Get the free NYCTL 2019 - Combined Regular and Subsequent Sale - Web File v4-Combined.xlsx

Get, Create, Make and Sign nyctl 2019 - combined

How to edit nyctl 2019 - combined online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nyctl 2019 - combined

How to fill out nyctl 2019 - combined

Who needs nyctl 2019 - combined?

Navigating the NYCTL 2019 Combined Form: A Comprehensive Guide

Understanding the NYCTL 2019 - Combined Form

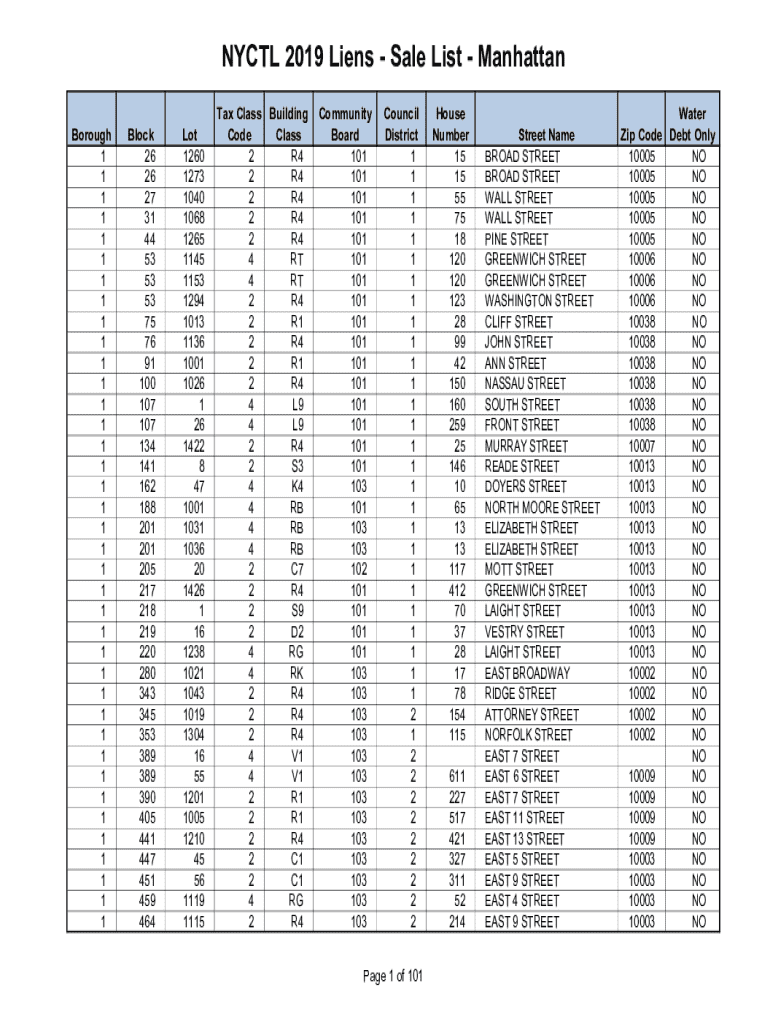

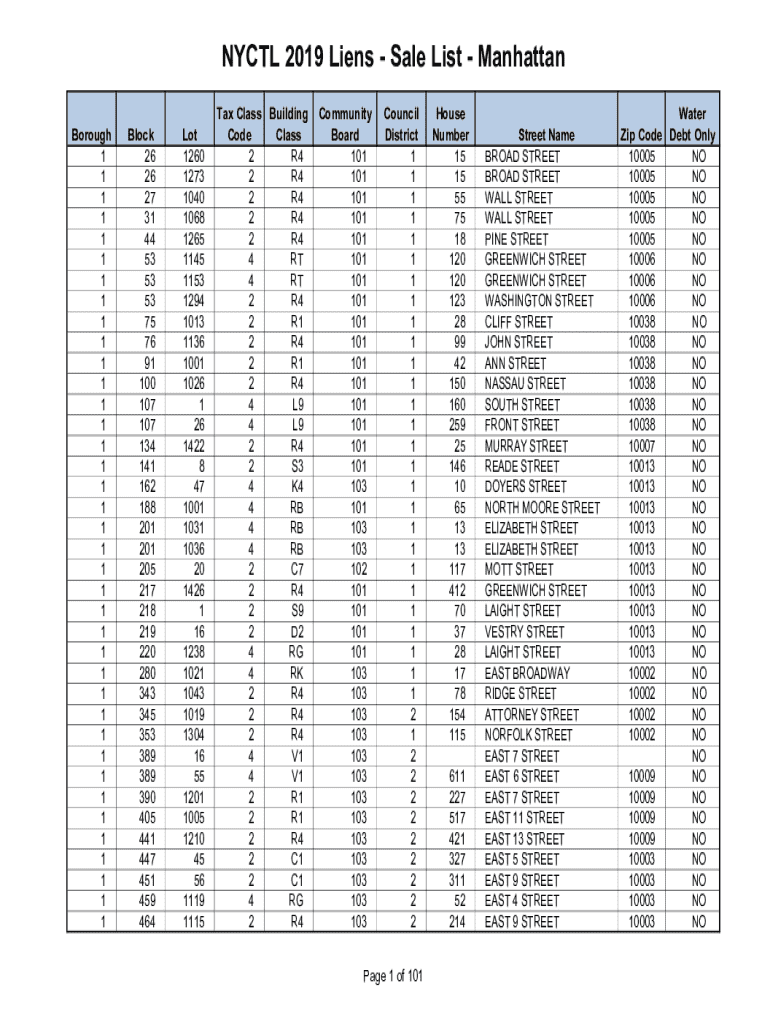

The NYCTL 2019 - Combined Form serves as an essential tool for taxpayers and businesses in New York. The New York City Tax Lien Certificate (NYCTL) program aims to collect overdue property taxes through the sale of tax lien certificates. By using the Combined Form, taxpayers can consolidate multiple tax obligations, making the process of filing simpler and more efficient.

The significance of the Combined Form extends beyond simplification; it helps ensure compliance with local tax laws. By accurately filling out the NYCTL 2019 Combined Form, individuals and corporations can clarify their tax status and sometimes even reduce penalties associated with late payments. This guide will delve into critical elements included in the 2019 Combined Form and provide comprehensive support on how to navigate its complexities.

Eligibility criteria for filing the NYCTL 2019 Combined Form

Not every taxpayer is required to file the NYCTL 2019 Combined Form. Generally, individuals or businesses with outstanding property tax liabilities must submit this form to resolve their tax obligations. However, the requirements can vary based on the specific circumstances surrounding each taxpayer’s financial situation.

Exceptions may apply, such as when a taxpayer has applied for an extension or when certain exemptions, such as those for senior citizens or veterans, are in effect. Additionally, New York State has established income thresholds that determine the necessity to file. Taxpayers exceeding these thresholds typically have tax obligations that necessitate filing this Combined Form.

Step-by-step guide to filling out the NYCTL 2019 Combined Form

Successfully filing the NYCTL 2019 Combined Form begins with gathering accurate information. Documents such as previous tax returns, property tax statements, and income statements are essential in ensuring you provide appropriate data for each section. A common pitfall while preparing the form is neglecting to update financial information, which can lead to errors that delay processing.

When you're ready to fill out the form, begin with personal information like your name and address. You'll then report your financial situation, including income from various sources and any deductions applicable to your case. Lastly, ensure that the taxes and credits sections reflect any eligible credits that can be claimed to reduce overall taxes owed. Careful attention to detail is crucial at each stage.

Reviewing your form

Finalizing your NYCTL 2019 Combined Form requires a thorough review to ensure accuracy. Common errors include miscalculating income, omitting deductions, or incorrect personal information. To mitigate these issues, double-check your entries, or even involve someone else for a second opinion. Cross-verifying against previous tax filings can also illuminate discrepancies or missing details.

