Get the free Payroll Check Stub Template Example

Get, Create, Make and Sign payroll check stub template

How to edit payroll check stub template online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll check stub template

How to fill out payroll check stub template

Who needs payroll check stub template?

Payroll Check Stub Template Form: A Comprehensive Guide

Understanding the payroll check stub template

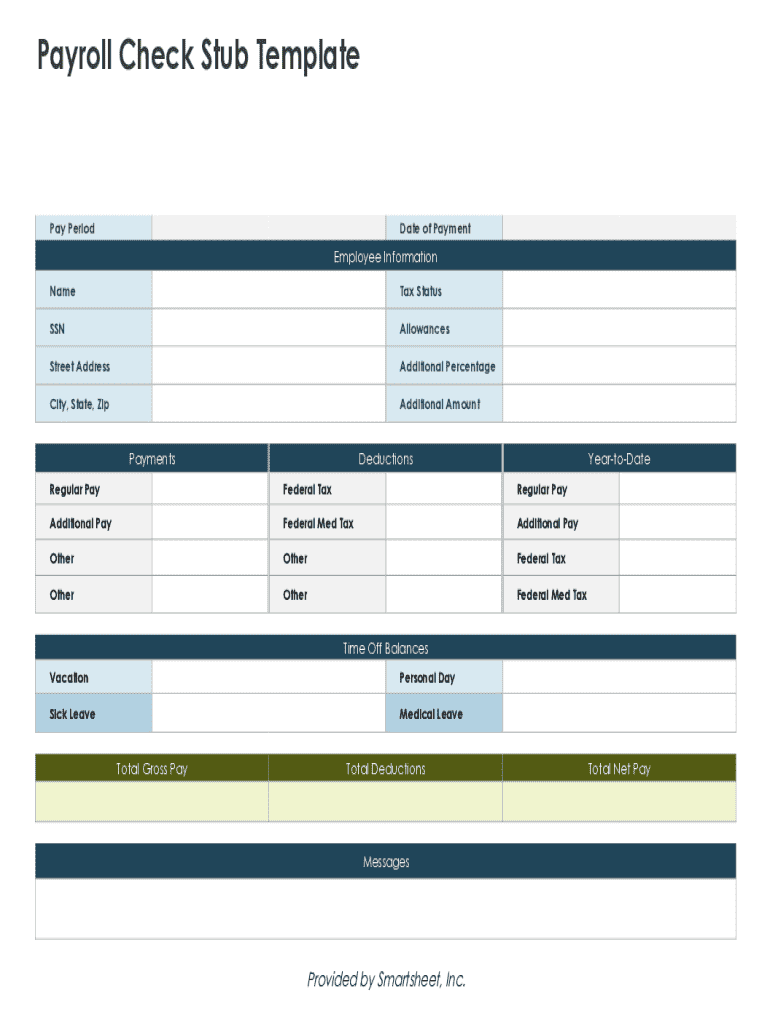

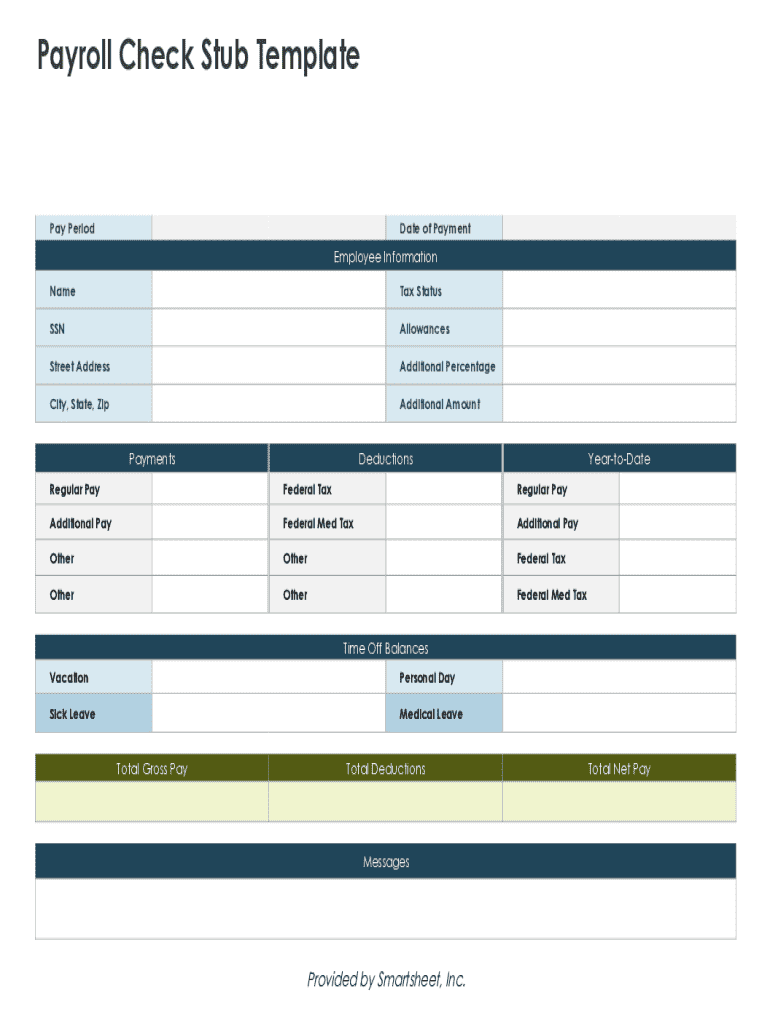

A payroll check stub is an essential document that captures critical information regarding an employee’s earnings, deductions, and personal details during a specific pay period. Employers provide these stubs to ensure transparency and help employees learn about their payment breakdown.

For both employees and business owners, payroll check stubs convey vital financial information. Employees utilize these stubs as proof of income and for tax purposes, while employers maintain records for accounting, compliance, and auditing. Incorporating accurate payroll check stub template forms into your business workflow streamlines payroll processing while enhancing employee trust.

Benefits of using a payroll check stub template

Utilizing a payroll check stub template form simplifies record-keeping, making it effortless for employers to track employee payments accurately. Instead of reinventing the wheel every pay period, businesses can customize existing templates for efficiency. Simplicity translates to accuracy — thus, minimizing mistakes that can arise with manual calculations.

Moreover, payroll check stubs serve as official proof of income, which can be beneficial for employees applying for loans, rentals, or other financial opportunities requiring verification of earnings. This assurance fosters a sense of transparency, contributing to better relationships between management and staff. The adoption of templates also significantly reduces processing times, allowing payroll departments to focus on more strategic tasks rather than mundane paperwork.

Types of payroll check stub templates available

Choosing the right payroll check stub template largely depends on your needs and preferences. There are two primary categories: digital templates, which can be edited online, and printable templates that can be filled out by hand. Each has its benefits, depending on how your business operates. Digital templates allow for instant adjustments and online accessibility, making them ideal for remote teams.

