Get the free Monetary Transfer Form (mtf)

Get, Create, Make and Sign monetary transfer form mtf

How to edit monetary transfer form mtf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monetary transfer form mtf

How to fill out monetary transfer form mtf

Who needs monetary transfer form mtf?

Monetary Transfer Form (MTF) Form: A Comprehensive How-To Guide

Understanding the monetary transfer form (MTF)

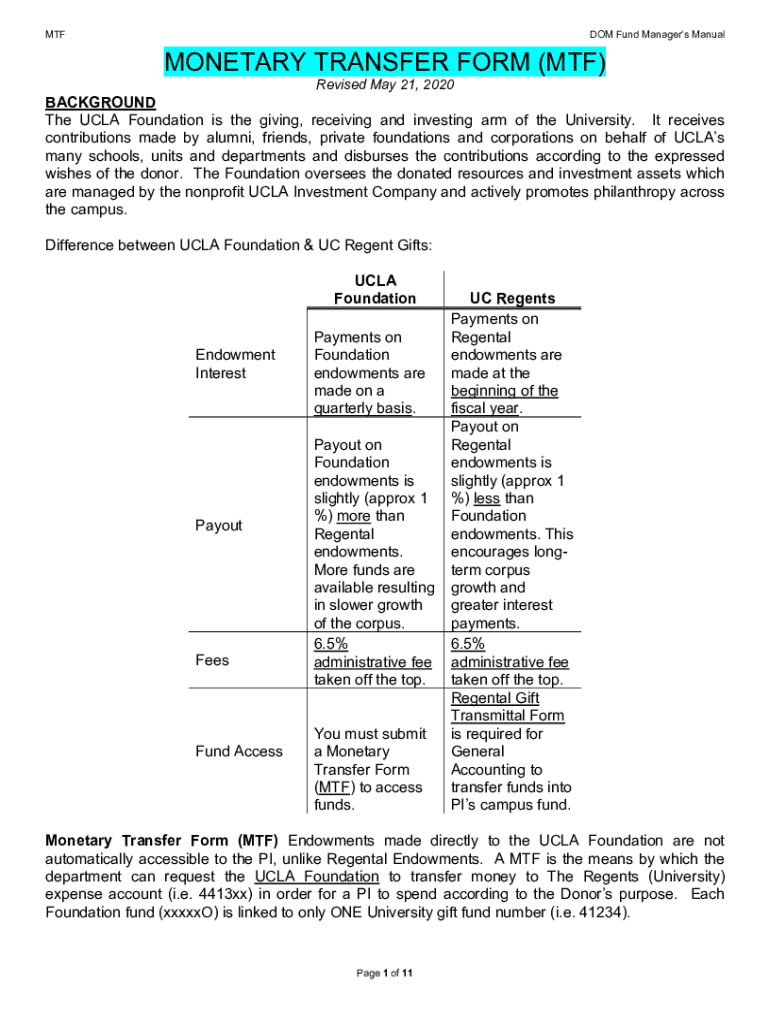

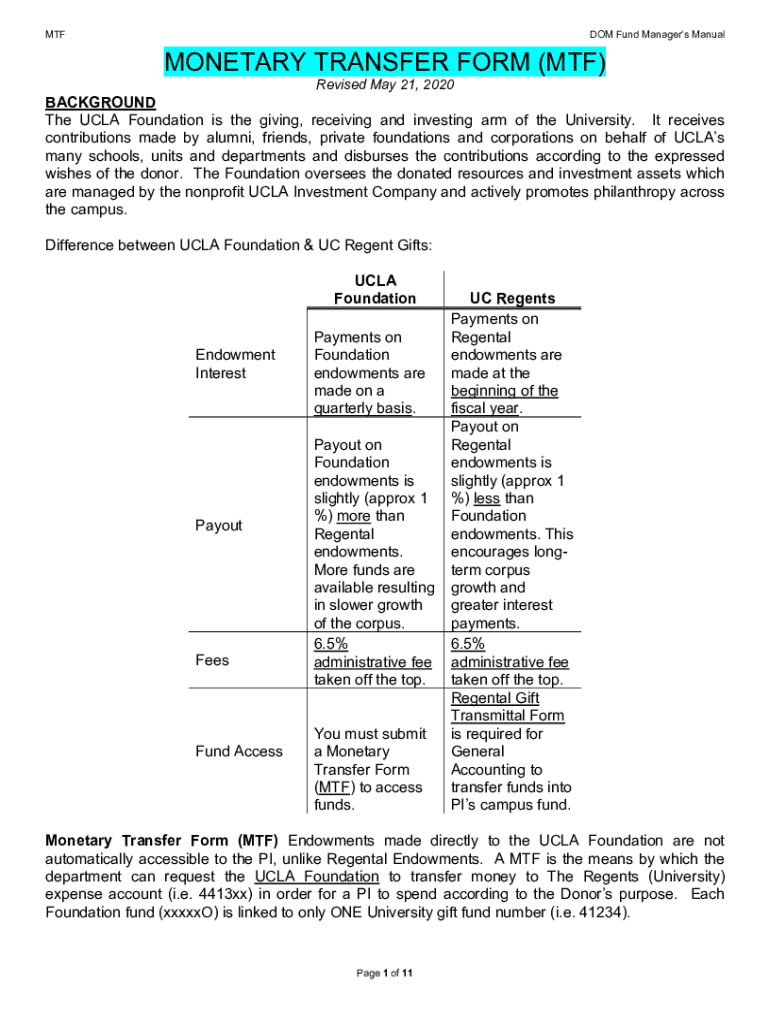

A Monetary Transfer Form (MTF) is a document used to facilitate the transfer of funds from one party to another, either domestically or internationally. This form is crucial in ensuring that financial transactions are documented, transparent, and compliant with various regulations. An MTF is commonly utilized in both personal and business contexts, enabling individuals to remit money to family overseas or businesses to settle invoices with suppliers across borders.

The importance of the MTF cannot be overstated. For individuals, it represents a reliable method for managing personal finances, especially in remittances where accuracy and proper documentation are paramount. For businesses, the MTF is vital for ensuring that payments are traceable and in line with contractual agreements. As such, a clear understanding of how to correctly complete and manage this form is crucial for anyone involved in monetary transactions.

Legal requirements and compliance

When using a monetary transfer form, it's essential to consider the legal regulations that govern financial transactions. Each country has its own set of laws and compliance requirements related to monetary transfers, often focusing on anti-money laundering (AML) and know-your-customer (KYC) regulations. This may require the sender to provide proof of identity and the source of funds to ensure compliance.

