Get the free New Accounts Report

Get, Create, Make and Sign new accounts report

How to edit new accounts report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new accounts report

How to fill out new accounts report

Who needs new accounts report?

Understanding the New Accounts Report Form: Your Comprehensive Guide

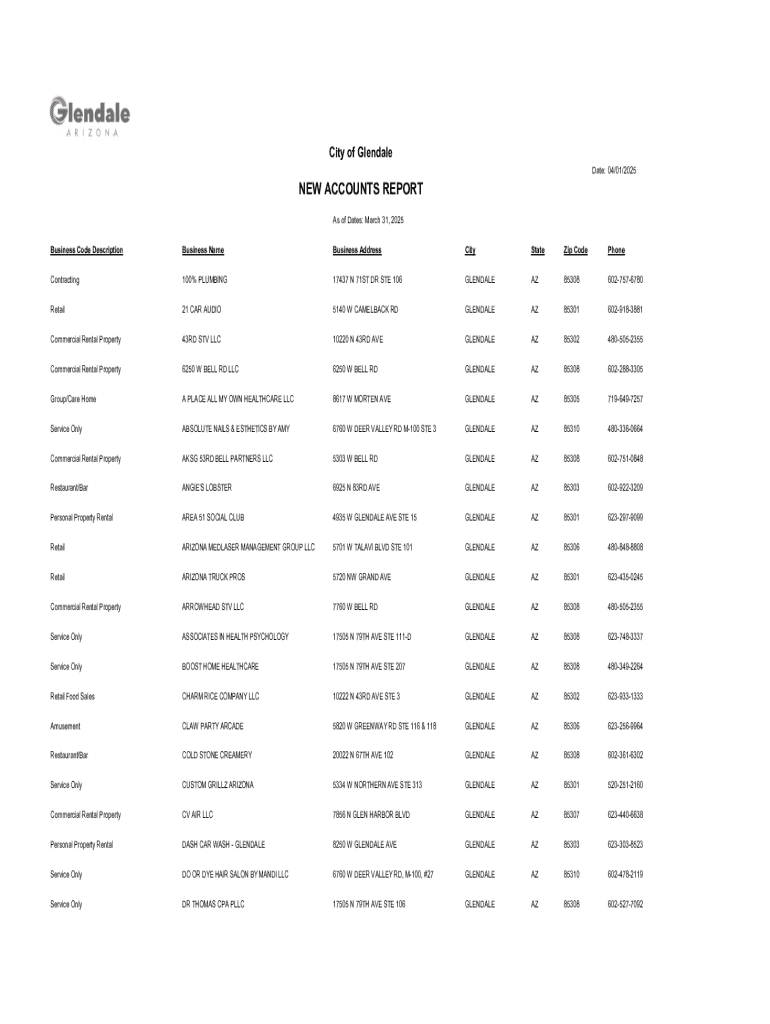

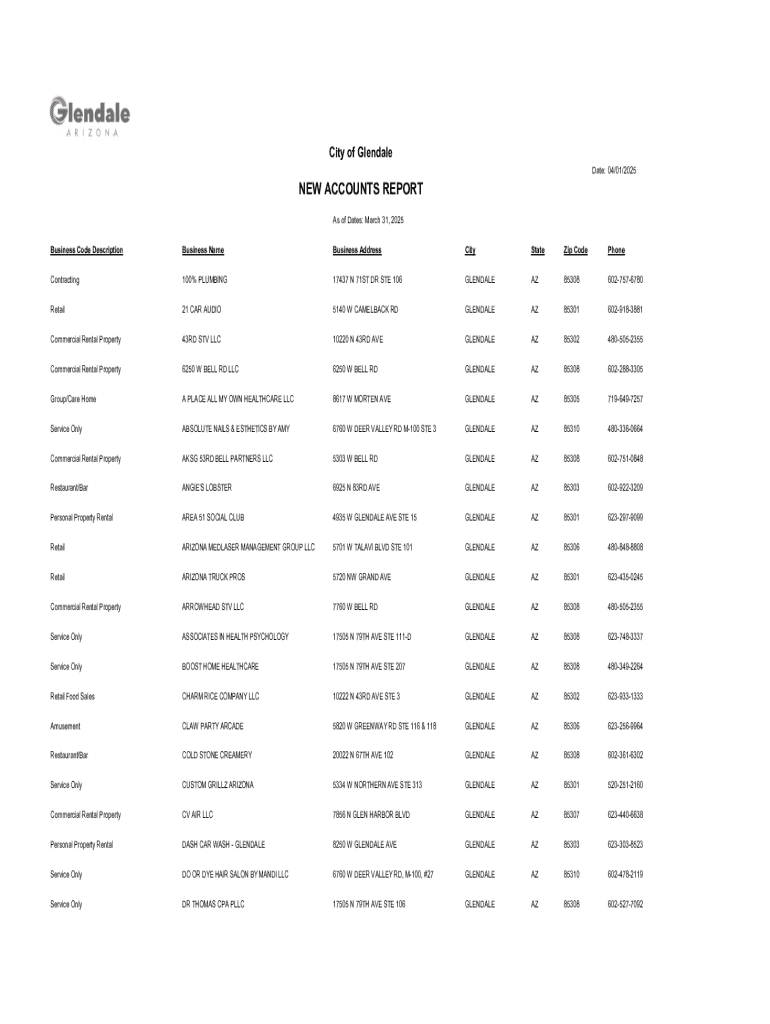

Understanding the new accounts report form

The new accounts report form is a crucial document for those opening new accounts, especially in relation to banking and financial services. Its primary purpose is to help governmental authorities track financial activities and ensure compliance with regulations regarding the reporting of accounts to reduce money laundering and other financial crimes.

Filing a new accounts report is not just a formality. It serves a significant role in maintaining financial integrity and security. Entities such as banks and their clients alike must understand their responsibilities to accurately complete this report. Individuals often wonder who needs to file this report; generally, it is mandatory for financial institutions to report any new accounts, especially those meeting certain thresholds.

Key sections of the new accounts report form

The new accounts report form is divided into several key sections, each designed to capture specific types of information essential for regulatory compliance. Understanding each section is vital for proper reporting.

PART : Basic information

This section requests essential details about the account holder, including name, address, social security number or taxpayer identification number, and account type. It's imperative to ensure that the information is accurate since errors could lead to compliance issues.

