Understanding and Completing Your Motor Vehicles Third-Party Insurance Form

Understanding third-party insurance

Third-party insurance is a mandatory coverage type for vehicle owners, aimed at protecting you from liability claims in the event of an accident. In essence, it provides coverage for damages or injuries you may cause to other individuals or their property while operating your vehicle. This form of insurance does not cover damages to your own vehicle; instead, it safeguards against the potential financial repercussions of being held responsible for causing harm to others. Having third-party coverage is not just a prudent decision; it is often a legal requirement, depending on your jurisdiction.

The importance of third-party coverage cannot be overstated. Accidents can be unpredictable and costly, leading to substantial financial burdens if you are found liable. Not only does this type of insurance help you comply with legal requirements, but it also serves as a layer of protection for your assets, ensuring that you won’t have to pay out-of-pocket for damages incurred during an accident.

Who requires third-party insurance?

In many countries, third-party insurance is a legal requirement for all vehicle owners. For instance, in the UK, it is compulsory for drivers to have at least third-party coverage before they can legally drive. Similarly, most states in the US mandate coverage, although the specific requirements can vary significantly. Individuals who own cars, motorcycles, or other motor vehicles must secure this insurance to operate their vehicles legally. Organizations using company-owned vehicles are also required to obtain third-party insurance to protect their interests and comply with operational regulations.

Not adhering to these requirements can lead to severe penalties, including fines and the potential loss of driving privileges. Consequently, both individual vehicle owners and businesses must consider the implications of operating a vehicle without proper third-party coverage to avoid legal repercussions and financial distress.

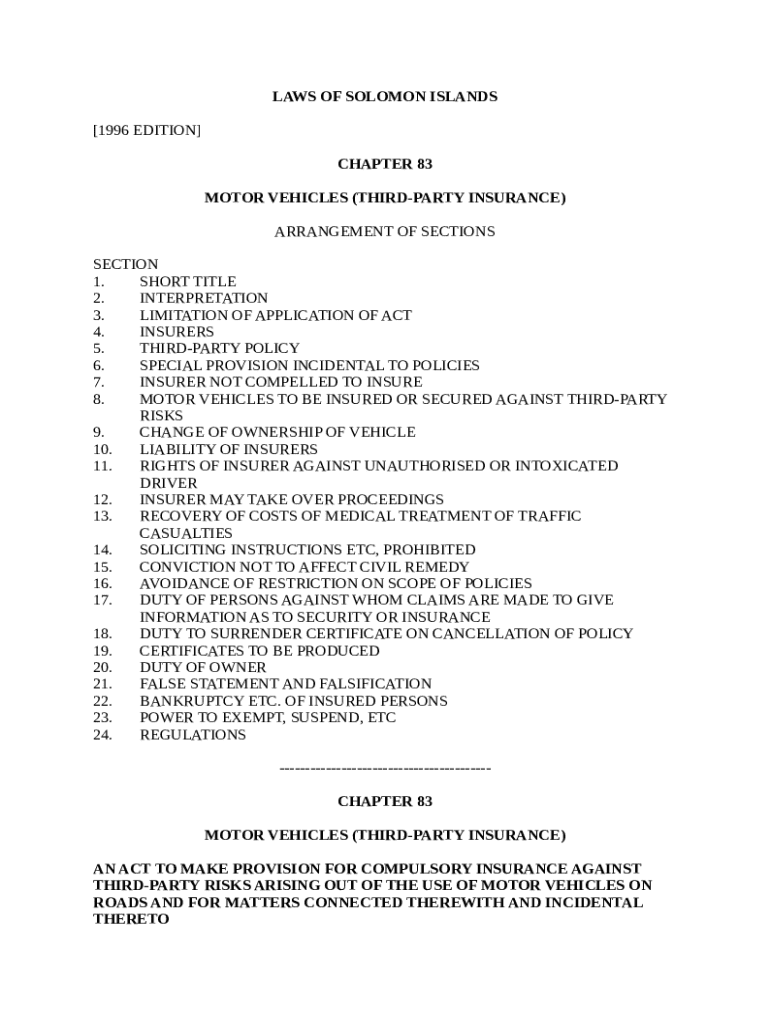

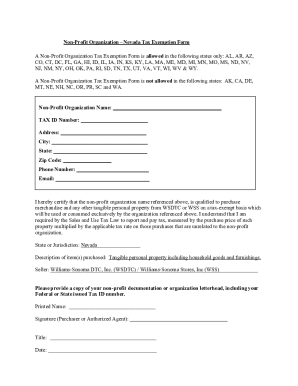

Key components of the motor vehicles third-party insurance form

Filling out the motor vehicles third-party insurance form accurately is vital to ensure you receive the correct coverage. Here are the primary components you will encounter:

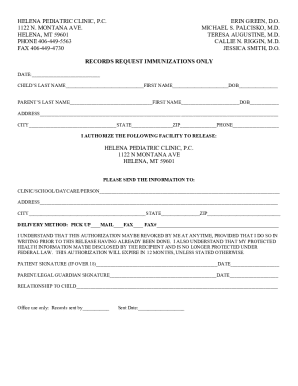

This section typically includes your vehicle identification number (VIN), registration number, and your contact information as the vehicle owner. Accurate details are critical for the insurance provider to process your application correctly.

