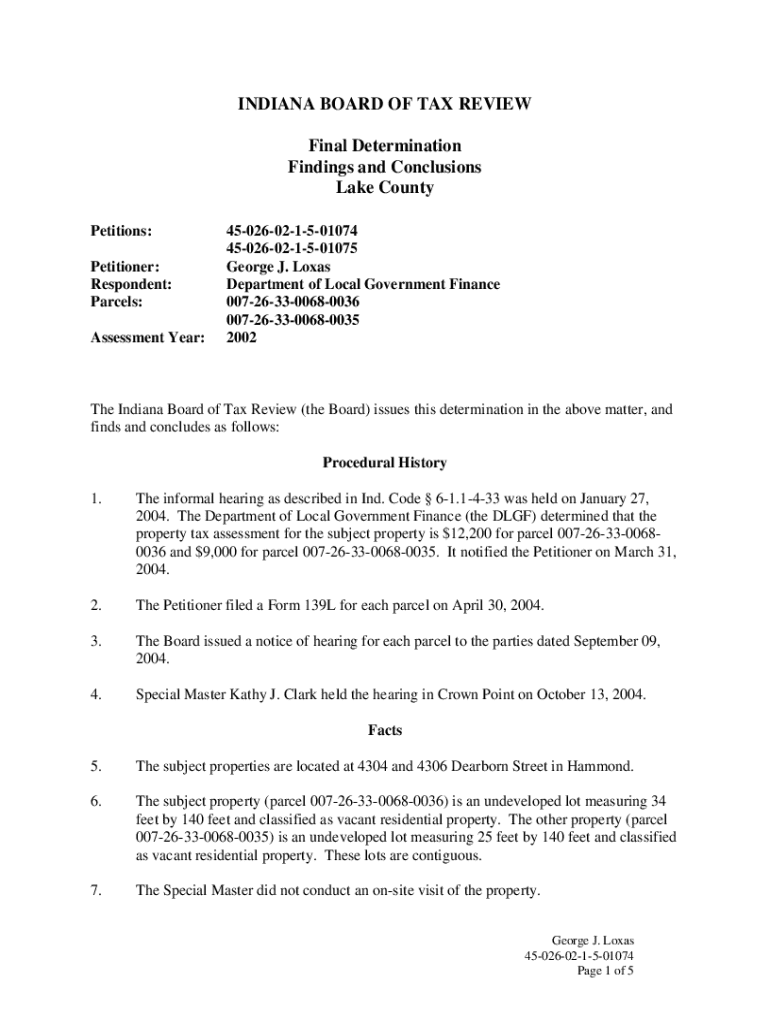

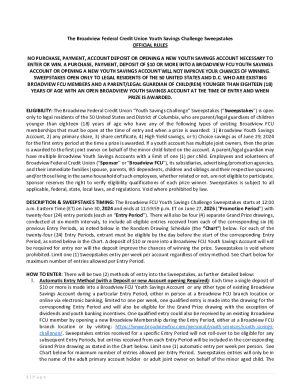

Get the free Indiana Board of Tax Review Final Determination

Get, Create, Make and Sign indiana board of tax

How to edit indiana board of tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indiana board of tax

How to fill out indiana board of tax

Who needs indiana board of tax?

