Get the free Maryland Supplemental Retirement Plan Contribution Change Form

Get, Create, Make and Sign maryland supplemental retirement plan

How to edit maryland supplemental retirement plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland supplemental retirement plan

How to fill out maryland supplemental retirement plan

Who needs maryland supplemental retirement plan?

Comprehensive Guide to the Maryland Supplemental Retirement Plan Form

Understanding the Maryland Supplemental Retirement Plan

The Maryland Supplemental Retirement Plan (MSRP) is designed to help state employees and public school employees in Maryland save for retirement. It acts as a supplemental savings plan aimed at enhancing the financial security of participants upon retirement. Unlike regular pensions, this plan empowers individuals to manage their contributions and investments actively, providing a range of options tailored to meet diverse financial goals.

The MSRP comprises various retirement accounts, including 401(k) plans and Individual Retirement Accounts (IRAs), allowing employees to choose the best fit for their individual circumstances. This flexibility is one of the plan's standout features, as it can accommodate participants at different stages of their careers, making it an ideal choice for anyone looking to secure a comfortable retirement.

Who should consider the supplemental retirement plan?

Understanding whether the Maryland Supplemental Retirement Plan is right for you involves evaluating your current financial situation and long-term goals. The primary demographic for this plan consists of state employees and public school personnel, but it also caters to other eligible workers who seek to bolster their retirement savings. A crucial part of determining eligibility is reviewing your participation in other public retirement plans, as being enrolled in such programs may affect the contributions to MSRP.

It is essential for anyone with a keen interest in long-term financial planning to consider the MSRP as it allows for increased savings beyond standard pension plans. Further, those who anticipate late career transitions, job changes, or disruptions might find this supplemental plan particularly beneficial.

Key features of the Maryland Supplemental Retirement Plan

One of the standout features of the Maryland Supplemental Retirement Plan is its wide array of investment options. Participants can choose from mutual funds, fixed and variable annuities, as well as stock and bond options. This diversity allows individuals to tailor their investment portfolios according to their risk tolerance and retirement timelines.

The tax advantages inherent in the MSRP are another crucial element. Contributions to the plan grow tax-deferred, meaning that employees will not owe taxes on their savings or earnings until withdrawals occur. Additionally, contributions to the plan may be deductible from gross income, significantly reducing annual tax liabilities.

It's also vital to note that there are annual contribution limits and guidelines individuals should adhere to. These limits vary based on age, with catch-up contributions available for those aged 50 and older, helping older employees maximize their retirement funding.

The Maryland Supplemental Retirement Plan Form: A step-by-step guide

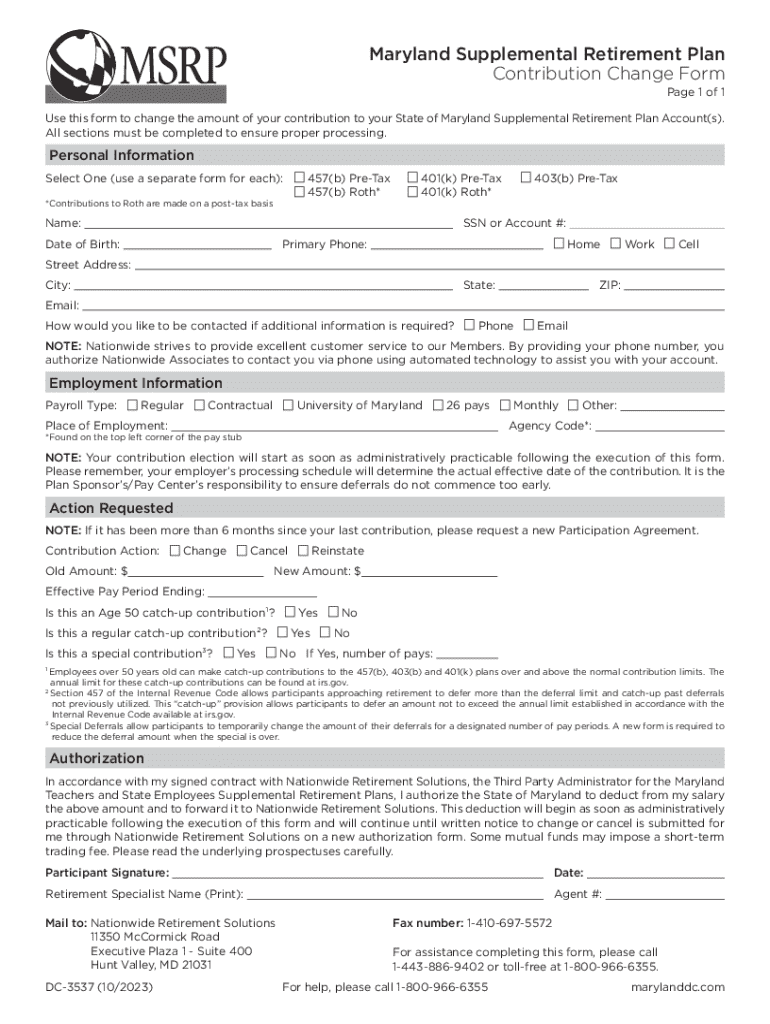

Filling out the Maryland Supplemental Retirement Plan form may seem daunting, but having the right documentation and following a structured approach can make the process seamless. Start by gathering essential documents such as your identification, Social Security Number, and financial information related to your income and assets.

