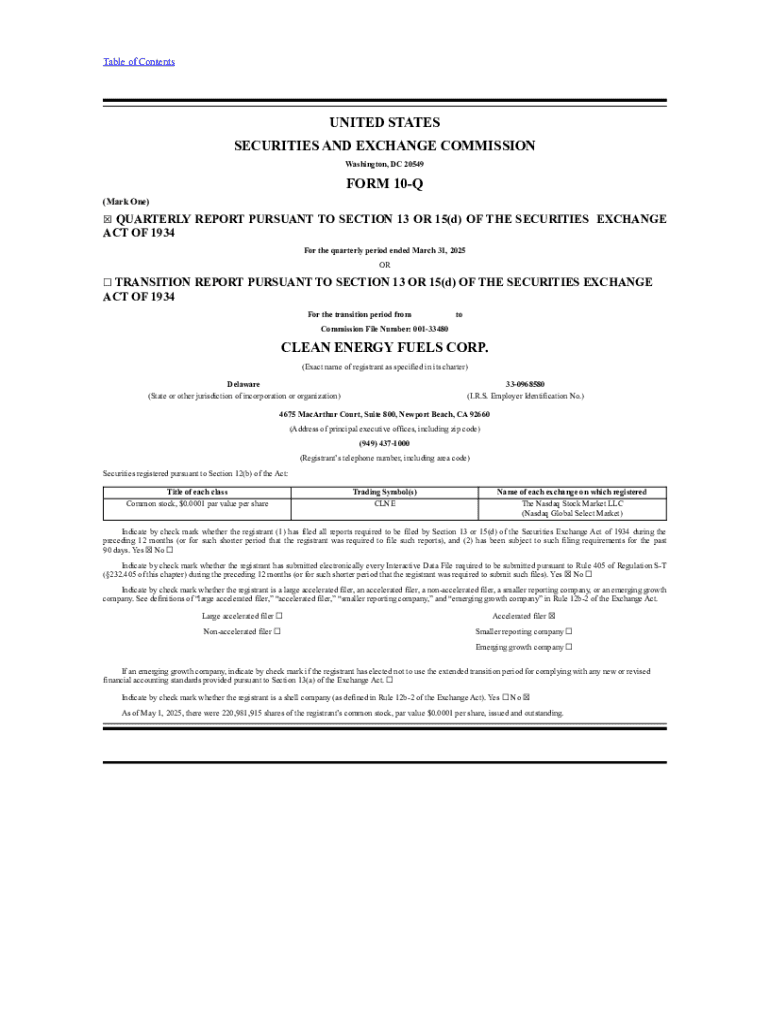

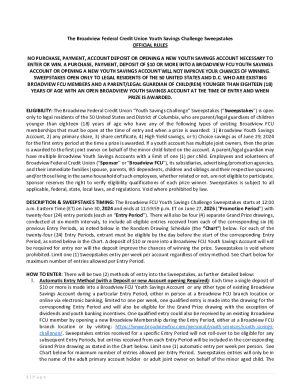

Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A Comprehensive How-to Guide