Complete guide to the Indiana board of tax form

Understanding the Indiana board of tax form

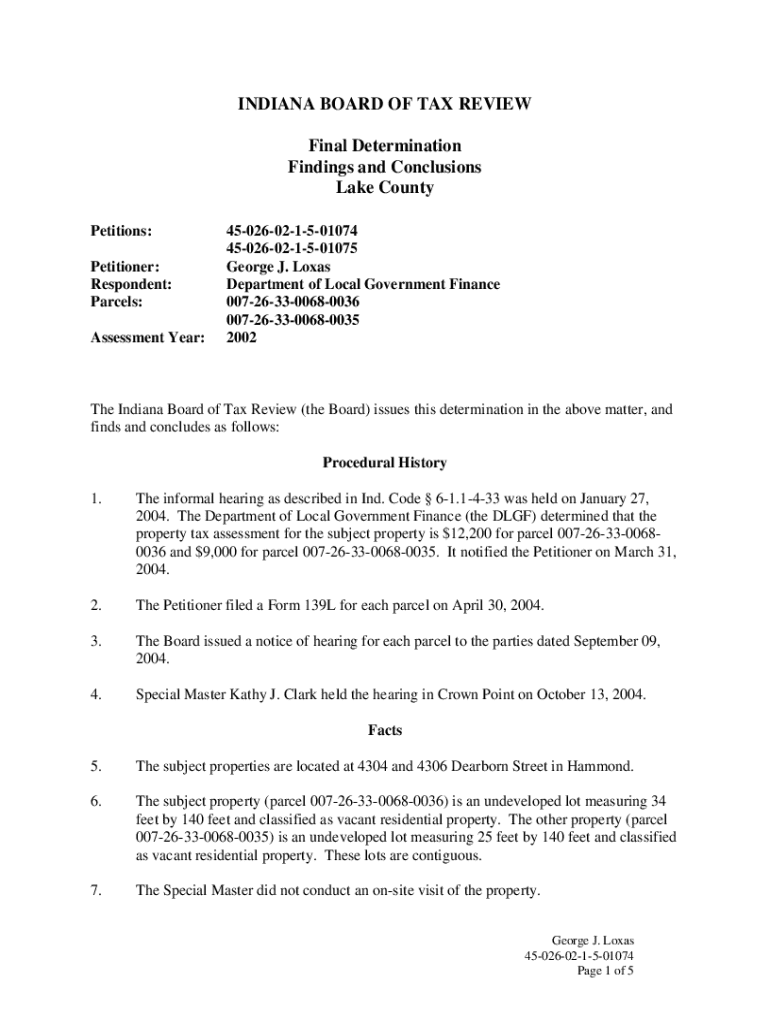

The Indiana board of tax form serves as a pivotal document for individuals and businesses operating in the state of Indiana. It is essential for declaring income, calculating tax liabilities, and submitting the necessary information to the Indiana Department of Revenue. Understanding this form is crucial as it helps ensure compliance with state tax regulations and allows taxpayers to avoid penalties.

The significance of the Indiana board of tax form extends beyond mere compliance. It directly impacts your financial health, influencing everything from your tax refunds to your eligibility for various tax credits. Whether you’re filing as an individual or on behalf of a business, getting it right is essential.

Types of Indiana tax forms available

Pre-filling requirements

Before filling out the Indiana board of tax form, understanding the eligibility criteria is essential. Individual filers must have earned income, while businesses need to ascertain their tax liability based on their revenue throughout the year. Each type of form has specific requirements, and knowing these can save you both time and errors during filing.

For individuals, the key considerations include your filing status, income level, and any applicable deductions or credits. Businesses need to assess optional taxes for corporate income and consider their business structure.

Gathering necessary documents

Organizing these documents can streamline the filing process. Using folders or an electronic management system will ensure that you have all the necessary information readily available, reducing the likelihood of mistakes in your submission.

Step-by-step guide on filling out the Indiana board of tax form

Accessing the Indiana board of tax form can be done easily online. You can find and download the forms from pdfFiller, which provides a streamlined platform for document management. Alternatively, the official Indiana Department of Revenue website and local tax offices are also reliable sources for obtaining these forms.

Once you have the form, it is important to carefully follow each section. Starting with your personal information, ensure all details are correct and current. As you progress, each line will typically ask for specific income data, deductions, and credits applicable to your situation.

Detailed walkthrough of each section of the form

Common pitfalls include misreporting income streams, forgetting eligible deductions, or using outdated forms. Double-checking each line can help mitigate these errors. Examples of completed sections can typically be found on the Indiana Department of Revenue website to provide clarity.

