Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

How to edit form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

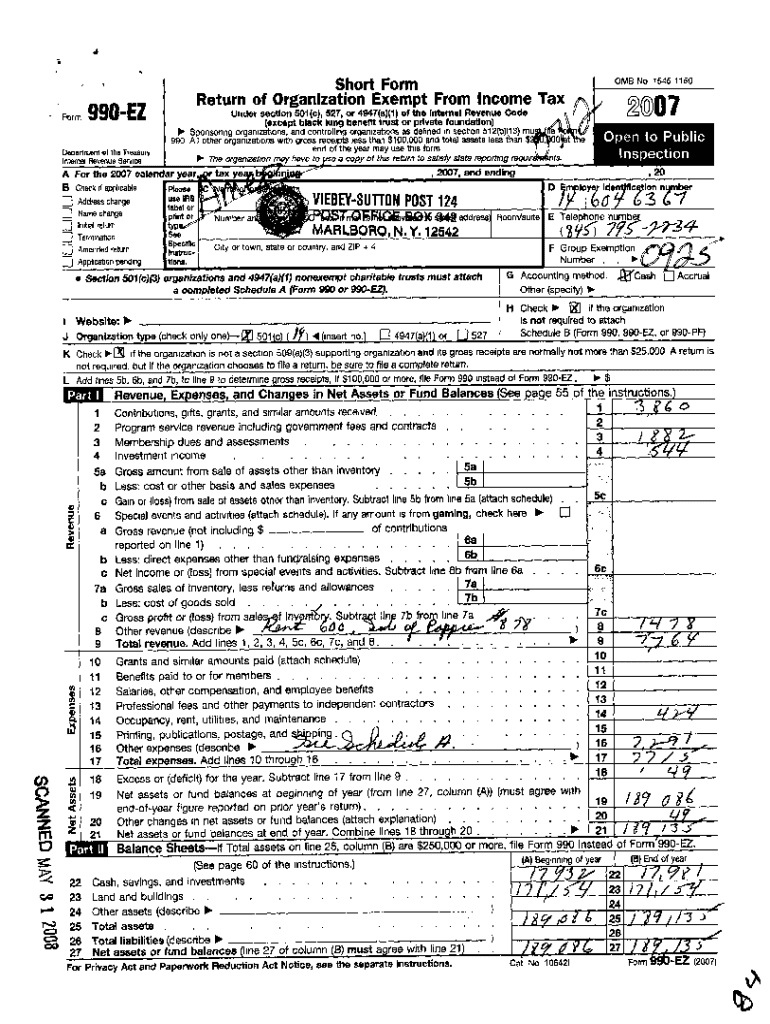

Form 990-EZ: A Comprehensive Guide for Nonprofits

Understanding Form 990-EZ

Form 990-EZ is an essential document that serves as a streamlined version of the more detailed Form 990. Designed specifically for small to medium-sized tax-exempt organizations, it enables these entities to report their financial activities to the IRS. The primary purpose of Form 990-EZ is to provide transparency regarding the organization's financial status and operational activities, ensuring compliance with federal regulations governing tax-exempt status.

Organizations required to file Form 990-EZ typically include those that earn below a certain income threshold and possess total assets under a specified limit. Most often, this applies to charities, foundations, and other nonprofit entities that are classified as tax-exempt by the IRS. By completing this form accurately, organizations can maintain their tax-exempt status and demonstrate their commitment to accountability.

Why choose Form 990-EZ over Form 990?

The choice between Form 990 and Form 990-EZ often comes down to an organization’s size and complexity. Form 990-EZ has fewer reporting requirements, making it easier and more efficient to complete. Small nonprofits often benefit from this simplified approach, allowing them to concentrate on their core missions rather than becoming bogged down with extensive tax filing requirements.

The key differences include the length of the forms, the level of detail required for financial data, and the overall complexity of information being reported. While Form 990 necessitates comprehensive disclosures and may take significantly longer to prepare, Form 990-EZ offers a clear, concise alternative for organizations operating within specific financial limits. Ultimately, opting for Form 990-EZ provides smaller organizations a straightforward pathway to meeting their filing obligations.

