Get the free Quarterly Treasurer's Report

Get, Create, Make and Sign quarterly treasurers report

How to edit quarterly treasurers report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out quarterly treasurers report

How to fill out quarterly treasurers report

Who needs quarterly treasurers report?

A comprehensive guide to the quarterly treasurers report form

Understanding the quarterly treasurers report form

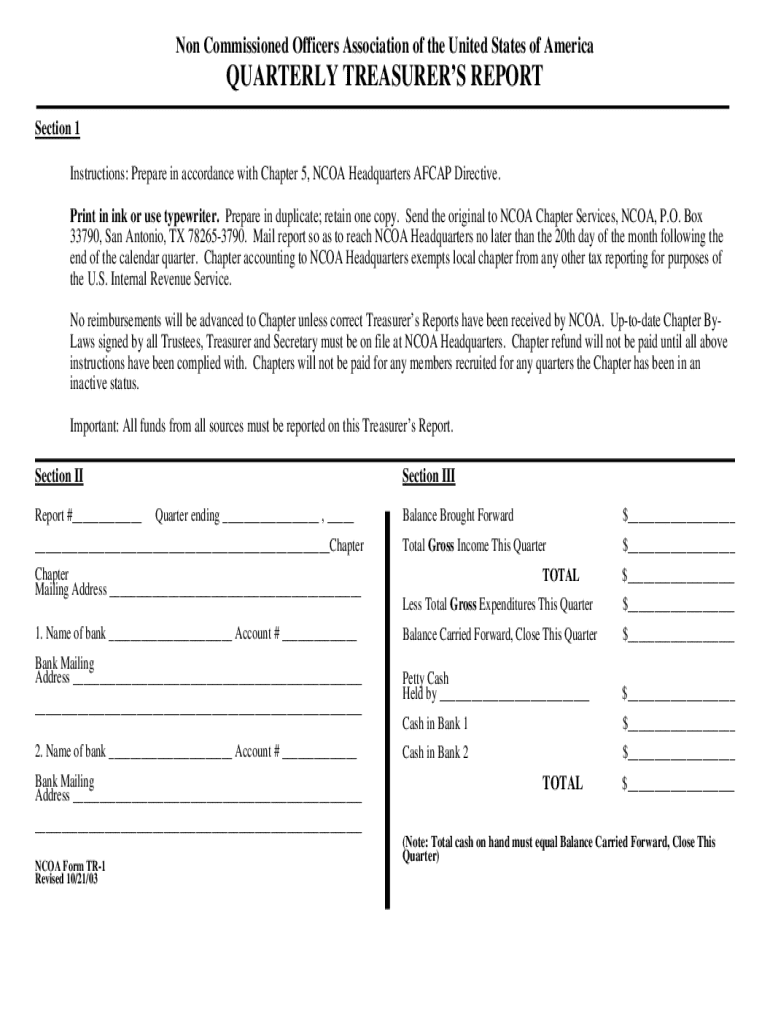

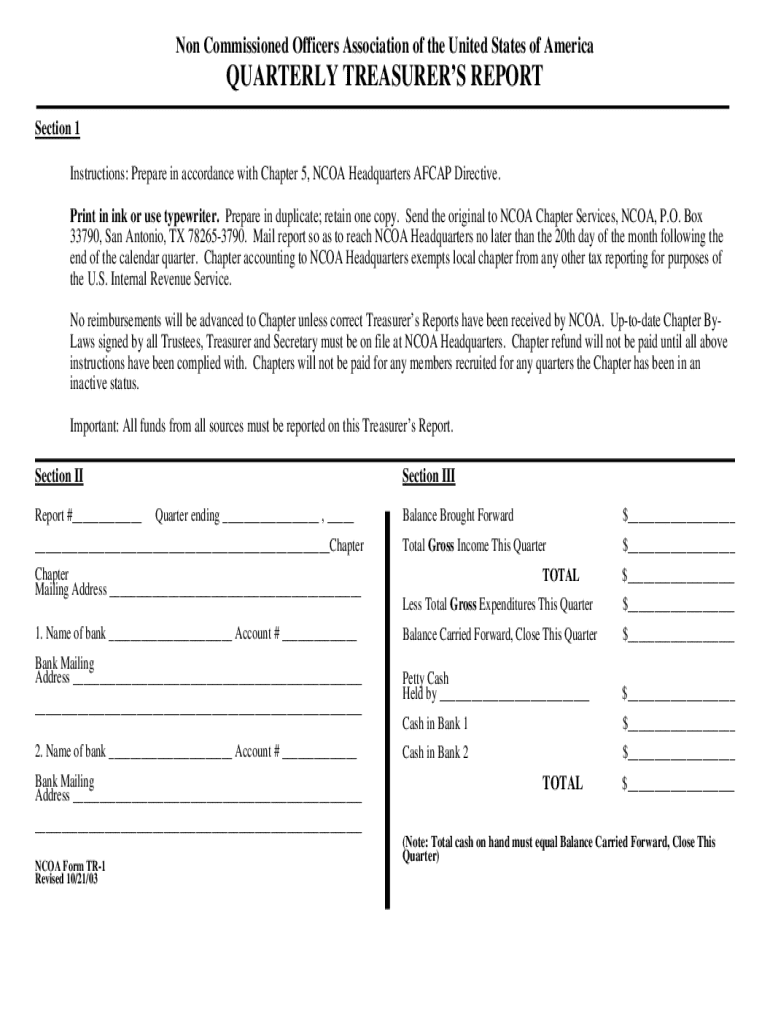

A quarterly treasurers report is a crucial document that provides an overview of an organization’s financial status at the end of each quarter. Its primary purpose is to summarize revenue, expenses, and net profit or loss over the reporting period, enabling stakeholders to assess financial stability and performance. Accuracy in these reports is vital, as they serve not only as a financial record but also as a tool for making informed decisions that align with organizational goals.

