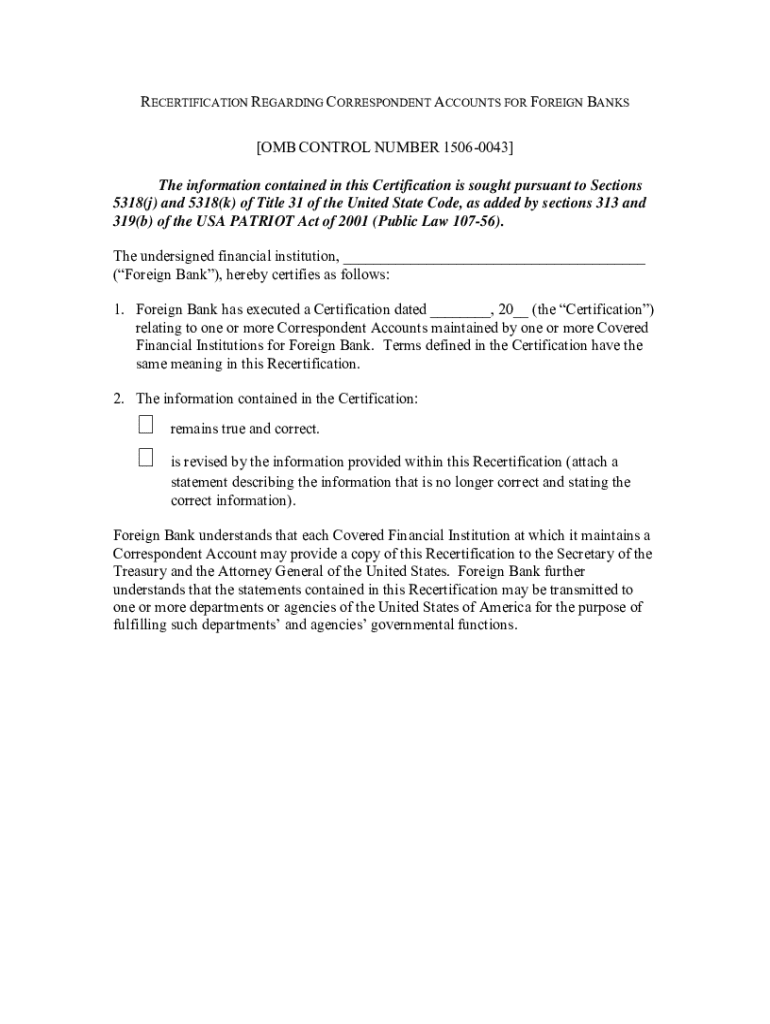

Get the free Recertification Regarding Correspondent Accounts for Foreign Banks

Get, Create, Make and Sign recertification regarding correspondent accounts

Editing recertification regarding correspondent accounts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out recertification regarding correspondent accounts

How to fill out recertification regarding correspondent accounts

Who needs recertification regarding correspondent accounts?

Recertification regarding correspondent accounts form: A comprehensive guide

Understanding recertification for correspondent accounts

Correspondent accounts serve as the backbone of international banking, allowing institutions to facilitate cross-border transactions for their clients. These accounts are established between financial institutions, enabling one bank to provide services on behalf of another. Given the significance of these relationships, maintaining compliance within correspondent accounts is paramount. Regulatory bodies require financial institutions to recertify their correspondent accounts periodically to ensure they adhere to the latest compliance guidelines and risk management protocols.

The primary purpose of recertification is twofold: first, to ensure that the information regarding the accounts remains accurate and up-to-date, and second, to mitigate risks associated with correspondent banking, including money laundering and terrorist financing. This proactive approach not only protects the institutions involved but also reinforces the integrity of the entire financial system.

Overview of the recertification process

Recertification for correspondent accounts is a systematic process that requires careful attention to detail. At the outset, institutions must conduct an initial assessment of their existing accounts. This step includes reviewing the current account information, transaction patterns, and the geographical areas served. Following this assessment, financial institutions need to gather all relevant documentation, including customer identification, regulatory filings, and transaction records.

The next phase involves a thorough verification process where the gathered information is cross-checked against internal records and regulatory benchmarks. Once this is completed, the institution submits the recertification form, ensuring all required fields are filled accurately. Typically, institutions should allow for several weeks to complete the entire recertification process, emphasizing the importance of adhering to designated deadlines to avoid compliance penalties.

Detailed guide to the correspondent accounts recertification form

The recertification form for correspondent accounts includes several critical components that must be meticulously filled out. Generally, the form is segmented into different sections, each seeking specific information. For instance, the first section requires the account holder's details, such as legal name, contact information, and business structure. Another section usually details the nature of the business conducted through the account, including transaction volumes and geographic focus.

Completing the recertification form can pose several challenges. Common pitfalls include misreporting account details, failing to provide sufficient documentation, or neglecting to update changes in business operations. To overcome these obstacles, financial institutions should establish a checklist of necessary documentation, ensuring everything is collated and double-checked before submission.

Best practices in filling out the recertification form

Gathering the necessary documentation is essential before attempting to complete the recertification form. Institutions should maintain a list of essential documents that typically include previous recertification forms, customer identification records, proof of ownership, and financial statements. Maintaining documentation integrity ensures that the recertification process is not delayed due to missing elements.

