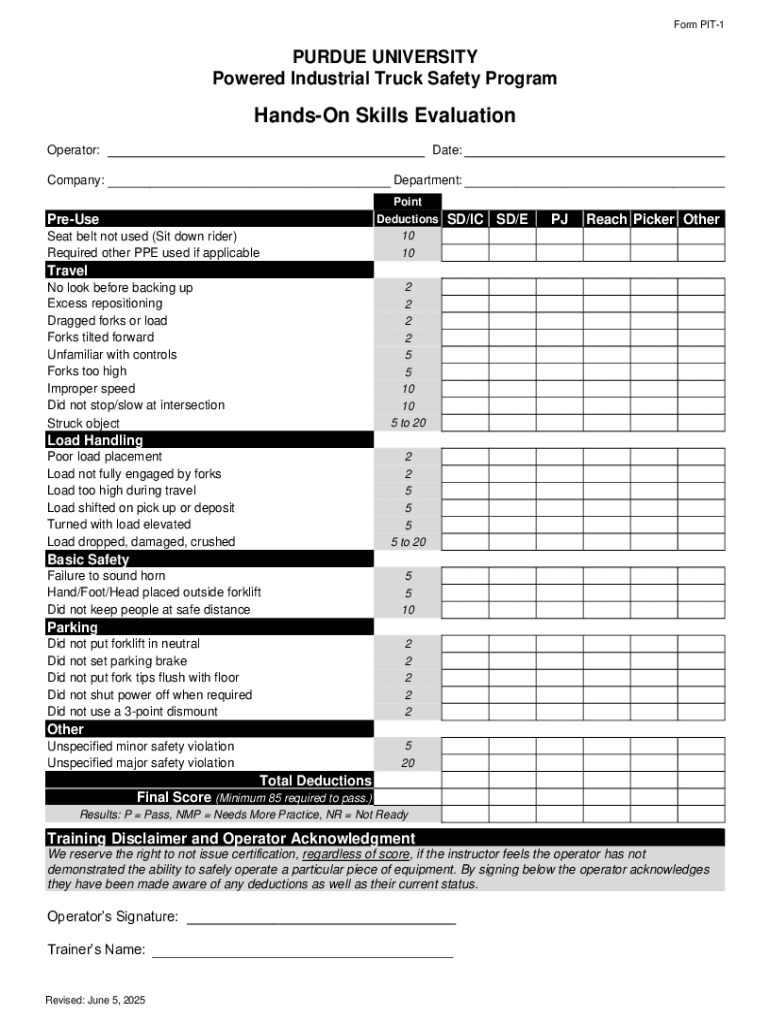

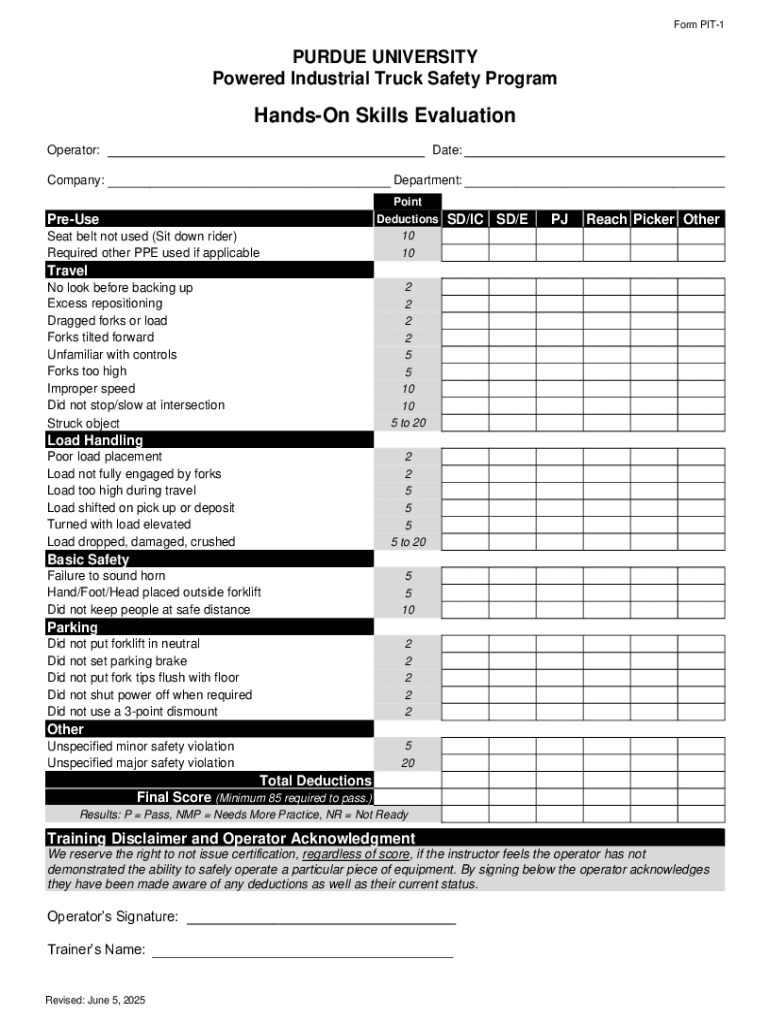

Get the free Pit-1

Get, Create, Make and Sign pit-1

How to edit pit-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pit-1

How to fill out pit-1

Who needs pit-1?

