Get the free Additional/one Time Pay Form – Faculty - hr fsu

Get, Create, Make and Sign additionalone time pay form

Editing additionalone time pay form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out additionalone time pay form

How to fill out additionalone time pay form

Who needs additionalone time pay form?

Understanding the Additional One-Time Pay Form

Overview of additional one-time pay form

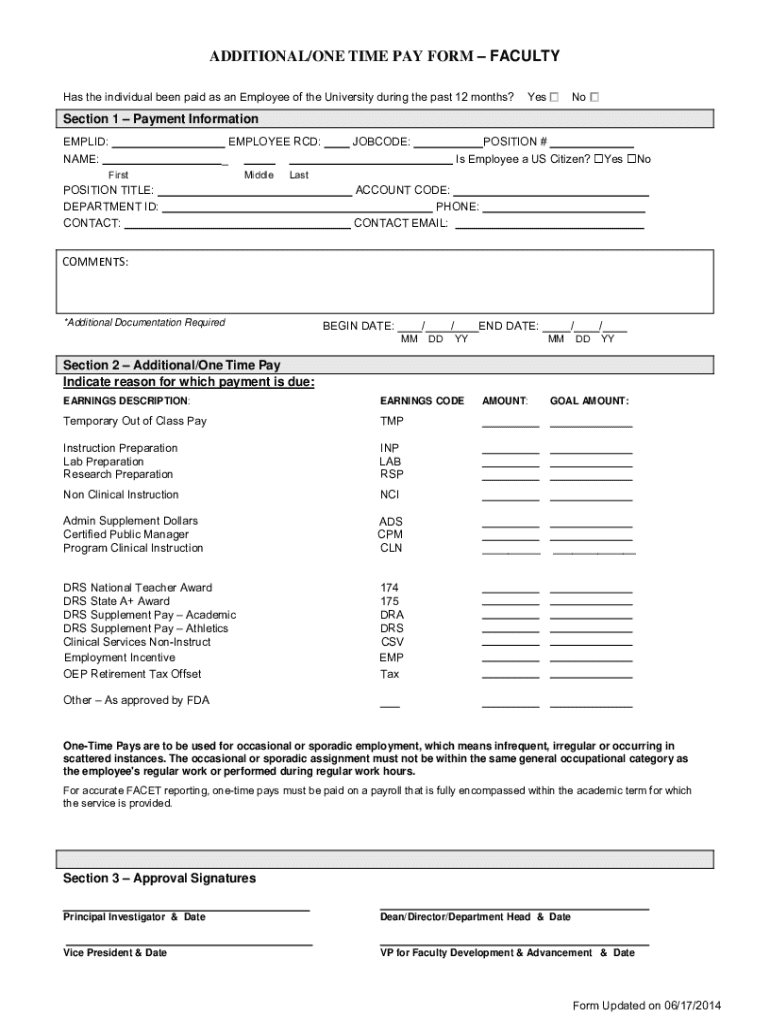

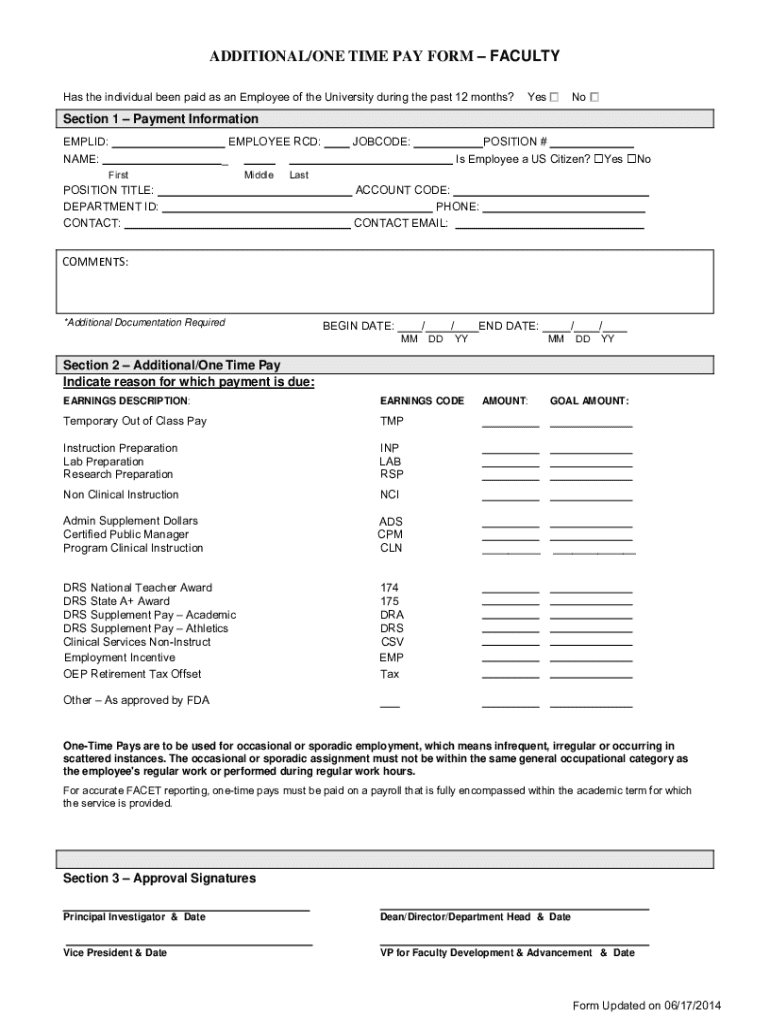

The additional one-time pay form is a vital document in many organizations, allowing for the efficient processing of unique compensation requests outside the regular payroll cycle. This form serves various purposes, such as handling bonuses, reimbursements, or special payments like relocation expenses for employees. Understanding its role is crucial for both employees and the administrative staff responsible for payroll management.

