Get the free 990 ez form online

Get, Create, Make and Sign 990 ez online form

How to edit 990 ez form online online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990 ez form online

How to fill out 990-ez

Who needs 990-ez?

Understanding the 990-EZ Form: A Comprehensive Guide for Nonprofits

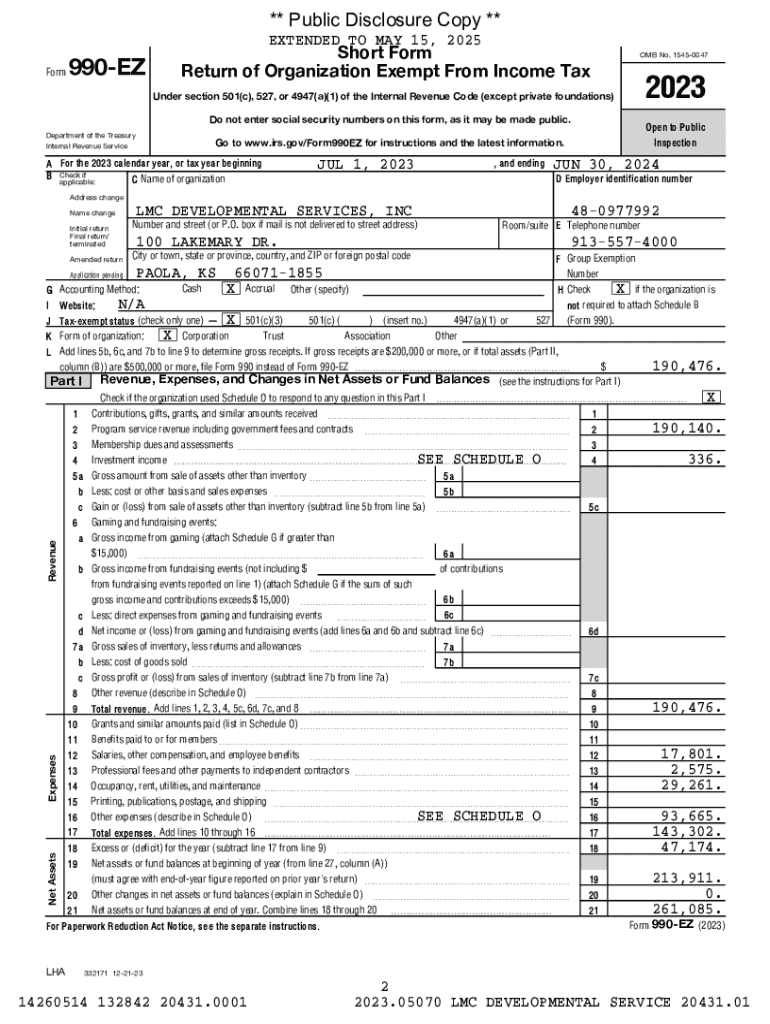

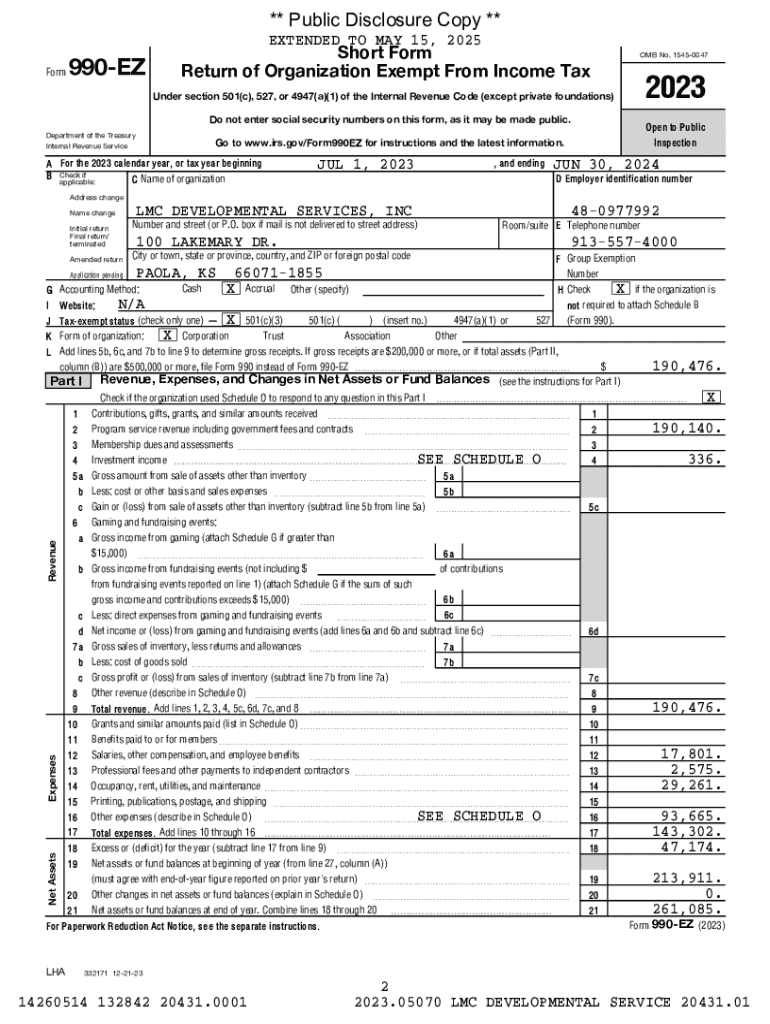

Overview of the 990-EZ Form

The IRS Form 990-EZ is a tax return designed specifically for small to mid-sized nonprofit organizations. This streamlined version of Form 990 enables eligible organizations to report their financial activities while providing necessary information to the IRS and the public. It includes revenue, expenses, assets, and functional expenses, reflecting crucial financial insights about the organization's operations.

Filing the 990-EZ is vital for nonprofits seeking tax-exempt status and maintaining that status. It showcases transparency in financial reporting, encouraging donor trust and compliance with federal regulations.

Understanding the structure of Form 990-EZ

Form 990-EZ consists of several sections that detail a nonprofit's financial activities. Each part plays a key role in illustrating the organization's activities and health.

Step-by-step instructions for completing Form 990-EZ

Filling out Form 990-EZ requires attention to detail and a clear understanding of your organization’s financial activities.

Part : Income and Contributions

This section requires organizations to report all types of revenue, including contributions and grants. To calculate total revenue, aggregate all income streams, ensuring accuracy to reflect the organization's financial status.

Part : Expenses

In this section, report functional expenses categorized into program services, management, and fundraising. Common expense types include salaries, rent, and utilities. Proper documentation is crucial for compliance and clarity.

To ensure your submission is free of errors, avoid vague categorizations and double-check all calculations.

Required attachments and schedules for Form 990-EZ

Depending on the nonprofit's activities, additional schedules may need to accompany the 990-EZ.

Ensure each schedule is completed correctly to avoid complications in the filing process.

