Get the free Personal Property Declaration

Get, Create, Make and Sign personal property declaration

How to edit personal property declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out personal property declaration

How to fill out personal property declaration

Who needs personal property declaration?

Personal Property Declaration Form - Your Ultimate How-to Guide

Understanding the personal property declaration form

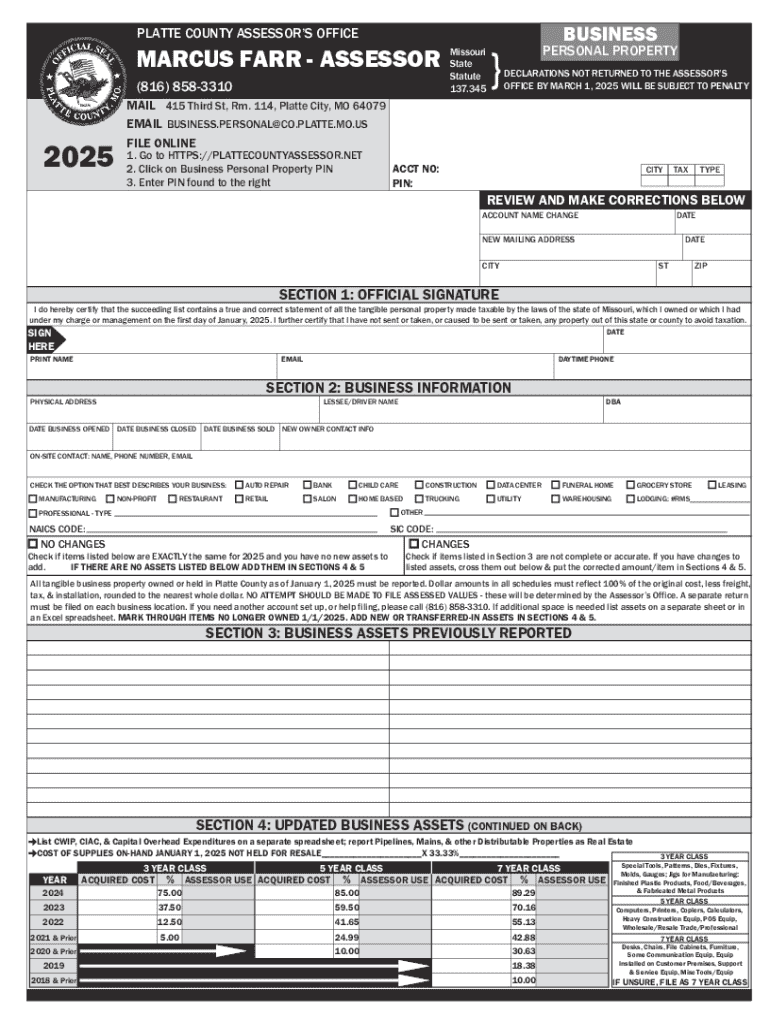

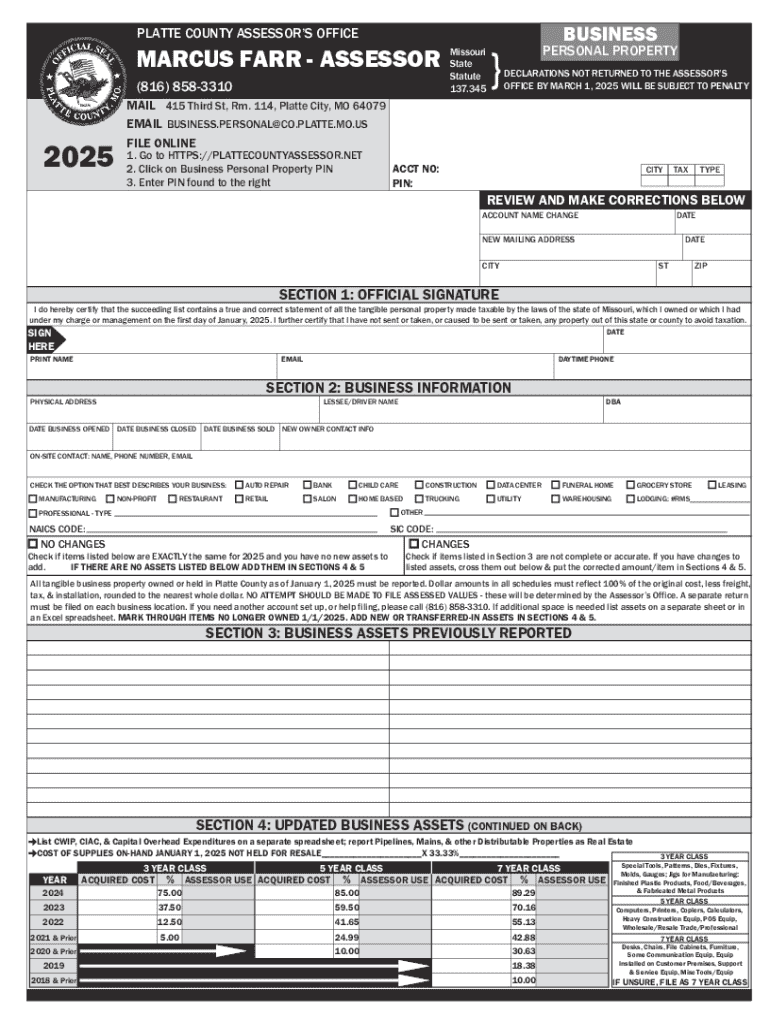

A personal property declaration form is a crucial document that property owners use to report their tangible personal property to the government for tax purposes. This form outlines the items owned by an individual or business, along with their estimated values, and serves the purpose of tax assessment and inventory management. Local governments often require this declaration annually to ensure accurate property assessments, which in turn helps in determining the tax obligations of taxpayers.

Filing this form is essential not only for compliance with state laws but also for maintaining transparency in property ownership. Failing to submit a personal property declaration can result in penalties and additional fees, making it imperative for property owners to understand its importance in taxation and legal ownership.

