Get the free Applying for Federal Financial Aid - United States University

Get, Create, Make and Sign applying for federal financial

How to edit applying for federal financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out applying for federal financial

How to fill out applying for federal financial

Who needs applying for federal financial?

Applying for Federal Financial Form: A Complete Guide

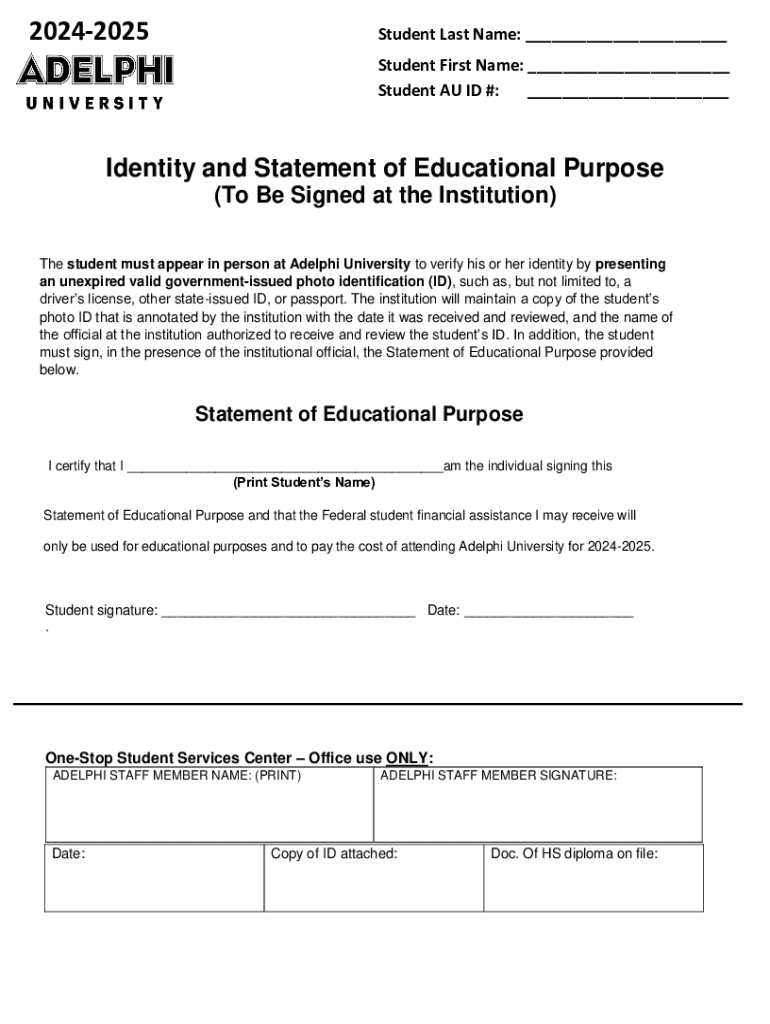

Understanding federal financial forms

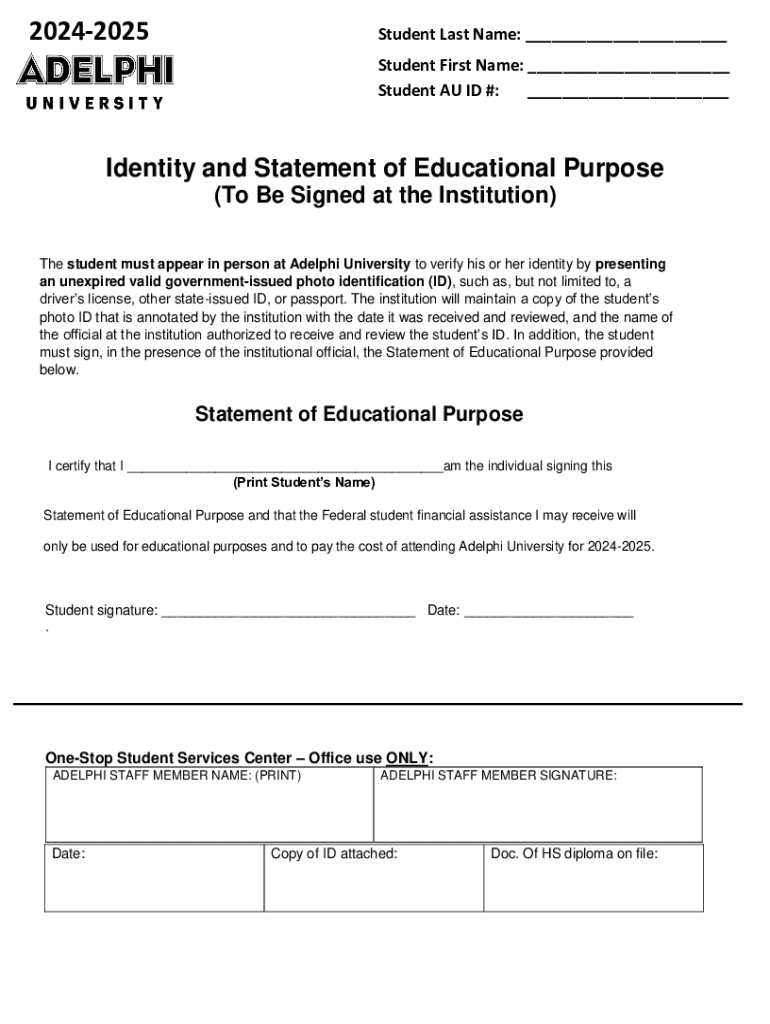

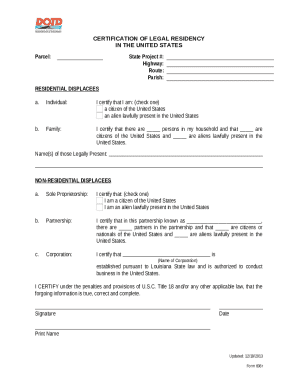

Federal financial forms are essential documents used in the process of applying for various types of federal funding. These forms serve multiple purposes, including ensuring that applicants meet eligibility criteria for grants, loans, or other forms of financial assistance. They help maintain transparency and compliance within federal programs by collecting standardized information from applicants.

The importance of these forms cannot be overstated, as they are critical in securing funding opportunities while also satisfying compliance requirements mandated by various governmental agencies. Each type of federal financial form may have unique specifications and instructions that must be carefully followed to avoid denials or delays.

