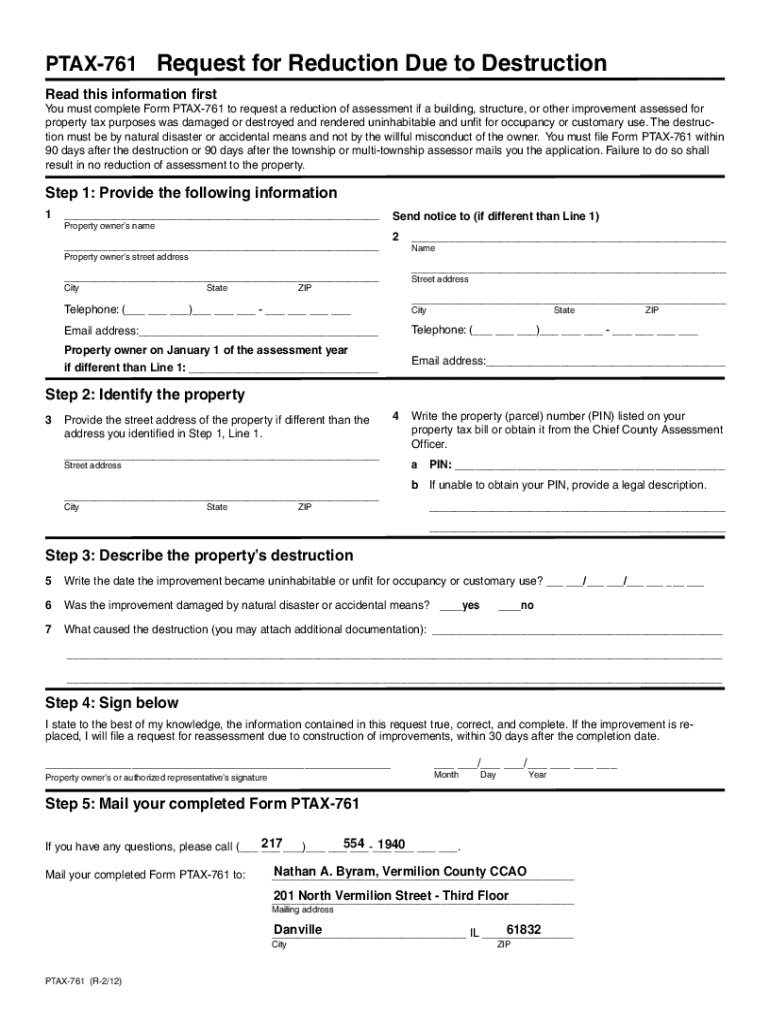

Get the free Ptax-761

Get, Create, Make and Sign ptax-761

How to edit ptax-761 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptax-761

How to fill out ptax-761

Who needs ptax-761?

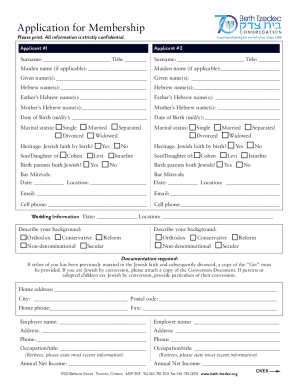

A comprehensive guide to the ptax-761 form

Overview of the ptax-761 form

The ptax-761 form, commonly referred to as the Illinois Department of Revenue's 'Donor's Gift Tax Return,' is an essential document for individuals who make significant gifts. Designed to report taxable gifts made during a calendar year, this form plays a crucial role in ensuring compliance with state tax regulations.

Completing the ptax-761 form accurately is important for both donors and recipients. It helps to establish the correct valuation of gifts and avoid potential legal disputes and penalties associated with improper reporting. As tax laws can evolve, understanding this form and its requirements aids in navigating the intricacies of tax obligations.

Understanding the structure of the ptax-761 form

The ptax-761 form is methodically structured into four main sections. Each section gathers specific details that are crucial for proper documentation and tax assessment. Below is a breakdown of these sections.

Step-by-step instructions for filling out the ptax-761 form

Filling out the ptax-761 form requires careful attention and a methodical approach. Start by gathering all necessary information and documentation to simplify the process.

Common mistakes include entering inaccurate information or failing to sign and date the form. Little oversights can lead to unnecessary delays or complications.

Editing and signing the ptax-761 form

After completing the ptax-761 form, ensuring that it is signed and ready for submission is crucial. On pdfFiller, users can easily edit, sign, and prepare the form for submission.

Managing the ptax-761 form with pdfFiller

Managing your ptax-761 form does not end with submission. pdfFiller empowers users to store, organize, and share documents efficiently.

Frequently asked questions about the ptax-761 form

Navigating through the regulations concerning the ptax-761 form can raise several questions. Here are some commonly asked inquiries.

Related forms and resources

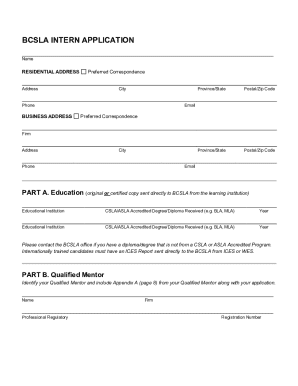

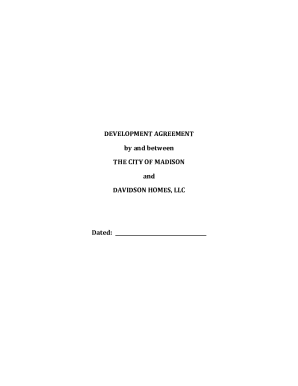

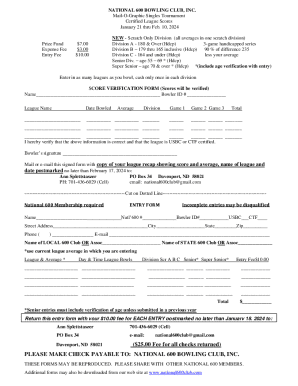

Understanding the ptax-761 form can be enhanced by looking at other relevant forms. Here’s a brief overview.

Users can also benefit from the additional tools provided by pdfFiller, including customizable templates that streamline form creation and submission.

User tips and best practices

To ensure accuracy and compliance with the ptax-761 form, consider the following best practices.

Feedback center

Engagement from users enhances the functionalities offered by pdfFiller. Here’s how you can contribute.

Next steps and continuing education

For those looking to deepen their understanding of document management and compliance, pdfFiller offers a range of educational opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ptax-761 in Gmail?

How can I edit ptax-761 from Google Drive?

How can I edit ptax-761 on a smartphone?

What is ptax-761?

Who is required to file ptax-761?

How to fill out ptax-761?

What is the purpose of ptax-761?

What information must be reported on ptax-761?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.