Get the free Secondary Direct Deposit Authorization Form

Get, Create, Make and Sign secondary direct deposit authorization

Editing secondary direct deposit authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out secondary direct deposit authorization

How to fill out secondary direct deposit authorization

Who needs secondary direct deposit authorization?

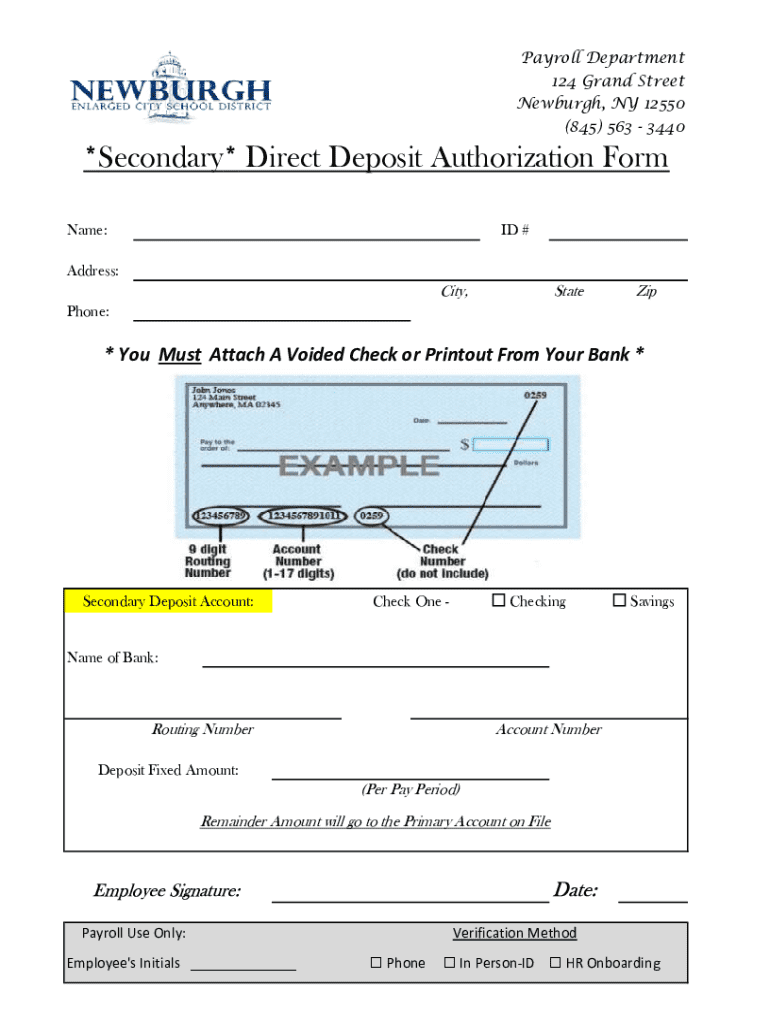

Understanding the Secondary Direct Deposit Authorization Form

Understanding secondary direct deposits

A secondary direct deposit refers to the process of allocating part of your earnings to a different bank account, separate from your primary account. This can be particularly useful for those looking to manage multiple financial objectives—such as savings, bills, or investments—simultaneously. By establishing a secondary direct deposit, individuals can ensure that funds designated for specific purposes are efficiently directed to their intended locations.

The importance of a secondary direct deposit lies in its ability to simplify budgeting and provide financial flexibility. For instance, employees can have a portion of their paycheck automatically routed to a savings account, making it easier to handle unexpected expenses or save for future goals. In team settings, such as for businesses or organizations, this can streamline payroll processes associated with specific projects or group expenditures.

The role of the secondary direct deposit authorization form

The secondary direct deposit authorization form is a key document in setting up this financial arrangement. It serves as legal proof of an employee’s request to direct a portion of their salary to a different account, thus ensuring both the employer and employee are on the same page regarding payroll distribution. This form also complies with regulations around consent and privacy, as employers need explicit permission to divert funds.