Customizable templates cater to specific industries, aligning with diverse requirements. For instance, contractors or freelancers may need different forms than traditional corporate employees. Additionally, you can find options ranging from free templates, which typically include basic features, to premium offerings that provide advanced functionalities like automated calculations and extensive reporting capabilities.

How to choose the right payroll check stub template

Selecting the appropriate payroll check stub template requires consideration of various factors. A business owner should evaluate the size and structure of their company to determine the best format for their needs. Smaller businesses might favor simpler, more straightforward templates, while larger corporations often benefit from comprehensive forms that accommodate a higher volume of information.

Another factor to consider is the type of employment. Full-time employees typically have more fixed wages and deductions, while part-time workers or freelancers may have variable earnings that require a different template. Furthermore, your specific information needs, such as tax withholding or bonuses, will drive the choice of template you utilize. Knowing this will ensure that the chosen payroll check stub template form aligns with your business' requirements.

Designing a payroll check stub template

An effective payroll check stub template features essential components and a user-friendly layout. When designing your template, think about the clarity of each section. Utilizing a structured format with distinct areas for employee and employer information, pay period dates, and pay breakdown promotes readability. Engaging designs, including brand identifiers like company logos and colors, reflect professionalism and may help in building trust with employees.

Compliance with state and federal regulations is critical. Ensure your payroll check stub template conforms to local guidelines regarding disclosures and mandatory information. Regularly updating templates to comply with changes in tax laws or employment regulations is crucial as it avoids legal complications and maintains payroll accuracy while safeguarding both employees and the organization.

