Get the free Ucc Financing Statement

Get, Create, Make and Sign ucc financing statement

Editing ucc financing statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ucc financing statement

How to fill out ucc financing statement

Who needs ucc financing statement?

UCC Financing Statement Form - How-to Guide

Understanding the UCC financing statement form

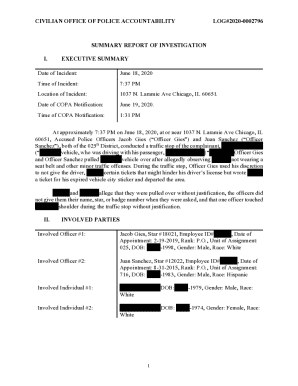

The UCC financing statement form is a pivotal legal document used primarily in the context of secured transactions. This form provides public notice to third parties that a certain lender (secured party) has a security interest in the personal property of a borrower (debtor). By filing this statement, the lender establishes a legal claim against the collateral specified, ensuring their interest is secured in case the borrower defaults on their loan obligations.

The significance of the UCC financing statement cannot be understated. It serves as both a declaration of a lender's rights and a method of protecting those rights against conflicting claims from other creditors. When a UCC financing statement is filed, it becomes part of the public record, which is crucial for establishing precedence in the event of bankruptcy or disputes over asset ownership.

Legal framework

The legal framework governing UCC financing statements is laid out in the Uniform Commercial Code (UCC), which standardizes commercial transactions across the United States. This set of laws encompasses various types of business transactions, including sales of goods and secured transactions. While the UCC provides a nationwide foundation, it's essential to be aware of jurisdictional nuances, as states may adopt specific amendments or interpretations. Thus, the rules surrounding UCC financing statements can differ significantly depending on the state in which the transaction occurs.

When to use a UCC financing statement

UCC financing statements must be filed in specific situations where secured transactions are taking place. Common scenarios include obtaining a loan for purchasing equipment, inventory, or real estate. Essentially, if a lender is providing a secured loan against collateral, a UCC filing is necessary to perfect their interest in the collateral. This legal step is crucial to safeguard the lender's investment and also benefits the borrower by potentially reducing interest rates due to the increased security provided.

Failing to file a UCC financing statement can lead to serious repercussions. For instance, if the debtor declares bankruptcy, unsecured creditors may claim the debtor's assets, leaving secured lenders without the collateral they relied upon. This lack of filing can also result in challenges during asset liquidation processes, where the absence of documented security interests can diminish the value of the lender's claim.

Elements of a UCC financing statement form

The UCC financing statement form consists of several critical elements. At the minimum, it must include details about the entities involved, primarily the debtor and the secured party. This identification ensures that all parties are correctly represented and protected under the law. Additionally, the form requires a clear description of the collateral. This description must be detailed enough for a third party to identify the assets in question, which may range from equipment to inventory or intellectual property.

Optional information can also be included in the form, which can enhance the filing. For example, a more detailed description of the collateral or additional parties involved can provide greater clarity and help prevent disputes. Adding alternative contact information or terms of the arrangement further substantiates the agreement and can aid in potential enforcement.

The process of filling out a UCC financing statement

Filling out a UCC financing statement can seem daunting at first, but breaking it into clear steps can simplify the process. Start by gathering the necessary information regarding the debtor, the secured party, and the collateral involved. Ensuring accuracy in the identification of all parties and correct descriptions of collateral is paramount to the potential success of the filing.

Once all information is collected, users can utilize pdfFiller’s editing tools, which are designed for ease of use. The intuitive features allow for straightforward input of details directly into the designated sections of the form. After completing the form, review it thoroughly to avoid common mistakes such as incorrect names, typographical errors, or incomplete descriptions. Clear and concise information is essential as it mitigates challenges down the line.

Utilizing pdfFiller for UCC financing statement creation

pdfFiller stands out as an essential tool for creating UCC financing statements due to its myriad of interactive features. Among these, users can find templates specifically designed for UCC forms, which can significantly reduce the time spent on document preparation. The drag-and-drop editing feature allows for seamless modifications, enabling users to quickly adapt the form based on their needs. Additionally, pdfFiller supports digital signatures, making it easier to secure necessary approvals electronically.

Collaboration features further enhance the utility of pdfFiller when dealing with UCC filings. Teams can easily share documents, review modifications in real-time, and ensure that everyone involved has access to the most current version of the form. This level of collaboration not only streamlines the filing process but also helps in maintaining accurate records, which is vital in the context of legal documentation.