Understanding the PIT-1 Form: A Comprehensive Guide for New Mexico Tax Filers

Overview of the PIT-1 Form

The PIT-1 form serves as the cornerstone of personal income tax filing in New Mexico. Specifically designed for individual taxpayers, it is essential for reporting income earned within the state. Understanding its purpose not only simplifies the filing process but also ensures compliance with state tax laws. Accuracy in completing this form is crucial, as it directly affects the assessment of tax liabilities and any potential refunds.

Common scenarios requiring the PIT-1 form include individuals with wages from employment, self-employment income, dividends, or rental income. Whether you’re a first-time filer or a seasoned taxpayer, mastering the completion of the PIT-1 form can minimize confusion and prevent overlooked deductions.

Eligibility for filing the PIT-1 form

To determine eligibility for filing the PIT-1 form, it is essential to understand who is required to submit it. Any individual who earns income in New Mexico must file this form. This includes residents and non-residents who receive income sourced from within the state. Therefore, it is critical to understand residency requirements, as they can affect your filing status and overall tax obligations.

Notably, certain individuals may be exempt from filing the PIT-1. For instance, if your income is below the state's estimated gross receipts threshold or you qualify for specific exemptions due to low income or certain tax statuses, you may not be required to file. Familiarizing yourself with these exceptions can save time and streamline your tax season.

Step-by-step guide to completing the PIT-1 form

Filing methods for the PIT-1 form

When it comes to submitting your PIT-1 form, there are various options available to you. One of the most convenient methods is online submission via pdfFiller. This platform offers an efficient e-filing process that walks you through each step, from initial filling to final submission. The real-time collaboration tools provided can enhance your experience, allowing you to share your form easily with professionals for review before filing.

If you prefer traditional methods, mailing a paper version of your PIT-1 form remains an option. For this, ensure that you follow best practices: print clearly, sign where necessary, and use appropriate postage to avoid delays.

Payment options associated with the PIT-1 form

Once you’ve submitted your PIT-1 form, it’s time to consider payment options for any taxes owed. Online payments can be made directly through the state tax website, which is often the quickest method. Additionally, you can opt to mail checks or money orders if you prefer paper transactions. It's crucial to ensure that payments are made promptly to avoid interest or penalties.

Individuals unable to pay their tax liability in full should explore available payment plans. The state provides various options that allow for manageable payments over time, making it easier to meet your obligations without unnecessary distress.

Managing your filing after submission

After submitting your PIT-1 form, it's vital to manage your filing responsibly. If you discover an error post-submission, knowing the amendments process is essential. This generally involves filing a corrected return, detailing the changes made. It's advisable to act promptly, as corrections can sometimes prevent bigger issues down the line.

Also, keep tabs on the status of your PIT-1 form through the state’s official channels. This typically involves using an online portal where you can track the processing of your return and stay informed about any correspondence from the state regarding your filing.

Utilizing pdfFiller for future form needs

Using pdfFiller not only simplifies the PIT-1 form process but can also facilitate your document management for years to come. The platform enables you to create, edit, and securely store important forms, making future tax seasons noticeably easier. With advanced collaboration features, you can share documents with family members or finance professionals seamlessly.

Explore additional templates available on pdfFiller for other tax-related forms or any other documentation needs. Having a centralized folder for all your important forms enhances organization and provides peace of mind during tax time.

FAQs about the PIT-1 form

Many questions arise regarding the PIT-1 form and its filing process. Common inquiries include clarifications about filing deadlines, exceptions to filing, and what documentation is necessary for accurate completion. Answering these questions accurately is crucial to navigating state tax requirements successfully.

For any further assistance with PIT-1 form-related queries, consider reaching out to the New Mexico Department of Taxation and Revenue or professional tax advisors. They can provide tailored support based on individual situations and needs.

Important deadlines for PIT-1 filing

Being aware of key tax filing dates specific to New Mexico is vital for all taxpayers. The typical deadline for submitting the PIT-1 form coincides with the federal tax filing date, usually April 15. However, ensure to check for any state-specific extensions or changes that may apply in a given tax year.

Failing to submit your PIT-1 form on time can lead to significant consequences, including late penalties and interest on owed taxes. Understanding these deadlines helps ensure compliance and can significantly affect your overall financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pit-1?

How can I fill out pit-1 on an iOS device?

How do I edit pit-1 on an Android device?

What is pit-1?

Who is required to file pit-1?

How to fill out pit-1?

What is the purpose of pit-1?

What information must be reported on pit-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.