Step 1: Personal Information Section

In this section, you will need to provide your basic details, including your name, address, date of birth, and contact information. It’s crucial to ensure the accuracy of this information, as any discrepancies can lead to complications down the line. Double-check for any common pitfalls, such as typos or incorrect Social Security Numbers, that could delay your application.

Step 2: Employment and income details

Next, report relevant employment and income details carefully. Include your employer's name, your job title, and the total income from all sources, ensuring all income streams are accounted for to avoid under-reporting. This information will be integral in determining your contribution limits and eligibility.

Step 3: Investment elections

Choosing the right investment options relevant to your risk tolerance is crucial. Take the time to evaluate each available investment vehicle listed in the form, as this decision impacts your retirement growth potential. Consulting financial advisors or utilizing online resources can help in making informed decisions.

Step 4: Signing and submitting the form

Finally, ensure you understand the submission method. You can opt for eSigning for convenience or choose traditional methods. If submitting online, ensure you properly follow all prompts to avoid any issues during submission.

Editing and updating your Maryland Supplemental Retirement Plan form

Life changes, such as marriage or a job change, can necessitate updates to your Maryland Supplemental Retirement Plan Form. Regularly reviewing your information is advisable to ensure it reflects your current financial and personal circumstances accurately. Having updated information contributes to better retirement planning.

Accessing and editing your document can be done efficiently using pdfFiller. This tool allows easy modifications, ensuring that you retain document integrity during updates. Familiarize yourself with how to navigate the platform to maximize its utility.

Best practices for managing your retirement form and account

Efficiently managing your retirement account entails actively tracking contributions and growth. Numerous software and tracking tools exist specifically for this purpose. Staying organized can simplify your financial assessments and decisions, ensuring you stay on top of your retirement planning.

Regularly reviewing and adjusting your investment strategy is essential as personal financial circumstances evolve. Periodic rebalancing of investments ensures alignment with your financial goals. Awareness of policies impacting Maryland retirement plans is also crucial; staying informed helps you maximize your participation and benefits.

Frequently asked questions about the Maryland supplemental retirement plan form

Completing the Maryland Supplemental Retirement Plan Form can lead to questions, especially concerning errors made during the process. If an error occurs, promptly contact customer support to receive guidance on rectification steps to prevent any delays in processing your form.

Understanding the policies surrounding changes to investment elections is also critical. Participants should review how often they can change these elections to maximize their investment strategies according to current market conditions. Additionally, ample support exists for form completion through resources offered by pdfFiller and state retirement resources.

Success stories: How individuals have benefited from the Maryland supplemental retirement plan

Numerous participants in the Maryland Supplemental Retirement Plan have reported enhanced financial security as a direct result of their involvement in the program. Notably, individuals who actively participated in investment strategy discussions and made informed decisions about their contributions experienced more significant growth in their retirement savings.

Case studies reveal individuals who took advantage of the catch-up contributions have successfully transitioned into retirement with more than adequate savings, providing peace of mind to them and their beneficiaries. Testimonials highlight the transformative impact of the IMG and financial literacy education they received.

Additional tools via pdfFiller for managing your retirement documents

pdfFiller not only facilitates filling out the Maryland Supplemental Retirement Plan form but also offers features that enhance broad document handling. These interactive tools simplify the process of managing retirement plans and can serve multiple team members responsible for overseeing financial security.

Security features are another critical aspect, with strong encryption ensuring your sensitive information remains protected. High privacy standards enable users to confidently manage their retirement plans without fear of breach.

Contact information for further assistance with the Maryland supplemental retirement plan

For support regarding the Maryland Supplemental Retirement Plan, participants can reach out directly to customer support through pdfFiller. This resource offers comprehensive assistance during the application process and can guide users through intricate forms. Moreover, official Maryland retirement resources provide valuable insights and personalized help as required, ensuring all participants have the tools they need for effective retirement planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute maryland supplemental retirement plan online?

How do I make edits in maryland supplemental retirement plan without leaving Chrome?

Can I create an electronic signature for the maryland supplemental retirement plan in Chrome?

What is Maryland supplemental retirement plan?

Who is required to file Maryland supplemental retirement plan?

How to fill out Maryland supplemental retirement plan?

What is the purpose of Maryland supplemental retirement plan?

What information must be reported on Maryland supplemental retirement plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.