Understanding Form 10-Q

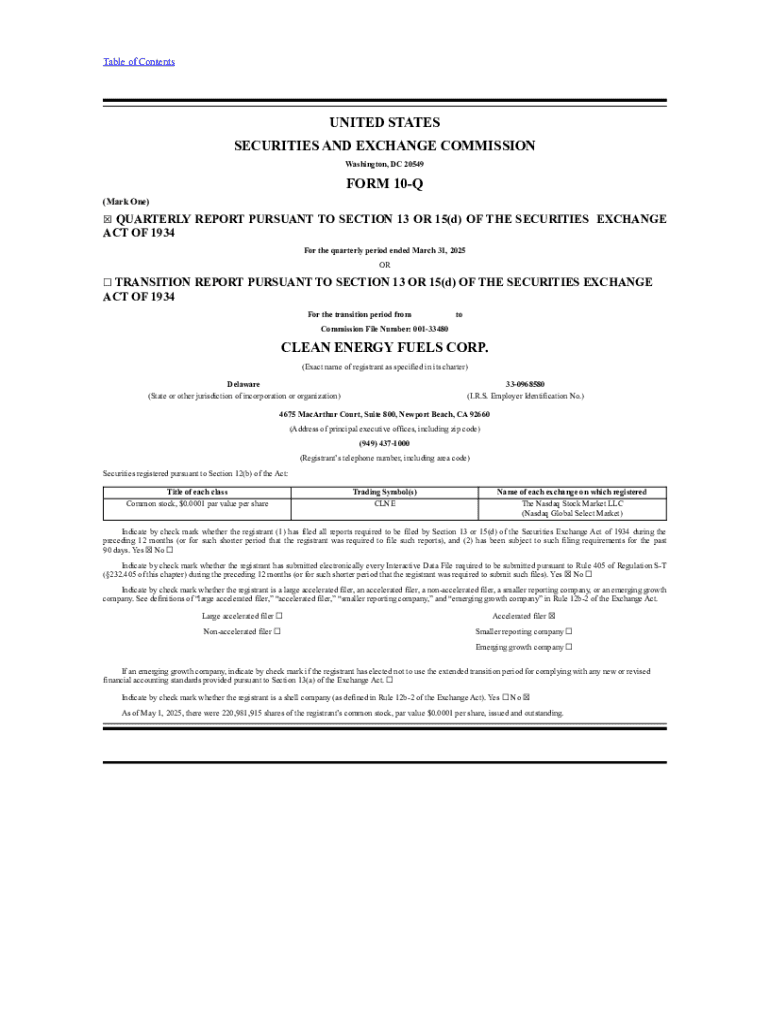

Form 10-Q is a quarterly report mandated by the Securities and Exchange Commission (SEC) for publicly traded companies. This document provides shareholders and the public with a thorough overview of a company's financial performance over a quarter. Unlike the annual Form 10-K, which offers an extensive annual snapshot, the 10-Q is focused on providing timely financial and operational information throughout the fiscal year.

The importance of the Form 10-Q lies in its ability to keep investors informed about a company's financial condition. It serves as a tool for transparency, allowing stakeholders to monitor financial health and operational changes. By releasing quarterly updates, companies disclose real-time information that can impact share prices.

Structure and components of Form 10-Q

A Form 10-Q is structured into several key sections that help convey essential data. The principal sections typically include financial statements, management's discussion and analysis (MD&A), and disclosures regarding market risks. Each of these parts plays a pivotal role in presenting a holistic view of a company's performance.

Financial statements, which include the balance sheet, income statement, and cash flow statement, form the core of the 10-Q. Management's discussion and analysis offers insight into the figures reported, while disclosures provide context on external factors that could affect performance.

Key items required in Form 10-Q

The SEC mandates specific items that companies must include in their Form 10-Q. Each item serves to enhance regulatory compliance and bolster transparency. Among the critical required elements are the financial statements, management’s analysis, disclosures of market risk, and a section dedicated to controls and procedures.

It’s essential to understand that each of these items has particular requirements. For instance, the financial statements must be reviewed by an independent auditor, while the MD&A should present a clear narrative that explains the financial results in layman's terms. Companies often overlook items such as the controls and procedures, which can lead to regulatory scrutiny.

Filing Form 10-Q: Step-by-step guide

Preparing to file Form 10-Q involves several critical steps, starting with the accurate preparation of financial statements. Proper accounting principles must be adhered to, ensuring that all data is both compliant with GAAP or IFRS standards and accurately reflects the company’s financial status.

The management discussion and analysis requires a narrative that not only summarizes the numbers but also offers context for them—discussing strategic decisions, market conditions, and future forecasts. Using tools like pdfFiller can significantly streamline document preparation by allowing for easy edits and collaborative features.

Filing procedures and deadlines

Public companies are required to file their Form 10-Q within a defined timeline—specifically within 40 days after quarter-end. Understanding these deadlines is crucial for maintaining regulatory compliance and ensuring timely financial communication with investors.

There are possible grace periods to consider, but relying on extensions can be risky. Failing to meet these filing deadlines can lead to penalties, increased scrutiny from regulators, and potentially, loss of public trust.

Common challenges and solutions in filing Form 10-Q

Companies often face challenges when preparing Form 10-Q. Incomplete information or errors in financial statements can lead to complications not only in the filing process but also in subsequent reporting periods. Thus, ensuring every component of the 10-Q is comprehensively addressed is essential.

To avoid common pitfalls, such as overlooked disclosures or inaccuracies, companies should foster collaborative environments where multiple stakeholders participate in the preparation process. Regular reviews and checks can help mitigate errors before filing.

Resources for tracking and accessing Form 10-Q

Investors and analysts can easily access filed Form 10-Qs through several platforms. The SEC’s EDGAR database is the primary source for public filings, providing a searchable repository of documents across industries. Additionally, companies’ investor relations websites may host their filings alongside other significant information.

Utilizing monitoring tools can also help keep stakeholders informed about new filings. Thanks to services like pdfFiller, users can simplify the process of tracking needed documents and subsequent updates.

Enhancing your Form 10-Q filing process

Leveraging document management solutions can dramatically streamline the filing process for Form 10-Q. With tools like pdfFiller, users can manage, edit, and sign documents from a single cloud-based platform, enhancing collaboration among team members.

Utilizing collaborative tools allows for seamless input from various stakeholders, improving the quality of the 10-Q. Regular updates and shared access help ensure that everyone is on the same page, making the document preparation smoother.

Case studies and examples

Analyzing well-prepared Form 10-Qs can provide valuable insights into the best practices across various industries. Observing companies renowned for their transparency can serve as benchmarks for others. For instance, large tech firms like Apple and Google exemplify how to articulate their MD&A effectively, showcasing clarity and financial strategic insights.

Conversely, examining filings that faced scrutiny reveals frequent missteps related to vague disclosures and inaccuracies in financial statements. Learning from such outcomes is critical for companies aiming to maintain compliance and protect their reputations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the form 10-q form on my smartphone?

How do I edit form 10-q on an Android device?

How do I fill out form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.