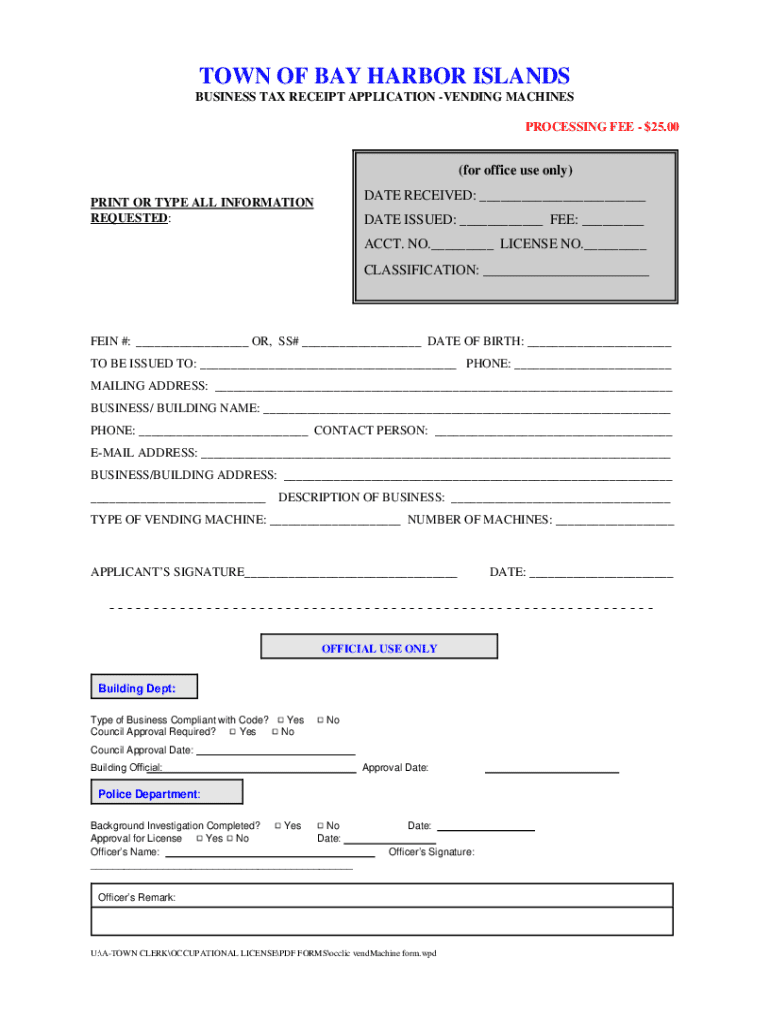

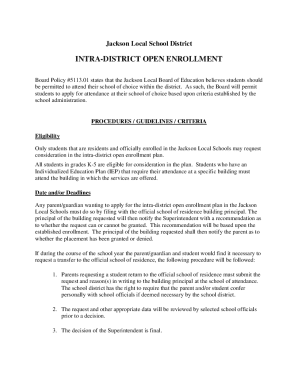

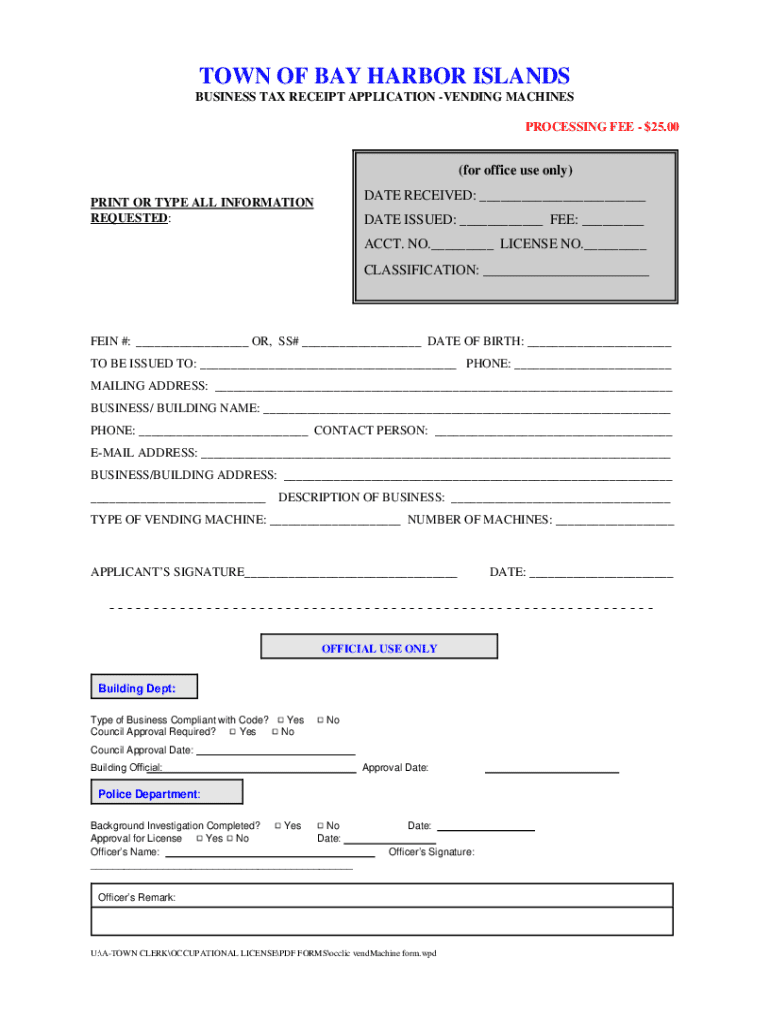

Get the free Business Tax Receipt Application - Vending Machines

Get, Create, Make and Sign business tax receipt application

How to edit business tax receipt application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax receipt application

How to fill out business tax receipt application

Who needs business tax receipt application?