Filing methods for Form 990-EZ

Organizations can submit Form 990-EZ through traditional paper filing or electronic filing, with each method having distinct advantages and processes.

Traditional paper filing

To file via paper, complete the form and mail it to the IRS address designated for your organization’s region. Ensure you account for postage and delays due to processing times.

Electronic filing via pdfFiller

Using pdfFiller for electronic filing can streamline the process significantly. Uploading documents, editing, signing online, and submitting directly through the platform enhances ease and reduces errors.

Don’t forget to mark your calendar with the filing deadline to ensure timely submission.

Managing your 990-EZ form post-filing

Tracking and maintaining copies of filed Form 990-EZ is essential for compliance and future reference.

Effective record-keeping practices and adhering to compliance requirements foster transparency and accountability.

Tips for nonprofits for a successful 990-EZ filing

Ensuring successful completion of Form 990-EZ involves several best practices tailored for nonprofits.

Applying these strategies not only simplifies the filing process but enhances overall organizational efficiency.

FAQs about IRS Form 990-EZ

Many nonprofits have questions regarding the nuances of Form 990-EZ, particularly about eligibility and reporting.

Understanding these common questions can provide clarity and assist in navigating the filing process with confidence.

Additional considerations and updates for the upcoming tax year

As the IRS adapts regulations annually, staying informed about changes to the 990-EZ form is essential for all nonprofits.

These actions not only ensure compliance but help in strategizing financial reporting effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute 990 ez form online online?

Can I create an electronic signature for the 990 ez form online in Chrome?

Can I create an electronic signature for signing my 990 ez form online in Gmail?

What is 990-ez?

Who is required to file 990-ez?

How to fill out 990-ez?

What is the purpose of 990-ez?

What information must be reported on 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.