Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out georgia transfer on death

Who needs georgia transfer on death?

A Comprehensive Guide to Georgia Transfer on Death Form

Understanding the Transfer on Death (TOD) deed in Georgia

A Transfer on Death (TOD) deed is a legal document that allows property owners in Georgia to designate a beneficiary who will automatically inherit real estate upon the owner's death. This innovative estate planning tool bypasses probate, streamlining the transfer process and providing a straightforward way to convey property rights after the grantor's passing.

The primary purpose of a TOD deed is to simplify the estate management process and ensure that properties are transferred directly to designated beneficiaries without court involvement. This is critical for individuals who wish to ensure their hard-earned assets transition smoothly to loved ones without unnecessary delays or costs.

In Georgia, the TOD deed operates under specific regulations laid out in state law, which governs the legitimacy and enforceability of the document. Understanding this legal framework is essential for homeowners looking to utilize a TOD deed effectively as part of their estate planning strategies.

Key features of the Georgia Transfer on Death form

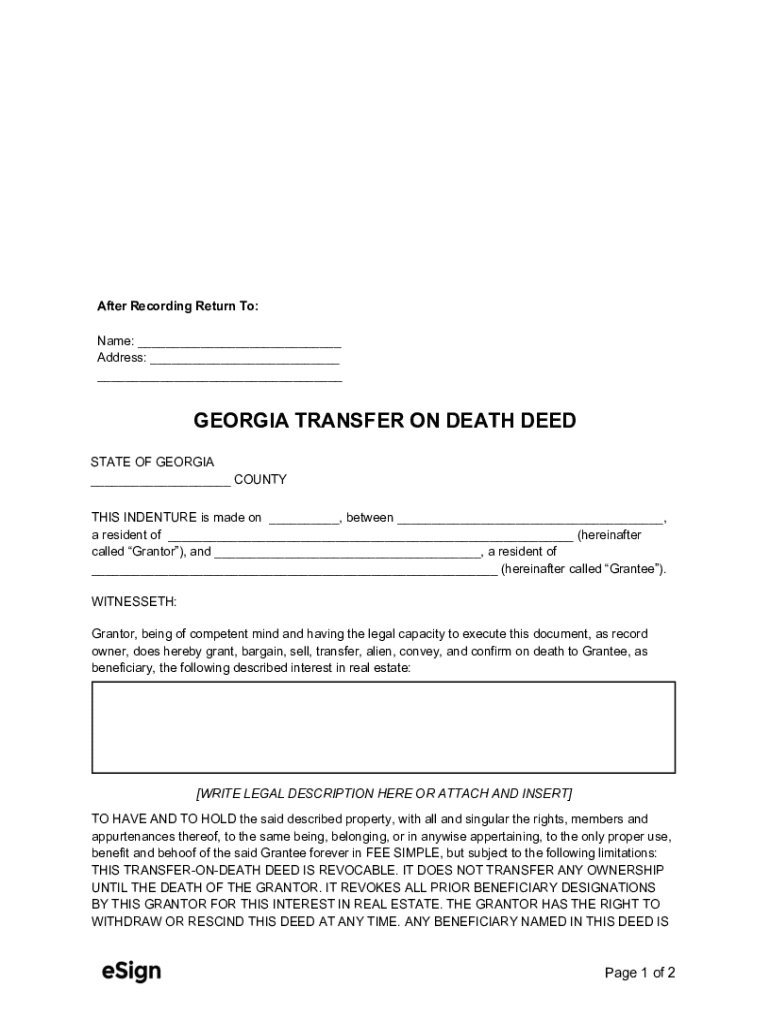

Completing the Georgia Transfer on Death form requires attention to detail and an understanding of the essential components needed for the deed to be valid. Components include grantor information, which identifies the current property owner, and the beneficiary designation, indicating who will inherit the property.

Further, the form requires a clear description of the property being transferred. This description ensures there are no ambiguities about what is being conveyed. The signing and notarization process is also a key feature, as it helps validate the document and ensures it complies with state legal requirements.

Benefits of using a transfer on death deed

One of the primary benefits of using a TOD deed is the ability to avoid probate. By transferring ownership upon death, the property bypasses the lengthy and often expensive probate process, allowing beneficiaries quicker access to their inheritance. This efficiency can be especially beneficial in maintaining family assets and reducing financial burdens.

Additionally, a TOD deed offers grantors flexibility by allowing them to retain full control of the property during their lifetime. They can sell, lease, or mortgage the property without interference from the designated beneficiaries. This ensures the grantor can adapt their estate planning as personal circumstances change over time.

Moreover, understanding the tax implications of a TOD deed is crucial. When property transfers occur through a TOD deed, generally no immediate gift taxes apply, and the property receives a step-up in basis for capital gains tax purposes, benefiting the beneficiaries.

Drawbacks and considerations when using TOD deeds

While there are significant advantages to using a TOD deed, several limitations warrant consideration. Certain property types, such as commercial or rental properties, may not always be best suited for a TOD structure. It’s essential to evaluate whether the property aligns with the grantor's overall estate planning goals.