Preparing to apply for a federal financial form

Before diving into the application process, it’s crucial to assess your eligibility for the type of funding being requested. Each federal program has specific criteria that applicants must meet, which can include organizational eligibility, project focus, and financial standing.

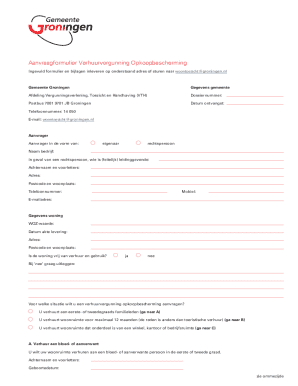

Common requirements for applicants often include demonstration of financial need, project plans, and detailed budgets. Having a clear understanding of what is needed will streamline the preparation process, helping to ensure all necessary documentation is gathered.

To stay organized, create a checklist of the required documents and establish a system for collecting them. This strategy minimizes the risk of overlooking necessary information.

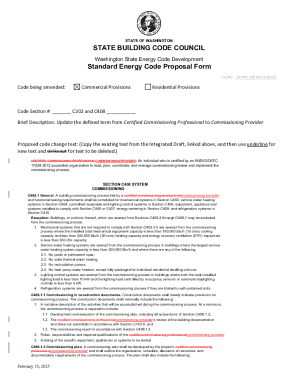

Familiarizing yourself with the specific forms you will encounter is also essential. Each form has requirements specific to its purpose, and understanding these will help you avoid pitfalls during the submission process.