Eligibility criteria for using Form 990-EZ

Eligibility for Form 990-EZ is primarily determined by the size and nature of an organization. In particular, tax-exempt organizations that have gross receipts of less than $200,000 and total assets under $500,000 at the end of the year may file Form 990-EZ. This makes it especially relevant for smaller, local nonprofits and community organizations that operate on a modest budget.

It’s important to note that not all organizations will qualify for Form 990-EZ. Organizations deriving their tax-exempt status from specific chapters or different IRS classifications, such as private foundations, often need to submit alternative forms, like the full Form 990. Awareness of these exceptions can help ensure the correct forms are filed in a timely manner.

Preparing to fill out Form 990-EZ

Before diving into completing Form 990-EZ, organizations should gather all essential documents to facilitate accurate reporting. Key documents include financial statements, bank statements, receipts for expenditures, and records of any contributions or grants received throughout the fiscal year. Having this financial data readily available is crucial for ensuring that all reported figures align with the organization's actual financial situation.

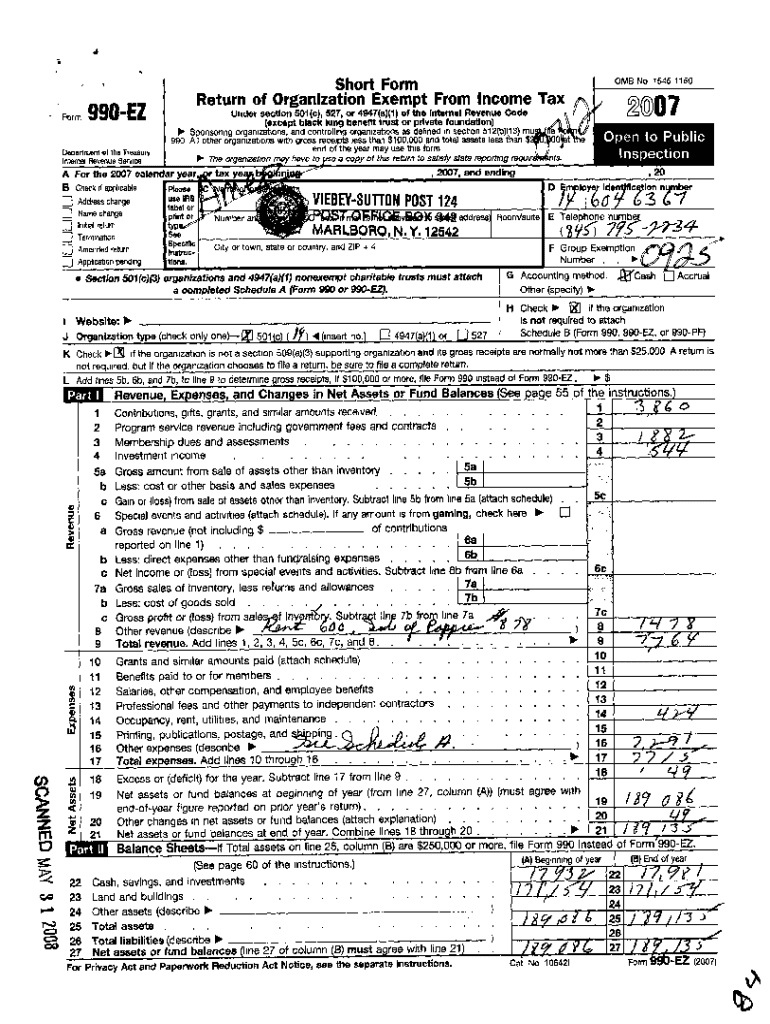

Another critical step involves understanding the sections of Form 990-EZ. The form is divided into five parts: Revenue, Expenses, Net Assets or Fund Balances, Statement of Program Service Accomplishments, and Other Information. Each section requires specific types of information that reflect different aspects of the organization's operations. Focusing on key sections such as revenue generation, expenses incurred, and net assets will provide a clearer view of the organization’s financial health and mission impact.

Step-by-step guide to completing Form 990-EZ

Commencing with Part I, organizations will report total revenue, including contributions and grants. Accurately documenting this section requires a comprehensive understanding of the various revenue sources to ensure that all incoming funds are accounted for properly. Be sure to categorize all revenue accurately to avoid discrepancies during IRS reviews.