Step-by-step guide to filling out a payroll check stub template using pdfFiller

Filling out a payroll check stub template using pdfFiller is a straightforward process that can be accomplished in just a few steps. Begin by accessing the template you require from pdfFiller's extensive library. The platform offers a variety of templates that can be quickly modified to suit your needs.

After choosing the desired template, you’ll need to input employee information, including their name and identification number. Next, specify the pay period and list earnings, clearly breaking down gross pay and any applicable bonuses. Finally, include all deductions, such as taxes and any contributions the employee makes towards benefits, before finalizing and saving the document.

Editing and customizing your payroll check stub template

Once you have filled out your payroll check stub template, you may find that you need to make additional customizations. pdfFiller provides a plethora of tools that allow users to personalize documents in various ways. You can add text notes to clarify any specific items, upload additional documents that might be necessary to accompany the stub, or integrate specific branding elements to reinforce company identity.

While customizing, ensure that you maintain the clarity and usability of the template. Consider adhering to best practices, such as limiting font styles and sizes for consistency and ensuring the layout remains user-friendly. By making thoughtful adjustments, you can create a payroll check stub template that is tailored to both your business needs and those of your employees.

eSigning and sharing payroll check stub templates

Digital signatures have simplified the payroll process significantly. eSigning payroll check stub templates ensures that all parties validate the document while maintaining a secure electronic record. With pdfFiller, electronically signing the template is an easy task that adds a layer of legitimacy to the documents exchanged between employers and employees.

Once the document is eSigned, sharing these stubs with employees can be managed securely through pdfFiller's platform. Users can send documents directly via email or provide access through a shared link. This streamlining of communication helps keep all parties in the loop, minimizing the risk of miscommunication regarding earnings, deductions, and overall pay.

Managing payroll check stub records

An organized approach to managing payroll check stub records is critical for both ongoing payroll operations and compliance. Establishing a clear system for storing these documents safely ensures that both employee privacy and company records are protected. Effective tools, like those provided by pdfFiller, allow for easy categorization and retrieval of documents, significantly reducing time spent on administrative tasks.

Additionally, maintaining best practices for data security and privacy is paramount. Utilize encrypted storage solutions, apply access controls, and regularly update your document management policies to mitigate data vulnerabilities. Implementing a solid framework for ongoing payroll management will not only help in handling issues efficiently but also foster trust and integrity between employers and their employees.

FAQs about payroll check stub templates

Many questions arise regarding payroll check stubs, primarily concerning their purpose and function. Employees often inquire about how much detail needs to be included, while employers may struggle with compliance and regulatory requirements that change frequently. Understanding these nuances is vital for all parties involved, ensuring employees receive the correct remuneration while the business remains compliant.

Additionally, troubleshooting issues with payroll check stub templates can be simplified by visiting dedicated resources or forums specifically designed for payroll queries. Investing the time to familiarize yourself with the capabilities of the payroll check stub template will heighten overall proficiency in managing these important documents.

Final thoughts on using payroll check stub templates

Leveraging the power of a robust payroll check stub template form can drastically improve the efficiency of payroll processing. By utilizing pdfFiller's capabilities, businesses can seamlessly manage these documents from a single platform—editing, eSigning, and sharing with ease. The result is a streamlined payroll process that saves time, reduces errors, and enhances overall transparency across the organization.

Adopting these practices not only improves current operations but also positions your workforce for effective management of documentation. As the landscape of payroll evolves, embracing technology like pdfFiller will ensure that your employee payment processes remain efficient and compliant.

Interactive tools and resources

To jumpstart your payroll management journey, pdfFiller provides quick links to download various payroll check stub templates tailored for different business needs. Dive into tutorials and video guides that walk you through using pdfFiller effectively, ensuring that you maximize the utility of this versatile document creation platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit payroll check stub template from Google Drive?

Can I edit payroll check stub template on an iOS device?

Can I edit payroll check stub template on an Android device?

What is payroll check stub template?

Who is required to file payroll check stub template?

How to fill out payroll check stub template?

What is the purpose of payroll check stub template?

What information must be reported on payroll check stub template?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.