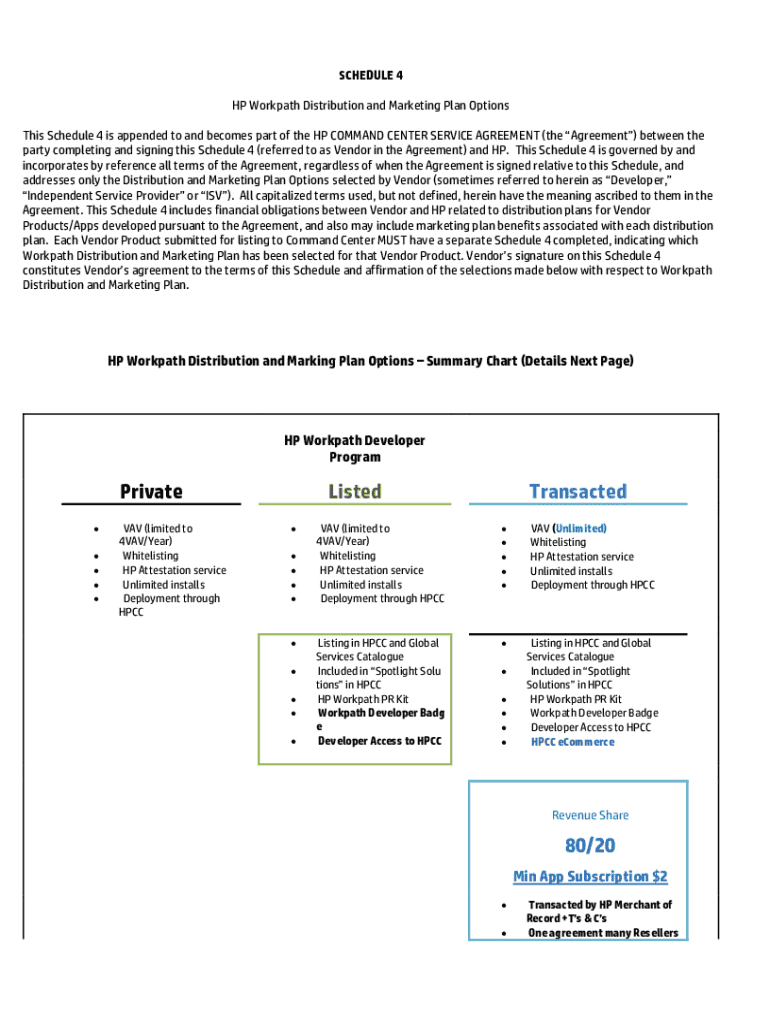

Get the free Schedule 4

Get, Create, Make and Sign schedule 4

Editing schedule 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 4

How to fill out schedule 4

Who needs schedule 4?