Moving to Part II involves detailing expenses. This section is vital as it covers both programmatic expenses—those directly related to the organization’s mission—and administrative expenses, which primarily support operations. Breaking expenses into distinct categories aids in providing clarity and adhering to IRS requirements regarding proper reporting.

Subsequently, Part III requires an overview of net assets or fund balances. Understanding this section involves presenting a balance sheet that reflects the organization’s financial position at the end of the tax year.

In Part IV, organizations need to narrate program service accomplishments succinctly. This section encourages organizations to engage in compelling storytelling that communicates the impact of their work to stakeholders.

Finally, Part V covers other pertinent information, such as governance policies and other inquiries. Responding accurately to the questions posed is essential to complete the form comprehensively.

Common errors to avoid when completing Form 990-EZ

Common pitfalls when filing Form 990-EZ can lead to unnecessary headaches and potential penalties, such as inaccuracies in reported revenue figures or missing sections entirely. Organizations that do not carefully check their financial information may inadvertently trigger audits or necessitate additional filings, consuming valuable resources that could be better spent fulfilling their missions.

To avoid such errors, consider employing a thorough review process that includes multiple stakeholders within the organization. Utilizing pdfFiller’s editing tools can streamline this process by enabling users to efficiently collaborate, refine entries, and ensure all aspects of the form are complete.

Filing Form 990-EZ

Electronic submission of Form 990-EZ through pdfFiller offers a fast and user-friendly approach that enhances efficiency and provides immediate confirmation of your submission. The step-by-step submission guide in pdfFiller ensures that all necessary criteria are met, allowing organizations to file confidently.

Awareness of filing deadlines is equally crucial, as the IRS mandates that Form 990-EZ be filed by the 15th day of the 5th month following the end of the organization’s fiscal year. Missing this deadline can result in penalties, including substantial fees or loss of tax-exempt status, underscoring the need for timely submissions.

Managing your Form 990-EZ after filing

Proper management of Form 990-EZ after submission is essential for ongoing compliance. Utilizing pdfFiller, organizations can easily track and store copies of their filed forms alongside other critical documentation. Maintaining another centralized repository helps safeguard valuable information and ensure a systematic process for easy access during audits or IRS inquiries.

Additionally, organizations should prepare to respond to any IRS inquiries following their filing. In this context, pdfFiller’s document management capabilities facilitate seamless communication and organization of relevant records, ensuring organizations are well-prepared to provide supplemental information if requested.

Interactive tools and resources on pdfFiller

pdfFiller enhances the form-filling experience with a robust suite of tools specifically designed for editing, signing, and managing PDFs. The platform's intuitive interface allows users to fill out Form 990-EZ efficiently while also offering various resources like live support channels and community forums that cater to questions about filing needs.

Moreover, the ability to use pdfFiller’s live support gives organizations access to real-time assistance for any inquiries, fostering a collaborative atmosphere where users can share insights, tips, and strategies for successful form completion and filing.

Success stories: Effective use of Form 990-EZ

Several organizations have successfully navigated the complexities of Form 990-EZ, demonstrating that proficient handling of the form can significantly enhance transparency and operational effectiveness. For instance, a small local charity focused on community development managed to secure additional funding after presenting a well-documented Form 990-EZ that clearly articulated its revenue and program accomplishments.

These success stories illustrate how accurate and comprehensive documentation can create positive impressions not only within the IRS framework but also among potential donors and partners, ultimately bolstering the organization's credibility and mission-driven outreach.

Additional considerations for nonprofits

While completing and filing Form 990-EZ is essential for compliance, organizations must also consider the future implications of their filing choices. Accurate reporting can influence future funding opportunities, partnerships, and the organization’s overall reputation within the nonprofit sector. Nonprofits should remain vigilant about changes in regulations related to tax filings, ensuring their understanding of any evolving requirements.

Additionally, regular updates to internal processes and training for team members responsible for financial reporting will reinforce compliance efforts. Equipping staff with ongoing education about nonprofit tax regulations fosters an informed workforce capable of adapting to changes as they arise, ultimately safeguarding the organization’s tax-exempt status and operational sustainability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990-ez for eSignature?

How do I make edits in form 990-ez without leaving Chrome?

How do I fill out form 990-ez on an Android device?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.