Preparing your personal property declaration

Before filling out the personal property declaration form, gather all necessary information. This includes purchase receipts, property titles, and any previous assessments. Compile a comprehensive list of all personal property you own, which may encompass items like furniture, equipment, vehicles, and inventory for businesses. Each entry should include precise details such as the property location, purchase date, and estimated market value.

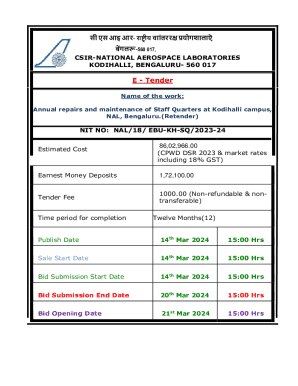

Timeliness is crucial when it comes to filing your declaration. Each state or locality has specific deadlines that must be adhered to, and missing these deadlines can lead to assessment penalties. Typically, the forms must be submitted annually by a designated date that's confirmed by local taxation offices, so it's advisable to stay updated on these timelines through local government resources.

Step-by-step instructions for filling out the form

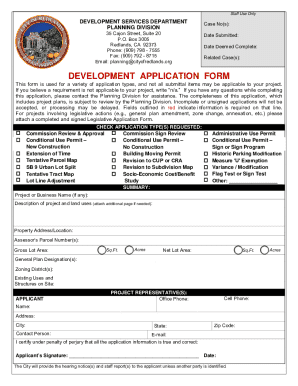

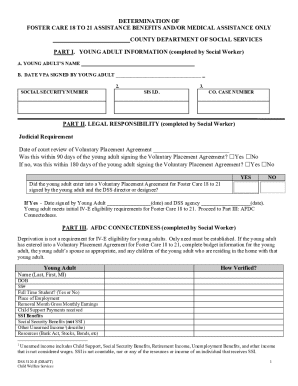

Navigating the personal property declaration form involves understanding its various sections. Typically, the first part requires your personal information, including name, address, and taxpayer identification number. Ensure the details are accurate, as any discrepancies can lead to complications later on.