The importance of accurate financial reporting cannot be overstated. For nonprofits and local governments, this transparency fosters trust with community members and donors. The integrity of reporting safeguards the organization's reputation and financial integrity, while businesses rely on these reports to strategize for future growth. Essentially, quarterly treasurers reports communicate the organization’s financial health and guide critical future decisions.

Typical users of the report

Typically, the role of preparing these reports falls to the organization’s treasurer or a financial officer, often in collaboration with other members of the finance team. Nonprofit organizations, local governments, and even some businesses regularly complete quarterly treasurers reports to maintain a clear understanding of their financial situation. Each participant in the reporting process plays a pivotal role in ensuring that accurate data is compiled, interpreted, and presented in a manner that is comprehensible and actionable.

Key components of the quarterly treasurers report

Essential components of the quarterly treasurers report include several financial metrics critical for stakeholders. Firstly, a revenue and expenses overview provides basic insights into the inflow and outflow of resources during the quarter. Typically, this comparison against budget forecasts presents opportunities and highlights, showing where the organization performed as expected versus where it did not.

Variance analysis is paramount in financial decision-making. It helps to explain variances, delineating between positive and negative discrepancies in expected versus actual figures. By understanding these variances, organizations can adjust their financial strategies accordingly to enhance performance. Furthermore, the report also includes an overview of assets and liabilities, differentiating between current and long-term assets, which is essential for understanding financial stability and net worth.

Step-by-step guide to completing the quarterly treasurers report form

Successful completion of a quarterly treasurers report begins with a pre-preparation checklist. Essential to this is gathering necessary financial records such as bank statements, invoices, and receipts—all vital components for reporting income and expenses accurately. Confirming the specific reporting period is also crucial; make sure to define which quarter's operations you are summarizing.

Detailed instructions for form completion follow: First, enter revenue data, categorizing income sources correctly to reflect the widest range of organizational transactions, including membership fees and sales. Next, document expenses accurately, ensuring to avoid common pitfalls such as under-reporting or miscategorizing costs. Calculating the net profit or loss is a key calculation—this is typically done by subtracting total expenses from total revenues. Lastly, preparing additional notes adds context to the numbers, essential for stakeholders who may need further clarification.

Tools and resources for completing the report

Utilizing tools like pdfFiller significantly eases the process of preparing a quarterly treasurers report. This platform enables users to edit PDFs, filling out forms seamlessly while maintaining the integrity of essential data. A standout feature includes the secure eSign options to ensure documents are legally binding when needed, enhancing overall workflow efficiencies.

Moreover, pdfFiller offers collaborative tools that facilitate teamwork, allowing various contributors to provide input on financial data in real-time. This cloud-based access ensures that team members can work on documents from any location, which is beneficial for organizations with remote finance teams. pdfFiller also provides a suite of templates designed for financial reporting which helps streamline the reporting process, allowing users to customize them to meet specific needs.

Common mistakes to avoid when filing the report

One of the critical mistakes to avoid when filing a quarterly treasurers report is missing deadlines, which can lead to penalties or reduced trust from stakeholders. Timely submissions ensure that all interested parties are informed and that the organization operates smoothly. Additionally, errors in data entry can occur, emphasizing the necessity of double-checking figures and calculations to ensure accuracy.

Another common issue is failing to keep documentation organized, which can lead to confusion and incomplete reporting. By adopting best practices such as systematically labeling records and utilizing digital storage, organizations can maintain thorough records that streamline the preparation of reports.

Best practices for effective financial reporting

Maintaining transparency is a fundamental principle in financial reporting. When organizations provide clear and accessible financial reports, they foster trust with board members, stakeholders, and community members. This practice builds goodwill and assures members that financial resources are being utilized effectively. Encouraging board review and external audits can enhance transparency further, making it easier to spot any discrepancies.

Furthermore, striving for continuous improvement in the reporting process is essential. Collecting feedback after each reporting cycle allows teams to refine their approaches and address any recurring issues. Analyzing past reports also equips treasurers to anticipate future challenges and adapt their strategies proactively, ultimately supporting organizational goals.

Frequently asked questions (FAQs)

One common question surrounding the quarterly treasurers report is what to do if data is missing. In such cases, it's critical to document that a data gap exists and to follow up to fill these gaps as quickly as possible. Communication with relevant teams or members can facilitate this process.

Another frequent inquiry is about how often the report should be reviewed after submission. Regular reviews should be scheduled at least quarterly to ensure that financial strategies remain aligned with organizational goals, prompting necessary adjustments in financial management.

Additionally, users often wonder if they can amend the report post-submission. While it can depend on the governing policies of the organization, it is generally advisable to formally document any necessary adjustments and provide context to explain the amendments.

Additional support and guidance

Accessing support from financial experts can be immensely beneficial when handling quarterly treasurers reports. Organizations should establish clear lines of communication with their finance team and consider reaching out to local accounting firms for additional assistance or resources. Networking through community forums focused on financial administration can also facilitate knowledge sharing among peers facing similar challenges.

Moreover, participating in training webinars is an effective means of enhancing financial reporting skills. These sessions often cover essential topics, from navigational support for specific tools like pdfFiller to deeper dives into best practices for financial integrity and transparency, ensuring that you are equipped to complete the quarterly treasurers report form effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in quarterly treasurers report?

How can I fill out quarterly treasurers report on an iOS device?

How do I complete quarterly treasurers report on an Android device?

What is quarterly treasurers report?

Who is required to file quarterly treasurers report?

How to fill out quarterly treasurers report?

What is the purpose of quarterly treasurers report?

What information must be reported on quarterly treasurers report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.