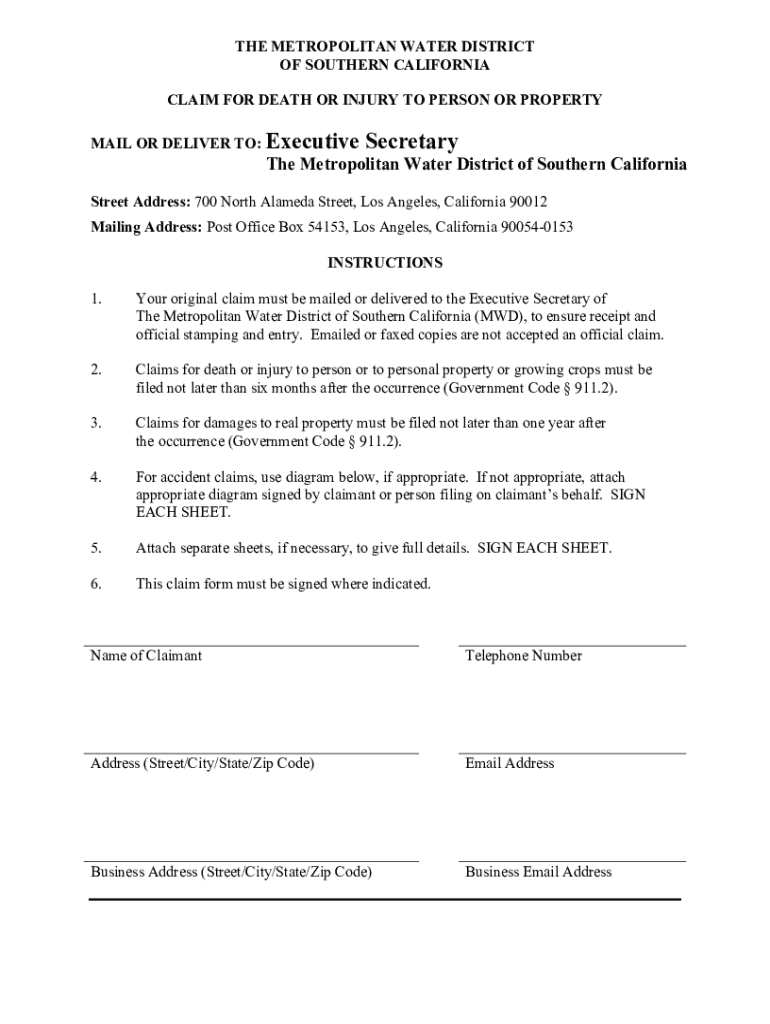

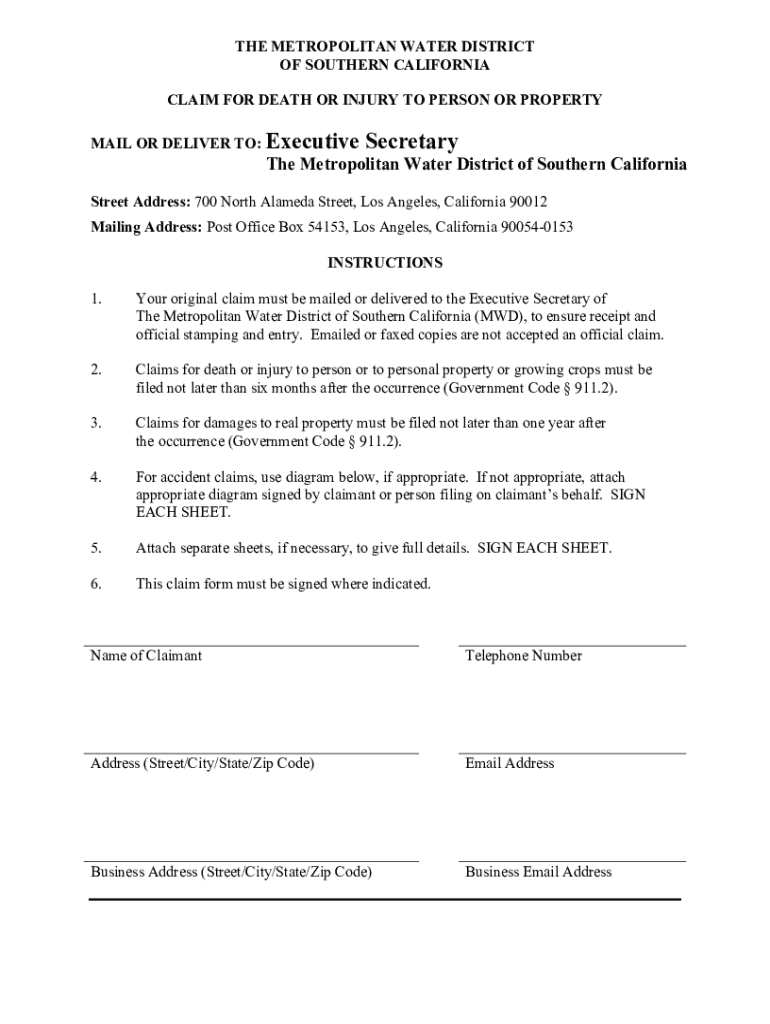

Get the free Claim for Death or Injury to Person or Property

Get, Create, Make and Sign claim for death or

How to edit claim for death or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim for death or

How to fill out claim for death or

Who needs claim for death or?

Claim for Death or Form: A Comprehensive Guide to Navigating Death Benefit Claims

Understanding the claim for death benefits

Claiming death benefits is an essential process that enables beneficiaries to receive financial support after the loss of a loved one. Death benefits are typically issued by life insurance companies or employer-sponsored insurance plans and often provide a monetary payout to designated beneficiaries.