Consistency is key; ensure that all personal and financial details match across any documents submitted. Additionally, printing out a copy of the form and manually checking it can often highlight errors missed on-screen. Taking these extra steps can save you significant time and frustration later.

Editing and modifying the NYCTL 2019 Combined Form

Editing the NYCTL 2019 Combined Form has become increasingly manageable thanks to tools like pdfFiller, which allows for seamless modifications. Users can leverage various interactive tools to add or remove information, and ensure compliance with the latest tax regulations. The cloud-based platform ensures that your editing can be done from any location, making it an ideal choice for busy professionals.

When modifying the form, always ensure to maintain the integrity of the original information. Adding annotations or notes might be beneficial, particularly if you're collaborating with others or if you're uncertain of specific entries. Always save revisions and changes separately until confident the form is accurate before finalization.

Signing and submitting the NYCTL 2019 Combined Form

Once your NYCTL 2019 Combined Form is complete, the next step is signing and submitting. The digital age provides various options for electronic signatures, which can be done easily with platforms like pdfFiller. Using eSign simplifies the process, allowing users to sign documents from anywhere without the hassle of printing and scanning.

Submission channels also vary, with options to submit online or via traditional mail. Keeping an eye on submission deadlines is crucial; missing these can lead to cumbersome penalties. It’s prudent to set reminders ahead of key dates, thus ensuring timely compliance with tax obligations.

Tracking and managing your NYCTL submission

After submission, tracking the status of your NYCTL 2019 Combined Form is essential for peace of mind. Utilizing online tracking tools, you can stay informed about whether your submission has been accepted or if additional information is required. If your form is rejected, immediate steps should be taken to rectify the issues highlighted by the tax authority.

Record-keeping practices are also vital. Ensure you have copies of submitted forms along with relevant correspondence with tax authorities. Robust documentation will come in handy should discrepancies arise in the future, helping to safeguard against issues that could hinder your financial standing.

Common questions about the NYCTL 2019 Combined Form

As with any complex form, inquiries surrounding the NYCTL 2019 Combined Form are common. Taxpayers often wonder about the specific requirements for filing, potential penalties for late submission, and the types of deductions available. Addressing these frequently asked questions can provide clarity and confidence as you proceed with the filing process.

Industry professionals typically emphasize the importance of understanding not only the form itself but also the broader context of tax obligations in New York. Seeking guidance from tax consultants can also provide tailored advice specific to your situation, helping mitigate common issues that arise during preparation.

Comparative analysis: NYCTL 2019 Combined Form vs. previous years

Each year, tax forms can undergo changes based on new regulations or shifts in fiscal policy. The NYCTL 2019 Combined Form introduced specific updates compared to its predecessors. Understanding these shifts not only offers insight into evolving tax obligations but also prepares taxpayers better for their future filings.

Industry professionals point out that taxpayers should remain vigilant about these updates, particularly those that may impact commonly used deductions or new adherence requirements that could arise within school district business leaders and others involved in New York State education governance. Early adoption of revised forms can streamline the filing process and help avoid last-minute complications.

Leveraging pdfFiller for a seamless form experience

pdfFiller offers users beyond just the NYCTL 2019 Combined Form to streamline all document management processes. Its cloud-based system enables individuals and teams to access, edit, and store documents securely, promoting easier collaboration. This platform not only reduces paperwork but enhances user experience by providing various features tailored for business professionals and individuals.

User testimonials highlight how pdfFiller’s functionalities have eliminated the daunting nature of paperwork. Individuals remark that having a single platform to handle multiple documents significantly cuts down on filing time and errors. Embracing technology not only makes the filing of the NYCTL Combined Form smoother but the overall management of documentation more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nyctl 2019 - combined for eSignature?

How do I make changes in nyctl 2019 - combined?

How do I fill out the nyctl 2019 - combined form on my smartphone?

What is nyctl - combined?

Who is required to file nyctl - combined?

How to fill out nyctl - combined?

What is the purpose of nyctl - combined?

What information must be reported on nyctl - combined?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.