Types of accounts that need reporting include savings accounts, checking accounts, and investment accounts. Each has different thresholds for reporting, dependent on the governing regulations.

PART : Transaction details

Part II focuses on transaction details, including reporting thresholds and criteria. Transactions above specific dollar amounts usually trigger additional reporting requirements. Maintaining meticulous records of all account transactions is vital, as financial institutions may need to present these records upon request.

PART : Income and tax implications

In this section, you will report any income generated by the new account. Understanding potential tax liabilities linked to earned interest is crucial, as it often affects the filer’s annual tax returns. Account holders should consult with an attorney or tax advisor for clarity on these implications.

Step-by-step guide to filling out the new accounts report form

Completing the new accounts report form can seem daunting, but a structured approach can demystify the process. Follow these steps for a streamlined experience.

Gathering necessary information

Before filling out the form, secure all necessary documentation, including identification, proof of residence, and prior tax returns if required. Take a comprehensive list of required details to avoid scrambling at the last minute.

Ensure that all information is collected accurately; discrepancies can lead to rejection of the form. Use spreadsheets or checklists to track collected information effectively.

Accessing the form

To find the new accounts report form, visit the relevant government agency's website. Often, these forms are downloadable PDFs. The pdfFiller website also provides easy access to these forms, streamlining the filling process.