To successfully use an MTF, you will need certain information and documentation. This generally includes government-issued identification, such as a passport or driver's license, details about the sender and recipient, and the specific amount to be transferred. By ensuring you have all the necessary documentation in order, you can streamline the process and avoid potential legal issues down the line.

Preparing to use the monetary transfer form

Before completing the monetary transfer form, it's crucial to identify the purpose behind the transfer. Different scenarios require different considerations when filling out the MTF. For instance, personal remittances may involve smaller amounts and a direct relationship with the recipient, while business payments may require greater detail regarding the transaction, including invoices and descriptions of services rendered.

Gathering the required information is the next step to ensure a smooth transaction. This includes obtaining personal details for both the sender and the receiver. You should have full names, addresses, contact information, and any pertinent account specifics, especially if the transfer is going to a bank account. Furthermore, clarify the amount to be transferred and the currency type.

Steps to fill out the monetary transfer form

Accessing the Monetary Transfer Form is the first step in the transfer process. This can be done through various channels such as online banking platforms, financial institutions, or service providers that facilitate fund transfers. Many organizations, including pdfFiller, offer the MTF as a downloadable PDF, which simplifies the process of data entry and editing.

Once you have the form, filling it out accurately is key. Start with the personal information section, where you will input the sender’s details. Accuracy is vital here as any discrepancies may delay the transfer.

