Get the free money services businesses fingerprint filing requirements

Get, Create, Make and Sign money services businesses fingerprint

How to edit money services businesses fingerprint online

Uncompromising security for your PDF editing and eSignature needs

How to fill out money services businesses fingerprint

How to fill out money services businesses fingerprint

Who needs money services businesses fingerprint?

Money services businesses fingerprint form: A comprehensive guide

Understanding money services businesses (MSBs)

Money services businesses (MSBs) encompass a range of financial services aimed at consumer needs. Defined broadly, MSBs are non-bank entities that engage in activities like money transmission, currency exchange, and check cashing. These businesses cater to individuals and communities that might not have access to traditional banking services, making them pivotal to the financial ecosystem.

Moreover, compliance within the financial sector is critical. Given the potential for abuse in money transmission, laws have been instituted to monitor and regulate MSBs. Compliance not only prevents illicit activities but also enhances customer trust, ensuring that businesses operate transparently and securely.

The role of the fingerprint form in MSB compliance

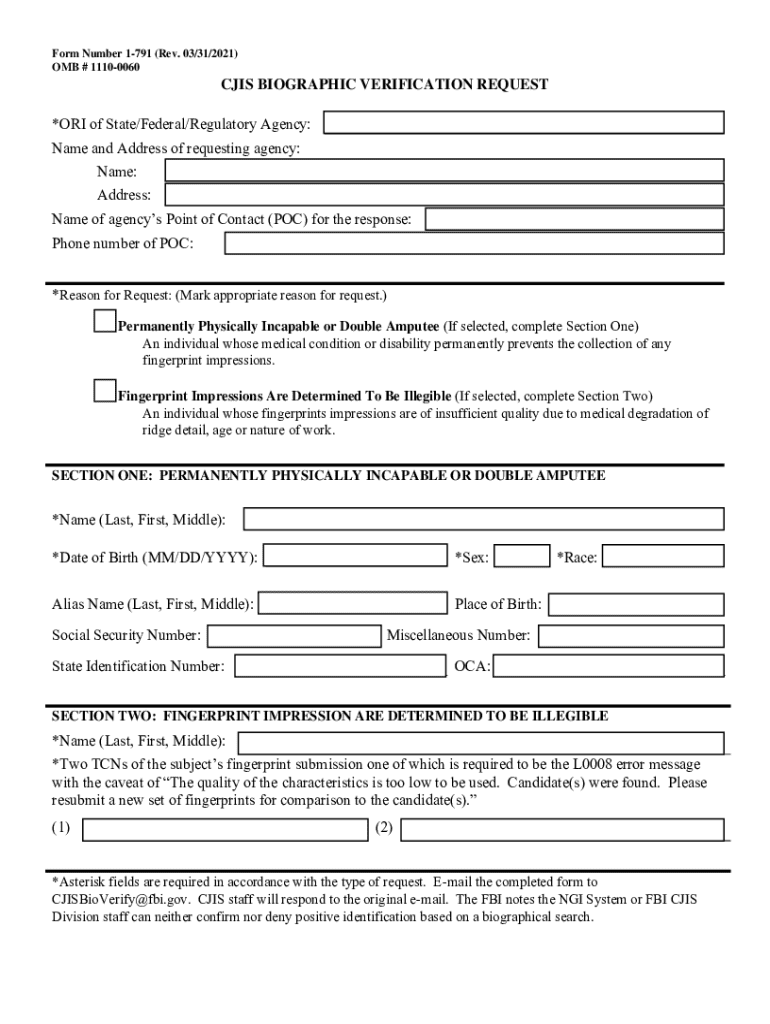

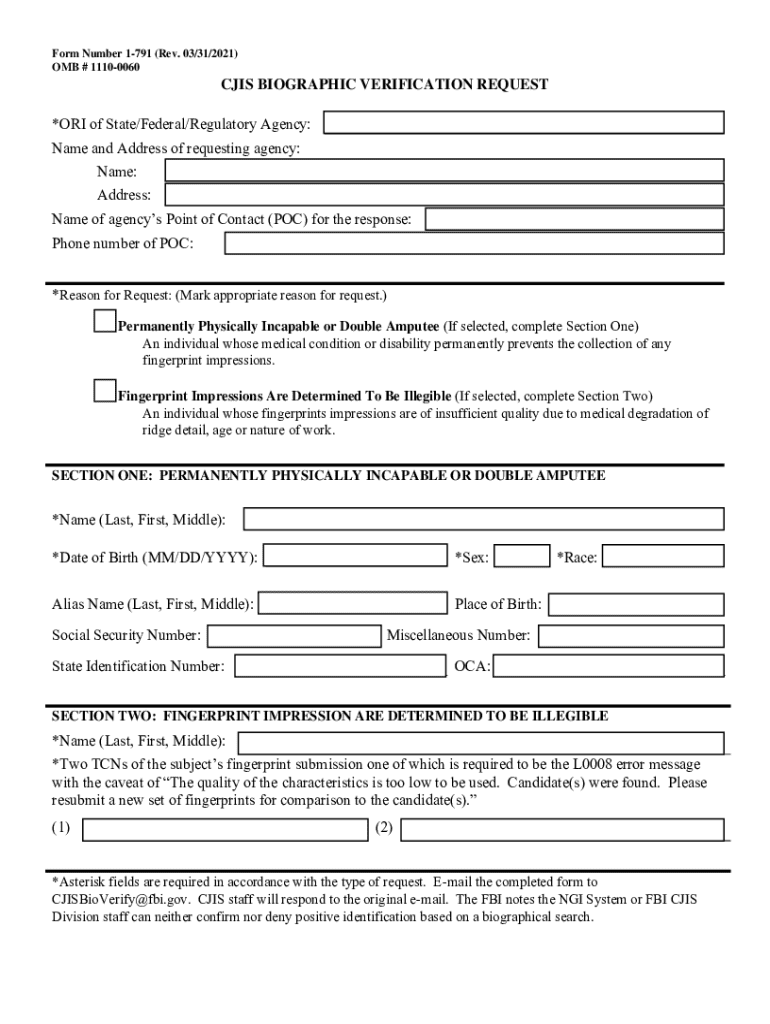

The fingerprint form is a critical component of compliance for MSBs. It serves to establish the identity of individuals associated with the business, particularly those in key positions or roles that involve oversight. Fingerprinting not only helps in verifying the backgrounds of applicants but also plays a significant role in identifying any potential risks involved.

This verification process directly affects licensing and operational capabilities. Regulatory bodies utilize fingerprint data to conduct background checks, ensuring that individuals involved with the MSB do not have a history of fraudulent activity or criminal behavior, thereby maintaining the integrity of the financial system.

Preparing to complete the money services businesses fingerprint form

Filling out the money services businesses fingerprint form requires careful preparation. Applicants should gather necessary personal information, such as full names, addresses, dates of birth, and social security numbers. Having this information ready contributes to a smoother submission and helps to avoid potential delays.

Background information is equally essential. This might include details about criminal history or previous employment that could affect eligibility. Understanding eligibility criteria beforehand helps ensure that all provisions are met and facilitates a successful fingerprinting process.

Step-by-step guide to filling out the fingerprint form

Completing the form requires precision and attention to detail. The personal information section typically asks for identifying information, while the employment history section requires a chronological list of employment relevant to the position you are applying for in the MSB.

Furthermore, the consent and disclosure obligations should be read thoroughly. It's crucial to understand what you are agreeing to, particularly regarding the investigation of personal backgrounds.

Common errors to avoid include typos in personal information and incomplete employment history. Ensuring clarity and legibility is imperative—messy handwriting can lead to misinterpretation of information, which might delay your application.

