out the tin number registration form, the next step is to sign it. pdfFiller simplifies this process with integrated electronic signature options. You can sign electronically, ensuring that your signature is legally binding and compliant with applicable laws.

Understanding the legalities surrounding e-signatures is important for compliance. In most situations, electronic signatures are accepted just as traditional signatures, providing a fast and efficient method to finalize your document.

Submitting your tin number registration form

After completing and signing your form, it's time to submit it. Common submission methods include online submissions through the IRS website, mailing a physical copy, or delivering it in person at an IRS office. Each method has its benefits, but online filing often leads to quicker processing times.

Once submitted, you can expect a confirmation of receipt from the IRS, typically within a few weeks. Understanding processing times for TIN applications can reduce anxiety, as users can plan accordingly for when they can expect their TIN.

Tracking and managing your application

Monitoring the status of your TIN application is crucial after submission. The IRS offers online tools to track your application, providing transparency and assurance throughout the waiting period. Staying informed will help you manage your compliance efficiently.

Moreover, pdfFiller boasts document management tools that make it simple to organize all your submissions. With features that enable users to track changes and maintain all versions of documents, it is easier to maintain compliance and oversight over all critical documents.

Common questions and troubleshooting tips

As you navigate the process of completing the tin number registration form, several questions are likely to arise. Frequent queries include issues with identification types accepted or the correct procedures to follow for different TIN applications. Addressing typical concerns helps clarify the process and encourage users.

Next steps after obtaining your TIN

After securing your TIN, it's important to understand how to utilize it effectively. Your TIN will be necessary for various tax filings, and keeping it confidential is crucial to prevent identity theft or fraud.

Moreover, businesses must ensure that they correctly report taxes and withholdings using their TIN to maintain compliance with federal and state tax regulations. Understanding the implications of your TIN within your overall financial management strategy is vital for sustained operations.

Interactive tools and additional features on pdfFiller

pdfFiller's platform excels in providing interactive tools that enhance user engagement and facilitate easier document management. Users can benefit from a range of features that allow for collaboration and editing of documents in real-time.

Setting up an account on pdfFiller gives users access to a suite of ongoing document management features. With tools that keep all TIN-related documents organized, there's no worry about losing important forms or sending an outdated document.

Why choose pdfFiller for your document needs

Selecting pdfFiller as your go-to solution for document management comes with numerous benefits. The platform empowers users not only to fill out the tin number registration form easily but also to edit PDFs, electronically sign documents, collaborate with team members, and securely store information—all in a single, cloud-based environment.

Customer testimonials emphasize pdfFiller's commitment to user satisfaction, showcasing successful outcomes and improved workflows. The flexibility to edit and manage documents from any device streamlines processes significantly, making it the preferred choice for individuals and organizations seeking effective solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tin application form for without leaving Google Drive?

How do I make changes in tin application form for?

How do I complete tin application form for on an Android device?

What is tin number registration form?

Who is required to file tin number registration form?

How to fill out tin number registration form?

What is the purpose of tin number registration form?

What information must be reported on tin number registration form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.