Additionally, existing wills or trusts can conflict with a TOD deed. If a property is included in a will but also has a TOD deed, this could lead to disputes over the intended distribution of the property. Effective communication with potential beneficiaries about the presence of a TOD deed can help mitigate misunderstandings.

Finally, personal circumstances can change. It’s crucial to regularly review and update beneficiary designations, especially after significant life events such as marriage, divorce, or the birth of children. Failing to communicate these changes can lead to unintended heirs receiving property.

How to complete the Georgia Transfer on Death form

Completing the Georgia Transfer on Death form involves several straightforward steps. First, gather all necessary information, including grantor and beneficiary details and the full description of the property. This foundational step ensures accuracy and completeness on the form.

Next, fill in each section accurately with the information you have gathered. It's essential to be thorough; any mistakes made at this stage can lead to complications later. After filling in the information, take a moment to review the document for any errors or omissions.

Finally, ensure that the document is signed in the presence of a notary public, as notarization is a vital step in validating the TOD deed.

Filing and recording the TOD deed in Georgia

Once the Georgia Transfer on Death form has been completed and notarized, the next step is to file and record the deed with the appropriate county clerk’s office. This step is crucial because recording the deed provides public notice of the transfer and protects the rights of the beneficiaries.

Fees for recording may vary by county, so it's advisable to check with the local office beforehand. Additionally, payment methods may also differ, with some offices accepting checks, credit cards, or cash. Finally, keeping copies of the filed TOD deed for personal records is essential in case the original needs to be referenced in the future.

Common mistakes to avoid when using a TOD deed

Many individuals overlook critical elements when utilizing a TOD deed. A frequent mistake is failing to update beneficiary information—life changes can significantly impact who should inherit property. Always ensure that any changes in relationships are reflected in the TOD deed.

Another common misstep involves misunderstanding the legal language. It's vital to comprehend precisely what the terms of the deed entail and how they interact with other estate planning tools such as wills and trusts. Failure to grasp these concepts could lead to misinterpretations or legal challenges.

Lastly, neglecting the potential impact of changes in personal circumstances can be detrimental. For instance, if the grantor experiences a significant life event, such as divorce or remarriage, they should re-evaluate the TOD deed to ensure it aligns with their current wishes. It’s advisable to set reminders for regular reviews of estate planning documents.

Seeking professional guidance

Engaging with an estate planning attorney is highly recommended for individuals considering a TOD deed. Legal professionals offer invaluable insights regarding the implications of the TOD options available, ensuring that the document is compliant with state law and tailored to the grantor's needs.

Their expertise can guide clients through the complexities of document preparation, correcting any inconsistencies that could compromise the document's effectiveness. Moreover, understanding the broader estate planning services available in Georgia allows individuals to make informed choices about their entire estate strategy.

Frequently asked questions (FAQs) about Georgia TOD deeds

One of the most common questions regarding the Georgia TOD deed is what happens if the beneficiary predeceases the grantor. In such cases, the deed may specify alternate beneficiaries or, if none are designated, the property would generally revert to the grantor's estate.

Another frequent inquiry relates to revocation or modification of a TOD deed. Grantors have the right to revoke or modify the document at any point during their lifetime, provided that formal processes are followed, such as creating a new TOD deed or filing a revocation form with the county.

Lastly, individuals often want to know how TOD deeds affect existing mortgages and liens. Generally, the existing mortgage will remain attached to the property after the grantor’s death, and the beneficiary will need to assume responsibility for these obligations.

Accessing and utilizing the Georgia Transfer on Death form

The Georgia Transfer on Death form is readily available online for download. Websites like pdfFiller provide easy access to the form in a user-friendly format, allowing individuals to fill out, edit, and manage their documents efficiently from anywhere, at any time.

Using interactive tools offered on platforms like pdfFiller can enhance the document completion process. These tools allow users to customize the form, ensuring clarity and precision. eSigning options add an additional layer of convenience, enabling individuals to finalize official documents from the comfort of their home.

Related estate planning considerations

Incorporating a TOD deed into an estate plan often leads individuals to consider other essential estate planning documents. Wills, trusts, and powers of attorney are all critical components that should work in tandem with the TOD deed to ensure a comprehensive approach to estate management.

It’s important to integrate TOD deeds with other planning tools, as this ensures consistency in property management and succession wishes. A well-structured estate plan, encompassing various document types, safeguards your assets and provides clarity for your beneficiaries.

Establishing a holistic view of estate planning allows individuals to anticipate potential issues, streamline asset distribution, and provide peace of mind that their wishes will be respected and adhered to after their passing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my pdffiller form in Gmail?

How can I edit pdffiller form on a smartphone?

How do I edit pdffiller form on an iOS device?

What is georgia transfer on death?

Who is required to file georgia transfer on death?

How to fill out georgia transfer on death?

What is the purpose of georgia transfer on death?

What information must be reported on georgia transfer on death?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.