Editing and customizing your form

With pdfFiller’s editing tools, customizing your Indiana board of tax form is straightforward and efficient. Users can edit PDF tax forms effortlessly, allowing for easy updates and modifications as necessary. This tool supports adding or removing sections based on individual needs or requirements.

Furthermore, incorporating signatures and initials into your forms can be handled seamlessly. Steps for eSigning a document legally require ensuring compliance with Indiana law, which pdfFiller accommodates with its electronic signature feature. Collaborative features also allow multiple users to input their information and finalize the document without issues.

Submitting your Indiana board of tax form

Once your form is completed and reviewed, submission is the next critical step. The Indiana board of tax form can be submitted both online and via traditional mail. Online submissions offer quicker processing times; however, some opt for mail-in to retain a physical copy of their submissions.

Be mindful of deadlines, typically set around April 15th each year for individual tax returns, and ensure to track your submission status. Utilizing tools provided by the Indiana Department of Revenue can help in monitoring the progress of your filings, ensuring you remain informed.

Handling corrections and amendments

Mistakes can happen when filling out the Indiana board of tax form. In such cases, knowing how to correct a submitted form is essential. Generally, you will need to fill out a corrected form indicating the changes and submit it according to the regular submission guidelines.

If an amendment is required, the Indiana Department of Revenue provides a specific process for filing an amended Indiana board of tax form, usually involving designated forms and following unique protocols for processing amendments.

Utilizing additional resources

Online tools, like tax calculators, can assist in estimating your obligations accurately. Moreover, the FAQs provided by the Indiana Department of Revenue can address common queries related to tax liabilities and the filing process, which helps demystify concerns across various filing scenarios.

It’s helpful to keep contact information for Indiana tax support on hand. The Indiana Department of Revenue can provide direct assistance during their business hours, allowing for prompt resolution of any difficulties encountered while completing your Indiana board of tax form.

Case studies and user experiences

Many individuals and businesses have successfully navigated the complexities of the Indiana board of tax form. For instance, a local café owner shared their experience of utilizing pdfFiller, highlighting how easy it was to edit their forms and submit them online. They found the clarity in line instructions enabled them to maximize deductions effectively, ultimately reflecting in a substantial tax refund.

Conversely, some challenges have arisen, such as difficulties understanding specific tax regulations or common mistakes leading to underreporting income. To tackle these, many have utilized the support resources offered by the Indiana Department of Revenue and have sought professional tax assistance to ensure compliance.

Continuous updates and tax law changes

Staying informed on Indiana tax regulations is key for all taxpayers. Laws and forms can undergo modifications significantly affecting compliance and financial outcomes. Individuals and businesses should routinely check the Indiana Department of Revenue updates and subscribe to their information channels to ensure adherence to the latest guidelines.

Understanding the impact of changes in tax law can help taxpayers make informed decisions, from deductions to potential credits. It’s important for taxpayers to integrate these updates into their tax planning strategies to maximize their benefits.

Why choose pdfFiller for your tax form needs

Choosing a cloud-based solution like pdfFiller for managing your Indiana board of tax form offers numerous advantages. Accessibility from any device ensures that users can work on their documents anytime, anywhere, meeting their needs seamlessly. Security features integrated into the platform protect sensitive information, giving peace of mind while managing tax documents.

User testimonials highlight the convenience and efficiency pdfFiller provides. Individuals appreciate the user-friendly interface, while teams find collaboration features invaluable for managing documents, sharing input, and finalizing submissions without hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send indiana board of tax for eSignature?

Where do I find indiana board of tax?

Can I create an eSignature for the indiana board of tax in Gmail?

What is indiana board of tax?

Who is required to file indiana board of tax?

How to fill out indiana board of tax?

What is the purpose of indiana board of tax?

What information must be reported on indiana board of tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.