The significance of death benefits lies in their ability to ease financial burdens during an emotionally challenging time. Various types of death benefits are available, including life insurance policies, pensions, and accidental death and dismemberment benefits. Understanding these types can guide beneficiaries in making informed decisions during their claim process.

Importance of filing a claim

Filing a claim for death benefits is time-sensitive, as beneficiaries often have a limited time frame from the date of death to initiate the claim. Delays in filing can jeopardize the financial support intended for the deceased's dependents and survivors. Common scenarios requiring death benefit claims include unexpected fatalities, workplace accidents, or terminal illnesses.

Key forms and documentation needed

To initiate a claim for death benefits, specific documentation is necessary. Knowing what forms are required can streamline the process and reduce the likelihood of delays. The essential forms typically include the Claim for Death Benefits Form, Beneficiary Designation Form, and a Certificate of Death.

Additionally, claimants should gather supporting documents such as a copy of the deceased's insurance policy, identification documents of the beneficiaries (like government IDs), and any relevant financial documents that may aid in the claim evaluation process.

Step-by-step guide to filing a death benefit claim

To successfully file a claim for death benefits, follow these structured steps to ensure nothing is overlooked.

Step 1: Gathering necessary information

Begin by collecting all pertinent personal details concerning the deceased, such as full names, dates of birth, and social security numbers. Additionally, assemble documents that prove your identity and your relationship to the deceased, as this will be necessary for the claims process.

Step 2: Completing required forms

Taking the time to accurately fill out the Claim for Death Benefits Form is critical. Ensure that all sections are completed, as missing information can delay the claim. It may be beneficial to review the form with a knowledgeable individual or consult the insurance provider if any sections are unclear.

Step 3: Submitting the claim

Once the forms are filled out correctly, submit them via the appropriate channels. Many insurance companies offer multiple submission options, including online submissions, mailing, or in-person delivery to specific offices. It is crucial to verify the submission process and keep copies of all documents for your records.

Step 4: Following up on your claim

After submission, follow up regularly to check the status of the claim. Knowing how to contact the right department within the insurance company can expedite the resolution process and ensure you receive updates on your claim.

Resources for different stakeholders

Each stakeholder involved in the claim for death benefits may face unique challenges and require tailored guidance. Employees, annuitants, and agencies can benefit from understanding their specific rights and responsibilities in these processes.

For employees

Employees of organizations with life insurance benefits need to familiarize themselves with the internal resources available for claims. Human resources departments often provide information and assistance in navigating the claim process.

For annuitants

Annuitants should consider the unique circumstances surrounding their death benefits. Understanding any additional documentation required and ensuring compliance with agency protocols will be paramount in securing their rights.

For agencies

Government agencies handling death claims also need resources to ensure compliance with legal requirements. Streamlined processes and thorough training can support agency personnel in effectively managing submissions and maintaining accurate records.

Navigating challenges in the claim process

Claims for death benefits can sometimes be delayed due to a variety of common issues, disrupting timely financial support for beneficiaries. Understanding these challenges and being proactive in addressing them can lead to a smoother experience.

Common reasons for delaying claims

Frequent issues that arise include incomplete paperwork, missing documentation, or discrepancies in identifying information. Failure to provide all required documentation can lead to unnecessary complications, lengthening the process significantly.

How to address and resolve issues

When faced with challenges in the claim process, claimants should immediately contact the insurer's claims department to correct any problems. Clear communication and prompt action can help minimize delays in claim approval.

When to seek legal advice

It may be necessary to seek legal counsel if a claim is denied without appropriate reasoning or if you encounter significant obstacles in the process. A qualified attorney specializing in insurance claims can provide valuable assistance in navigating complex disputes.

Embracing an efficient document management solution

Utilizing a document management solution like pdfFiller can drastically enhance the claim process. Efficient documentation management, alongside tools for editing and signing forms, can streamline workflows and accelerate the claim's progression.

How pdfFiller can assist in the claim process

pdfFiller allows users to easily create, edit, and personalize forms essential for the claim for death benefits, including the Claim for Death Benefits Form. Its eSigning capabilities enable quick electronic signatures, eliminating wait times associated with traditional methods.

Collaborating with team members

With pdfFiller, sharing documents securely among stakeholders is seamless. Cloud-based collaboration ensures that every party involved in the claim process, from claimants to insurers, can access current document versions, enhancing efficiency during critical times.

Final tips for successful claims

Maximizing the likelihood of a successful claim for death benefits requires organization and understanding of deadlines and rights. Being proactive and informed empowers beneficiaries to navigate the complexities of the process effectively.

Staying organized

Creating a checklist of required documents and ensuring each is collected before initiating the claim will help maintain order throughout the process. Staying organized can prevent missing crucial items that could delay claims.

Understanding your rights

Beneficiaries should be knowledgeable about their rights regarding death benefits. Familiarizing yourself with the policies and conditions stipulated in the insurance documents can empower you to assert your rights and claim amounts effectively.

Deadlines and timeframes to watch

Awareness of the various deadlines associated with different types of claims is critical. Familiarize yourself with time-sensitive stipulations related to life insurance and pension benefits to ensure compliance and preserve your rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify claim for death or without leaving Google Drive?

Can I sign the claim for death or electronically in Chrome?

How do I edit claim for death or on an iOS device?

What is claim for death or?

Who is required to file claim for death or?

How to fill out claim for death or?

What is the purpose of claim for death or?

What information must be reported on claim for death or?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.