Here, you'll specify the type of third-party coverage you want. It’s important to understand the different options available, which might include bodily injury liability and property damage liability. Exclusions and limitations should also be carefully reviewed to avoid surprises later.

Your premium will be influenced by several factors, including your age, driving history, and the make and model of your vehicle. Insurance companies assess these factors to determine the risk associated with insuring you, which directly impacts your premiums.

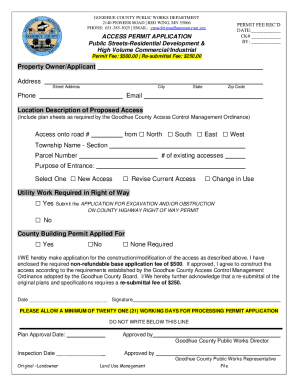

Step-by-step guide to filling out the third-party insurance form

Completing the motor vehicles third-party insurance form requires careful attention to detail. Here’s a step-by-step guide to help you through the process:

Before you start filling out the form, collect essential documents such as your driver's license, vehicle title, and past insurance policies to provide accurate information.

Take it section by section, starting with:

Enter details such as your full name, address, and contact number accurately to avoid delays.

Input your vehicle’s VIN, model, year, and registration number, which is crucial for identifying the vehicle you want to insure.

Review and choose the appropriate coverage levels that best suit your needs based on your vehicle's use and your budget.

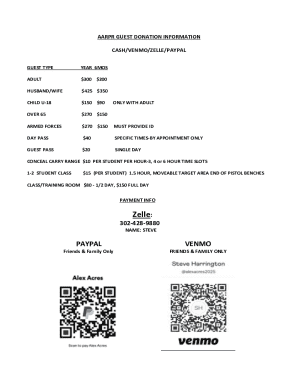

Fill in your payment details, deciding on payment frequency based on your financial preference, whether monthly, bi-annually, or annually.

When completing the form, common mistakes include entering inaccurate VINs, forgetting to review the coverage options, or neglecting to provide current contact information. To ensure your submission is processed without issues, double-check everything before you submit.

Editing and signing your third-party insurance form

After filling out your motor vehicles third-party insurance form, it’s essential to review and finalize it. Utilizing services such as pdfFiller can simplify this process significantly.

Using pdfFiller, you can easily edit the PDF form directly on their platform. The tools enable you to make any necessary corrections without having to print or resubmit new copies, ensuring the highest level of accuracy.

Once you have your form ready, electronically signing it is a breeze with pdfFiller. eSigning is not only quick and convenient but it also offers a more secure way to finalize important documents. This method eliminates the worry of losing physical papers while preserving your legal rights.

If you're collaborating with others, pdfFiller allows for easy sharing of your document with team members or insurance agents. You can receive input and feedback directly on the same document, streamlining communication and improving efficiency.

Submitting your motor vehicles third-party insurance form

Once your form is complete, the next step is submission. Depending on your local regulations and the insurance provider’s guidelines, you have multiple submission options.

Submit your completed form online via the insurer’s portal, in person at a branch office, or by mailing it directly to their designated address. Ensure you keep a copy for your records.

Post-submission, you can anticipate a processing time that varies among providers, typically ranging from a few days to a couple of weeks. Be sure they notify you about the acceptance or any additional information required.

If you haven’t received confirmation within the specified timeframe, don’t hesitate to contact your insurer to verify the status of your application.

Managing your third-party insurance policy

Once you’ve submitted the motor vehicles third-party insurance form and received your policy, proper management of this document is essential. Staying organized and informed will help you maintain the appropriate level of coverage.

Use the insurer's online tools or mobile apps to monitor the status of your application. This transparency keeps you informed throughout the process.

If you need to update your coverage, it’s straightforward. Contact your insurance provider to make adjustments based on changes like vehicle upgrades or modifications in your driving habits.

Stay aware of your renewal dates. Most policies require annual or semi-annual reviews to ensure your coverage remains adequate. Consider reviewing your options as your needs change over time.

Additional support and resources

Navigating the motor vehicles third-party insurance landscape can be daunting. It’s natural to have questions or require support during the process.

Consult the FAQ section provided by your insurer or on reputable insurance education websites to find quick answers to common queries.

For specific inquiries, reach out to your insurance provider's customer service for clarity about any uncertainties or concerns you may have regarding your policy.

Explore interactive features on pdfFiller that can facilitate a smoother document experience, such as the ability to fill forms online and access templates that suit your needs.

Conclusion on the importance of proper insurance form management

Proper management of your motor vehicles third-party insurance form is essential not only for compliance but also for ensuring adequate protection against unforeseen circumstances. A clear understanding of the information required, robust document management practices, and correct submission procedures will secure your compliance and financial protection.

Using pdfFiller as your document management solution empowers you to seamlessly edit PDFs, eSign, collaborate, and manage your insurance forms from a single cloud-based platform. By leveraging these features, you guarantee that your documentation process is efficient, reliable, and secure.