Submission process for the fingerprint form

Once the form is completed, submitting it is the next crucial step. The form generally needs to be sent to the state regulatory body overseeing MSBs. Understanding where to submit can vary by state, so be sure to consult local regulations for guidance.

Be aware of any associated fees, which can vary depending on the specific requirements of the regulatory body. Payment methods typically include bank transfers or credit card options, so choose the most convenient option.

Understanding the fingerprinting process

Fingerprinting can be conducted in various ways, the most prevalent being Live Scan and traditional ink fingerprinting. Live Scan uses electronic devices to capture fingerprints rapidly, while ink fingerprinting involves rolling fingers on an inked pad before transferring them to the fingerprint form.

When attending your fingerprinting session, ensure you arrive prepared. Bring along identification and any documents requested. Typically, fingerprinting sessions take only a few minutes, but understanding what happens during these appointments helps to ease any anxiety.

Fingerprinting for multiple states: Navigating challenges

Operating as an MSB in multiple states requires navigating a complex set of licensing regulations. Each state has its own fingerprinting requirements, which can complicate compliance for businesses that operate regionally or nationally.

State-specific fingerprint forms are often required. It's essential to acquaint yourself with these differing requirements to avoid lapses in compliance, which could result in fines or licensing issues.

Compliance and reporting obligations post-submission

After submitting your fingerprint form, the results are crucial for licensing applications. MSBs must ensure that the results reflect positively on personal and professional histories to secure licensing approvals.

Keeping fingerprint records updated is an ongoing responsibility. Changes in ownership or management roles may necessitate new fingerprint submissions to adhere to licensing regulations. MSBs need to monitor ongoing compliance and ensure that their operations remain within the bounds of state and federal regulations.

Exploring related topics in MSB licensing and compliance

Understanding MSB licensing doesn't end with fingerprint forms. There are broader regulatory requirements to consider, such as obtaining a money transmitter business license. MSBs are subject to both state and federal regulations safeguarding consumer interests and the integrity of the financial system.

When dealing with regulatory bodies, maintaining clear communication, submitting complete documentation, and being ready for inspections can all contribute to smoother operations and more successful licensing outcomes.

Interactive tools and resources

Utilizing tools from pdfFiller can greatly enhance the process of managing your money services businesses fingerprint form. One notable feature is their document editing capabilities, which allow users to fill out, sign, and collaborate on forms seamlessly.

Interactive checklists specifically designed for MSB compliance can ensure that all steps—including fingerprinting and documentation—are completed accurately and in a timely fashion. These resources help to track document submission effectively, providing a structured approach that MSBs can rely on.

FAQs on the money services businesses fingerprint form

As professionals enter the realm of money services businesses, they often have questions about the fingerprinting process. Common inquiries revolve around the steps involved, the importance of data privacy, and how results are handled. Understanding these facets is vital for those navigating compliance in this area.

Concerns regarding privacy and data security are legitimate. MSBs must ensure that fingerprint data is handled responsibly, complying with all relevant laws to protect both the business and its clients.

Success stories: How proper compliance benefits MSBs

Real-world examples illustrate how diligence in compliance, especially with fingerprinting requirements, has led to successful licensing outcomes for MSBs. These companies recognized the value of adhering to regulations and, as a result, have built reputations for transparency and reliability.

Testimonials from those who have managed fingerprinting and licensing processes effectively highlight the importance of staying informed, organized, and proactive. These stories not only inspire confidence but also demonstrate the tangible benefits of compliance, ranging from increased customer loyalty to smoother operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit money services businesses fingerprint online?

How do I fill out the money services businesses fingerprint form on my smartphone?

How do I complete money services businesses fingerprint on an Android device?

What is money services businesses fingerprint?

Who is required to file money services businesses fingerprint?

How to fill out money services businesses fingerprint?

What is the purpose of money services businesses fingerprint?

What information must be reported on money services businesses fingerprint?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.