Next, move to the transfer details section, specifying the amount, currency type, and payment method. In the receiver information section, ensure you provide all essential details for the recipient’s identification and where the funds should reach. Finally, the declaration and signature section signifies your agreement to the terms and authenticity of the information provided, carrying legal significance.

Editing and customizing your MTF with pdfFiller

pdfFiller enables users to enhance their monetary transfer forms through interactive tools designed for document customization. These features include text editing, annotating, and various design options to fit your unique requirements. With pdfFiller, the MTF can be easily adapted to include essential additional information or notes related to the transaction.

One key feature is the ability to add an electronic signature to the MTF. This adds an extra layer of convenience, enabling users to sign from anywhere without needing to print or scan the document. Understanding the legal implications of eSignatures is essential, as they are widely accepted in many jurisdictions, provided the signing occurs under specific conditions consistent with legal standards.

Submitting your monetary transfer form

After filling out and editing the monetary transfer form, the next step is submission. Depending on the service you are using, pdfFiller allows you to submit the MTF online directly through its platform, ensuring a quick and efficient transfer process. Alternatively, some users may prefer traditional submission methods, such as mailing the form or delivering it in person to a financial institution.

Once your form has been submitted, understanding the tracking process is crucial. Many online services, including pdfFiller, offer confirmation processes, allowing you to verify that your transfer has been initiated and is in progress. It's important to keep track of the transfer timelines to ensure all parties are informed and prepared for the receipt of funds.

Managing and storing your MTF

Effective management and storage of your Monetary Transfer Form are crucial for future reference. pdfFiller provides robust document management solutions, allowing users to store their completed forms securely in the cloud. This means you can access your forms anytime and from any device, streamlining the process of managing multiple transactions, especially for businesses who regularly deal with monetary transfers.

For secure document management, it's advisable to follow best practices, such as using strong passwords, regularly updating security measures, and organizing files with clear naming conventions. Keeping your financial documents well-structured not only enhances efficiency but also helps in quick retrieval when needed, especially during audits or when addressing disputes.

Common issues and troubleshooting

Even with the best preparation, errors in completing the monetary transfer form can occur. Common mistakes include entering the wrong information, failing to sign the document, or missing section requirements. It's essential to double-check all entries before finalizing the MTF to mitigate these issues. If an error is found post submission, contact the service provider immediately to discuss available options for amending the information.

In instances where help is needed, reaching out to customer support is a prudent step. Most platforms offer a dedicated support team to assist users with any issues related to their monetary transfer form. Don't hesitate to utilize these resources; they can guide you through the process of correcting information or addressing misunderstandings about submission protocols.

Advanced features of pdfFiller for enhanced document experience

With pdfFiller, users can access advanced features that enhance team collaboration and document efficiency. For business users, sharing the MTF with team members for review can significantly streamline the approval process. Collaborative features allow multiple users to access a single document, providing feedback and ensuring that all required changes are made before final submission.

Additionally, pdfFiller offers insights and analytics services that help you track document usage and performance. These features are particularly beneficial for businesses needing to keep an eye on transaction volumes and patterns over time, facilitating smarter financial decisions and helping to identify areas for improvement.

FAQ about monetary transfers and the MTF

When navigating the details of monetary transfers, many users often have common questions. What happens if the wrong information is entered? How long does it take for a transfer to process? Understanding these concerns is crucial for ensuring a smooth experience. Frequently asked questions typically revolve around the completion of the MTF, regulations affecting transactions, and security measures in place to protect users.

While many misunderstandings exist, educating yourself on these subjects clarifies the process ahead. Engaging with customer support and reading service documentation on pdfFiller can provide insights into nuances and address common misconceptions effectively. This ensures you approach monetary transfers with confidence and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my monetary transfer form mtf in Gmail?

Where do I find monetary transfer form mtf?

How do I edit monetary transfer form mtf on an iOS device?

What is monetary transfer form mtf?

Who is required to file monetary transfer form mtf?

How to fill out monetary transfer form mtf?

What is the purpose of monetary transfer form mtf?

What information must be reported on monetary transfer form mtf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.