Filing your UCC financing statement

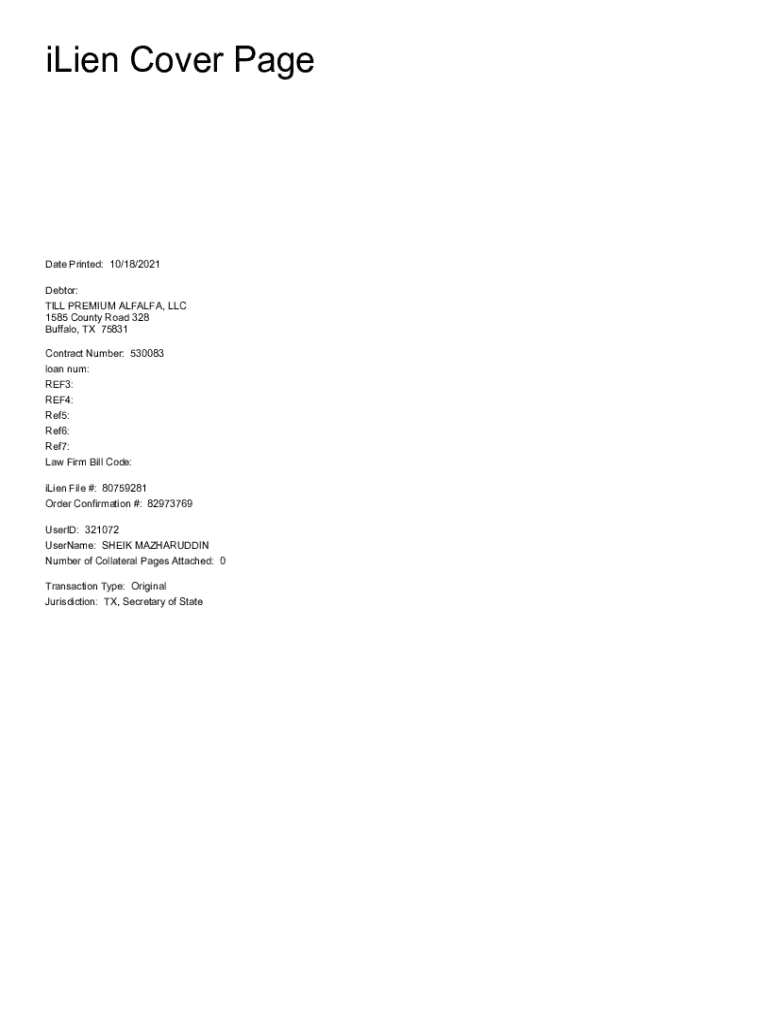

Once the UCC financing statement has been completed, the next step involves submission. Filing can typically occur via electronic or paper submission, depending on state regulations and preferences. Electronic filing is increasingly encouraged due to its efficiency, reduced processing times, and lower costs associated with document handling. Additionally, many states now offer e-filing systems that facilitate this process further.

It’s important to note that filing requirements can differ significantly from state to state. Key differences may include variations in filing offices, associated fees, and deadlines for filing. Therefore, it is essential to familiarize oneself with the specific requirements of the state where the filing occurs, ensuring compliance with local laws and procedures.

Managing your UCC financing statement

After your UCC financing statement has been filed, ongoing management of the document is crucial. It's important to monitor the status of the filing regularly. This includes checking for any potential objections or disputes that may arise and ensuring that any required amendments or renewals are filed on time. Best practices suggest maintaining a well-organized filing system that tracks all filed documents and their statuses.

Amendments may be necessary if there are changes in the debtor’s details, new collateral added, or any modifications to the loan agreement. Understanding when and how to file a UCC financing statement amendment, including any additional parties, is essential to sustaining the strength of your secured interest. Additionally, being proactive in addressing potential issues, such as discrepancies in filed information, can save time and resources in the long run.

Additional considerations and best practices

One key consideration for those filing UCC financing statements is understanding lien priorities. The order in which filings are made can significantly affect secured interests, especially in cases of debtor insolvency. The first creditor to file their UCC financing statement typically holds priority over later filings, which can dictate recovery during bankruptcy proceedings. Therefore, being aware of the timing of your filing in relation to others is essential.

Record-keeping plays a crucial role in the effective management of UCC filings. Maintaining thorough documentation not only assists in compliance but also safeguards the party’s interests. Best practices include creating backup copies of all filings, storing correspondence regarding the status and terms of agreements, and regularly reviewing records to ensure their accuracy and currency. Utilizing digital platforms like pdfFiller for document storage can also enhance accessibility and organization.

Real-world applications of UCC financing statements

UCC financing statements are utilized across various industries, showcasing their versatility in securing transactions. For instance, in the automotive industry, dealers often use UCC filings when providing financing for vehicle purchases, ensuring their interest is protected despite vehicles changing ownership. Similarly, in real estate transactions, contractors may file a UCC statement to secure rights to construction equipment or materials, protecting their investment while working on a project.

Recent trends in UCC filings reveal a shift towards digitalization, with increasing numbers of lenders opting for electronic filing methods. This trend not only streamlines the filing process but also reduces the chances of human error associated with paper forms. Additionally, as companies continue to adapt to a rapidly-evolving business landscape, understanding the implications of UCC financing statements is becoming increasingly critical in maintaining competitive advantages.

FAQs about UCC financing statement forms

As with any complex legal document, many individuals have questions regarding UCC financing statements. Common queries often revolve around the process of filing, associated costs, and how to amend a filing when necessary. Additionally, misconceptions about the necessity and impact of UCC filings can lead to confusion. Understanding these aspects is critical for both lenders and borrowers to navigate the secured transaction landscape effectively.

For those seeking further guidance, resources such as the Secretary of State's website or legal counsel can provide invaluable insights. Staying informed about changes in UCC regulations and the best practices surrounding filings ensures that individuals remain compliant and equipped to handle any situations that may arise with their UCC financing statements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ucc financing statement in Chrome?

How do I edit ucc financing statement straight from my smartphone?

How do I fill out ucc financing statement on an Android device?

What is ucc financing statement?

Who is required to file ucc financing statement?

How to fill out ucc financing statement?

What is the purpose of ucc financing statement?

What information must be reported on ucc financing statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.