Business Tax Receipt Application Form: A Comprehensive Guide

Understanding the business tax receipt application

A business tax receipt, often referred to as a business license or permit, is an essential document that allows businesses to operate legally within a specific jurisdiction. This receipt serves as evidence that a business has complied with local regulations, including tax obligations and zoning laws. Without it, businesses may face penalties such as fines or even closure.

The importance of obtaining a business tax receipt cannot be overstated. It not only legitimizes a business but also assures customers and clients that it adheres to local laws and regulations. For many businesses, having this receipt is crucial for building trust and establishing a solid reputation in the community.

Who needs a business tax receipt?

Typically, any business that engages in commercial activities within a city or county must apply for a business tax receipt. This includes sole proprietors, partnerships, corporations, and non-profit organizations. Local regulations may vary, so it's essential for business owners to verify their specific requirements based on their location.

Understanding the specific obligations tied to a business tax receipt is vital for compliance reasons, as various regions might impose additional requirements depending on the type of business and its operations.

Overview of the application process

The application process for a business tax receipt can be straightforward if approached methodically. Below is a step-by-step breakdown of this process, ensuring business owners are well-prepared.

Ultimately, understanding these steps can simplify the application journey and facilitate a smoother process.

Estimated processing times

Processing times for business tax receipt applications can vary considerably. Typically, applicants can expect processing periods ranging from two weeks to a few months. Factors influencing these timeframes include the volume of applications received by the local authority, completeness of submitted documents, and the specific regulations of the jurisdiction in question.

Preparing your application

Preparation is key when applying for a business tax receipt. Having the right documents on hand can significantly expedite the application process. Here’s a comprehensive list of documents usually required:

When filling out the application form, it is crucial to read instructions carefully. Each section of the form typically requires specific information ranging from business details to contact information and service descriptions. Missing or incorrect details can lead to delays or even denial of the application.

Common mistakes to avoid while filling out the form

Tools and resources from pdfFiller

pdfFiller offers a versatile suite of tools that streamline the application process for a business tax receipt. Their interactive form creation tools allow users to create and edit application forms with ease. Collaborative features enable team members to work together on completing forms, ensuring accuracy and efficiency.

Interactive form creation tools

Users can take advantage of pdfFiller’s capabilities to create or modify their business tax receipt application form. The intuitive interface allows users to input data seamlessly, making the form-filling exercise far less daunting.

eSigning options

Additionally, pdfFiller supports e-signatures, allowing firms to incorporate electronic signatures directly into their submitted applications. This feature not only streamlines the submission process but also ensures compliance with regulatory standards governing e-signatures.

Managing your documents securely

With pdfFiller, managing your documents securely is a top priority. The platform offers features that enable users to store and organize receipts and related documents in a secure cloud environment. This ensures that important business documents are easily accessible when needed.

Finalizing your submission

After preparing your business tax receipt application, it’s time to finalize your submission. Local jurisdictions generally provide multiple submission options, including online submissions, mailing details, or in-person application at designated offices. It’s crucial to check your local authority's guidelines to select the method that suits you best.

Submitting your application

Payment of any applicable fees is often required when submitting an application. Accepted payment methods may include credit cards, checks, or electronic payment platforms, depending on local regulations.

Once submitted, tracking the status of your application is important. If you do not receive confirmation within the estimated processing timeframe, reach out to local business tax offices for updates.

Navigating potential issues

Despite thorough preparation, issues may arise during the application process. If your application is denied, it’s important to understand common reasons for denial, which may include incomplete documents or non-compliance with local laws. Knowing these issues beforehand can help you avoid them.

In case of denial, business owners can often appeal the decision or reapply after addressing the outlined issues.

Reporting problems with your application

Should you encounter issues during the application process, local authorities typically have designated contacts you can reach for assistance. Make a note of the contact information for your local business tax office and have your application details handy for more productive interactions.

Frequently asked questions (FAQs)

Business tax receipt applications often prompt several common queries. Being informed can make the process less confusing.

Local variations in business tax receipt requirements

Business tax receipt requirements can vary widely from one locality to another. For instance, cities like Los Angeles may require more extensive documentation compared to smaller municipalities. Therefore, it’s essential for businesses to familiarize themselves with their local regulations.

Conclusion and additional contacts

In summary, obtaining a business tax receipt is pivotal for running a compliant, trusted business. While the application process may seem complicated at first, taking a structured approach using tools such as those offered by pdfFiller can streamline your experience. If you encounter challenges along the way, remember that support is available through local authorities and resources like pdfFiller.

Contact information for pdfFiller support

For further assistance in navigating the application process or utilizing form creation tools, reach out to pdfFiller support. They provide various communication channels to help you every step of the way.

Connecting with local authorities

Establishing connections with local business support units can also enhance your understanding of the requirements specific to your area. Engaging with these authorities can provide valuable guidance in the preparation of your business tax receipt application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business tax receipt application to be eSigned by others?

Can I create an electronic signature for the business tax receipt application in Chrome?

How do I complete business tax receipt application on an Android device?

What is business tax receipt application?

Who is required to file business tax receipt application?

How to fill out business tax receipt application?

What is the purpose of business tax receipt application?

What information must be reported on business tax receipt application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.