Moreover, accuracy in submitting information cannot be overstated. Financial institutions should cross-verify details with various internal records to ensure consistency and accuracy. Leveraging digital tools for document management can significantly streamline this process, reducing errors and enhancing efficiency. Utilizing templates, workflows, or collaborative tools can assist teams in managing complex data sets smoothly.

Post-submission steps & monitoring compliance

After submitting the recertification form, tracking its status is crucial. Institutions should implement a system for following up with regulatory bodies or departments responsible for processing submissions. Tools for managing and tracking submissions can significantly enhance transparency and accountability when dealing with compliance processes.

Maintain compliance moving forward by establishing best practices for ongoing monitoring of correspondent accounts. Regular audits, staff training, and staying updated on regulatory changes are indispensable in this ever-evolving field. Institutions should invest in continual education and resources that provide updates about changes in correspondent banking regulations to ensure they are always prepared for future recertification requirements.

Leveraging technology for a smooth recertification process

Technology plays a crucial role in simplifying the recertification process. Tools like pdfFiller streamline document management, offering features that allow users to fill, sign, and manage the recertification form with ease. The platform’s cloud-based nature means that users can access their documents from anywhere, which is essential for teams working in various geographical locations.

Additionally, interactive tools offered by pdfFiller enhance efficiency. Users can take advantage of editing and collaboration features that allow multiple team members to work on a document simultaneously. Real-time updates and notifications ensure that everyone involved is on the same page regarding the status of submissions, significantly improving the recertification workflow.

Conclusion and continuous learning

Ongoing education regarding regulatory changes is integral for financial institutions engaging in correspondent banking. Staying informed about changes in correspondent banking regulations ensures that institutions can effectively manage their compliance obligations and prepare accurately for recertification processes. Resources such as webinars, workshops, and industry publications can provide vital insights into evolving regulatory standards.

Encouraging users to share their experiences in the recertification process helps to build a community focused on knowledge sharing and support. As institutions navigate their compliance requirements, feedback opportunities also serve as a valuable tool for identifying areas of improvement within the recertification process, ultimately leading to enhanced operational effectiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my recertification regarding correspondent accounts directly from Gmail?

How can I edit recertification regarding correspondent accounts from Google Drive?

How do I fill out recertification regarding correspondent accounts on an Android device?

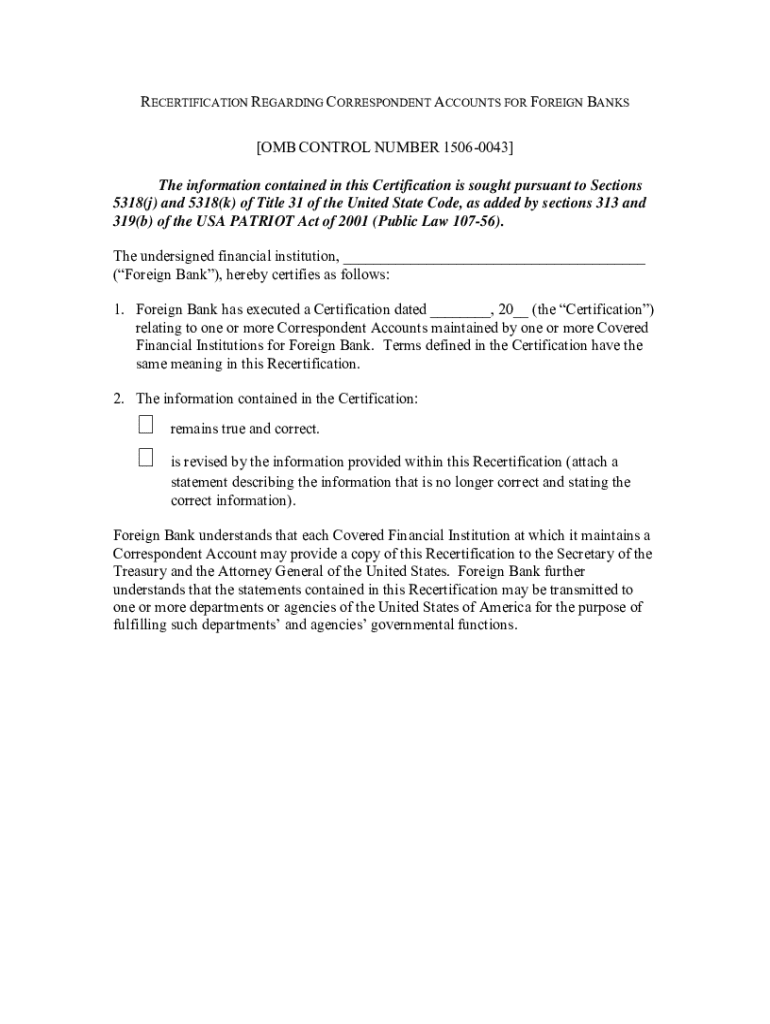

What is recertification regarding correspondent accounts?

Who is required to file recertification regarding correspondent accounts?

How to fill out recertification regarding correspondent accounts?

What is the purpose of recertification regarding correspondent accounts?

What information must be reported on recertification regarding correspondent accounts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.