Efficient management of the additional one-time pay form streamlines payroll processes, ensuring timely and accurate payments. This not only improves employee satisfaction but can also foster positive relationships between employees and the department administration. For employees, knowing how to properly fill out this form can save time and prevent delays in receiving deserved compensation.

Understanding the form’s components

The additional one-time pay form consists of several key sections that need to be filled out accurately. First and foremost is the employee information section, which typically requires personal details such as the employee's name, employee ID, and possibly their job title to ensure identification in the payroll system. Correctly inputting this information is vital for ensuring that payments are processed without issues.

Next, the payment details section includes specifying the amount of additional payment and explaining the purpose of the request. It's crucial to be clear about why this payment is being made; reasons might include performance bonuses, re-appointment compensation, or adjustments for significant extra duties. Following this is the approval workflow, which details the required signatures from supervisors or department heads. Finally, submission guidelines outline how and where to submit the completed form, which can vary between different offices or campuses.

Step-by-step instructions for completing the form

Before you begin filling out the additional one-time pay form, it's essential to prepare by gathering necessary documentation. This might include previous pay stubs, company policies regarding compensation, and any correspondence related to the payment request. Having all relevant information at hand allows for a smoother process and reduces the chance of errors.

To start filling out the form:

Common mistakes include misreporting payment amounts, which can lead to significant delays or incorrect compensation, and leaving signature fields incomplete. Always review the final document to ensure it's fully compliant with the guidelines.

How to edit and manage the form using pdfFiller

pdfFiller serves as an excellent tool for streamlining the completion and submission of the additional one-time pay form. One of its many features is the ability to edit PDFs easily. If you need to make changes to the form after filling it out, pdfFiller allows you to adjust content seamlessly without requiring physical reprints.

Another valuable feature is eSignature integration, where users can collect signatures digitally. This functionality aids in expediting the approval workflow since approvals can be secured remotely. Furthermore, pdfFiller encourages collaboration by allowing team members to review and approve documents directly on the platform, maximizing efficiency across departments.

Resources for teams

To support teams in processing the additional one-time pay form effectively, various resources are available. Downloadable templates can help users visualize a completed form, making it easier to understand how to fill out their requests. Interactive tools also provide guidance and practice opportunities, ensuring that employees feel confident in their submissions.

For administrators managing multiple forms, it's helpful to establish a system for tracking submissions. Setting reminders for key deadlines can prevent late payments or missed opportunities for bonuses. Additionally, providing clear job aids that detail the submission process for different types of payments reduces confusion among employees.

FAQs regarding the additional one-time pay form

Many users have common questions when dealing with the additional one-time pay form. For instance, what happens if an incomplete form is submitted? Usually, the processing of such forms is halted until all information is provided, leading to delays in payment. Therefore, it’s essential to ensure that every section is completed prior to submission.

Another frequent query pertains to the possibility of modifying the form after submission. Depending on the organization's policies, some forms can be rescinded or edited post-submission, while others may require a new submission altogether. Always check internal guidelines to ensure compliance and avoid miscommunication.

Testimonials from users

User feedback is invaluable for understanding how the additional one-time pay form impacts organizations. Many companies have reported that utilizing pdfFiller has significantly improved their document management processes. Users often highlight the ability to edit forms quickly and collect electronic signatures as major time-savers.

Furthermore, testimonials reveal that employees appreciate the clarity and accessibility of the form templates provided by pdfFiller. The platform's user-friendly interface enables team members to engage with the forms effectively, resulting in fewer errors and enhanced overall efficiency. This feedback is reflective of how well pdfFiller's solutions align with the needs of contemporary workplaces.

Contact information for further support

For those seeking assistance with the additional one-time pay form or any document-related query, reaching out to customer service is straightforward. Detailed support options are available directly through pdfFiller, guiding users as they navigate the software and document workflows.

Additionally, community forums and support resources provide avenues for engaging with other users, sharing insights, and discussing common challenges. Leveraging these resources can empower teams to use the additional one-time pay form effectively and make the most out of the platforms available to them.

Key advantages of using pdfFiller for additional one-time pay form

Using pdfFiller for the additional one-time pay form offers several benefits that contribute to a streamlined document management experience. Primarily, the platform provides comprehensive document management capabilities, enabling users to create, edit, and navigate forms in real-time. This flexibility is essential for efficiently managing payment requests and ensuring timely compensation.

Moreover, the seamless integration of editing and signature capabilities allows for quick adjustments, further expediting the approval process. Finally, the cloud-based accessibility ensures that documents can be accessed from anywhere, promoting a flexible work environment. These features make pdfFiller a compelling choice for organizations looking to optimize their payroll and compensation operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify additionalone time pay form without leaving Google Drive?

How do I execute additionalone time pay form online?

How can I fill out additionalone time pay form on an iOS device?

What is additionalone time pay form?

Who is required to file additionalone time pay form?

How to fill out additionalone time pay form?

What is the purpose of additionalone time pay form?

What information must be reported on additionalone time pay form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.