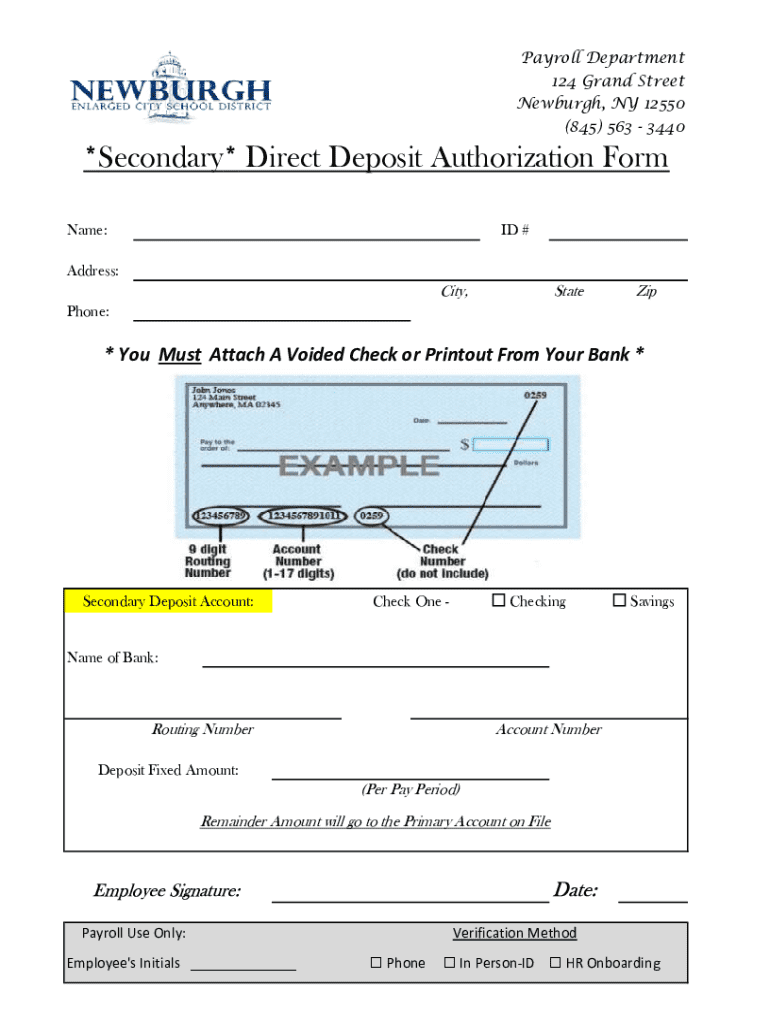

The form typically includes critical components that must be completed accurately to avoid any issues with payment processing. It includes personal information such as the employee's name and address along with necessary banking details. This transparency provides clarity and helps prevent potential disagreements or mistakes in the allocation of funds.

How to complete the secondary direct deposit authorization form

Completing the secondary direct deposit authorization form is straightforward, especially when following a structured approach. Here’s a step-by-step guide to help you through the process:

Additionally, tools like pdfFiller can enhance this process with features such as auto-fill options, minimizing chances for errors while ensuring smooth form submission. Take advantage of these resources to reinforce accuracy.

Remember to review the completed form for any mistakes before submitting it to your employer.

Editing and modifying the form

In an ever-evolving financial landscape, you might find the need to edit or modify your secondary direct deposit authorization form. With pdfFiller, the editing process is user-friendly. Users can add text, checkboxes, and even collaborate with colleagues to ensure the form accurately reflects current account details and allocations.

When modifying your form, be mindful of common mistakes to avoid. These include providing incorrect account details, misplacing signatures, or failing to date the document. Such errors can cause delays and could potentially disrupt the timely processing of your deposits.

Submitting the secondary direct deposit authorization form

Once you've completed your secondary direct deposit authorization form, the next step is its submission. Different employers may have various processes for submission, so it's essential to understand yours. Typically, you might submit the form to your human resources or payroll department, either digitally or in hard copy.

Digital submissions can offer faster processing times and help eliminate potential loss of paperwork. However, some individuals may prefer paper forms for record-keeping. Each option has its pros and cons, so choose the method that best suits your needs.

Typically, turnaround times can vary; it's advisable to inquire about the status of your submission, especially if you're close to a payday.

Frequently asked questions (FAQs)

With any financial arrangement, questions often arise. Here are some common inquiries regarding the secondary direct deposit process:

For troubleshooting these issues, it's recommended to reach out directly to your HR or payroll department. They can provide assistance or guide you through the necessary steps to rectify any concerns. Additionally, pdfFiller offers support for form-related queries, making it easier to manage and edit your required documents.

Conclusion on best practices for direct deposits

Successfully managing direct deposits involves more than just filling out forms; it's about maintaining good practices. One of the primary takeaways is to routinely check that all account information is accurate and up to date. Regularly reviewing your deposit statements can also alert you to any discrepancies early on.

Furthermore, leveraging online resources available through platforms like pdfFiller can facilitate your ongoing engagement with document management, ensuring you have the tools you need at your fingertips to navigate any challenges. By implementing these best practices, you can maximize the benefits of secondary direct deposits effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send secondary direct deposit authorization for eSignature?

Can I create an electronic signature for the secondary direct deposit authorization in Chrome?

How do I fill out secondary direct deposit authorization on an Android device?

What is secondary direct deposit authorization?

Who is required to file secondary direct deposit authorization?

How to fill out secondary direct deposit authorization?

What is the purpose of secondary direct deposit authorization?

What information must be reported on secondary direct deposit authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.