Next, you must disclose the details of the properties you own. Include a comprehensive description for each item, outlining its condition, use, and place of storage. Proceed to the valuation section, where you report the estimated value of your personal property. It's wise to refer to reliable resources, like market analyses, to ensure your reported values are realistic.

Once you’ve filled in all sections, the declaration will require your signature or electronic signature to finalize it. Ensure you review all entered information thoroughly before submission.

Editing and customizing your form

After drafting your personal property declaration form, you may find areas that require changes or enhancements. Utilizing pdfFiller's editing tools allows you to adjust your form with ease. You can add new entries, remove outdated information, or correct any errors while keeping the document intact and compliant.

When it comes to attachments, ensure that any additional documents are properly formatted, and adhere to size limitations that your local tax office may impose. This could include supporting documents like invoices or proof of purchase, which can substantiate your claimed values.

Signing your declaration: The e-sign advantage

E-signatures have gained popularity due to their legal validity and enhanced convenience. Utilizing an e-signature feature in pdfFiller, you can sign your personal property declaration form securely and track signature requests seamlessly. This ensures a straightforward process for yourself and any parties involved, all while maintaining compliance with legal standards.

The e-signature process simplifies document management, allowing you to sign from your own device anytime, anywhere. Proper training on utilizing e-signature tools will expedite your workflow, helping prevent any potential delays in submissions.

Submitting your personal property declaration

Once you have completed your personal property declaration form, you will need to submit it according to your local regulations. Typically, there are two primary submission options: online and via physical mail. If you opt for electronic submission, pdfFiller streamlines the process by allowing you to send the completed form directly to your tax office. Just follow the electronic submission guidelines provided within the tool.

To confirm that your declaration has been successfully submitted, monitor your email for confirmation receipts or check your local tax office’s portal if available. If you encounter any issues, be proactive in reaching out to your local tax office for clarity.

Post-submission management

After your personal property declaration has been submitted, it's important to keep track of its status. Using pdfFiller's document management features, you can easily store and manage your filed documents. This allows you to have a central view of all submissions and corresponding records.

You might receive feedback from your tax office regarding your declaration. Be prepared to communicate effectively, whether it involves clarifying information or providing additional documents. Having a structured approach to these interactions will help you navigate any queries smoothly.

Ensuring compliance and staying informed

Taxes can be complex, and avoiding common pitfalls is crucial for property owners. Some frequent mistakes include underreporting property value, failing to attach necessary documents, and missing submission deadlines. To avoid these issues, be meticulous in your documentation and ensure all figures are accurate before filing.

Staying informed about changes in tax law and deadlines is equally important. You can set alerts for updates within your state or utilize pdfFiller’s tools to keep your document management current, ensuring you remain compliant with any new regulations.

Additional features of pdfFiller for document management

pdfFiller not only aids in creating and submitting personal property declarations but also enhances document management through collaborative features. Teams can share forms and set permissions to ensure that the right individuals have access to sensitive materials. This can streamline communication and expedite approvals and modifications as necessary.

Moreover, using templates for future declarations not only saves time but also ensures consistency in reporting. By saving commonly used phrases or formatting, you can create a straightforward process for future filings, allowing you to focus more on managing your properties rather than paperwork.

FAQs on the personal property declaration form

Many individuals have common questions regarding the personal property declaration form. Potential queries might include what items should be reported, how to estimate property value, or what to do if a mistake is discovered post-submission. Answering these questions can help demystify the declaration process and build confidence among taxpayers.

Additionally, insights from individuals who have successfully navigated the declaration process can provide valuable tips and tricks. For example, establishing a consistent routine for gathering property information and maintaining records can greatly ease the burden of annual filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute personal property declaration online?

Can I create an electronic signature for the personal property declaration in Chrome?

Can I edit personal property declaration on an iOS device?

What is personal property declaration?

Who is required to file personal property declaration?

How to fill out personal property declaration?

What is the purpose of personal property declaration?

What information must be reported on personal property declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.