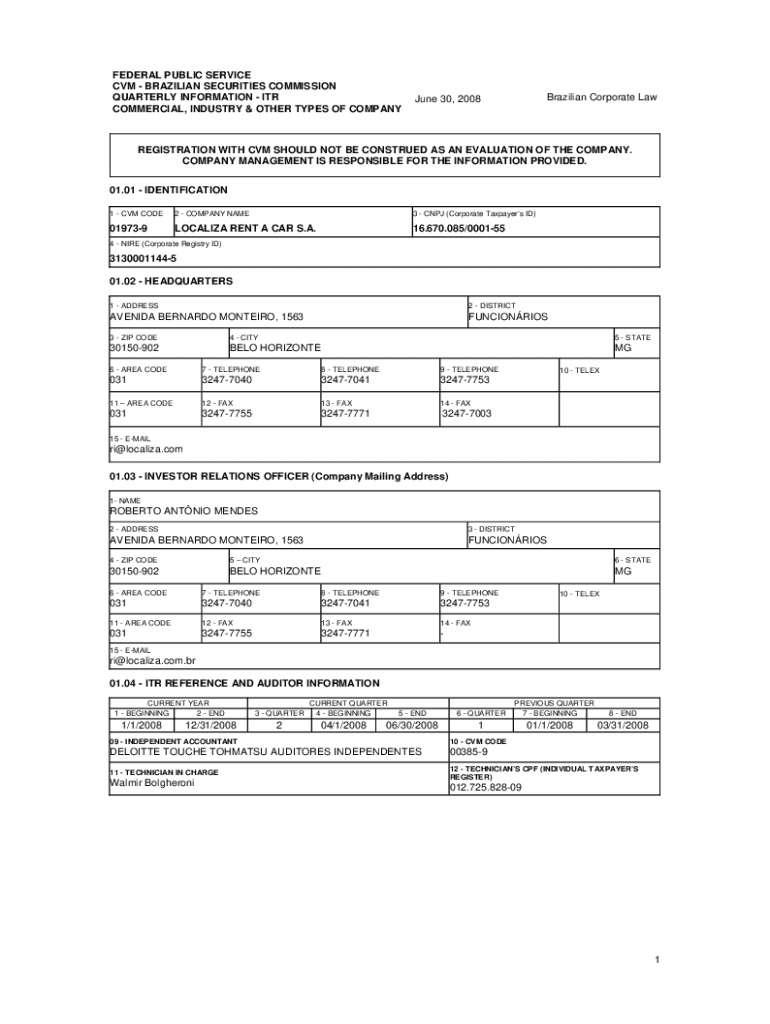

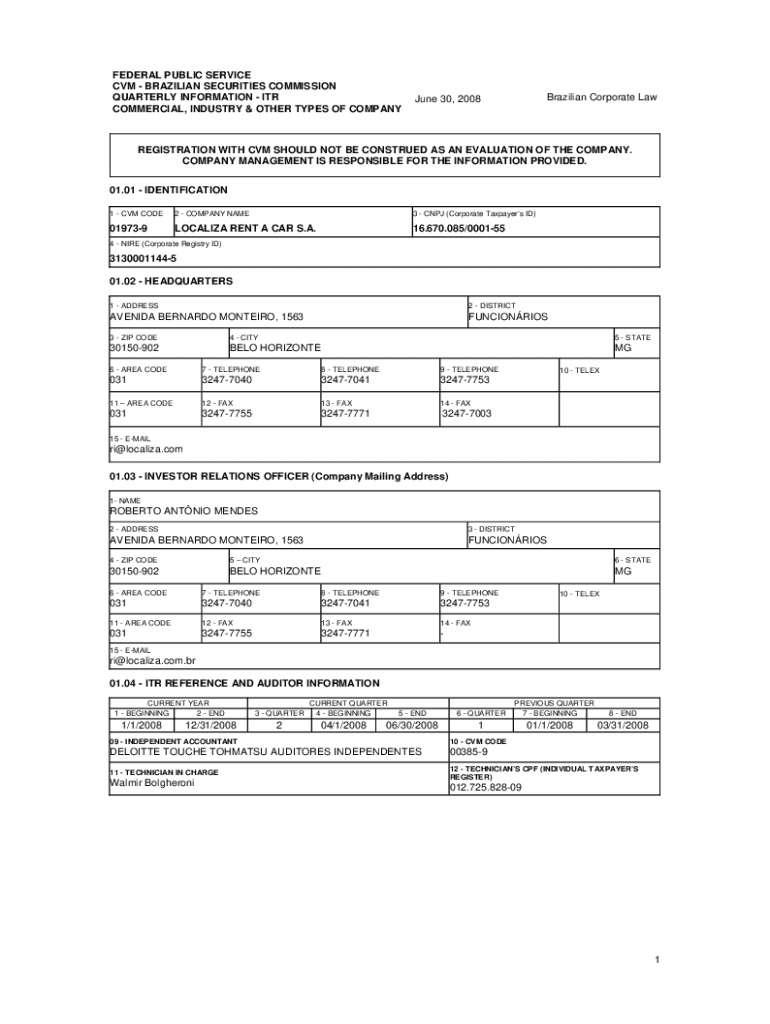

Get the free Quarterly Information - Itr

Get, Create, Make and Sign quarterly information - itr

How to edit quarterly information - itr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quarterly information - itr

How to fill out quarterly information - itr

Who needs quarterly information - itr?