Completing each section

Every segment of the form must be methodically filled out. Start with Part I and ensure all information is accurate. As you navigate through each part, double-check all entries to avoid common errors, such as typographical mistakes in social security numbers or misreporting transaction amounts.

Editing and customizing the new accounts report form

One of the standout features of pdfFiller is its editing tools, which facilitate customization of the new accounts report form to suit individual needs. This is particularly useful if a user needs to update information mid-process.

Using pdfFiller's editing tools

The platform allows users to add information where needed, delete sections that are irrelevant, and approach formatting issues with ease. This flexibility means that changes can be executed quickly without having to start from scratch.

Collaboration capabilities

Filing a new accounts report can often involve multiple parties. PdfFiller allows users to invite team members to review the form, making it easy to collaborate on changes and gather input from necessary stakeholders. Setting clear guidelines for collaboration ensures the process remains streamlined and efficient.

Signing the new accounts report form

Signing the new accounts report form is another step that cannot be overlooked. With advances in technology, options for electronic signatures have emerged, making the signing process more convenient.

eSigning options

The benefits of electronic signatures include speed and convenience. Using pdfFiller, users can securely eSign their forms, ensuring confidentiality and compliance with legal standards.

Legal considerations

It is crucial to be aware of the legal validity of electronic signatures. In the United States, electronic signatures are generally recognized as legally binding if they meet specific criteria. Users must fully comply with regulations related to electronic documentation to avoid legal challenges.

Submitting the new accounts report form

After completing and signing the new accounts report form, the next step is submission. This can be done online or via traditional mailing methods depending on the guidelines specified by the respective authority.

Options for submission

Online submission is generally faster and allows for immediate confirmation of receipt. Using a platform like pdfFiller can also provide tools for tracking submission status, ensuring users know when their form has been officially received.

After submission checklist

Once the form has been submitted, confirm receipt of the report through written communication from the relevant authorities. Maintaining copies for personal records and future references is essential, as this documentation can be critical for audits and inquiries.

Troubleshooting common issues

Filling out and submitting the new accounts report form can sometimes lead to confusion or complications. Understanding how to solve common problems is important for a smooth experience.

FAQs regarding the new accounts report form

Most frequently asked questions revolve around filing deadlines, required documents, and how to report discrepancies. Engaging with these concerns early can save time and effort down the road.

Customer support contacts

If issues arise during the process, users can turn to pdfFiller support for help. The website offers extensive online resources, tutorials, and direct customer service paths to resolve challenges quickly.

Real-life use cases and scenarios

Practical insights and testimonials can underscore the importance and efficiency of using the new accounts report form effectively.

Case study: A business perspective

Consider a case where a small business streamlined its reporting processes through pdfFiller. By utilizing the platform, they reported all new accounts accurately and efficiently, complying with regulations without hassle. They credited pdfFiller for saving time and reducing stress when managing financial documents.

Individual experiences

Individuals have also shared their positive experiences using the platform. Users often highlight how the collaboration features allowed them to work with financial advisors seamlessly, ensuring accuracy in their accounts reporting.

Best practices for managing new accounts reporting

As regulations and requirements evolve, it's essential for teams and individuals alike to adapt accordingly.

Regular training for teams

Conducting regular training sessions ensures that all team members stay up-to-date on reporting requirements. This awareness significantly reduces errors and ensures timely reporting of new accounts.

Utilizing pdfFiller for ongoing document management

Storing and organizing completed documents in pdfFiller allows for easy access in the future. Users can create a logical filing system that simplifies finding previous reports when needed.

Staying informed about regulatory changes

Resources such as government websites and professional organizations can help individuals and businesses monitor updates in reporting requirements. Staying informed is crucial to avoiding potential penalties for non-compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out new accounts report using my mobile device?

How do I edit new accounts report on an iOS device?

How do I fill out new accounts report on an Android device?

What is new accounts report?

Who is required to file new accounts report?

How to fill out new accounts report?

What is the purpose of new accounts report?

What information must be reported on new accounts report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.