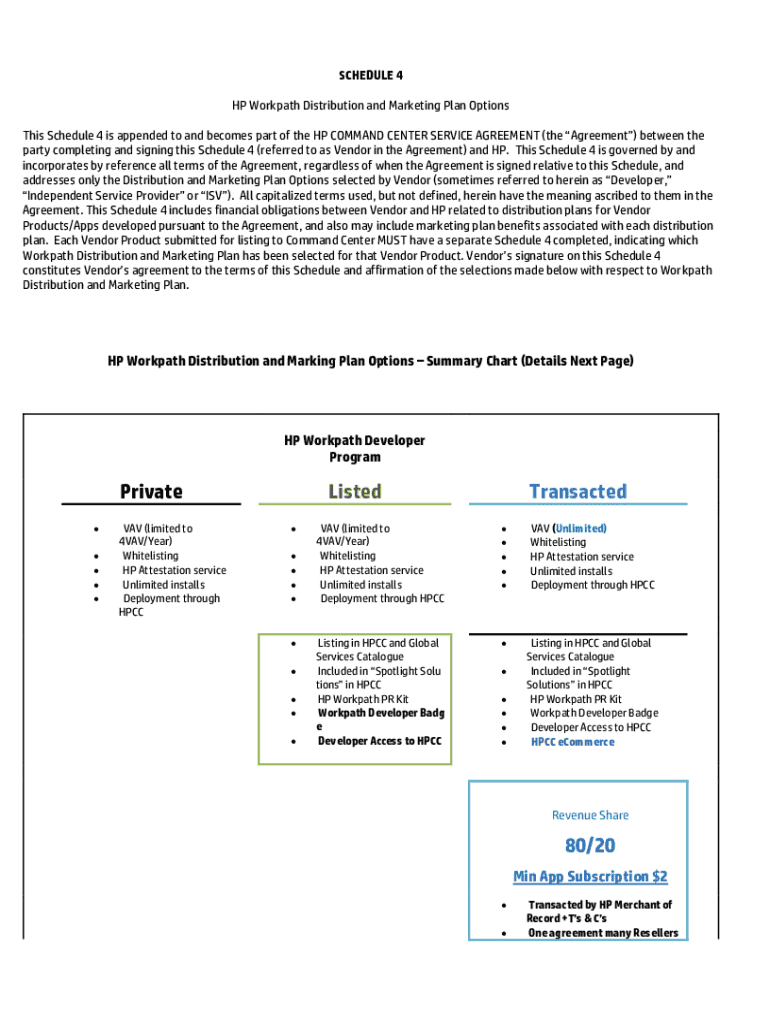

Comprehensive Guide to the Schedule 4 Form

Understanding the Schedule 4 Form

The Schedule 4 Form is a crucial document often utilized in various financial reporting contexts. Primarily, it serves the purpose of detailing income and deductions for individual taxpayers, allowing for accurate tax computations. It provides both taxpayers and tax authorities a clear picture of an individual's financial standing within a designated fiscal year.

Commonly, the Schedule 4 Form is used by individuals who have multiple income sources or deductions that need attention. This includes self-employed individuals, investors, and people with significant medical expenses. The importance of accurate completion cannot be overstated, as errors can lead to financial penalties, incorrect tax liabilities, and potentially, legal troubles.

Key components of the Schedule 4 Form

The Schedule 4 Form comprises several essential components that collect comprehensive information required for completing tax returns. Understanding these elements is imperative for anyone looking to fill out the form correctly.

The required information typically includes personal details such as your name, address, and social security number, along with various financial figures related to income and deductions. Specific sections are structured to gather this information effectively:

In particular, the Schedule 4 Form separates into several sections for detailed breakdowns: Section A for income details, Section B for deductions and credits, and Section C for signatures and declarations, ensuring a thorough approach to individual financial reporting.

Step-by-step guide to filling out the Schedule 4 Form

Filling out the Schedule 4 Form can seem daunting, but breaking it down into manageable steps makes the process clear and straightforward. Here's a step-by-step guide to assist you:

Editing and managing your Schedule 4 Form

In an era where digital forms take precedence, managing your Schedule 4 Form online can streamline the process further. pdfFiller offers the perfect platform to edit your forms efficiently. Here’s how to navigate the editing process:

These features ensure that whether you’re working solo or as part of a team, your Schedule 4 Form is handled efficiently and accurately.

Troubleshooting common issues

Despite careful attention to detail, issues can still arise when submitting the Schedule 4 Form. Recognizing and resolving these common problems is key to a smooth submission process.

Interactive tools and resources on pdfFiller

pdfFiller not only allows for editing and signing forms but also offers various interactive tools to help users complete their Schedule 4 Form seamlessly.

Frequently asked questions (FAQs)

Addressing concerns related to the Schedule 4 Form can prevent potential issues. Below are common FAQs that might arise during your filing process.

Engaging with the pdfFiller community

Joining the pdfFiller community provides an avenue for support and collaboration, enhancing your experience with the platform. Engage with other users and learn from their expertise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send schedule 4 for eSignature?

Can I create an eSignature for the schedule 4 in Gmail?

How do I fill out the schedule 4 form on my smartphone?

What is schedule 4?

Who is required to file schedule 4?

How to fill out schedule 4?

What is the purpose of schedule 4?

What information must be reported on schedule 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.