Quarterly information - ITR form: Your Comprehensive Guide

Understanding the importance of quarterly information in ITR forms

An Income Tax Return (ITR) form is a document that taxpayers use to report their income, calculate tax liabilities, and claim refunds if applicable. The significance of quarterly information lies in its role in ensuring tax compliance, especially for individuals and businesses whose income fluctuates throughout the year. By reporting income and expenses quarterly, taxpayers can better manage their cash flow and avoid potential penalties for under-reporting their earnings.

Quarterly information provides insights into tax implications for various income types, including salary, business profits, and investment income. For instance, if you're self-employed, the quarterly filing can significantly help you track your estimated tax payments and ensure that you meet deadlines to avoid any interest and penalties.

Key components of the ITR form

Understanding the ITR form is crucial for accurate reporting. Essential sections typically found in an ITR form include:

Accuracy in each of these components is imperative. Errors can lead to disputes with tax authorities or missed opportunities for deductions.

Filling out ITR forms for quarterly reporting

Completing an ITR form for quarterly reporting involves several steps. Start by gathering necessary documents such as salary slips, bank statements, and proof of investments. It's important to have everything organized to ease the filling process.

You can choose to fill out the ITR form online or use a paper format. Many taxpayers prefer online tools, which offer user-friendly interfaces and often pre-fill some information based on previous submissions. Common mistakes to avoid include incorrect PAN entries, miscalculation of deductions, or failing to report all income sources, which could lead to complications.

Interactive tools for managing your ITR form

pdfFiller offers a suite of features designed to simplify your ITR filing process. With pdfFiller, you can edit PDFs seamlessly, ensuring that your ITR form accurately reflects your financial information.

Features such as eSigning allow you to quickly sign documents electronically, saving you time. To utilize pdfFiller for completing your ITR form, follow these steps:

Best practices for quarterly filing of ITR forms

Effective planning and record-keeping are essential for successful quarterly filing of ITR forms. To optimize this journey, consider organizing your financial documents for easy access. Create a filing system that categorizes documents by type, ensuring they are always within reach.

Additionally, set reminders for quarterly deadlines to avoid last-minute stress and potential penalties. When it comes to maximizing deductions, research available exemptions thoroughly. Utilize tools like pdfFiller to help manage this process more efficiently.

Collaborating with team members on ITR forms

If you're part of a team that files an ITR form, collaboration is key. pdfFiller allows you to share and collaborate on ITR forms seamlessly. You can manage multiple users and set permissions to ensure document security.

For successful collaboration, utilize version control and track changes made to the document. This allows all parties involved to stay updated on the latest alterations while contributing to a cleaner, more organized filing process.

Troubleshooting common issues with ITR forms

While filling out your ITR form, you may encounter common issues such as rejected submissions or missing information prompts. Frequently encountered problems include discrepancies in PAN, mismatches with reported income, and not adhering to prescribed formats.

Consider implementing solutions like double-checking all entries against your supporting documents. If issues persist, consulting with a tax professional for guidance is recommended to prevent errors that could lead to penalties.

Staying compliant: Key regulations and updates

Tax regulations are always evolving, and staying abreast of changes is imperative for ITR filing. Familiarize yourself with current tax laws affecting ITR submissions, including filing deadlines and changes in deduction limits.

Utilizing electronic filing has its benefits, such as faster processing times and reduced chances of errors. Ensure that you set aside regular time to read updates from reliable sources, keeping your knowledge current in this ever-changing landscape.

Case studies: Successful quarterly reporting using ITR forms

Examining successful case studies can provide valuable insights. For instance, a small business that employed quarterly reporting noted a significant reduction in year-end tax liabilities after shifting to proactive quarterly filings. By leveraging pdfFiller for document management, they were able to streamline the approval workflow and resolve discrepancies quickly.

The strategy included engaging a tax consultant who provided guidance on maximizing deductions and interest savings through consistent record-keeping and timely submissions.

Expanding your knowledge: Resources for ITR filing

Continuous learning is vital when it comes to tax practices. There are numerous online resources, courses, and forums dedicated to tax preparation that can help individuals and teams improve their knowledge. Knowledge-sharing platforms and tax consultants can offer invaluable advice tailored to your specific financial circumstances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get quarterly information - itr?

How do I complete quarterly information - itr online?

How do I make changes in quarterly information - itr?

What is quarterly information - itr?

Who is required to file quarterly information - itr?

How to fill out quarterly information - itr?

What is the purpose of quarterly information - itr?

What information must be reported on quarterly information - itr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.