Step-by-step guide to filling out federal financial forms

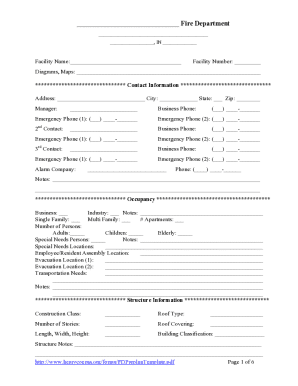

Begin the process by accessing the official form. Federal financial forms can typically be found on government websites or via platforms like pdfFiller which offer easy access and may even have built-in guidance.

Choose the format that best suits your needs; you may have the option of PDFs that can be completed digitally or Word documents that allow for more editing.

During the form completion stage, attention to detail is crucial. Ensure that each section is filled out completely, avoiding common mistakes such as typos, missing signatures, or incomplete fields. Utilize our checklist to confirm all required elements are present before submission.

After submission, tracking the status of your application is vital. Keep a record of submission dates and any confirmation numbers to aid in following up with the funding agency if needed.

Using pdfFiller to simplify the process

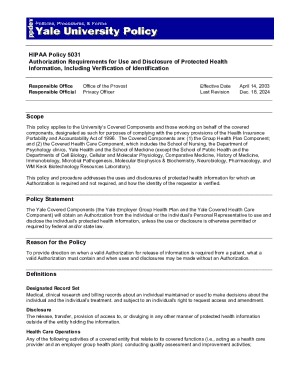

pdfFiller shines as a powerful tool for those applying for federal financial forms. Its cloud-based access means you can fill out and sign documents from anywhere, a game-changer for busy teams and individuals juggling multiple commitments.

One of the standout features of pdfFiller is its editing capabilities, which allow users to customize forms with ease. Whether updating financial figures, adding project details, or providing additional explanations, having the flexibility to edit is crucial to producing a polished and compliant submission.

In addition to traditional document handling, pdfFiller offers interactive tools, including step-by-step guides and templates for various federal forms. The eSigning feature enhances security and streamlines the submission process, allowing you to sign documents electronically without unnecessary delays.

Common challenges and solutions in applying for federal financial forms

Navigating the intricate landscape of federal financial forms can present numerous challenges. From complex instructions to varying requirements, many applicants find themselves overwhelmed. Experienced applicants encourage focusing on clear communication and seeking assistance when needed. It’s beneficial to consult with professionals or colleagues who have successfully navigated the process.

In the unfortunate event that your application is denied, be proactive. Carefully review the feedback provided in the decision letter, as doing so will help pinpoint areas needing correction. Understanding the reasons for denial is the first step toward improving your application for resubmission.

Frequently asked questions (FAQs)

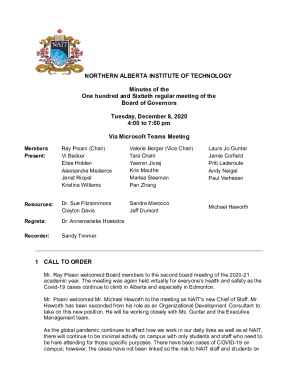

Understanding federal financial forms can raise several questions, especially regarding logistics and best practices. For instance, many applicants wonder how to manage multiple submissions. It's advisable to maintain a comprehensive tracking system, documenting each form and its associated deadlines to stay organized.

Missed deadlines can severely impact eligibility, so staying on top of timelines is critical for success. Most agencies allow for a grace period or offer assistance in some circumstances, but it’s best to consult guidelines specific to each funding opportunity.

Ensuring compliance and staying informed

Compliance with federal funding requirements is paramount. Applicants should stay informed about changes in regulations that may impact eligibility or required documentation. This diligence can significantly influence the success of applications.

One effective way to keep abreast of developments is by participating in webinars, workshops, or courses dedicated to federal forms and funding applications. Additionally, online forums and community groups can serve as excellent resources for support and shared experiences, enabling collaboration and knowledge exchange among applicants.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify applying for federal financial without leaving Google Drive?

Can I create an electronic signature for signing my applying for federal financial in Gmail?

How can I edit applying for federal financial on a smartphone?

What is applying for federal financial?

Who is required to file applying for federal financial?

How to fill out applying for federal financial?

What is the purpose of applying for federal financial?

What information must be reported on applying for federal financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.